In this age of technology, with screens dominating our lives yet the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education as well as creative projects or just adding some personal flair to your area, Fd Interest Rebate In Income Tax For Senior Citizen have proven to be a valuable source. We'll dive into the world of "Fd Interest Rebate In Income Tax For Senior Citizen," exploring the benefits of them, where they are available, and how they can add value to various aspects of your lives.

Get Latest Fd Interest Rebate In Income Tax For Senior Citizen Below

Fd Interest Rebate In Income Tax For Senior Citizen

Fd Interest Rebate In Income Tax For Senior Citizen - Fd Interest Rebate In Income Tax For Senior Citizens, How Much Fd Interest Is Tax Free For Senior Citizens, Interest On Fixed Deposit Deduction For Senior Citizens, Is Interest On Fd Taxable For Senior Citizens, Tax Rebate On Fd Interest For Senior Citizens, Interest On Fd Deduction For Senior Citizens

Web 12 juil 2023 nbsp 0183 32 Section 80TTB of the Income Tax Act 1961 allows a resident senior citizen to claim a deduction against interest on the deposit Section 80TTB is popular for

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

Printables for free cover a broad range of downloadable, printable materials available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. One of the advantages of Fd Interest Rebate In Income Tax For Senior Citizen is in their versatility and accessibility.

