In the digital age, where screens have become the dominant feature of our lives, the charm of tangible printed materials hasn't faded away. Whether it's for educational purposes and creative work, or just adding a personal touch to your space, Federal Tax Credits For Furnace Replacement are a great source. This article will dive into the world "Federal Tax Credits For Furnace Replacement," exploring what they are, where to find them and how they can enrich various aspects of your daily life.

Get Latest Federal Tax Credits For Furnace Replacement Below

Federal Tax Credits For Furnace Replacement

Federal Tax Credits For Furnace Replacement -

Furnaces Boilers Central Air Conditioners Electric Panel Upgrade Home Energy Audit Save 30 on Residential Clean Energy Equipment Upgrades This credit can be claimed for the following qualifying expenditures incurred for either an existing home or a newly constructed home Geothermal Heat Pumps Small Wind Turbines Solar Energy Systems

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

Federal Tax Credits For Furnace Replacement include a broad selection of printable and downloadable materials online, at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and more. The great thing about Federal Tax Credits For Furnace Replacement lies in their versatility and accessibility.

More of Federal Tax Credits For Furnace Replacement

The Inflation Reduction Act pumps Up Heat Pumps Hvac

The Inflation Reduction Act pumps Up Heat Pumps Hvac

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification and

Find out how to claim federal income tax credits when replacing your furnace To claim federal income tax credits for furnace replacement there are a few steps you need to follow Determine eligibility Check if your new furnace meets the criteria set by the IRS for energy efficiency and qualifies for tax credits

Federal Tax Credits For Furnace Replacement have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: It is possible to tailor designs to suit your personal needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value: The free educational worksheets can be used by students of all ages, making them a great aid for parents as well as educators.

-

Accessibility: immediate access the vast array of design and templates can save you time and energy.

Where to Find more Federal Tax Credits For Furnace Replacement

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Air Conditioners Heat Pumps 2023

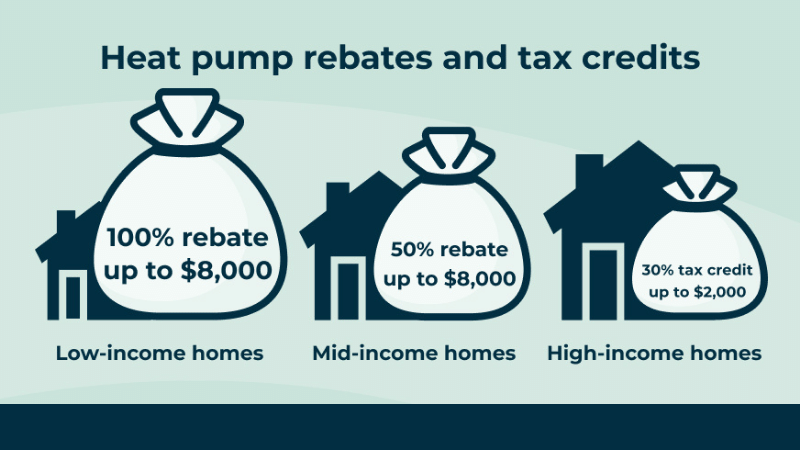

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Eligible models as listed above are qualified and dependent upon specific system combinations

How to apply Gas Propane or Oil Furnaces and Fans Gas furnaces that are ENERGY STAR certified except those for U S South only meet the requirements for the furnace tax credit Gas and oil furnaces that have earned the ENERGY STAR include fans that meet the requirements of the fan tax credit

We hope we've stimulated your interest in printables for free Let's find out where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Federal Tax Credits For Furnace Replacement suitable for many goals.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing Federal Tax Credits For Furnace Replacement

Here are some ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Federal Tax Credits For Furnace Replacement are an abundance filled with creative and practical information catering to different needs and passions. Their accessibility and versatility make these printables a useful addition to each day life. Explore the vast array of Federal Tax Credits For Furnace Replacement today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Credits For Furnace Replacement really for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printouts for commercial usage?

- It's based on the conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Be sure to review the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with printing equipment or visit the local print shops for higher quality prints.

-

What software do I need in order to open printables for free?

- The majority of PDF documents are provided in PDF format, which is open with no cost programs like Adobe Reader.

Federal Solar Tax Credit What It Is How To Claim It For 2023

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Check more sample of Federal Tax Credits For Furnace Replacement below

4 Ways To Prepare For Furnace Replacement IT Landes Home Service

Tax Credits For Energy Efficient Replacement Windows What You Should

Is It Time For Furnace Replacement Team Harding

Federal Tax Credits Bryant

New Federal Tax Credits Make Replacing Your Furnace Easier

30 Federal Tax Credits For Heat Pump Water Heaters 2023

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

https://www.irs.gov/newsroom/irs-releases...

IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home

Federal Tax Credits Bryant

Tax Credits For Energy Efficient Replacement Windows What You Should

New Federal Tax Credits Make Replacing Your Furnace Easier

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Solar Tax Credits Rebates Missouri Arkansas

Furnace Motor Replacement Cost Blower Motor

Furnace Motor Replacement Cost Blower Motor

Solar Tax Credit 2022 Incentives For Solar Panel Installations