In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. If it's to aid in education and creative work, or simply adding some personal flair to your area, Ev Credit Form 2022 are a great resource. Through this post, we'll take a dive into the world "Ev Credit Form 2022," exploring what they are, where to find them, and what they can do to improve different aspects of your life.

Get Latest Ev Credit Form 2022 Below

Ev Credit Form 2022

Ev Credit Form 2022 -

An EV purchased in or before 2022 with a five kilowatt hour battery is eligible for a 2 917 credit The credit increases by 417 per additional kilowatt hour over 5 kWh up to a maximum of

Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year

Ev Credit Form 2022 offer a wide range of printable, free content that can be downloaded from the internet at no cost. They come in many formats, such as worksheets, templates, coloring pages, and many more. The attraction of printables that are free is their versatility and accessibility.

More of Ev Credit Form 2022

Here Are The Electric Vehicles That Are Eligible For The 7 500 Federal

Here Are The Electric Vehicles That Are Eligible For The 7 500 Federal

Electric vehicles purchased in 2022 or before are still eligible for tax credits If you bought a new qualified plug in electric vehicle in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 Learn more Sign Up for Email Updates

Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500

Ev Credit Form 2022 have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: They can make the templates to meet your individual needs such as designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Printing educational materials for no cost provide for students from all ages, making them an invaluable instrument for parents and teachers.

-

Convenience: Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more Ev Credit Form 2022

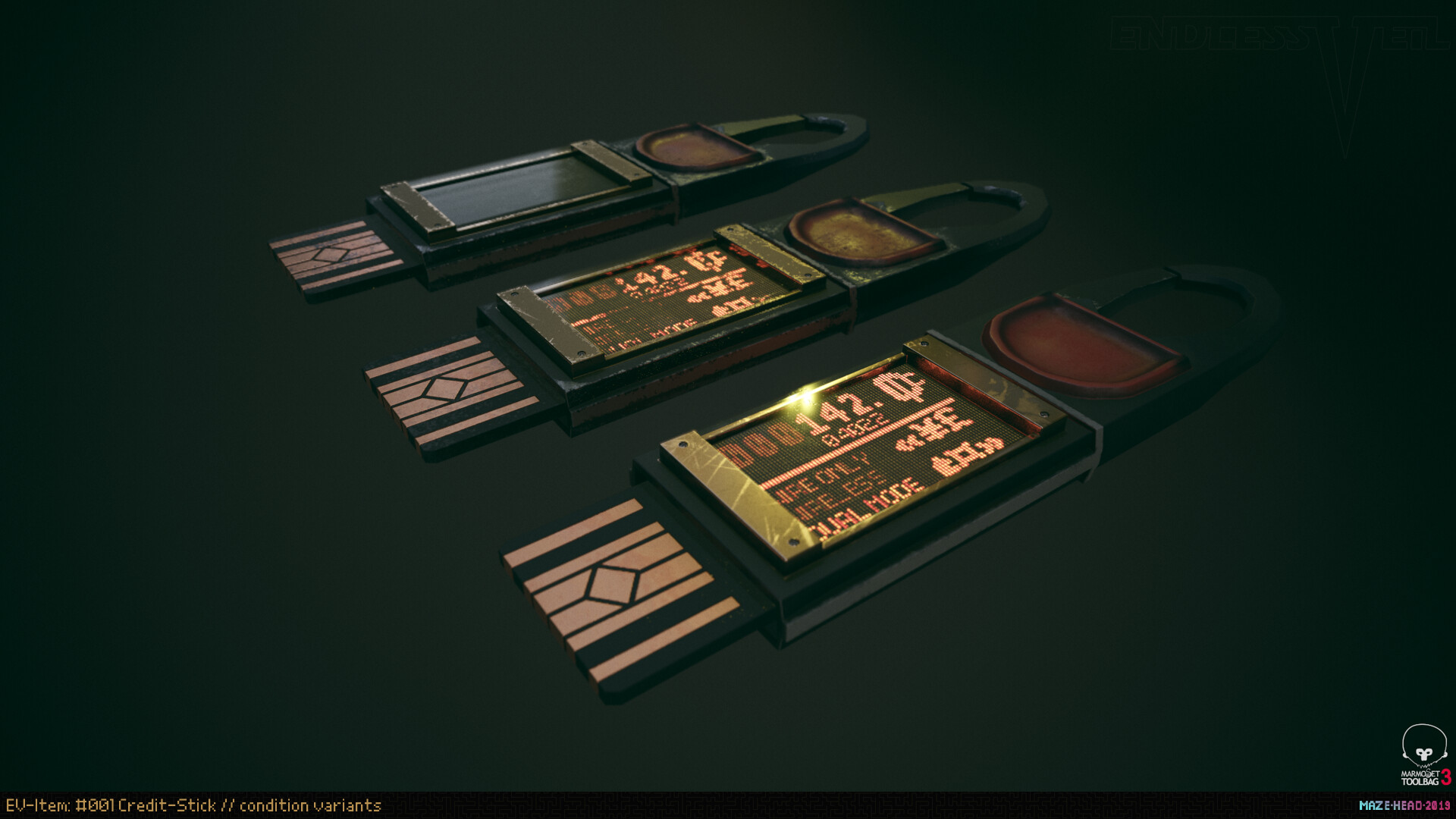

ArtStation EV Credit Sticks

ArtStation EV Credit Sticks

The Qualified Plug In Electric Drive Motor Vehicle Credit has been replaced with the Clean Vehicle Credit for qualifying vehicles purchased after December 31 2022 The credit for personal vehicles is non refundable and any excess value can t be claimed on future tax returns

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Since we've got your interest in printables for free Let's see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Ev Credit Form 2022 for different uses.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Ev Credit Form 2022

Here are some creative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Ev Credit Form 2022 are an abundance of practical and innovative resources that can meet the needs of a variety of people and passions. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the vast collection of Ev Credit Form 2022 today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Ev Credit Form 2022 really for free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial use?

- It's dependent on the particular rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may contain restrictions in use. Make sure you read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with printing equipment or visit a local print shop for higher quality prints.

-

What software will I need to access Ev Credit Form 2022?

- Many printables are offered in PDF format. These can be opened with free software such as Adobe Reader.

EV Tax Credit 2022 Updates Shared Economy Tax

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Check more sample of Ev Credit Form 2022 below

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Tax Credits For Electric Vehicles Are About To Get Confusing The New

China Revises EV Credits For Automakers Reducing Offset Opps

A Complete Guide To The New EV Tax Credit

Waaree Energies Introduces Customized Solar Modules For Electric

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://www. irs.gov /forms-pubs/about-form-8936

Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year

https://www. irs.gov /credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

A Complete Guide To The New EV Tax Credit

Tax Credits For Electric Vehicles Are About To Get Confusing The New

Waaree Energies Introduces Customized Solar Modules For Electric

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

The Best EV Credit Card To Use With Your Electric Vehicle Aspiration

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives