Today, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. Whatever the reason, whether for education, creative projects, or simply to add some personal flair to your space, Federal Income Tax Credit are now a vital resource. With this guide, you'll take a dive in the world of "Federal Income Tax Credit," exploring what they are, how to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Federal Income Tax Credit Below

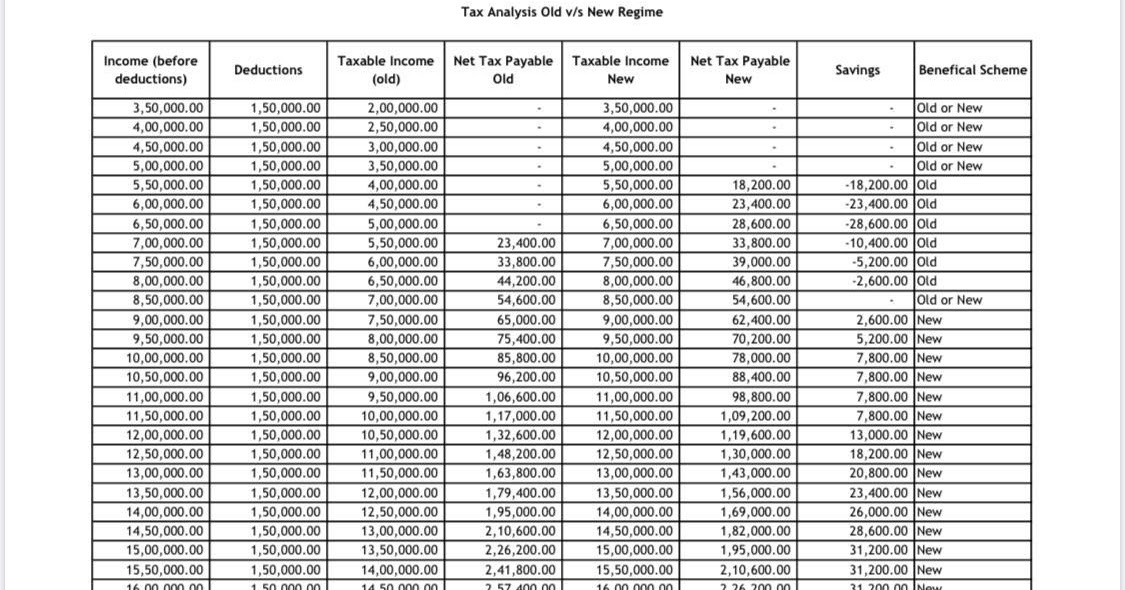

Federal Income Tax Credit

Federal Income Tax Credit -

The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people not taking advantage of this valuable credit Help us reach the workers who qualify but miss out on thousands of

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

Federal Income Tax Credit cover a large array of printable resources available online for download at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and much more. The appeal of printables for free is in their variety and accessibility.

