In this age of electronic devices, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add some personal flair to your area, Family Pension Deduction Under Income Tax have become an invaluable resource. For this piece, we'll take a dive to the depths of "Family Pension Deduction Under Income Tax," exploring the benefits of them, where to locate them, and how they can add value to various aspects of your life.

Get Latest Family Pension Deduction Under Income Tax Below

Family Pension Deduction Under Income Tax

Family Pension Deduction Under Income Tax -

Updated on Mar 20th 2024 5 min read Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is

For family pensioners a standard deduction of Rs 15 000 will be available under the new tax regime Income for a family pensioner is taxed under the head Income from other sources

Family Pension Deduction Under Income Tax offer a wide assortment of printable, downloadable items that are available online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and many more. One of the advantages of Family Pension Deduction Under Income Tax is their versatility and accessibility.

More of Family Pension Deduction Under Income Tax

ITAT Rules On Deduction Under IT Act Legal 60

ITAT Rules On Deduction Under IT Act Legal 60

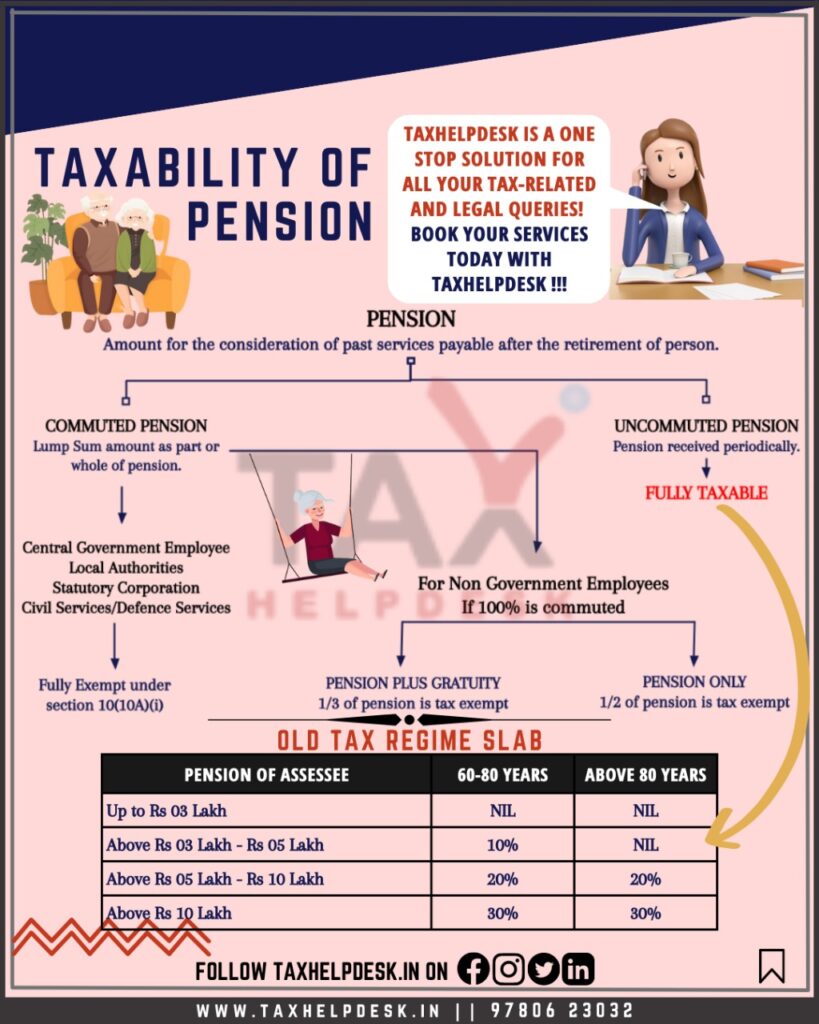

While the provisions of salary income would be applicable to retired employees beneficiaries of family pension will get a deduction of 1 3 of the amount of family pension received or Rs

Also family pensioners can now get a standard deduction of Rs 15 000 under the new tax regime Previously this benefit was only available to old tax regime taxpayers Increase in Tax Rebate Limit Previously incomes up to Rs 5 lakh were eligible for tax rebates under the new tax regime

Family Pension Deduction Under Income Tax have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor printables to your specific needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Value: The free educational worksheets are designed to appeal to students of all ages, which makes them a great instrument for parents and teachers.

