In this digital age, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education and creative work, or simply to add a personal touch to your area, First Recovery Rebate Credit have proven to be a valuable resource. For this piece, we'll take a dive deep into the realm of "First Recovery Rebate Credit," exploring the different types of printables, where to find them, and ways they can help you improve many aspects of your life.

Get Latest First Recovery Rebate Credit Below

First Recovery Rebate Credit

First Recovery Rebate Credit -

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

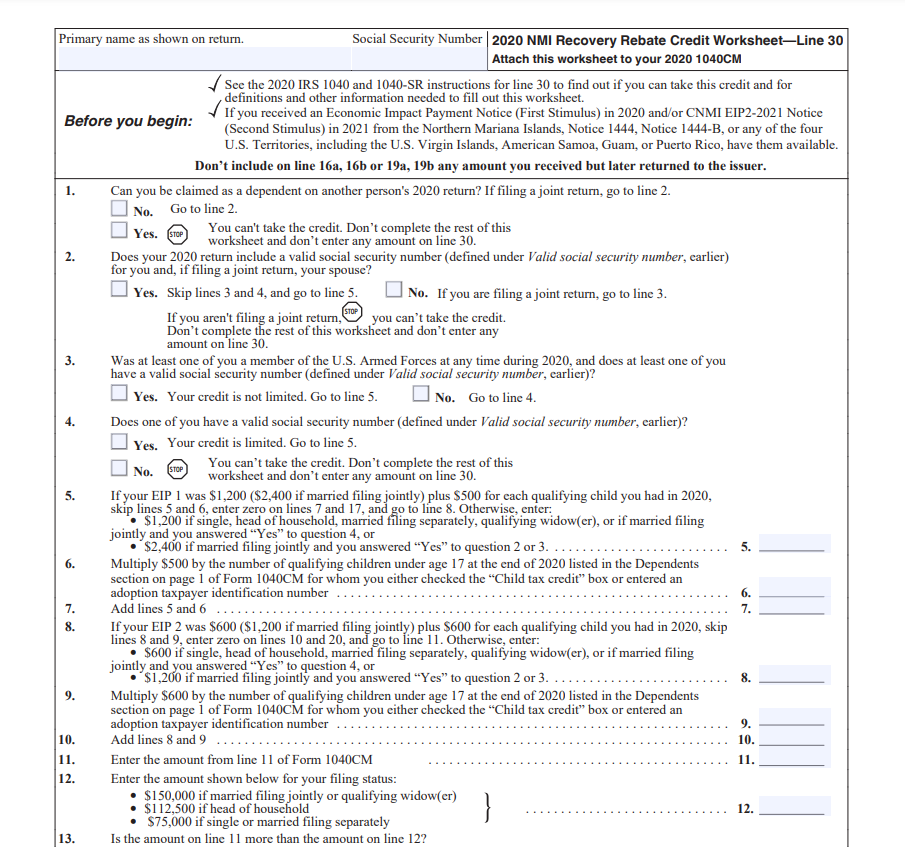

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

First Recovery Rebate Credit include a broad range of printable, free materials that are accessible online for free cost. These printables come in different types, such as worksheets coloring pages, templates and more. The attraction of printables that are free is in their versatility and accessibility.

More of First Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full First and Second Payments Claim the 2020 Recovery Rebate Credit You may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return Claim 2020

First Recovery Rebate Credit have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: We can customize printables to fit your particular needs, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational value: The free educational worksheets are designed to appeal to students of all ages. This makes the perfect aid for parents as well as educators.

-

Easy to use: instant access numerous designs and templates saves time and effort.

Where to Find more First Recovery Rebate Credit

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

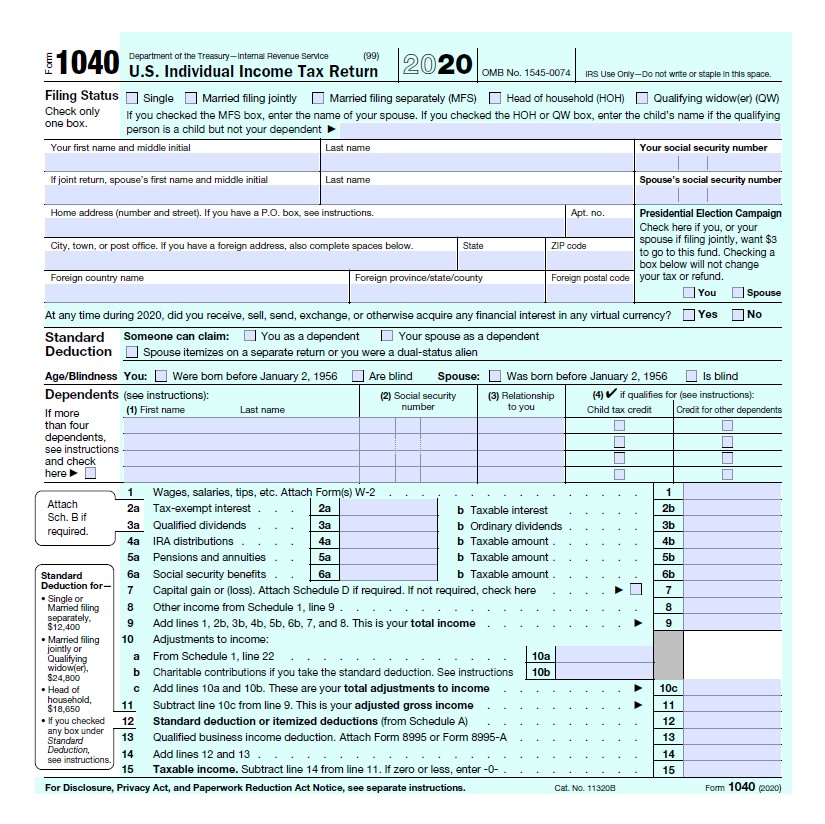

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR

Web 29 mars 2021 nbsp 0183 32 This tax season a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds But you need to send in a 2020 federal tax return in order

Since we've got your curiosity about First Recovery Rebate Credit Let's look into where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in First Recovery Rebate Credit for different reasons.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free or flashcards as well as learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad array of topics, ranging including DIY projects to party planning.

Maximizing First Recovery Rebate Credit

Here are some ways in order to maximize the use use of First Recovery Rebate Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

First Recovery Rebate Credit are an abundance of creative and practical resources that satisfy a wide range of requirements and interests. Their access and versatility makes them an invaluable addition to the professional and personal lives of both. Explore the vast collection of First Recovery Rebate Credit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial use?

- It depends on the specific conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions concerning their use. Check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to an area print shop for top quality prints.

-

What software is required to open printables for free?

- The majority are printed in PDF format, which can be opened with free software like Adobe Reader.

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Check more sample of First Recovery Rebate Credit below

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-f...

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

How To Figure The Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate