In this day and age where screens have become the dominant feature of our lives, the charm of tangible printed material hasn't diminished. In the case of educational materials such as creative projects or simply adding a personal touch to your area, Federalelectric Vehicle Tax Rebate have become an invaluable source. This article will dive into the sphere of "Federalelectric Vehicle Tax Rebate," exploring what they are, where they are available, and how they can enrich various aspects of your lives.

Get Latest Federalelectric Vehicle Tax Rebate Below

Federalelectric Vehicle Tax Rebate

Federalelectric Vehicle Tax Rebate - Federal Electric Vehicle Tax Rebate, Federal Electric Vehicle Tax Credit 2022, Federal Electric Vehicle Tax Credit Income Limit, Federal Electric Vehicle Tax Credit Used, Federal Electric Vehicle Tax Credit Lease, Federal Electric Vehicle Tax Credit 2024, Federal Electric Vehicle Tax Credit Form, Federal Electric Vehicle Tax Credit Tesla, Federal Electric Vehicle Tax Credit Refundable, Federal Electric Vehicle Tax Credit Calculator

Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Federalelectric Vehicle Tax Rebate cover a large assortment of printable, downloadable material that is available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages, and more. The benefit of Federalelectric Vehicle Tax Rebate is in their versatility and accessibility.

More of Federalelectric Vehicle Tax Rebate

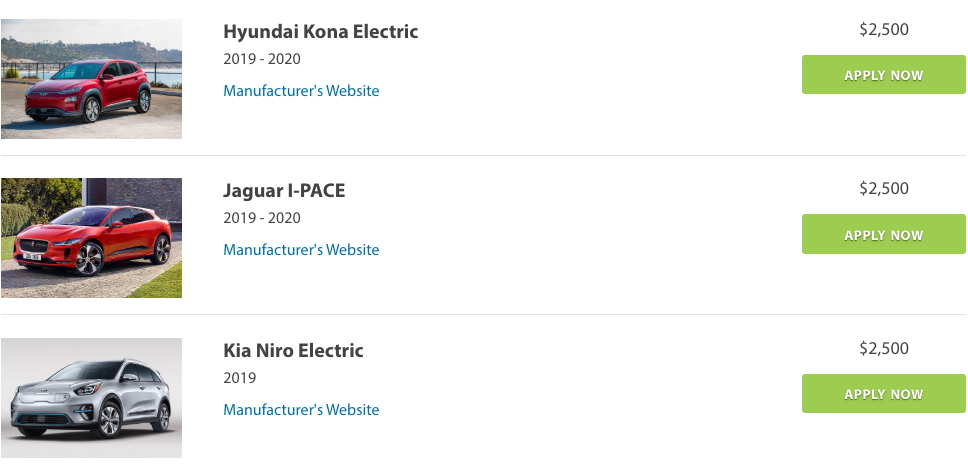

Federal Rebate For Electric Cars FederalProTalk

Federal Rebate For Electric Cars FederalProTalk

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Federalelectric Vehicle Tax Rebate have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: We can customize the templates to meet your individual needs such as designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Education-related printables at no charge can be used by students of all ages, making them a valuable tool for parents and teachers.

-

Simple: Instant access to a plethora of designs and templates will save you time and effort.

Where to Find more Federalelectric Vehicle Tax Rebate

Federal Tax Rebates Electric Vehicles ElectricRebate

Federal Tax Rebates Electric Vehicles ElectricRebate

Web 15 f 233 vr 2023 nbsp 0183 32 Buyers of new plug in EVs or fuel cell electric vehicles may qualify for a credit up to 7 500 The vehicle must be bought for personal transportation and not for

Web New EVs are eligible for a 7 500 credit for now until the Treasury and IRS release further guidance That guidance could mean automakers have to have increasing

Now that we've ignited your interest in Federalelectric Vehicle Tax Rebate Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Federalelectric Vehicle Tax Rebate for different needs.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing Federalelectric Vehicle Tax Rebate

Here are some innovative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Federalelectric Vehicle Tax Rebate are an abundance of innovative and useful resources that can meet the needs of a variety of people and passions. Their access and versatility makes them a valuable addition to any professional or personal life. Explore the world of Federalelectric Vehicle Tax Rebate right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can download and print the resources for free.

-

Does it allow me to use free printables for commercial purposes?

- It's all dependent on the conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns when using Federalelectric Vehicle Tax Rebate?

- Certain printables could be restricted concerning their use. Make sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to any local print store for premium prints.

-

What software do I need to open printables that are free?

- Many printables are offered in PDF format, which can be opened using free software such as Adobe Reader.

