In this day and age with screens dominating our lives yet the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons and creative work, or simply adding a personal touch to your area, Federal Tax Deduction Car Registration are now a vital source. For this piece, we'll take a dive deep into the realm of "Federal Tax Deduction Car Registration," exploring their purpose, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest Federal Tax Deduction Car Registration Below

Federal Tax Deduction Car Registration

Federal Tax Deduction Car Registration -

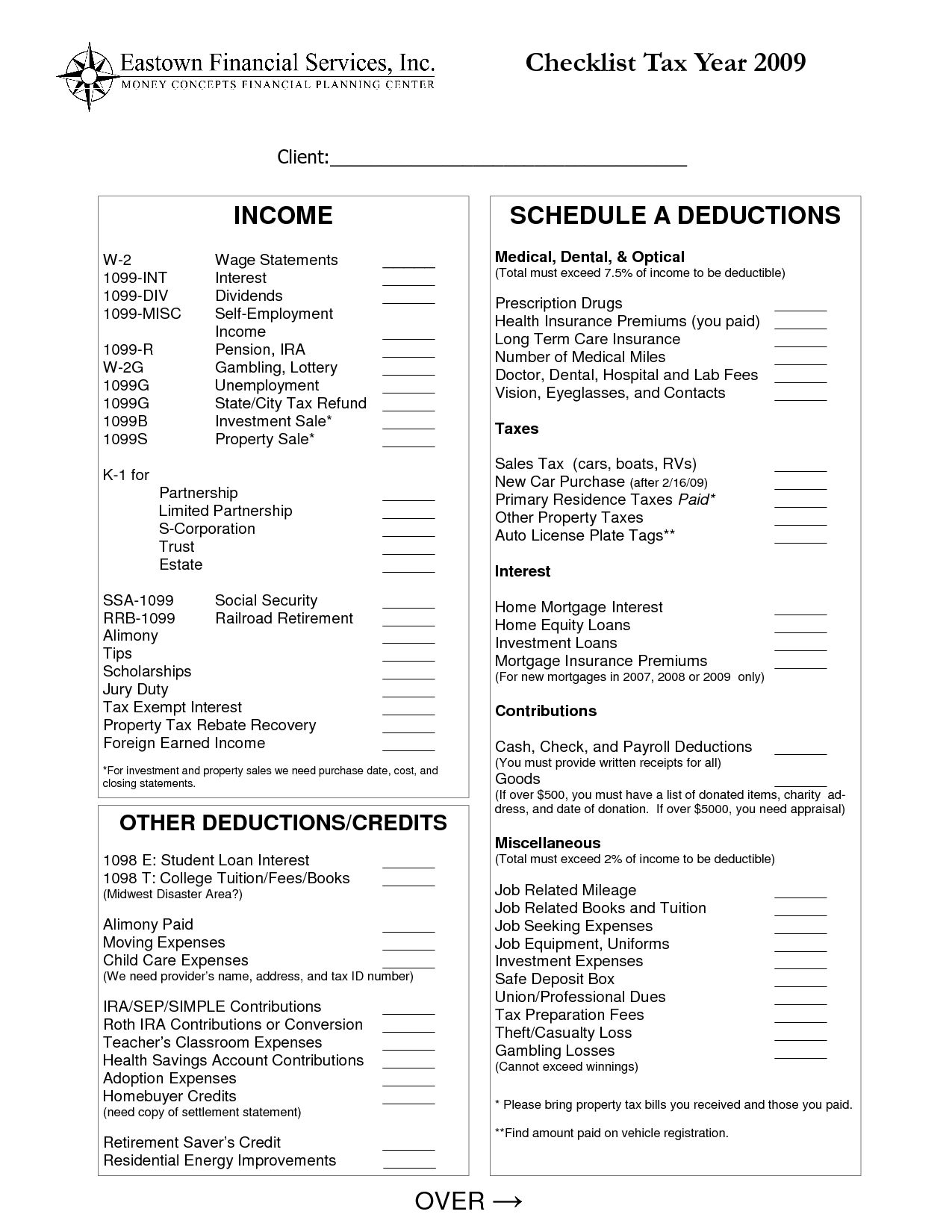

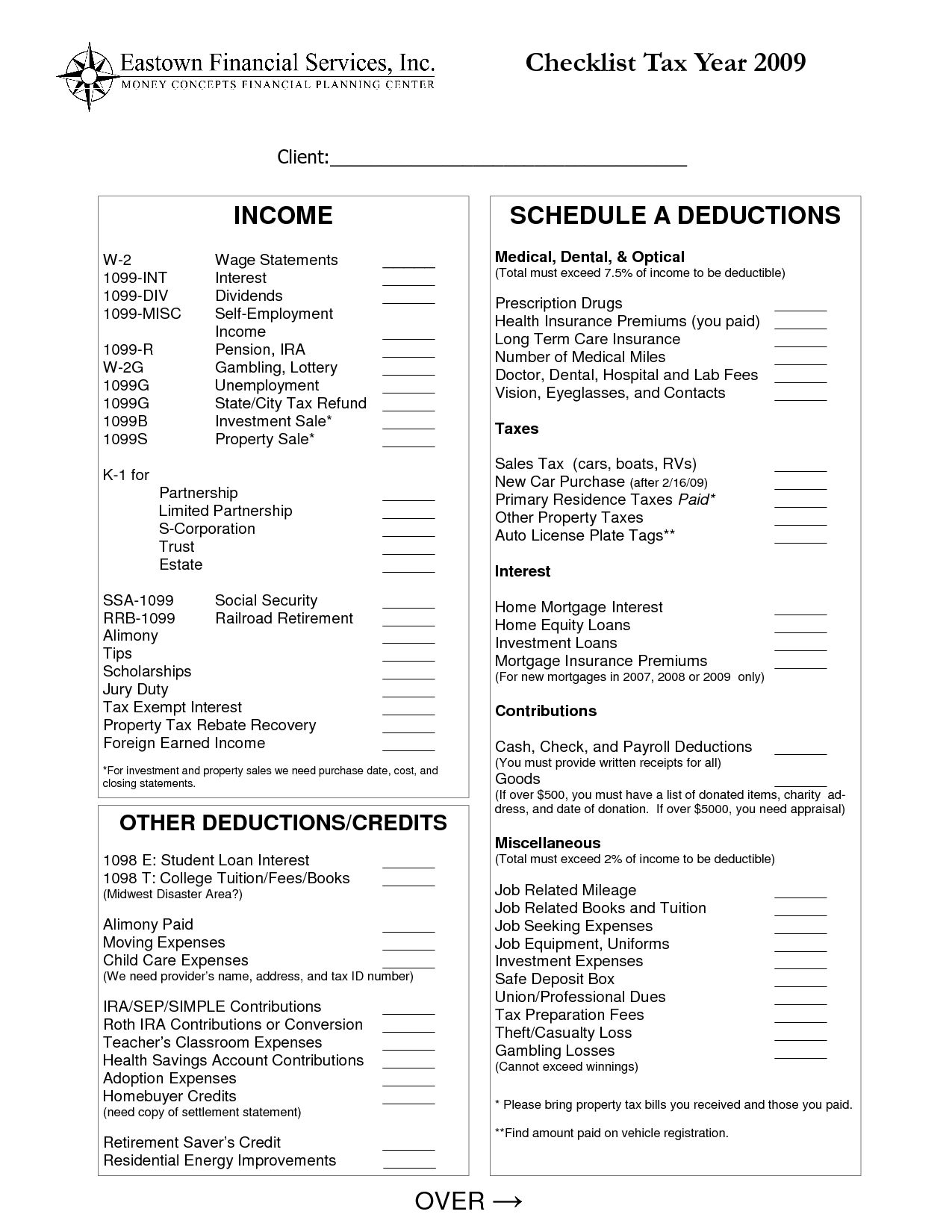

Your state charges a yearly motor vehicle registration tax of 1 of value plus 50 cents per hundredweight You paid 32 based on the value 1 500 and weight 3 400 lbs of your car You can deduct 15 1 1 500 as a personal property tax because it is based on the value The remaining 17 0 50 34 based on the weight isn t deductible

Your total registration fee might be 175 but your actual tax deduction is limited to 60 if if the fee includes a value calculation such as 2 for each 1 000 of value and your car is worth 30 000 or 2 times 30 You can t claim the whole 175 How To Determine Value

The Federal Tax Deduction Car Registration are a huge range of downloadable, printable material that is available online at no cost. They come in many kinds, including worksheets coloring pages, templates and much more. The benefit of Federal Tax Deduction Car Registration is in their versatility and accessibility.