More of Fd Interest Rebate In Income Tax For Senior Citizen

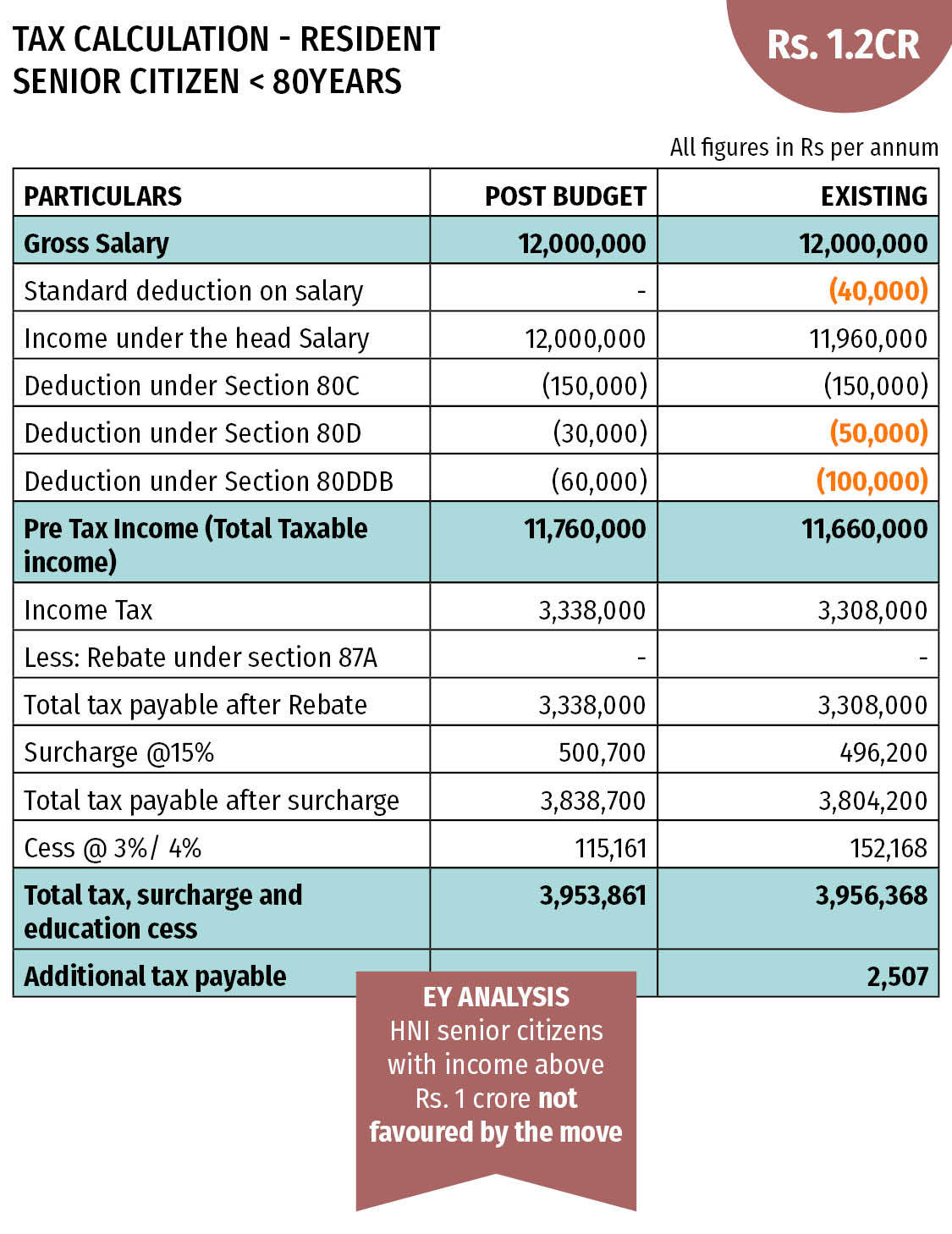

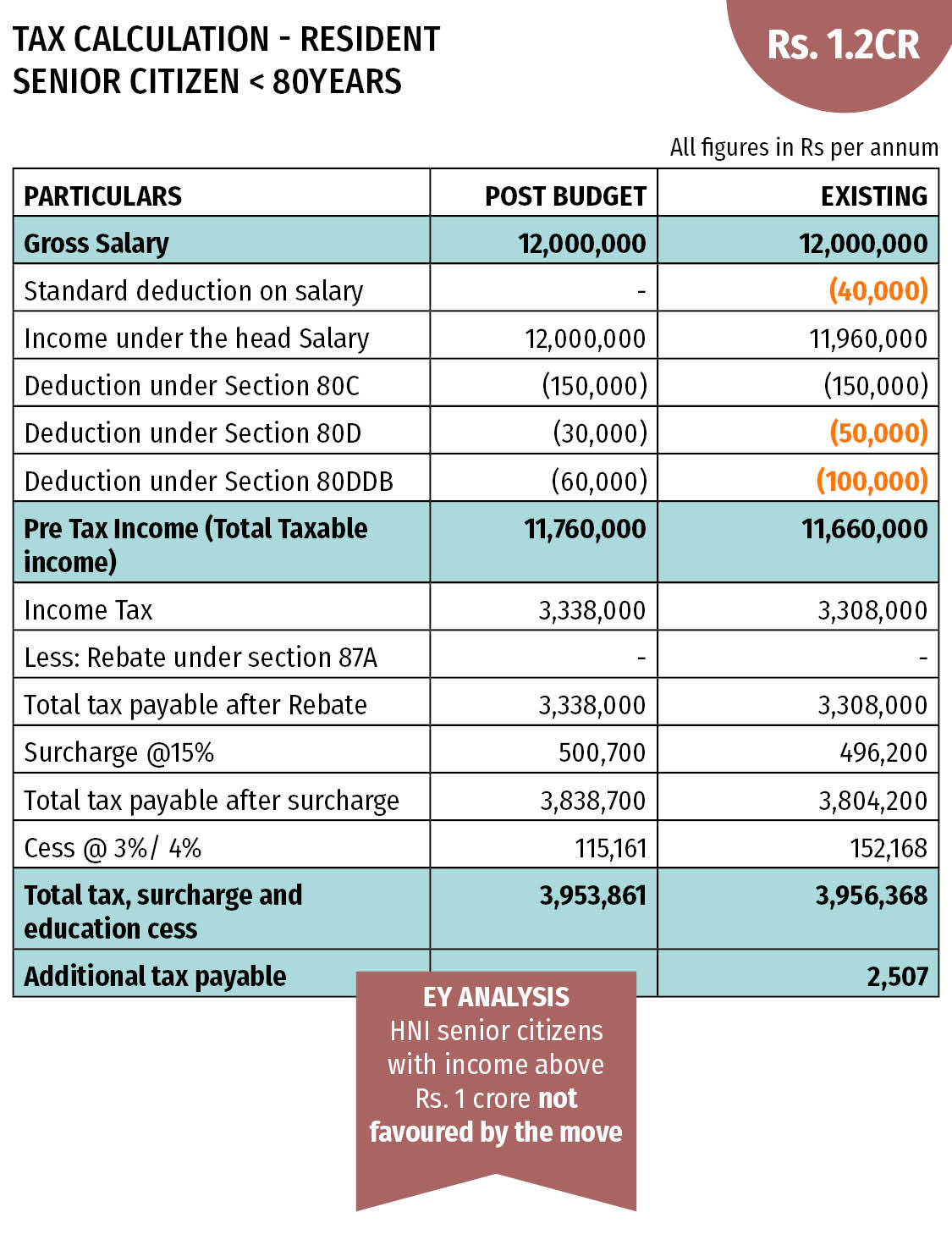

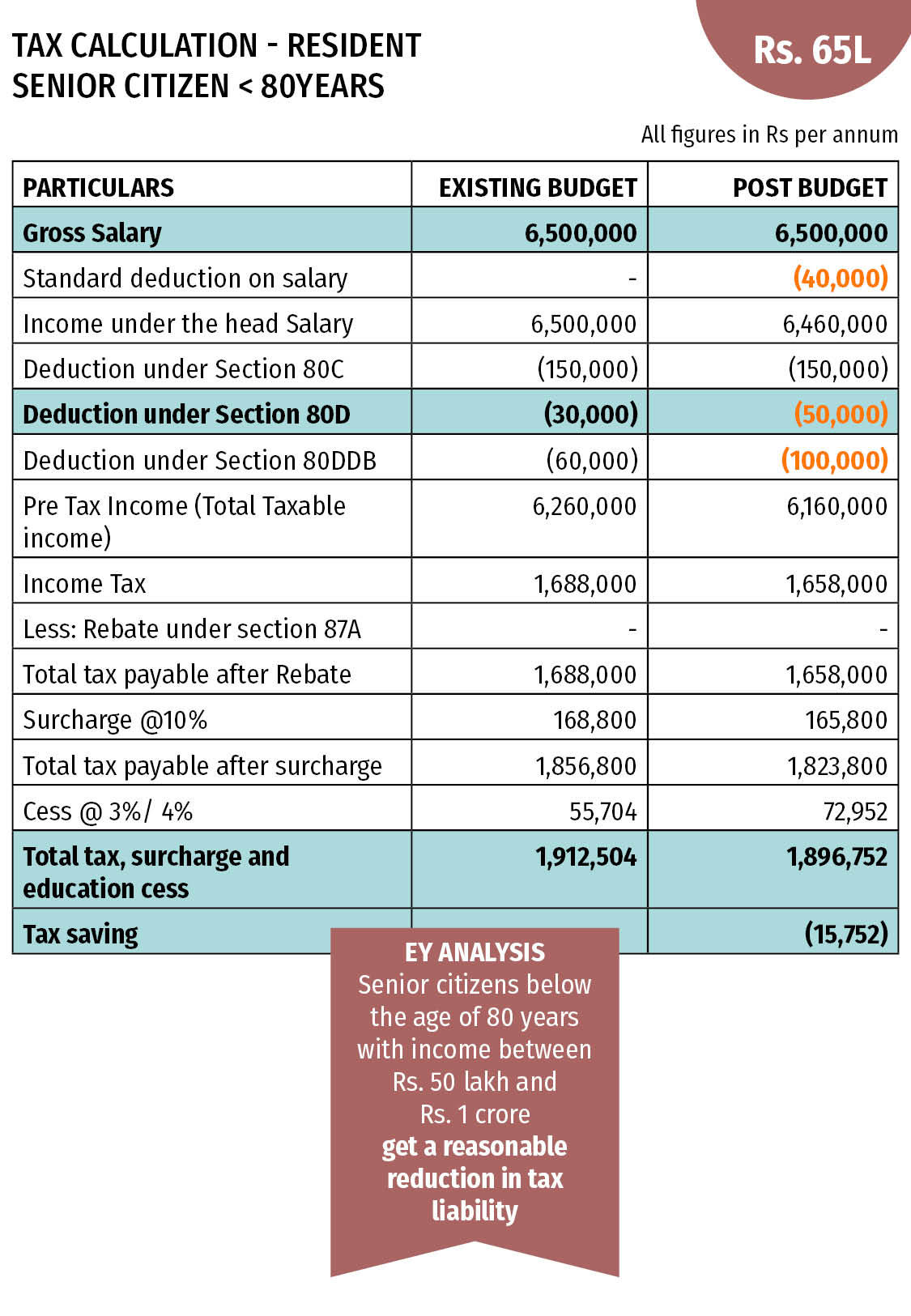

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Web 31 mars 2023 nbsp 0183 32 Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the Income tax Act 1961 This tax

Web 29 juin 2022 nbsp 0183 32 Fixed Deposits Tax Saving FD for Sec 80C Deductions Benefits amp Interest Rates Risks Limits Updated on Jun 29 2022 12 14 25 AM Budget 2021 update It

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor the design to meet your needs, whether it's designing invitations planning your schedule or decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages, which makes them an essential device for teachers and parents.

-

Accessibility: You have instant access various designs and templates saves time and effort.

