In a world where screens dominate our lives and the appeal of physical printed objects hasn't waned. Whether it's for educational purposes project ideas, artistic or simply to add a personal touch to your space, Exemption To Senior Citizens In Income Tax can be an excellent source. This article will take a dive through the vast world of "Exemption To Senior Citizens In Income Tax," exploring their purpose, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Exemption To Senior Citizens In Income Tax Below

Exemption To Senior Citizens In Income Tax

Exemption To Senior Citizens In Income Tax -

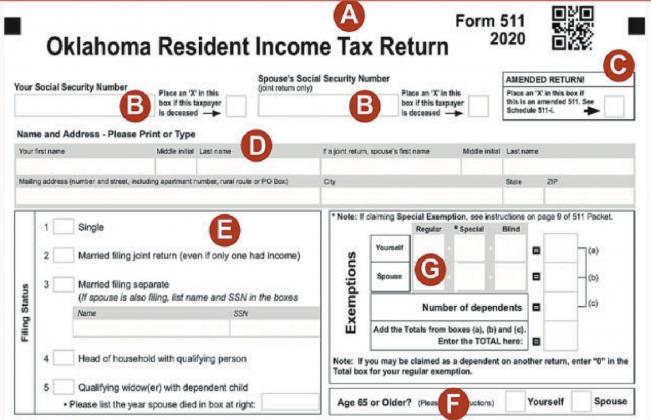

If you re married filing jointly or separately the extra standard deduction amount is 1 500 per qualifying individual If you are 65 or older and blind the extra

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The

Exemption To Senior Citizens In Income Tax include a broad assortment of printable, downloadable items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. The attraction of printables that are free is their versatility and accessibility.

More of Exemption To Senior Citizens In Income Tax

Senior Citizens Tax Exemption Are Senior Citizens Going To Get Income

Senior Citizens Tax Exemption Are Senior Citizens Going To Get Income

By tax filing 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh for those below 60

The AMT exemption amount has increased to 81 300 126 500 if married filing jointly or qualifying surviving spouse 63 250 if married filing separately Earned income credit The maximum amount of income

Exemption To Senior Citizens In Income Tax have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: We can customize printables to your specific needs whether it's making invitations and schedules, or decorating your home.

-

Educational Impact: The free educational worksheets cater to learners of all ages, making them an essential source for educators and parents.

-

Accessibility: Access to numerous designs and templates helps save time and effort.

Where to Find more Exemption To Senior Citizens In Income Tax

State Says Income Tax Exemption For Tribal Citizens On Reservations

State Says Income Tax Exemption For Tribal Citizens On Reservations

Under the old tax regime the basic exemption limit for senior citizens Resident individuals aged 60 years or above is 3 lakh This means that their income

Credit for the Elderly or Disabled You must file using Form 1040 or Form 1040 SR to receive the Credit for the Elderly or Disabled Be sure to apply for the Credit

Now that we've piqued your interest in printables for free Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Exemption To Senior Citizens In Income Tax to suit a variety of purposes.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Exemption To Senior Citizens In Income Tax

Here are some new ways to make the most of Exemption To Senior Citizens In Income Tax:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Exemption To Senior Citizens In Income Tax are an abundance of innovative and useful resources designed to meet a range of needs and needs and. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the wide world of Exemption To Senior Citizens In Income Tax and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes, they are! You can download and print these materials for free.

-

Do I have the right to use free templates for commercial use?

- It's determined by the specific usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations concerning their use. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home with the printer, or go to any local print store for top quality prints.

-

What software do I need to open printables for free?

- Most printables come in PDF format. They can be opened using free software like Adobe Reader.

