In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed items hasn't gone away. For educational purposes for creative projects, simply adding some personal flair to your space, Federal Tax Credits For Renewable Energy are now a vital source. This article will dive into the sphere of "Federal Tax Credits For Renewable Energy," exploring the different types of printables, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Federal Tax Credits For Renewable Energy Below

Federal Tax Credits For Renewable Energy

Federal Tax Credits For Renewable Energy -

Credit Amount 0 20 gallon 0 35 gal for aviation fuel multiplied by CO2 emissions factor 1 00 gallon 1 75 gal for aviation fuel multiplied by CO2 emissions factor if PWA is met 1 7 Please see the notes on the next page or see IRS gov cleanenergy for more information Notes

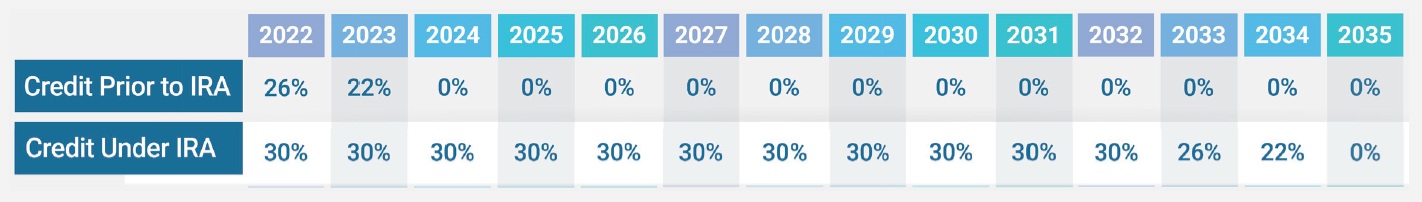

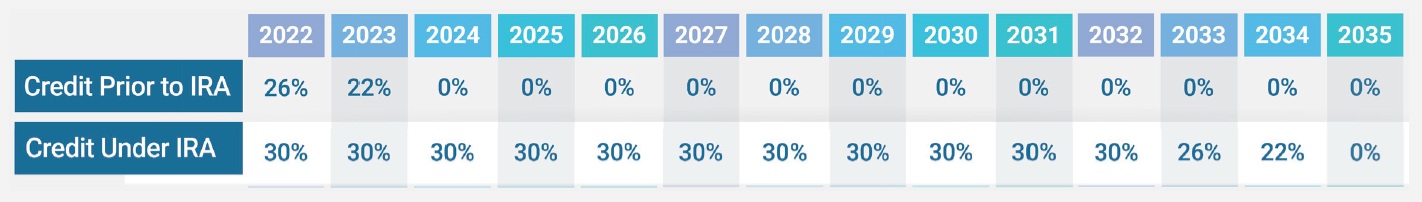

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Printables for free include a vast range of downloadable, printable materials available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and more. The value of Federal Tax Credits For Renewable Energy is their versatility and accessibility.

