In this age of technology, where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons or creative projects, or simply to add an individual touch to the area, First Time Homebuyer Tax Credit 2023 Irs can be an excellent source. The following article is a take a dive deeper into "First Time Homebuyer Tax Credit 2023 Irs," exploring the different types of printables, where they are, and how they can enrich various aspects of your lives.

Get Latest First Time Homebuyer Tax Credit 2023 Irs Below

.png)

First Time Homebuyer Tax Credit 2023 Irs

First Time Homebuyer Tax Credit 2023 Irs -

The Bottom Line On The First Time Home Buyer Tax Credit Despite recent attempts there is currently no first time home buyer tax credit available at the

Although there isn t a tax credit available for first time homebuyers at least as of November 2023 you may be able to claim the following deductions if you re

First Time Homebuyer Tax Credit 2023 Irs provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages, and many more. The appealingness of First Time Homebuyer Tax Credit 2023 Irs is their versatility and accessibility.

More of First Time Homebuyer Tax Credit 2023 Irs

Clock Ticking On First time Homebuyer Tax Credit

Clock Ticking On First time Homebuyer Tax Credit

Unauthorized use of this system is prohibited and subject to criminal and civil penalties including all penalties applicable to willful unauthorized access UNAX or inspection of

A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization They can make printing templates to your own specific requirements whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Use: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and educators.

-

Simple: You have instant access a myriad of designs as well as templates reduces time and effort.

Where to Find more First Time Homebuyer Tax Credit 2023 Irs

The First Time Homebuyer Tax Credit Explained Jeanine Hemingway CPA

The First Time Homebuyer Tax Credit Explained Jeanine Hemingway CPA

Introduced in the House of Representatives in April by Rep Earl Blumenauer and Rep Jimmy Panetta the First Time Homebuyer Act would establish a refundable

The First Time Home Buyer Tax Credit In 2023 7Min Read Updated Dec 26 2023 FACT CHECKED Disclosure Written By Melissa Brock There are lots of perks to

Now that we've ignited your curiosity about First Time Homebuyer Tax Credit 2023 Irs and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of First Time Homebuyer Tax Credit 2023 Irs suitable for many goals.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing First Time Homebuyer Tax Credit 2023 Irs

Here are some inventive ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

First Time Homebuyer Tax Credit 2023 Irs are a treasure trove of useful and creative resources that can meet the needs of a variety of people and passions. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the vast array that is First Time Homebuyer Tax Credit 2023 Irs today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes you can! You can print and download the resources for free.

-

Can I utilize free printables for commercial purposes?

- It's dependent on the particular terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download First Time Homebuyer Tax Credit 2023 Irs?

- Certain printables could be restricted on usage. Be sure to read the terms of service and conditions provided by the designer.

-

How do I print First Time Homebuyer Tax Credit 2023 Irs?

- You can print them at home using a printer or visit the local print shop for superior prints.

-

What program do I require to open printables that are free?

- A majority of printed materials are with PDF formats, which can be opened with free software such as Adobe Reader.

