Today, with screens dominating our lives yet the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add personal touches to your area, Federal Tax Credit For High Efficiency Hvac Systems are a great source. With this guide, you'll take a dive in the world of "Federal Tax Credit For High Efficiency Hvac Systems," exploring the benefits of them, where they are, and what they can do to improve different aspects of your lives.

Get Latest Federal Tax Credit For High Efficiency Hvac Systems Below

Federal Tax Credit For High Efficiency Hvac Systems

Federal Tax Credit For High Efficiency Hvac Systems -

These rebates which include the Home Efficiency Rebates and Home Electrification and Appliance Rebates will put money directly back in the hands of American households The

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Federal Tax Credit For High Efficiency Hvac Systems encompass a wide range of printable, free materials online, at no cost. These resources come in many formats, such as worksheets, templates, coloring pages, and many more. The appeal of printables for free is in their versatility and accessibility.

More of Federal Tax Credit For High Efficiency Hvac Systems

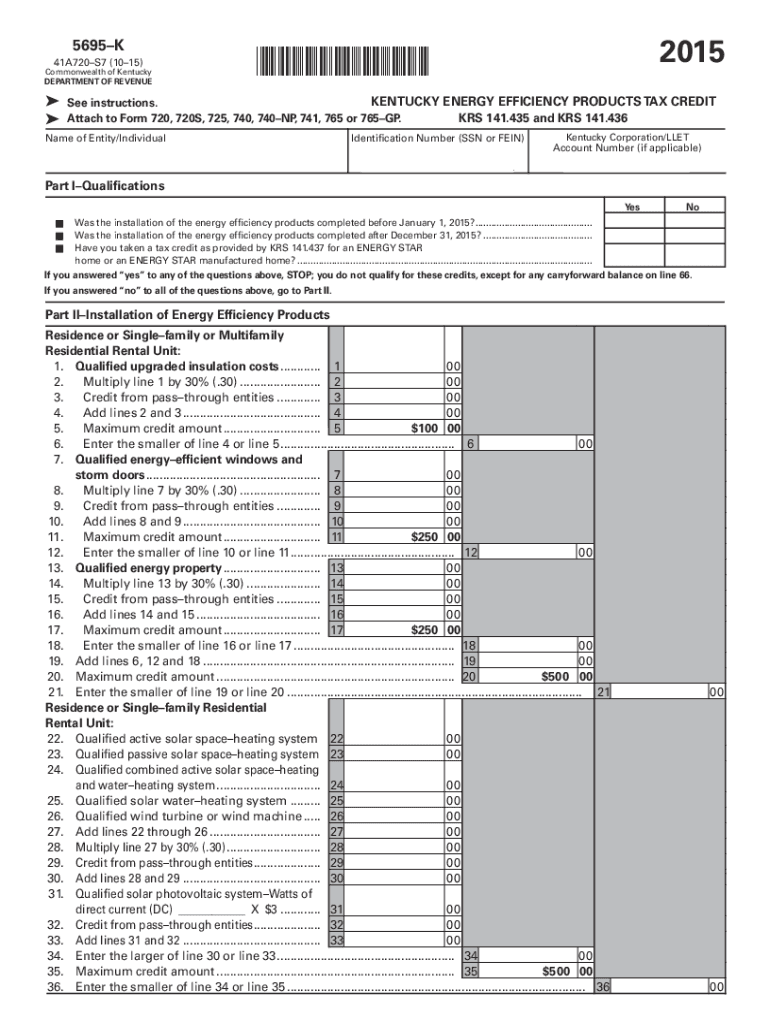

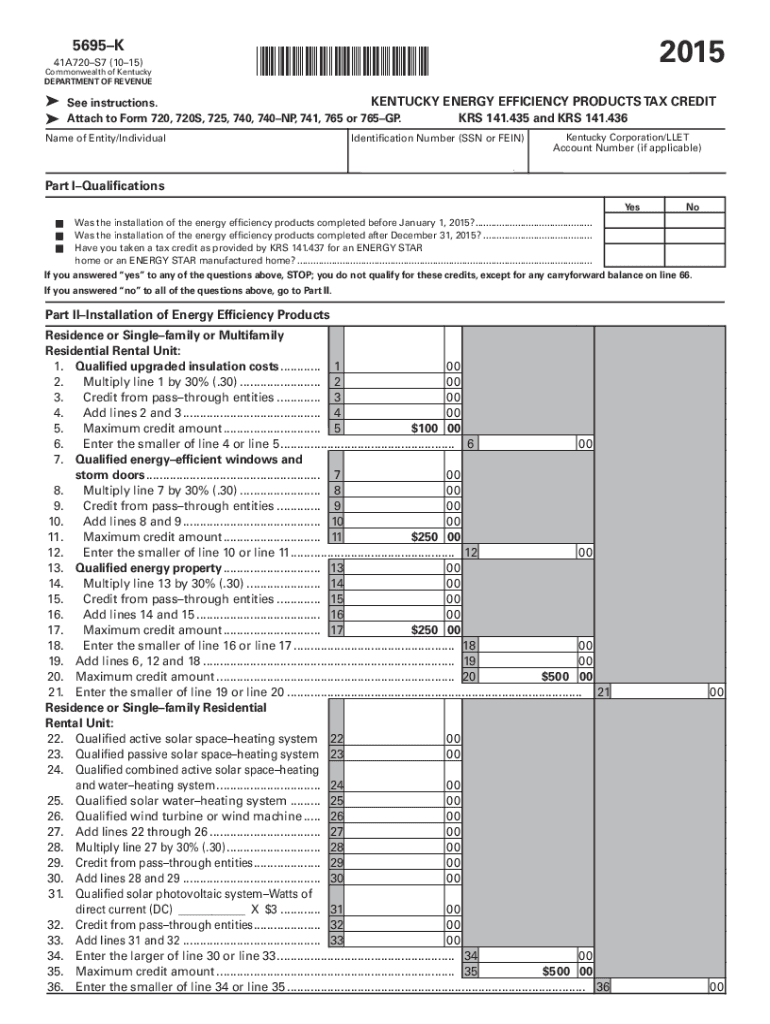

Form 5695 Fill Out And Sign Printable PDF Template SignNow

Form 5695 Fill Out And Sign Printable PDF Template SignNow

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up

One key provision of the Inflation Reduction Act is the extension and expansion of federal tax credits for energy efficient home improvements like HVAC systems insulation

Federal Tax Credit For High Efficiency Hvac Systems have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Individualization We can customize the design to meet your needs, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Value The free educational worksheets can be used by students of all ages. This makes them a vital resource for educators and parents.

-

