In the digital age, where screens rule our lives, the charm of tangible printed objects isn't diminished. For educational purposes in creative or artistic projects, or simply to add an element of personalization to your home, printables for free are now an essential resource. We'll take a dive through the vast world of "Federal Incentive Programs," exploring the different types of printables, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Federal Incentive Programs Below

Federal Incentive Programs

Federal Incentive Programs -

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification

Printables for free cover a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and more. The value of Federal Incentive Programs is in their variety and accessibility.

More of Federal Incentive Programs

Services EcoHaven LLC

Services EcoHaven LLC

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain

Publication 5886 A Clean Energy Tax Incentives for Individuals PDF Page Last Reviewed or Updated 09 Jan 2024 The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: They can make print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students from all ages, making them a valuable source for educators and parents.

-

An easy way to access HTML0: The instant accessibility to many designs and templates can save you time and energy.

Where to Find more Federal Incentive Programs

2023 Federal EV Charging Infrastructure Rebates Part 1 Incentive

2023 Federal EV Charging Infrastructure Rebates Part 1 Incentive

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households

The National Electric Vehicle Infrastructure Formula Program NEVI created under BIL apportions a total of 5 billion to States D C and Puerto Rico over five years from Fiscal Year 2022 through 2026 to strategically deploy EV charging infrastructure and to establish an interconnected national network to facilitate station data collection

We've now piqued your curiosity about Federal Incentive Programs Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Federal Incentive Programs for a variety reasons.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing Federal Incentive Programs

Here are some ideas for you to get the best of Federal Incentive Programs:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Federal Incentive Programs are a treasure trove of fun and practical tools designed to meet a range of needs and passions. Their accessibility and versatility make them an essential part of both personal and professional life. Explore the vast array that is Federal Incentive Programs today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Incentive Programs really free?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free templates for commercial use?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions in use. Be sure to review the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with the printer, or go to any local print store for better quality prints.

-

What program do I need in order to open printables that are free?

- A majority of printed materials are with PDF formats, which can be opened with free programs like Adobe Reader.

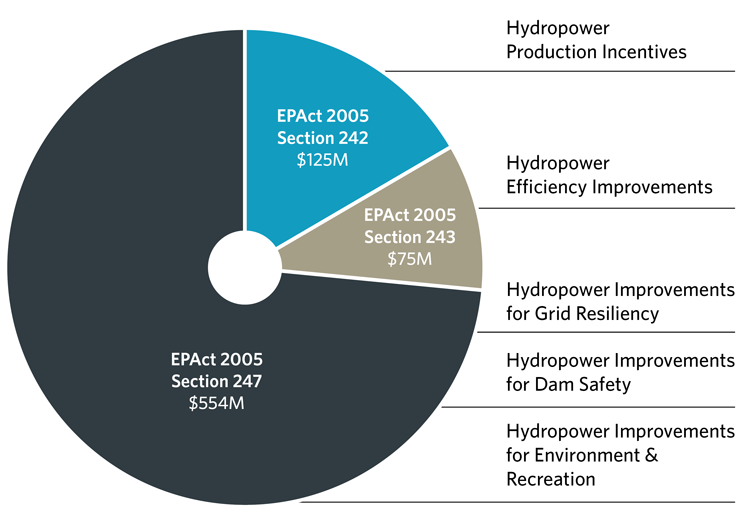

Prioritize Hydropower Projects For Government Funding HDR

West Adams Avenues Incredible Resources

Check more sample of Federal Incentive Programs below

Switch To Solar Windmar

LCFS Credit Generation Benefiting Vehicles Forklifts U S Gain

The Cost And Savings Of Solar Power Solar Power Production

Payroll Systems 250 000 Federal Incentive Payroll Tax Credit

Crosstown Industrial Park Partner Tulsa

Pide IP A Gobierno Incentivar Inversi n Periodico El Vigia

https://www.energy.gov/scep/home-energy-rebates-program

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification

https://www.eia.gov/energyexplained/renewable-sources/incentives.php

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS Grant and loan programs may be available from

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS Grant and loan programs may be available from

Payroll Systems 250 000 Federal Incentive Payroll Tax Credit

LCFS Credit Generation Benefiting Vehicles Forklifts U S Gain

Crosstown Industrial Park Partner Tulsa

Pide IP A Gobierno Incentivar Inversi n Periodico El Vigia

February 2007 Diesel Industry News Diesel Power Magazine

Federal EV Incentive Could Be Expanded Following Boosted Sales

Federal EV Incentive Could Be Expanded Following Boosted Sales

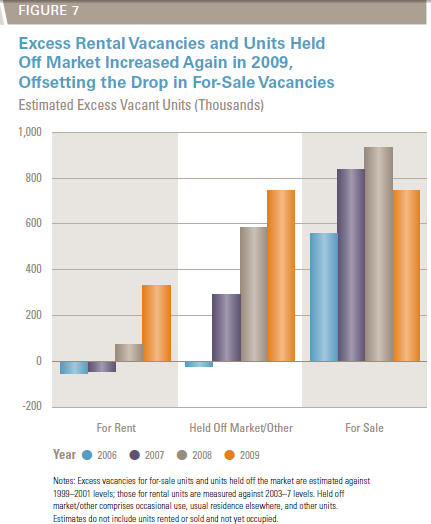

Harvard Housing Report Delivers Facts And Figures