House Of Representatives Files Bill Of Tax Exemption For Senior

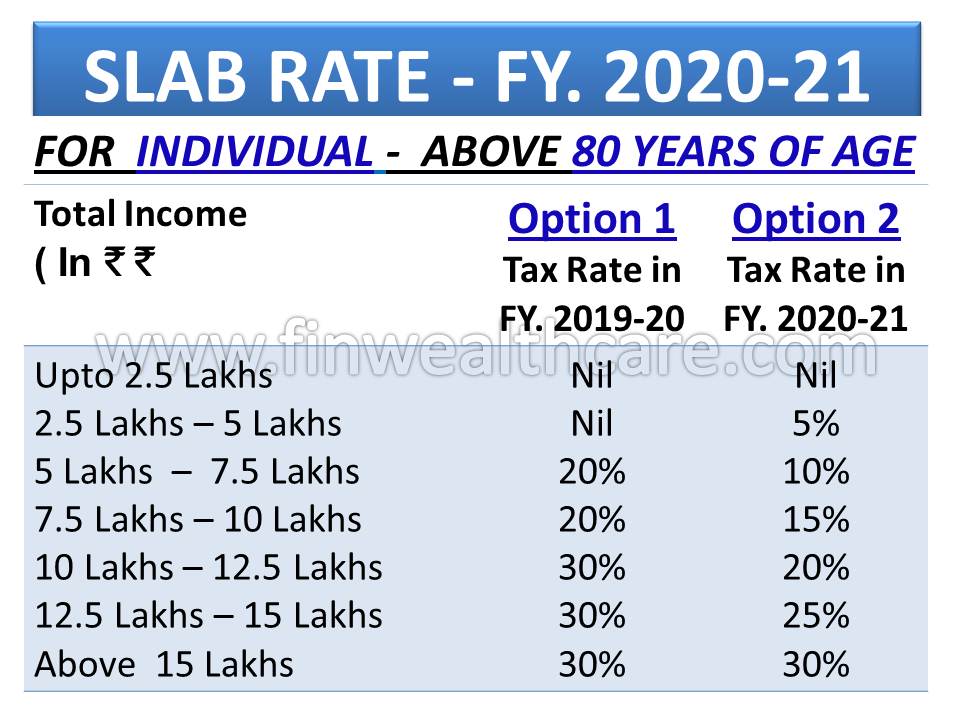

What Are The Income Tax Slabs For Senior Citizens In India

Check more sample of Exemption To Senior Citizens In Income Tax below

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

Tax Saving For Senior Citizens In India StepUpMoney

Tax Exemption Limit Increases For Senior Citizens Financial Freedom

Income Tax Exemption Granted To Senior Citizens AY2023 24

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

https://taxguru.in/income-tax/what-are-the-ta…

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The

https://www.irs.gov/individuals/seniors-retirees

Tax information for seniors and retirees including typical sources of income in retirement and special tax rules Older adults have special tax situations

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The

Tax information for seniors and retirees including typical sources of income in retirement and special tax rules Older adults have special tax situations

Income Tax Exemption Granted To Senior Citizens AY2023 24

Tax Saving For Senior Citizens In India StepUpMoney

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

New Income Tax Slab FY 2020 21 India Vs Old

Senior Citizens Granted 20 Discount VAT Exemption For Vitamins

Senior Citizens Granted 20 Discount VAT Exemption For Vitamins

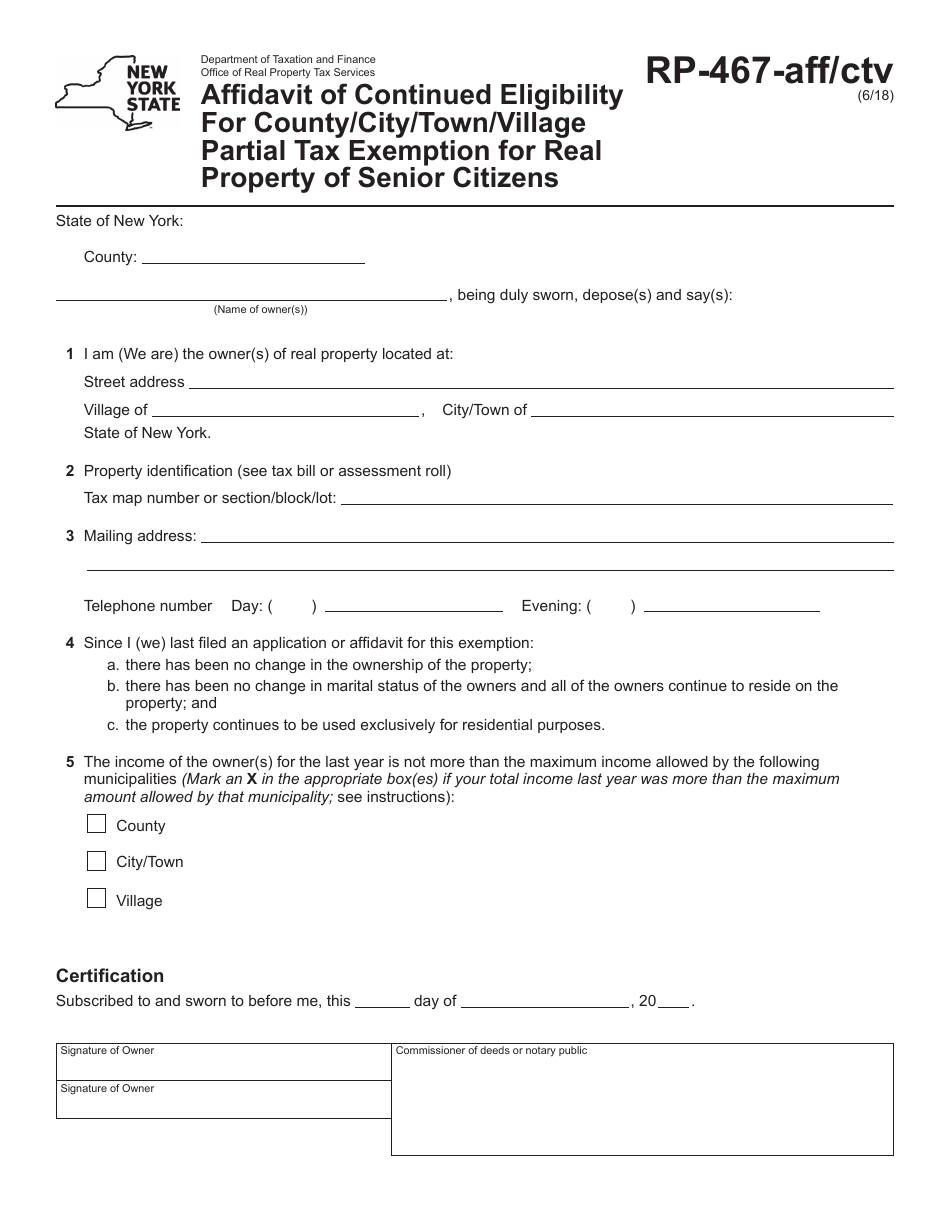

Form RP 467 AFF CTV Fill Out Sign Online And Download Fillable PDF