Where to Find more Fd Interest Rebate In Income Tax For Senior Citizen

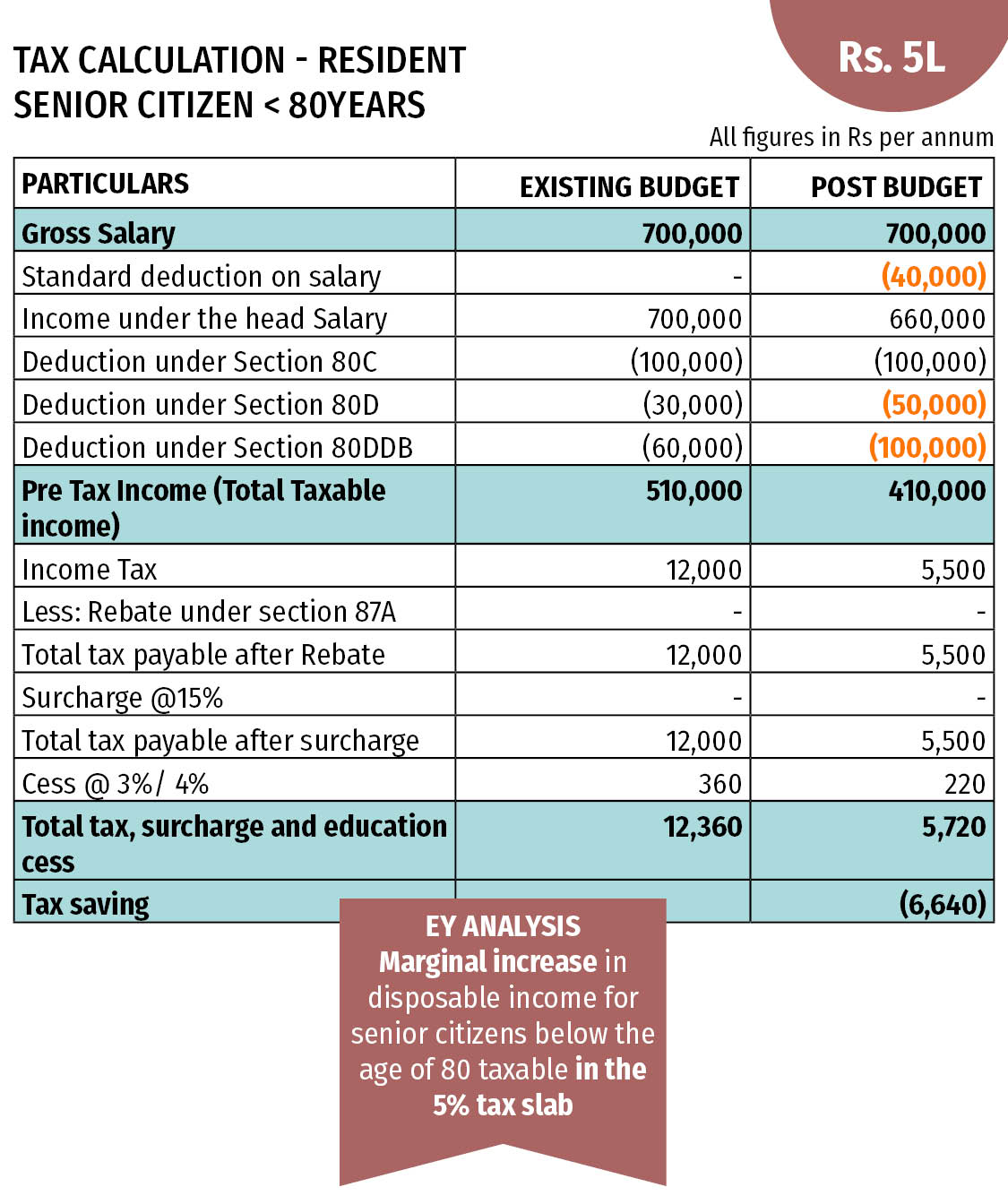

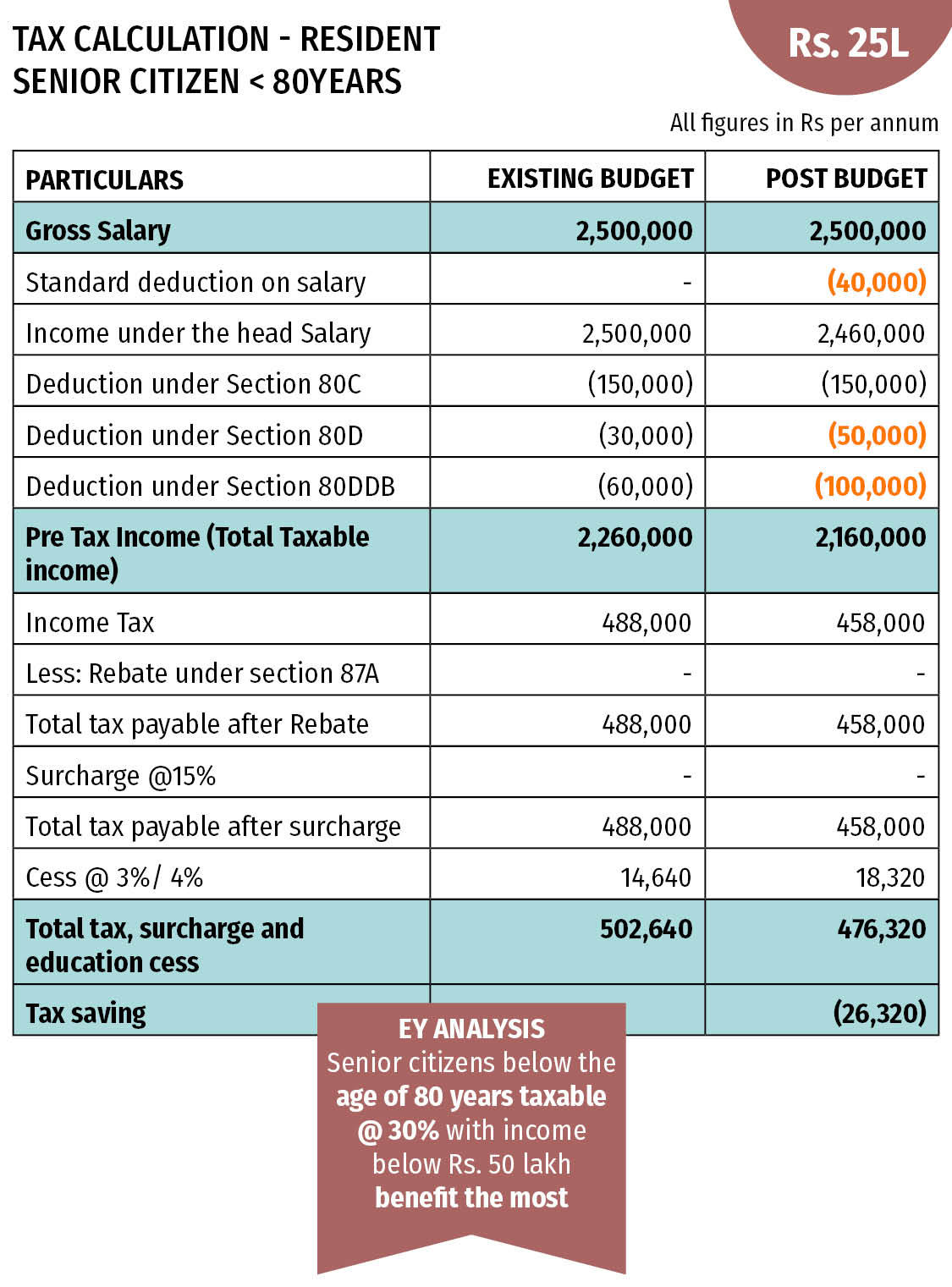

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Web 29 juin 2022 nbsp 0183 32 Show more 13 Exclusive Benefits Available to Senior Citizens In Income Tax Senior Citizen Tax Benefits 2022 In this video I have discussed many benefits exclusively available to senior

Web 22 juil 2023 nbsp 0183 32 Compare interest income with the maximum limit If your interest income is equal to or less than Rs 50 000 you can claim the entire interest income as a deduction under Section 80TTB If your

We've now piqued your curiosity about Fd Interest Rebate In Income Tax For Senior Citizen Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Fd Interest Rebate In Income Tax For Senior Citizen for different objectives.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning tools.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Fd Interest Rebate In Income Tax For Senior Citizen

Here are some ideas of making the most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Fd Interest Rebate In Income Tax For Senior Citizen are an abundance filled with creative and practical information that can meet the needs of a variety of people and hobbies. Their access and versatility makes them a valuable addition to any professional or personal life. Explore the vast world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Fd Interest Rebate In Income Tax For Senior Citizen really gratis?

- Yes, they are! You can download and print these tools for free.

-

Can I utilize free printables in commercial projects?

- It depends on the specific rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with Fd Interest Rebate In Income Tax For Senior Citizen?