More of Federal Income Tax Credit

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

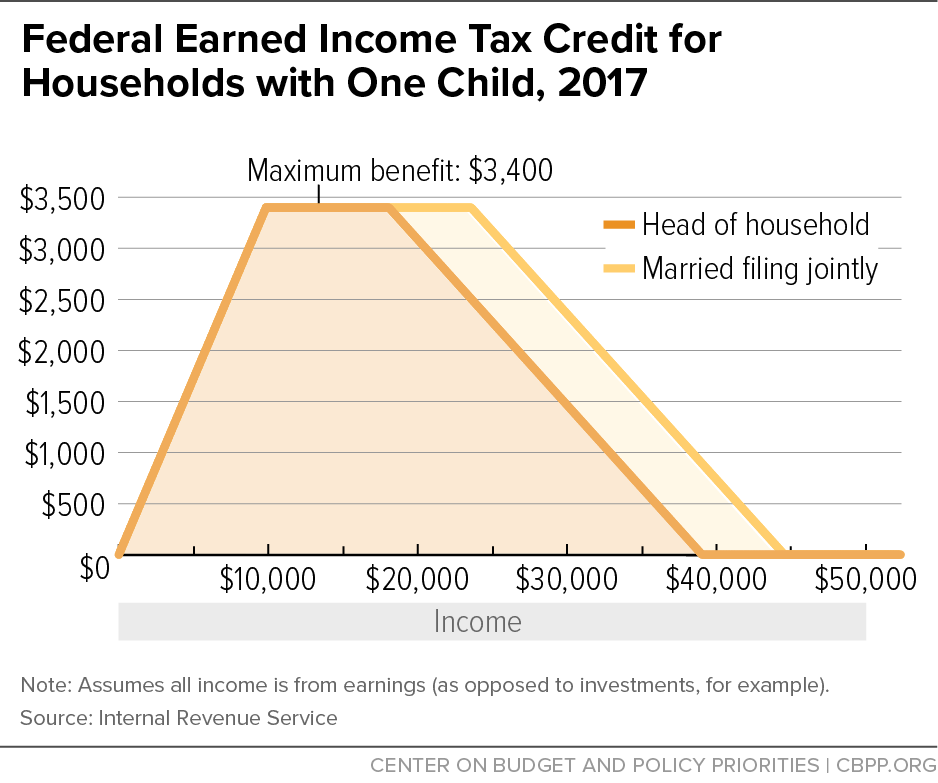

The EITC is a federal tax credit that offers American workers and families a financial boost The EITC has been benefitting low and moderate income workers for 46 years and many working families receive more money through EITC than they pay in

More people without children now qualify for the Earned Income Tax Credit EITC the federal government s largest refundable tax credit for low to moderate income families In addition families can use pre pandemic income levels to qualify if

Federal Income Tax Credit have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization There is the possibility of tailoring printing templates to your own specific requirements be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Use: Free educational printables offer a wide range of educational content for learners of all ages, which makes these printables a powerful device for teachers and parents.

-

Accessibility: instant access many designs and templates saves time and effort.

Where to Find more Federal Income Tax Credit

What Is Child Tax Credit Federal Income Tax Return ExcelDataPro

What Is Child Tax Credit Federal Income Tax Return ExcelDataPro

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info 2 Filing Status 3 AGI 4 Qualifying Children 5 Results General Information Answer a few quick questions about yourself to see if you qualify

Must have lived in the United States for more than half of the tax year Either you or your spouse if filing a joint return must be at least age 25 but less than age 65 Cannot qualify as the dependent of another person Special rules apply for members of the military on extended duty outside the United States

Now that we've piqued your curiosity about Federal Income Tax Credit and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Federal Income Tax Credit for various needs.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Federal Income Tax Credit

Here are some inventive ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Federal Income Tax Credit are an abundance of fun and practical tools that meet a variety of needs and interests. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the vast array of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free templates for commercial use?

- It depends on the specific terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright problems with Federal Income Tax Credit?

- Certain printables may be subject to restrictions concerning their use. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print Federal Income Tax Credit?

- You can print them at home with the printer, or go to a print shop in your area for premium prints.

-

What program is required to open Federal Income Tax Credit?

- A majority of printed materials are in the format of PDF, which can be opened using free software like Adobe Reader.

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

2023 Form 1040 Tax Tables Printable Forms Free Online

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)