Convenience: Quick access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Federal Tax Credit For High Efficiency Hvac Systems

Rebates And Tax Credits Available For High Efficiency HVAC Equipment

Rebates And Tax Credits Available For High Efficiency HVAC Equipment

Under the 25C tax credit program homeowners can receive credits on qualifying energy efficient home improvements including high efficiency heat pumps and central air conditioners that

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

Now that we've piqued your curiosity about Federal Tax Credit For High Efficiency Hvac Systems we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Federal Tax Credit For High Efficiency Hvac Systems designed for a variety applications.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing Federal Tax Credit For High Efficiency Hvac Systems

Here are some creative ways in order to maximize the use use of Federal Tax Credit For High Efficiency Hvac Systems:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Federal Tax Credit For High Efficiency Hvac Systems are an abundance of creative and practical resources for a variety of needs and preferences. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the wide world of Federal Tax Credit For High Efficiency Hvac Systems today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Credit For High Efficiency Hvac Systems really free?

- Yes you can! You can download and print these files for free.

-

Does it allow me to use free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with Federal Tax Credit For High Efficiency Hvac Systems?

- Certain printables may be subject to restrictions concerning their use. You should read the terms and conditions provided by the designer.

-

How can I print Federal Tax Credit For High Efficiency Hvac Systems?

- You can print them at home with any printer or head to the local print shops for superior prints.

-

What software do I need to open printables for free?

- Most PDF-based printables are available as PDF files, which can be opened using free programs like Adobe Reader.