- Some printables may come with restrictions regarding their use. Make sure you read the conditions and terms of use provided by the designer.

-

How do I print Fd Interest Rebate In Income Tax For Senior Citizen?

- Print them at home with either a printer or go to a print shop in your area for higher quality prints.

-

What program is required to open printables that are free?

- A majority of printed materials are in the format PDF. This can be opened with free software like Adobe Reader.

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Important Deduction For Income Tax For Salaried Persons Employees On

.jpg)

Check more sample of Fd Interest Rebate In Income Tax For Senior Citizen below

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Income Tax Slabs FY 2020 21 AY 2021 22 Wealthtech Speaks

![]()

Income Tax India On Twitter RT nsitharamanoffc As Announced In

Method Of Calculating Income Tax For Senior Citizen Pensioners

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

https://cleartax.in/s/section-80ttb

Web 4 avr 2018 nbsp 0183 32 Section 80TTB is a provision whereby a taxpayer who is a resident senior citizen aged 60 years and above at any time during a Financial Year FY can claim a

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

Web 4 avr 2018 nbsp 0183 32 Section 80TTB is a provision whereby a taxpayer who is a resident senior citizen aged 60 years and above at any time during a Financial Year FY can claim a

Method Of Calculating Income Tax For Senior Citizen Pensioners

Income Tax Slabs FY 2020 21 AY 2021 22 Wealthtech Speaks

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

SENIOR CITIZEN INCOME TAX CALCULATION FY 2019 20 REBATE 87A TAX

Income Tax Slab For Senior Citizen Super Senior Citizen Income Tax

Income Tax Slab For Senior Citizen Super Senior Citizen Income Tax

INCOME TAX Relief Senior Citizens Change In FORM 15H Rebate 87A Senior