In this age of technology, when screens dominate our lives, the charm of tangible printed objects isn't diminished. Whether it's for educational purposes as well as creative projects or just adding the personal touch to your home, printables for free are a great resource. With this guide, you'll take a dive into the world "Ev Tax Credit Refundable Or Nonrefundable," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Ev Tax Credit Refundable Or Nonrefundable Below

Ev Tax Credit Refundable Or Nonrefundable

Ev Tax Credit Refundable Or Nonrefundable -

EV tax credits are nonrefundable This means they can only be applied to tax owed in the year in which you took delivery Businesses however can transfer new EV tax credits to future years

The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

The Ev Tax Credit Refundable Or Nonrefundable are a huge assortment of printable materials that are accessible online for free cost. These printables come in different designs, including worksheets templates, coloring pages and many more. The value of Ev Tax Credit Refundable Or Nonrefundable lies in their versatility as well as accessibility.

More of Ev Tax Credit Refundable Or Nonrefundable

Is EV Tax Credit Refundable

Is EV Tax Credit Refundable

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

In 2022 the available credit you can take is the Qualified Plug in Electric Vehicle Credit This non refundable tax credit is for four wheeled plug in electric vehicles that meet particular battery specifications The credit is worth

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization There is the possibility of tailoring printables to your specific needs such as designing invitations making your schedule, or decorating your home.

-

Education Value Free educational printables cater to learners of all ages, which makes them a vital tool for parents and teachers.

-

Easy to use: Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Ev Tax Credit Refundable Or Nonrefundable

Nonrefundable Tax Credit Requirements Examples How To Claim

Nonrefundable Tax Credit Requirements Examples How To Claim

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a

That s because the credit is applied against your tax bill for vehicles purchased in 2023 you ll get the credit when you file in 2024 and you don t get a refund if your tax credit is

Since we've got your curiosity about Ev Tax Credit Refundable Or Nonrefundable Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Ev Tax Credit Refundable Or Nonrefundable to suit a variety of purposes.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Ev Tax Credit Refundable Or Nonrefundable

Here are some inventive ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Ev Tax Credit Refundable Or Nonrefundable are an abundance of creative and practical resources that cater to various needs and needs and. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast collection of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use the free printables in commercial projects?

- It's based on the terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations in use. Always read these terms and conditions as set out by the author.

-

How do I print Ev Tax Credit Refundable Or Nonrefundable?

- You can print them at home using your printer or visit an area print shop for superior prints.

-

What software do I need to run Ev Tax Credit Refundable Or Nonrefundable?

- A majority of printed materials are with PDF formats, which can be opened with free software, such as Adobe Reader.