The Inflation Reduction Act And The New Tax Incentives Rebates For High

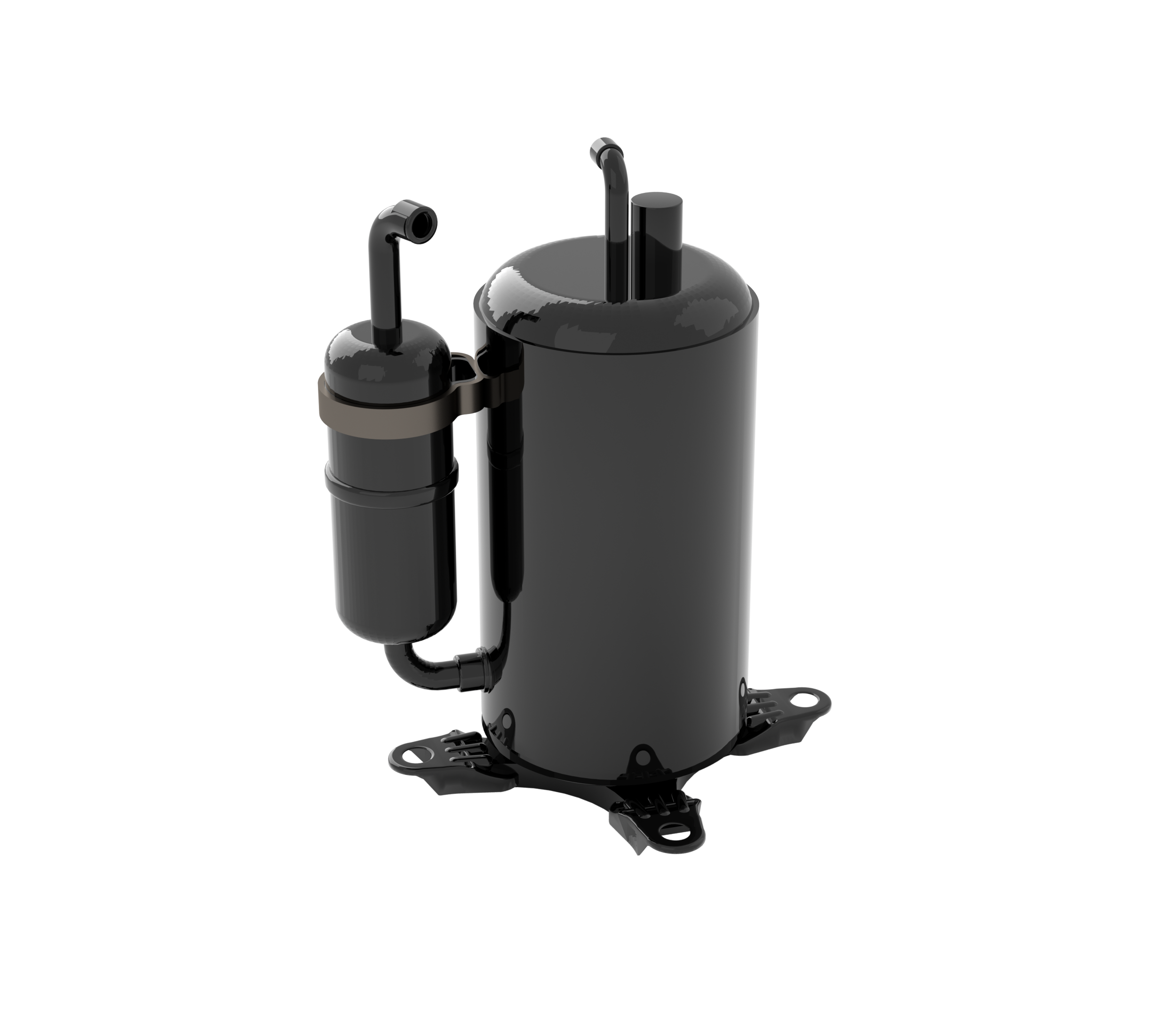

High Efficiency AC Federal Tax Credits High Efficiency HVAC Unit

Check more sample of Federal Tax Credit For High Efficiency Hvac Systems below

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Federal Tax Credit For Electric Cars OsVehicle

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

Taking Advantage Of HVAC Rebates Federal Tax Credits With An HVAC

https://www.energystar.gov/about/fede…

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

Federal Tax Credit For Electric Cars OsVehicle

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

Taking Advantage Of HVAC Rebates Federal Tax Credits With An HVAC

Devil Is In The Details Technology Enabled Tools To Differentiate

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Air Conditioning Compressors Panasonic Industrial Devices