More of Federal Tax Credits For Renewable Energy

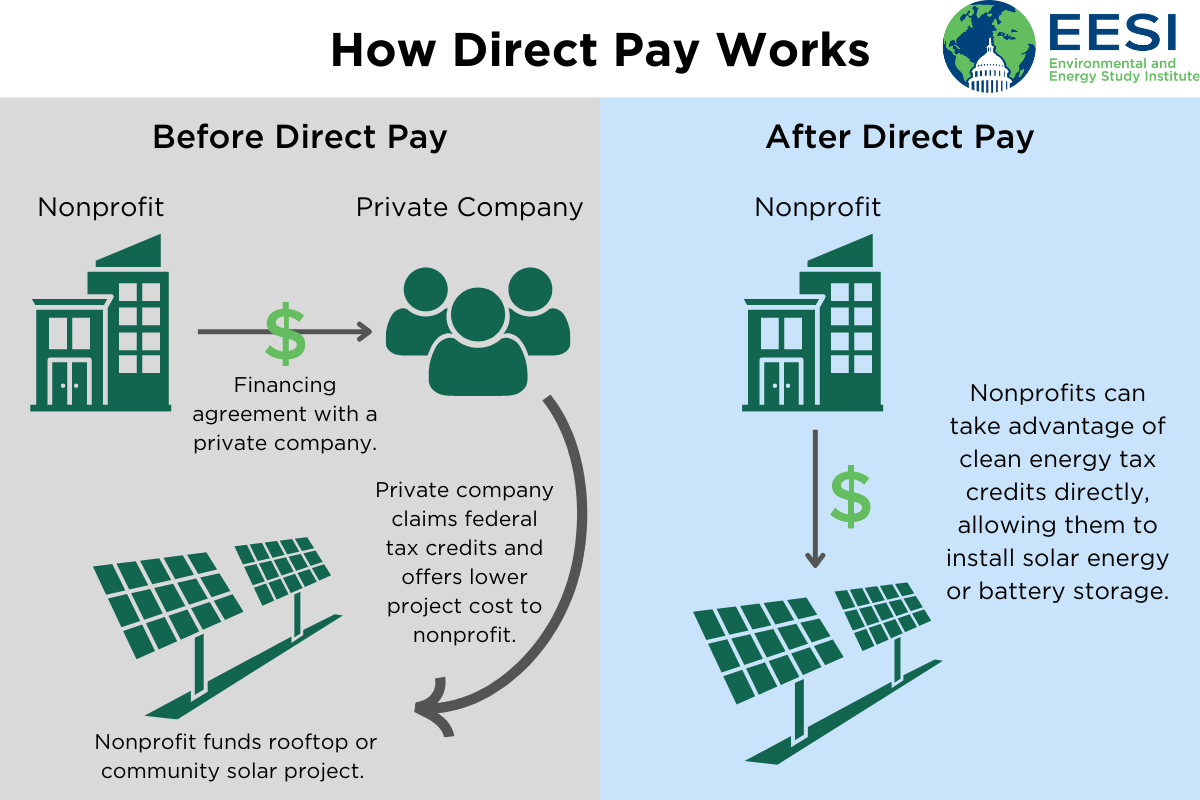

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization It is possible to tailor printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making them a useful tool for teachers and parents.

-

Affordability: immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more Federal Tax Credits For Renewable Energy

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC which was expanded in 2022 through the passage of the Inflation Reduction Act IRA

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a

We hope we've stimulated your interest in printables for free Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Federal Tax Credits For Renewable Energy for all motives.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Federal Tax Credits For Renewable Energy

Here are some ideas that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Tax Credits For Renewable Energy are an abundance of practical and imaginative resources for a variety of needs and pursuits. Their accessibility and flexibility make them a fantastic addition to the professional and personal lives of both. Explore the vast array of Federal Tax Credits For Renewable Energy now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download these resources at no cost.

-

Do I have the right to use free printables to make commercial products?

- It's based on the terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions on usage. Be sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home using either a printer or go to any local print store for premium prints.

-

What software must I use to open Federal Tax Credits For Renewable Energy?

- Many printables are offered in the PDF format, and is open with no cost software such as Adobe Reader.

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Congress Joined In This December Performing Its Own Yearly Ritual Of

Check more sample of Federal Tax Credits For Renewable Energy below

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credits For Businesses Department Of Energy

What You Need To Know About The Extended Federal Tax Credits For Energy

Wind Turbine

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Let Them Eat ITCs Buttondown

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.eia.gov/energyexplained/renewable-sources/incentives.php

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS Grant and loan programs may be

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS Grant and loan programs may be

Wind Turbine

Federal Solar Tax Credits For Businesses Department Of Energy

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Let Them Eat ITCs Buttondown

Solar Tax Credit Calculator NikiZsombor

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Determining Eligibility For The Solar Investment Tax Credit Geoscape