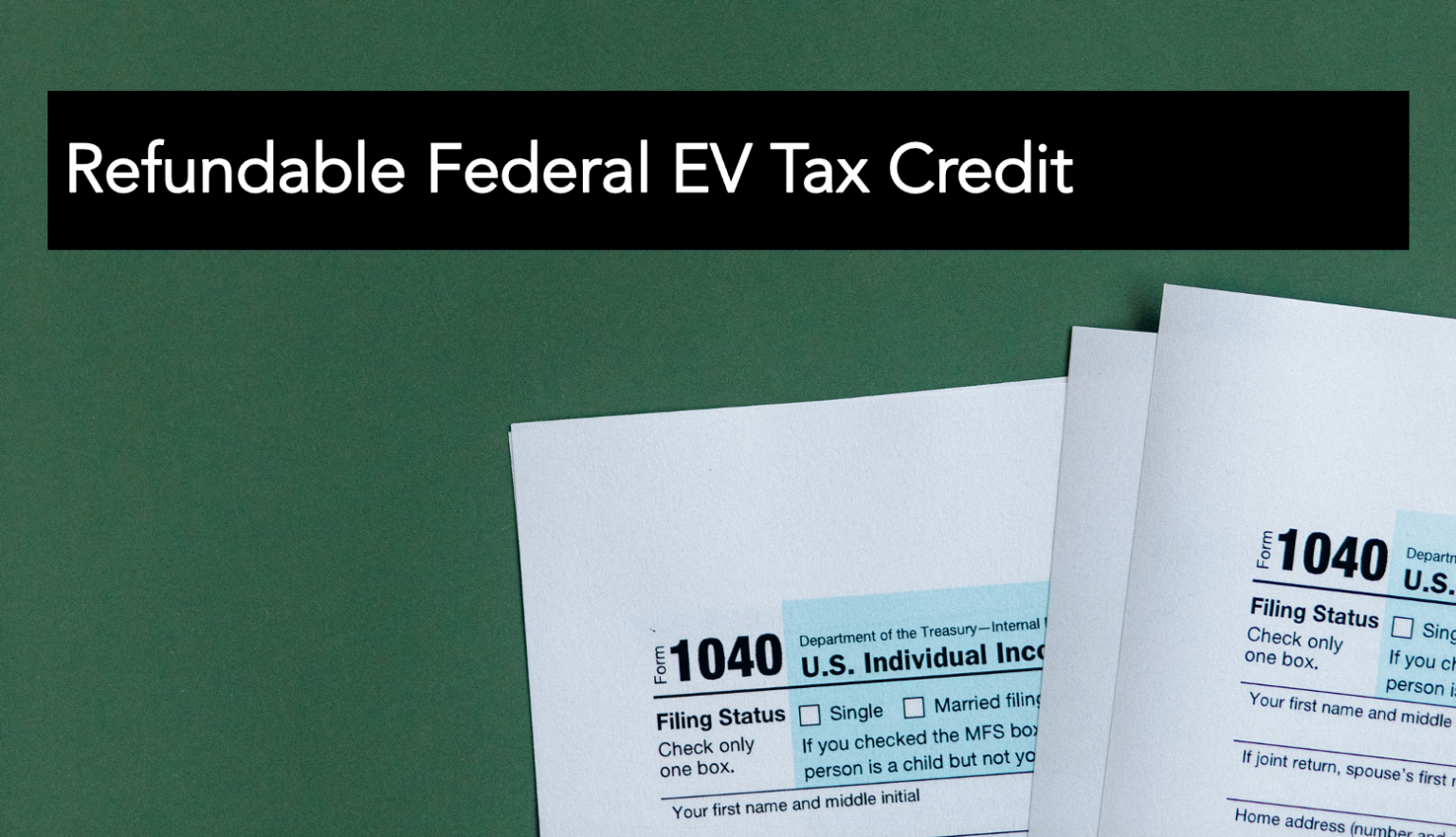

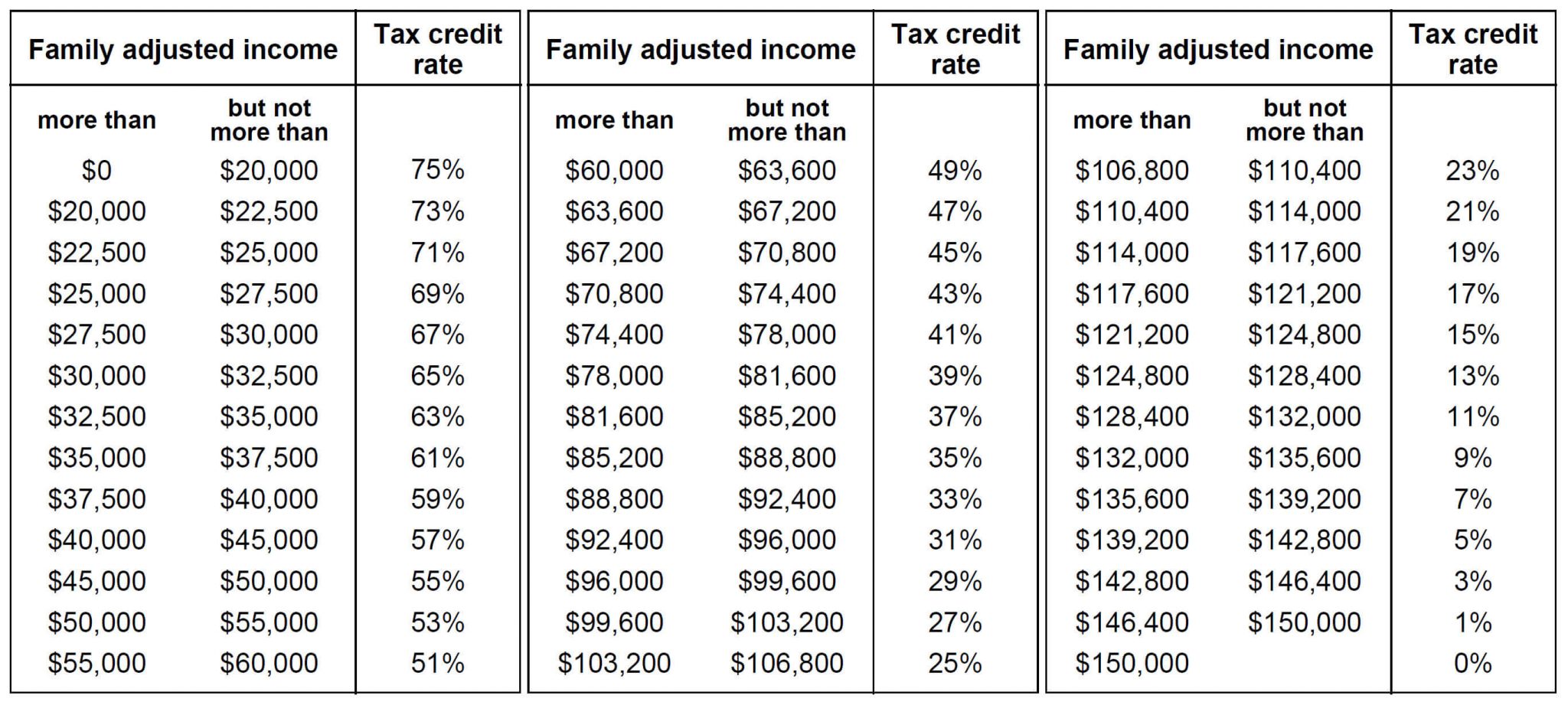

A Refundable EV Tax Credit Huddleston Tax CPAs Blog

Refundable Vs Non Refundable Tax Credits IRS

Check more sample of Ev Tax Credit Refundable Or Nonrefundable below

Refundable Federal EV Tax Credit featured Image EVAdoption

Potential Change To EV Tax Credit Nonrefundable To Refundable Chevy

3 Easy Ways Is The Ev Tax Credit Refundable Heartsforhoundsrescue

The Potential Impact Of The Trump Administration Cancelling The

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

Candidate Q A State Senate District 22 Maile Shimabukuro Honolulu

https://turbotax.intuit.com/tax-tips/going-green/...

The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

https://www.irs.gov/credits-deductions/credits-for...

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck

The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck

The Potential Impact Of The Trump Administration Cancelling The

Potential Change To EV Tax Credit Nonrefundable To Refundable Chevy

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

Candidate Q A State Senate District 22 Maile Shimabukuro Honolulu

Nonrefundable Stock Photos Free Royalty Free Stock Photos From

Police Cruiser Damaged In The Chase

Police Cruiser Damaged In The Chase

What Is The Difference Between A Refundable And A Nonrefundable Credit