-

Accessibility: You have instant access numerous designs and templates helps save time and effort.

Where to Find more Family Pension Deduction Under Income Tax

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C Its Allied Sections

Family pension is taxable after allowing an exemption of 33 33 or Rs 15000 whichever is less For example a family member receives a monthly pension of Rs 50 000 So the exemption will be Rs 15 000 lower of Rs 15 000 or Rs 16 665 Rs 50 000 33 33 Thus the taxable family pension will be Rs 35 000 Rs 50 000 Rs 15 000

Under section 115BAC the total income of the taxpayer shall be computed without any deduction under the provisions of Allowances for income of minor Section 10 32 Note Deduction for family Pension Section 57 iia is allowed from Financial Year 2023 24 Assessment Year 2024 25

Now that we've piqued your curiosity about Family Pension Deduction Under Income Tax, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Family Pension Deduction Under Income Tax to suit a variety of purposes.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad array of topics, ranging that range from DIY projects to planning a party.

Maximizing Family Pension Deduction Under Income Tax

Here are some fresh ways in order to maximize the use use of Family Pension Deduction Under Income Tax:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Family Pension Deduction Under Income Tax are an abundance of practical and imaginative resources catering to different needs and pursuits. Their access and versatility makes them an invaluable addition to any professional or personal life. Explore the vast array of Family Pension Deduction Under Income Tax to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free templates for commercial use?

- It's based on the rules of usage. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright violations with Family Pension Deduction Under Income Tax?

- Some printables could have limitations on usage. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home using printing equipment or visit a local print shop for better quality prints.

-

What program do I need in order to open printables free of charge?

- The majority are printed in the format PDF. This can be opened using free software like Adobe Reader.