First Time Homebuyer Tax Credit Explained YouTube

What Is The First Time Homebuyer Tax Credit Does It Still Exist

Check more sample of First Time Homebuyer Tax Credit 2023 Irs below

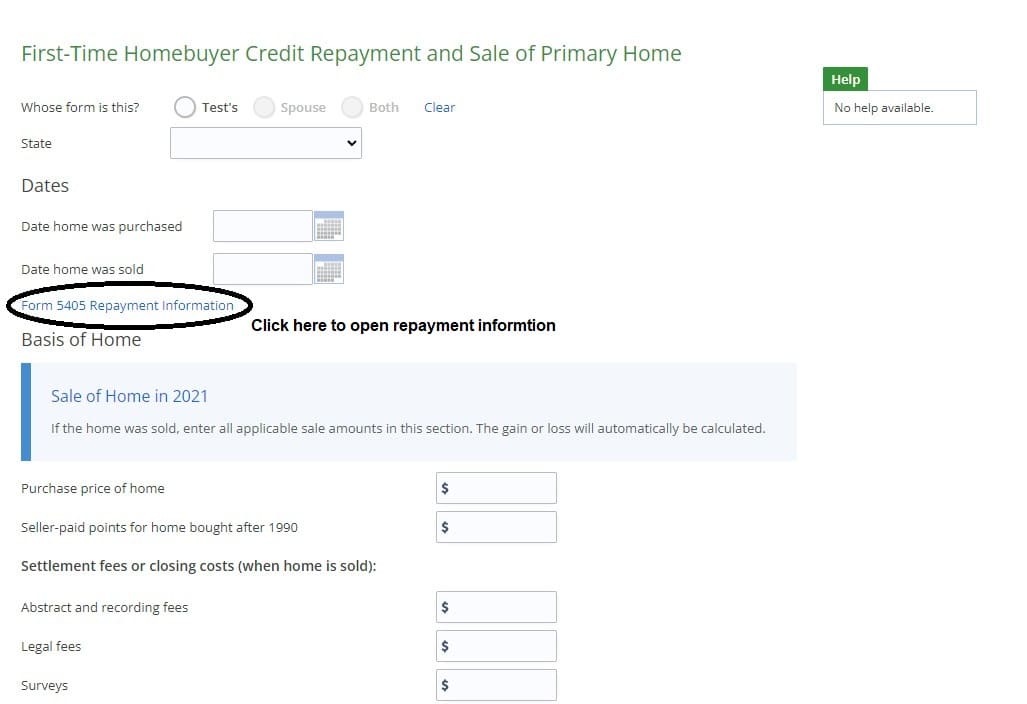

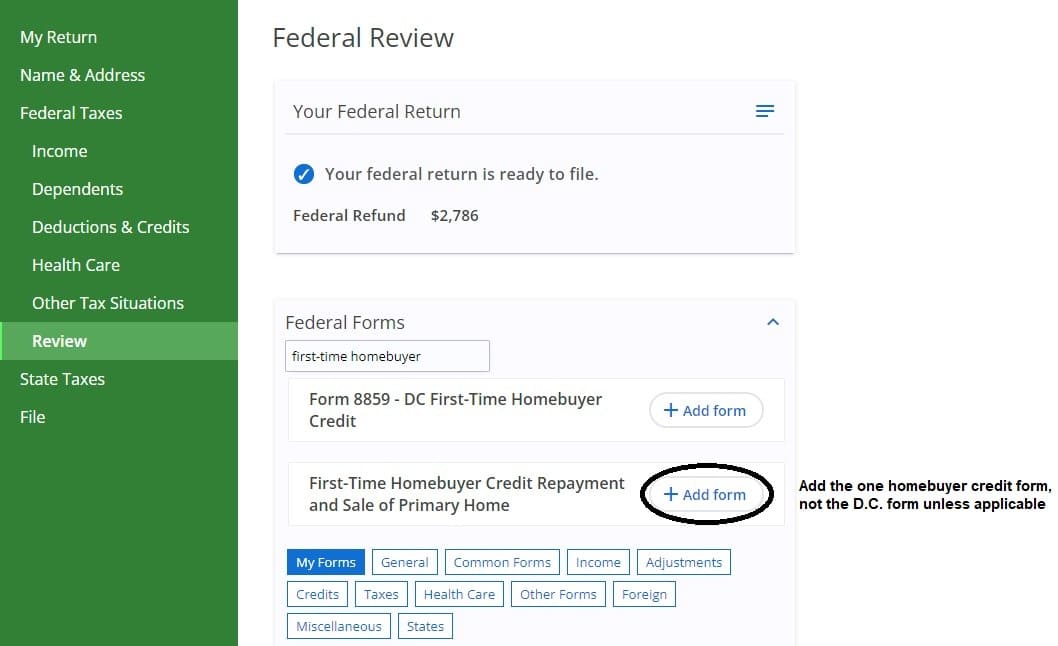

Add IRS Form 5405 To Repay First Time Homebuyer Credit

Add IRS Form 5405 To Repay First Time Homebuyer Credit

First Time Homebuyer Tax Credit 2022 All That You Need To Know

How The First time Homebuyer Tax Credit Worked HowStuffWorks

Another 15K First time Homebuyer Tax Credit Bill Emerges Michael Gersitz

No There Is No First time Homebuyer Tax Credit With The IRS IRS

.png?w=186)

https://www.cnn.com/cnn-underscored/money/first...

Although there isn t a tax credit available for first time homebuyers at least as of November 2023 you may be able to claim the following deductions if you re

https://homebuyer.com/learn/15000-firs…

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation

Although there isn t a tax credit available for first time homebuyers at least as of November 2023 you may be able to claim the following deductions if you re

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation

How The First time Homebuyer Tax Credit Worked HowStuffWorks

Add IRS Form 5405 To Repay First Time Homebuyer Credit

Another 15K First time Homebuyer Tax Credit Bill Emerges Michael Gersitz

No There Is No First time Homebuyer Tax Credit With The IRS IRS

The HELPER Act Mortgage Explained

Biden s First Time Homebuyer Tax Credit Program How To Benefit The

Biden s First Time Homebuyer Tax Credit Program How To Benefit The

First Time Homebuyer Tax Credit The Snyder Team