In this digital age, where screens dominate our lives yet the appeal of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or simply to add an individual touch to the home, printables for free are a great resource. This article will dive deep into the realm of "Federal Tax Credits For Home Improvements 2023," exploring their purpose, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Federal Tax Credits For Home Improvements 2023 Below

Federal Tax Credits For Home Improvements 2023

Federal Tax Credits For Home Improvements 2023 -

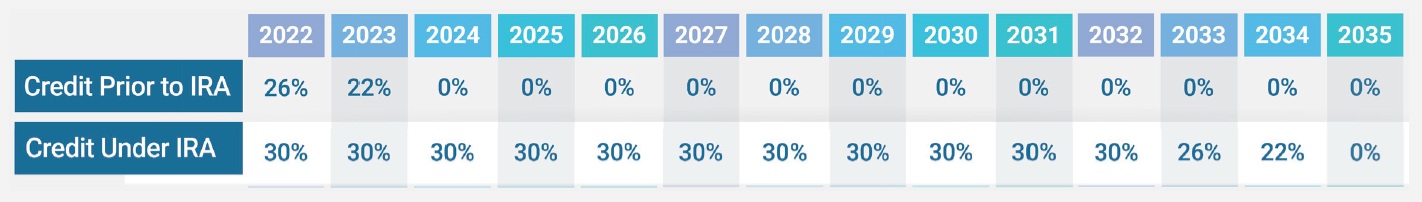

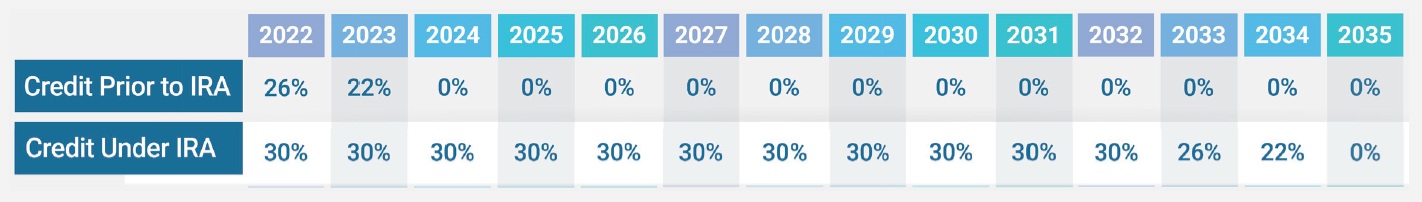

Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year

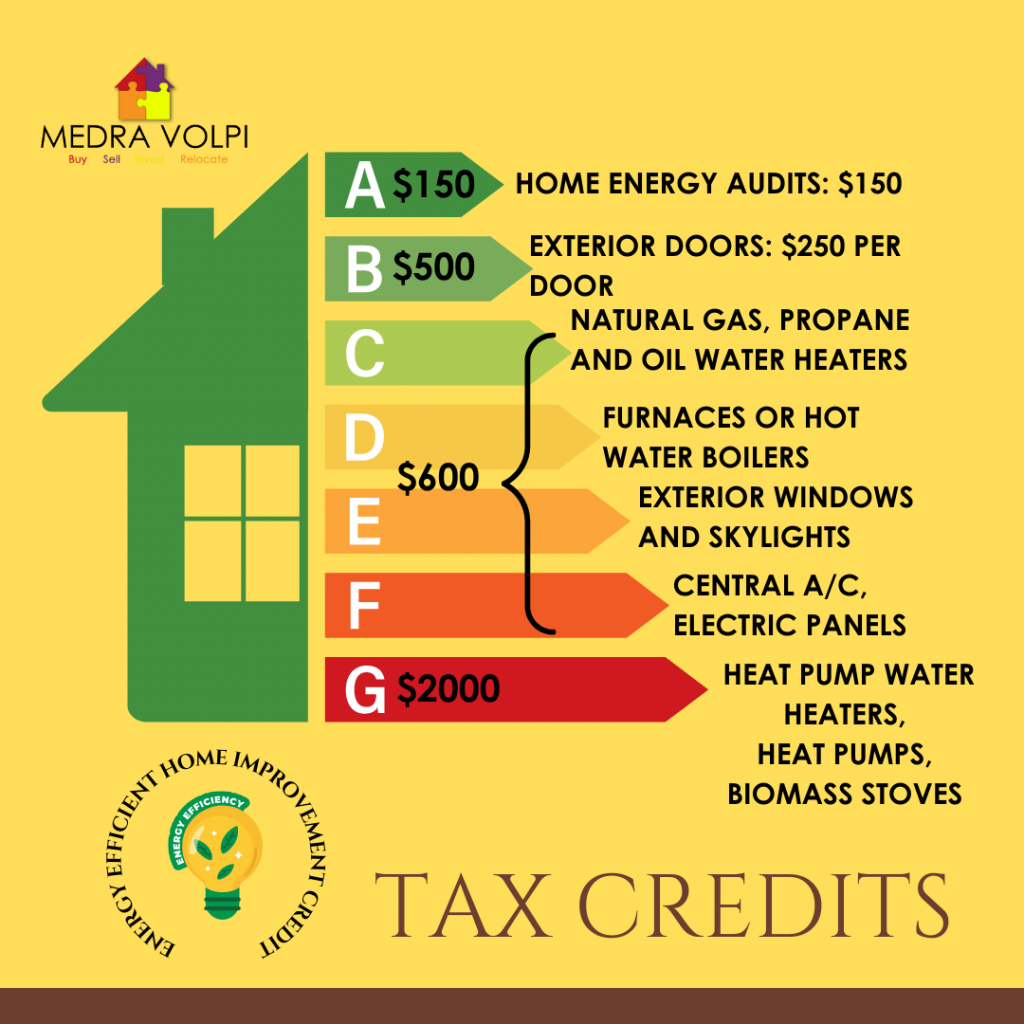

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

Federal Tax Credits For Home Improvements 2023 cover a large selection of printable and downloadable resources available online for download at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and much more. The appealingness of Federal Tax Credits For Home Improvements 2023 is in their variety and accessibility.

More of Federal Tax Credits For Home Improvements 2023

Energy Tax Credits For Home Improvements In 2023

Energy Tax Credits For Home Improvements In 2023

The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit amount is 1 200 for home

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy systems in your home including solar panels wind turbines battery storage and more 2 Get Pumped

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization You can tailor the design to meet your needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a useful tool for teachers and parents.

-

Accessibility: Quick access to the vast array of design and templates can save you time and energy.

Where to Find more Federal Tax Credits For Home Improvements 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the value of your home

April 17 2024 The IRS today issued frequently asked questions FAQs in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements A related IRS release IR 2024 113 April 17 2024 identifies the FAQs revisions as General questions Question 4