Check more sample of Federal Income Tax Credit below

Why Tax Credits For Working Families Matter

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

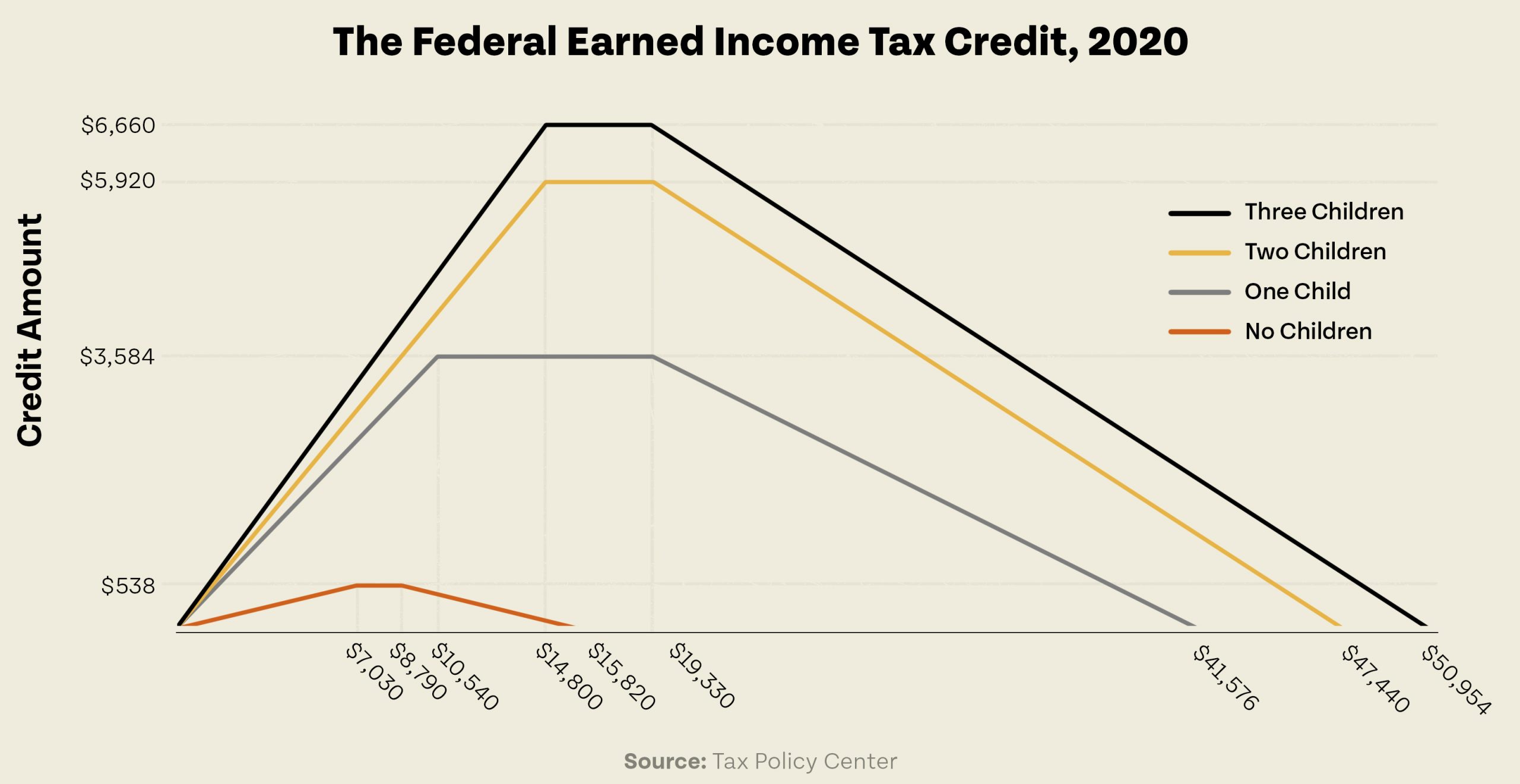

The Federal Earned Income Tax Credit Neighborhood Legal

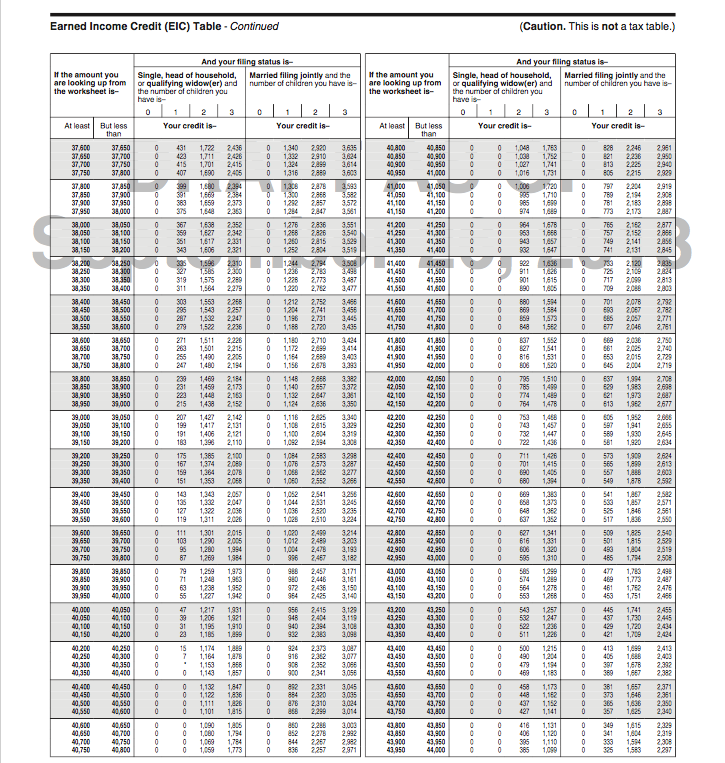

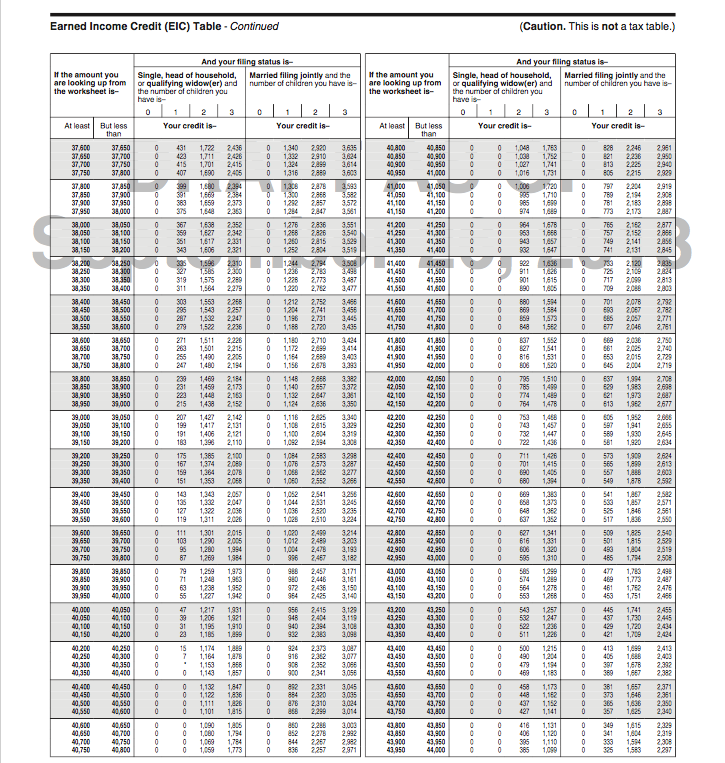

Eic Worksheet B 2020

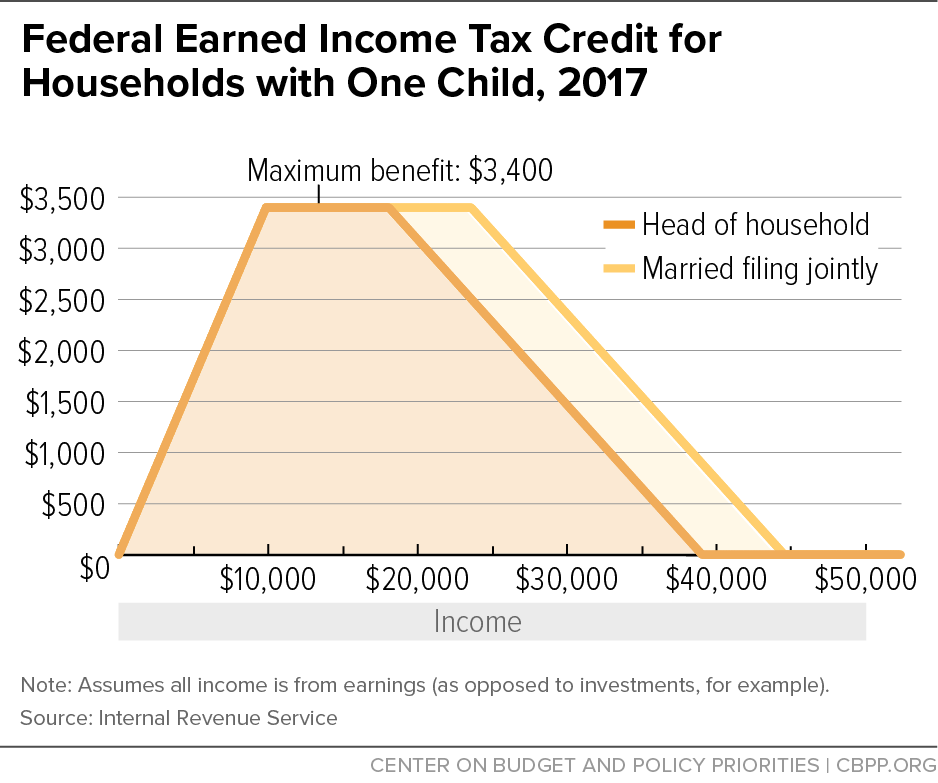

Federal Earned Income Tax Credit For Households With One Child 2017

https://www. irs.gov /newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

https://www. nerdwallet.com /article/taxes/can-you...

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the

The Federal Earned Income Tax Credit Neighborhood Legal

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

Eic Worksheet B 2020

Federal Earned Income Tax Credit For Households With One Child 2017

1040ez Printable Form Carfare me 2019 2020

2023 Tax Tables Australia IMAGESEE

2023 Tax Tables Australia IMAGESEE

What s New For 2023 Tax Year Get New Year 2023 Update