More of Federal Tax Deduction Car Registration

Business Use Of Vehicle Tax Deductions

Business Use Of Vehicle Tax Deductions

State and local personal property taxes Deductible personal property taxes are those based only on the value of personal property such as a boat or car The tax must be charged to you on a yearly basis even if it s collected more than once a

IRS Tax Topic on deductible car expenses such as mileage depreciation and recordkeeping requirements If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor printables to your specific needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes these printables a powerful tool for parents and educators.

-

An easy way to access HTML0: You have instant access an array of designs and templates saves time and effort.

Where to Find more Federal Tax Deduction Car Registration

Donate A Car To Charity But Avoid Crooks One Of The Biggest Scams

Donate A Car To Charity But Avoid Crooks One Of The Biggest Scams

If your vehicle registration fee takes into account both value and weight you may deduct the portion that your state charges you for taxes that are based on the car s value You may be able to identify the value based portion of the fee on the car owner s registration billing statement itself in states like California

This rate changes regularly and in 2022 the standard mileage rate for businesses was set at 58 5 cents per mile Miles driven to and from work from your home otherwise known as commuting miles are not deductible You must keep detailed records and be able to provide enough evidence to support your claims

In the event that we've stirred your interest in printables for free We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Federal Tax Deduction Car Registration for various applications.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad variety of topics, starting from DIY projects to party planning.

Maximizing Federal Tax Deduction Car Registration

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free for teaching at-home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Federal Tax Deduction Car Registration are an abundance of fun and practical tools that cater to various needs and pursuits. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the vast collection of Federal Tax Deduction Car Registration to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Deduction Car Registration truly cost-free?

- Yes they are! You can print and download these resources at no cost.

-

Do I have the right to use free printing templates for commercial purposes?

- It's all dependent on the rules of usage. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations concerning their use. Be sure to read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to the local print shop for better quality prints.

-

What software is required to open printables that are free?

- The majority of printables are in PDF format. These can be opened using free software such as Adobe Reader.

13 Car Expenses Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

Check more sample of Federal Tax Deduction Car Registration below

New 2022 Maserati Levante Modena Sport Utility In Newport Beach

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

Registration Fees A Tax Deduction Auto Credit Express

Claim Your Car As A Tax Deduction YouTube

Tax Deduction For Buying A Car For Business Everything You Should Know

10 Business Tax Deductions Worksheet Worksheeto

https://www.thebalancemoney.com/can-you-claim-a...

Your total registration fee might be 175 but your actual tax deduction is limited to 60 if if the fee includes a value calculation such as 2 for each 1 000 of value and your car is worth 30 000 or 2 times 30 You can t claim the whole 175 How To Determine Value

https://ttlc.intuit.com/turbotax-support/en-us/...

Yes your car registration fee is deductible if it s a yearly fee based on the value of your vehicle and you itemize your deductions You can t deduct the total amount you paid only the portion of the fee that s based on your vehicle s value In addition not all states have value based registration fees

Your total registration fee might be 175 but your actual tax deduction is limited to 60 if if the fee includes a value calculation such as 2 for each 1 000 of value and your car is worth 30 000 or 2 times 30 You can t claim the whole 175 How To Determine Value

Yes your car registration fee is deductible if it s a yearly fee based on the value of your vehicle and you itemize your deductions You can t deduct the total amount you paid only the portion of the fee that s based on your vehicle s value In addition not all states have value based registration fees

Claim Your Car As A Tax Deduction YouTube

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

Tax Deduction For Buying A Car For Business Everything You Should Know

10 Business Tax Deductions Worksheet Worksheeto

Tax Deduction For Car Expenses KMT Partners

Car Tax Deduction

Car Tax Deduction

Methods To Donate Cars For Tax Credit Best Tax Deduction