Electric Vehicle Rebates For The USA

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

Check more sample of Federalelectric Vehicle Tax Rebate below

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

Federal Electric Car Rebate Usa 2022 ElectricRebate

Federal Electric Vehicle Rebate ElectricRebate

Federal Electric Car Rebate Rules ElectricRebate

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Federal Electric Vehicle Rebate ElectricRebate

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

Federal Electric Car Rebate Rules ElectricRebate

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

Electric Car Available Rebates 2023 Carrebate

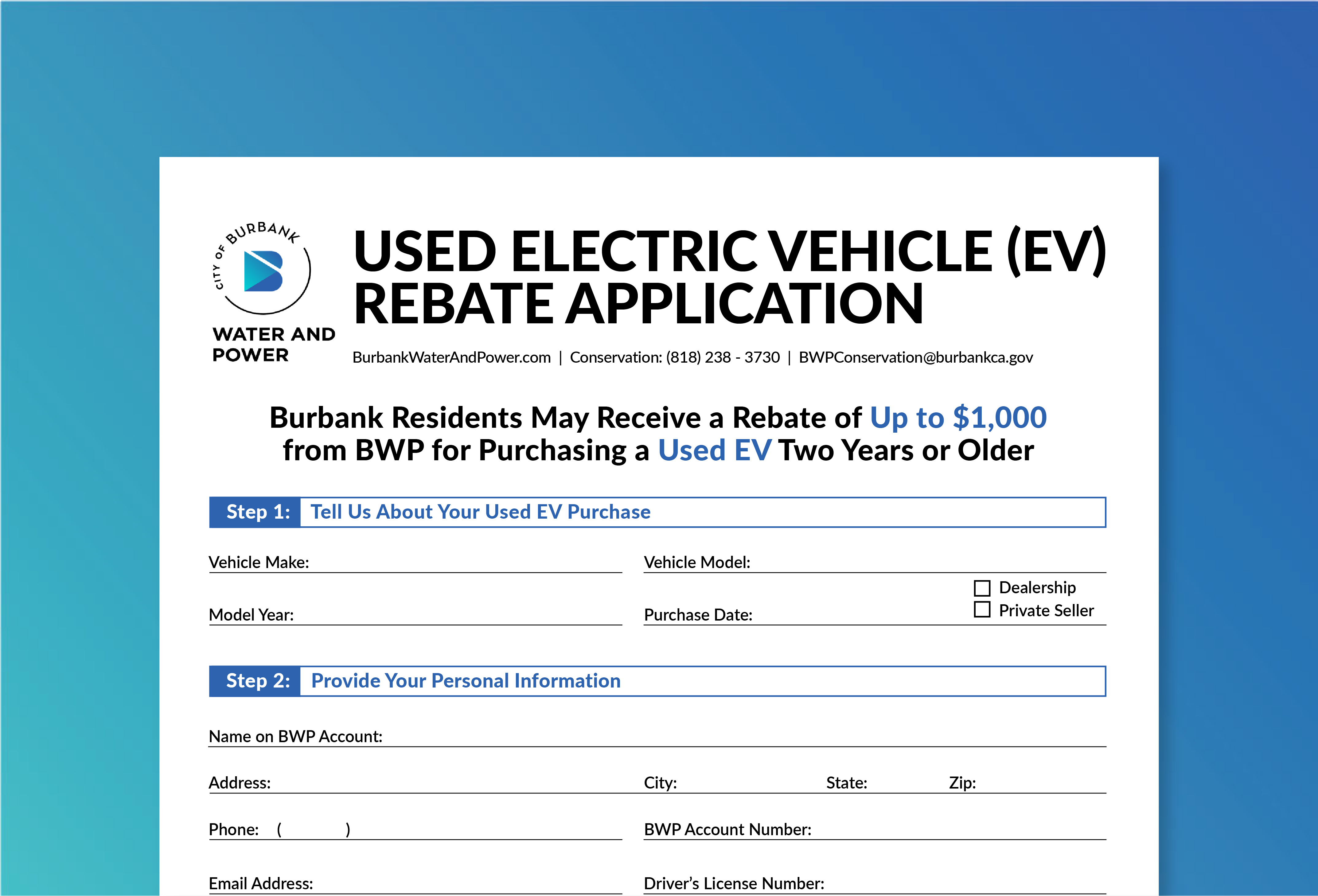

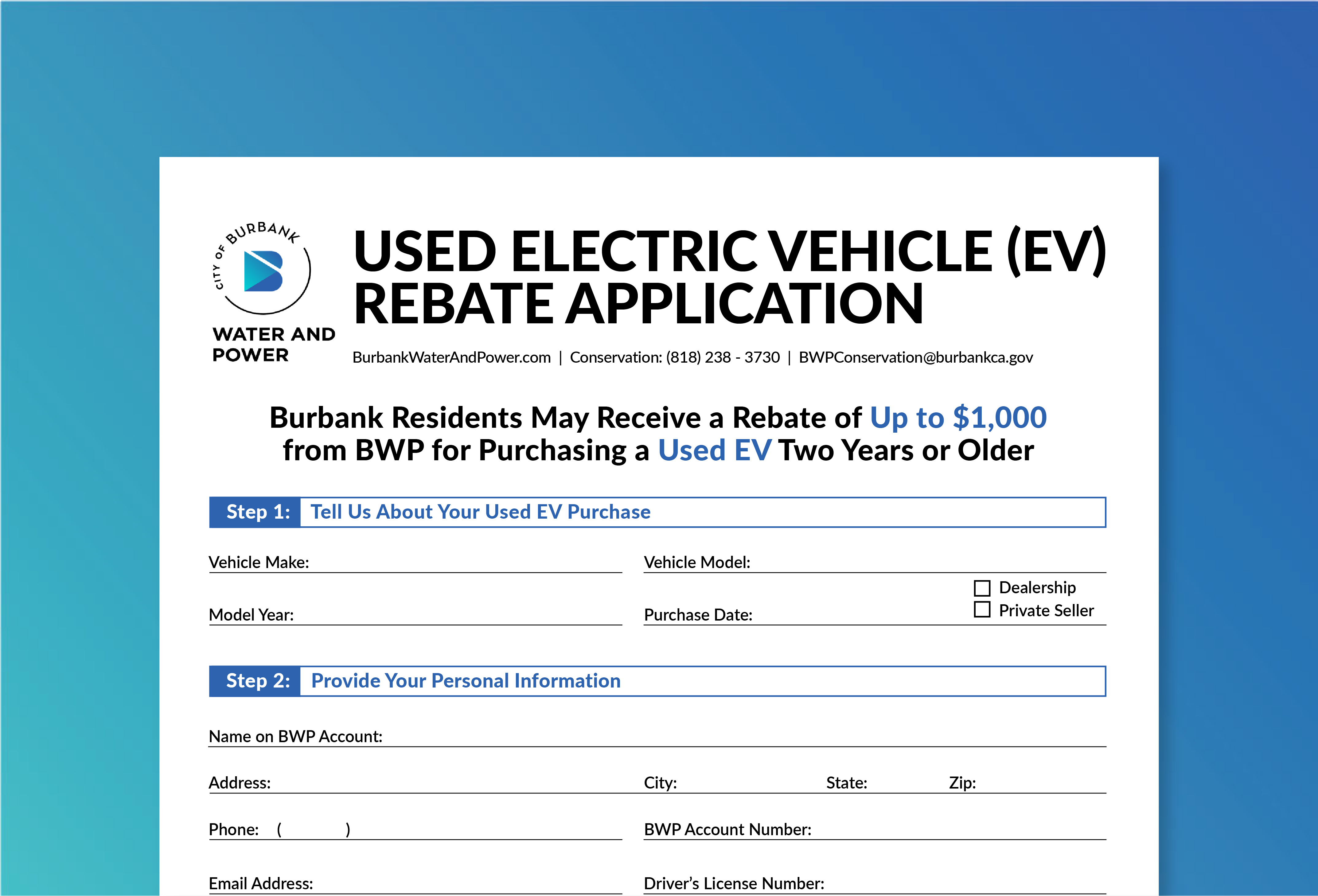

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

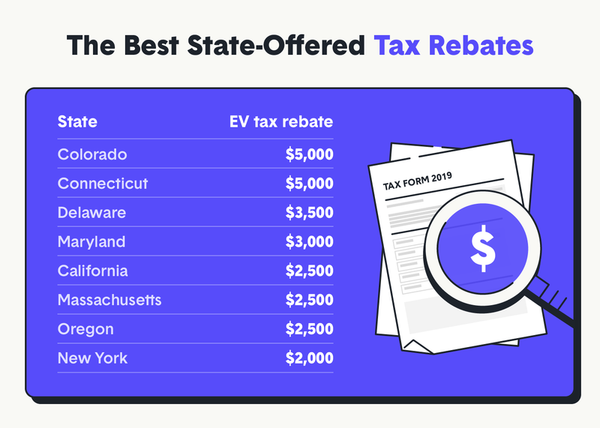

These Eight States Offer The Best Electric Vehicle Incentives