After we've peaked your curiosity about Federal Tax Credits For Home Improvements 2023 We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Federal Tax Credits For Home Improvements 2023 suitable for many uses.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a broad selection of subjects, all the way from DIY projects to party planning.

Maximizing Federal Tax Credits For Home Improvements 2023

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Federal Tax Credits For Home Improvements 2023 are a treasure trove of practical and innovative resources which cater to a wide range of needs and needs and. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the vast world of Federal Tax Credits For Home Improvements 2023 now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Credits For Home Improvements 2023 really are they free?

- Yes you can! You can download and print these items for free.

-

Can I download free printables for commercial purposes?

- It depends on the specific rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions regarding their use. Be sure to review the terms and conditions offered by the author.

-

How can I print Federal Tax Credits For Home Improvements 2023?

- You can print them at home with either a printer at home or in an in-store print shop to get top quality prints.

-

What program do I require to view printables for free?

- The majority of PDF documents are provided with PDF formats, which can be opened with free programs like Adobe Reader.

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Check more sample of Federal Tax Credits For Home Improvements 2023 below

Tax Credits Available For Making Efficiency Improvements Heartland Energy

File Home Alone 2 GB Credits Manual jpg Video Game Music

Put Federal Tax Credits For Energy Efficient Home Improvements To Good

Energy Efficiency Rebates And Tax Credits For Home Improvements In 2023

How To Save Money On Home Improvements With Energy Efficiency Tax

Let Them Eat ITCs Buttondown

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Energy Efficiency Rebates And Tax Credits For Home Improvements In 2023

File Home Alone 2 GB Credits Manual jpg Video Game Music

How To Save Money On Home Improvements With Energy Efficiency Tax

Let Them Eat ITCs Buttondown

Tax Credits For Home Energy Upgrades

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Maximizing Your Tax Savings Understanding Energy Tax Credits For Home