Income Tax Deduction Under 80C Lex N Tax Associates

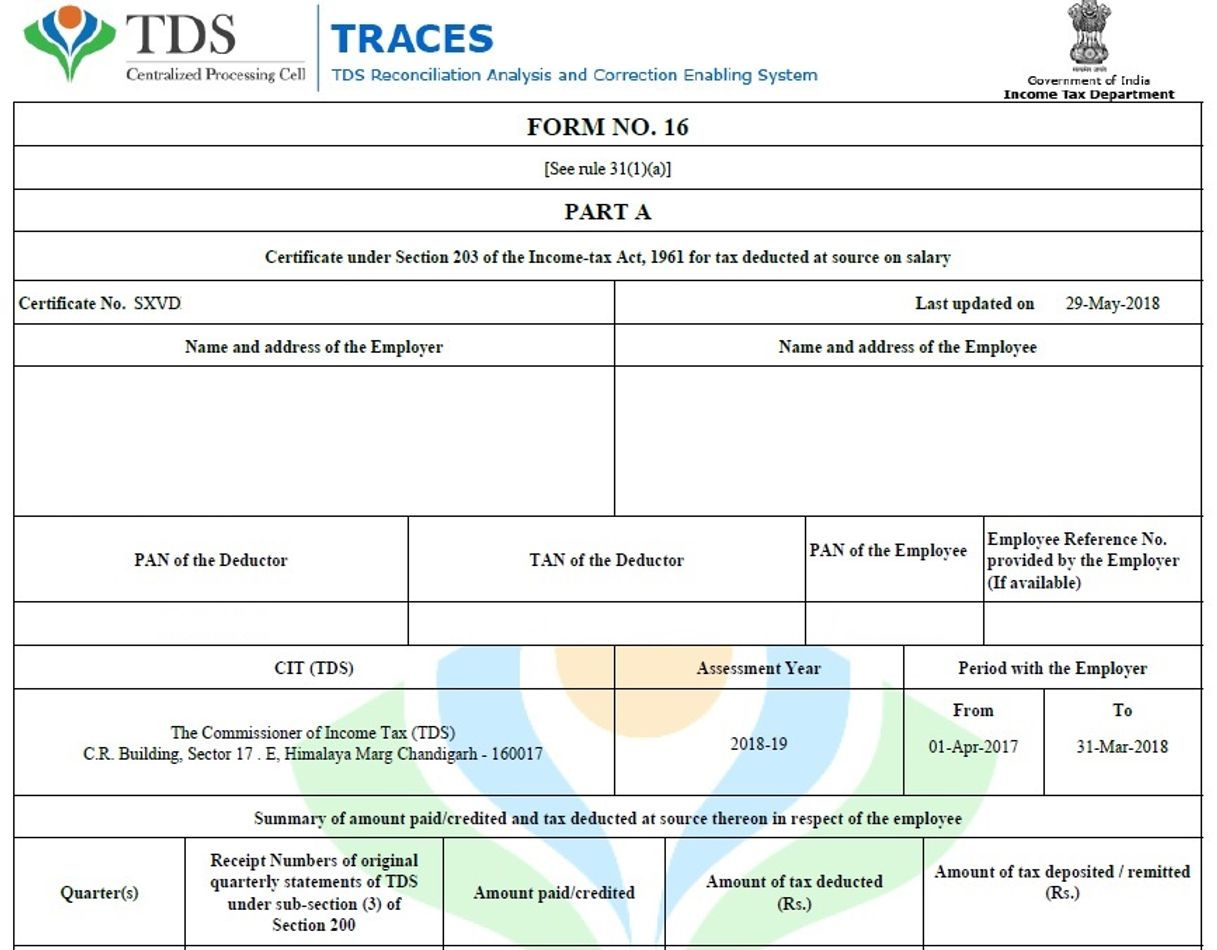

Providing Form 16 To All Pensioners And Family Pensioners CPAO

Check more sample of Family Pension Deduction Under Income Tax below

Taxability Of Pension All You Need To Know

Nps Contribution By Employee Werohmedia

Atal Pension Yojana Deduction Under Income Tax Fastag Recharge

Deductions Towards Commutation To Be Made From Family Pension Or Not

Deduction Under Income Tax 80CCC And 80CCD

Medical Expenses Deduction Under Income Tax Act 2023 Update

https://economictimes.indiatimes.com/wealth/tax/...

For family pensioners a standard deduction of Rs 15 000 will be available under the new tax regime Income for a family pensioner is taxed under the head Income from other sources

https://cleartax.in/s/are-pensions-taxable

Latest Update Budget 2023 Standard Deduction on family pension under the new tax regime is allowed Rs 15 000 or 1 3rd of the pension amount whichever is lower Budget 2022 It has been proposed to exempt senior citizens from filing income tax returns if pension income and interest income are their only annual income source

For family pensioners a standard deduction of Rs 15 000 will be available under the new tax regime Income for a family pensioner is taxed under the head Income from other sources

Latest Update Budget 2023 Standard Deduction on family pension under the new tax regime is allowed Rs 15 000 or 1 3rd of the pension amount whichever is lower Budget 2022 It has been proposed to exempt senior citizens from filing income tax returns if pension income and interest income are their only annual income source

Deductions Towards Commutation To Be Made From Family Pension Or Not

Nps Contribution By Employee Werohmedia

Deduction Under Income Tax 80CCC And 80CCD

Medical Expenses Deduction Under Income Tax Act 2023 Update

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

List Of Deductions Under Chapter Via

List Of Deductions Under Chapter Via

Donation To Political Party Get Deduction Under Income Tax 80GGB