In a world with screens dominating our lives it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses project ideas, artistic or simply to add personal touches to your space, Eu Vat Rates 2024 are a great source. For this piece, we'll dive into the sphere of "Eu Vat Rates 2024," exploring what they are, how they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Eu Vat Rates 2024 Below

Eu Vat Rates 2024

Eu Vat Rates 2024 -

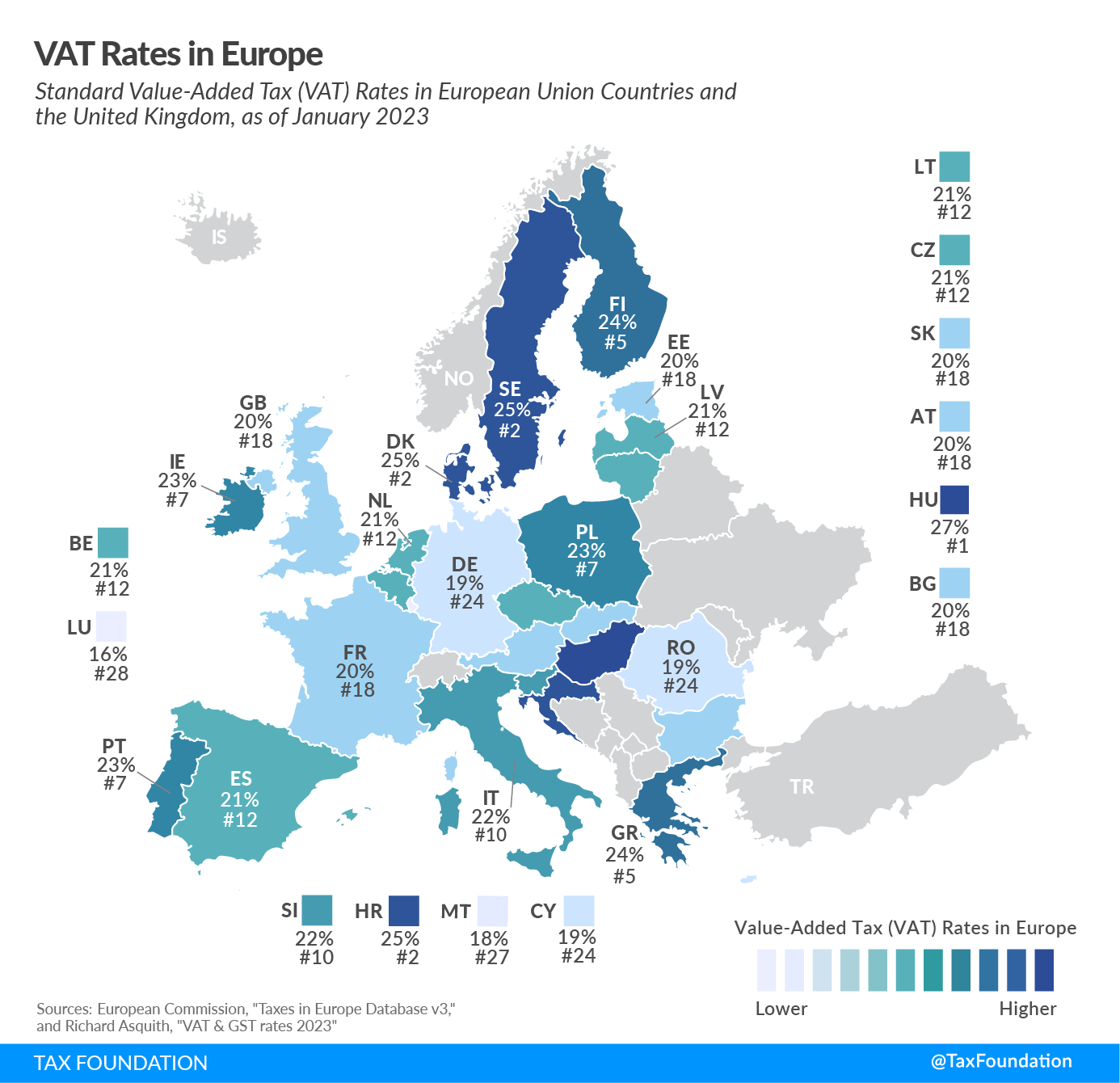

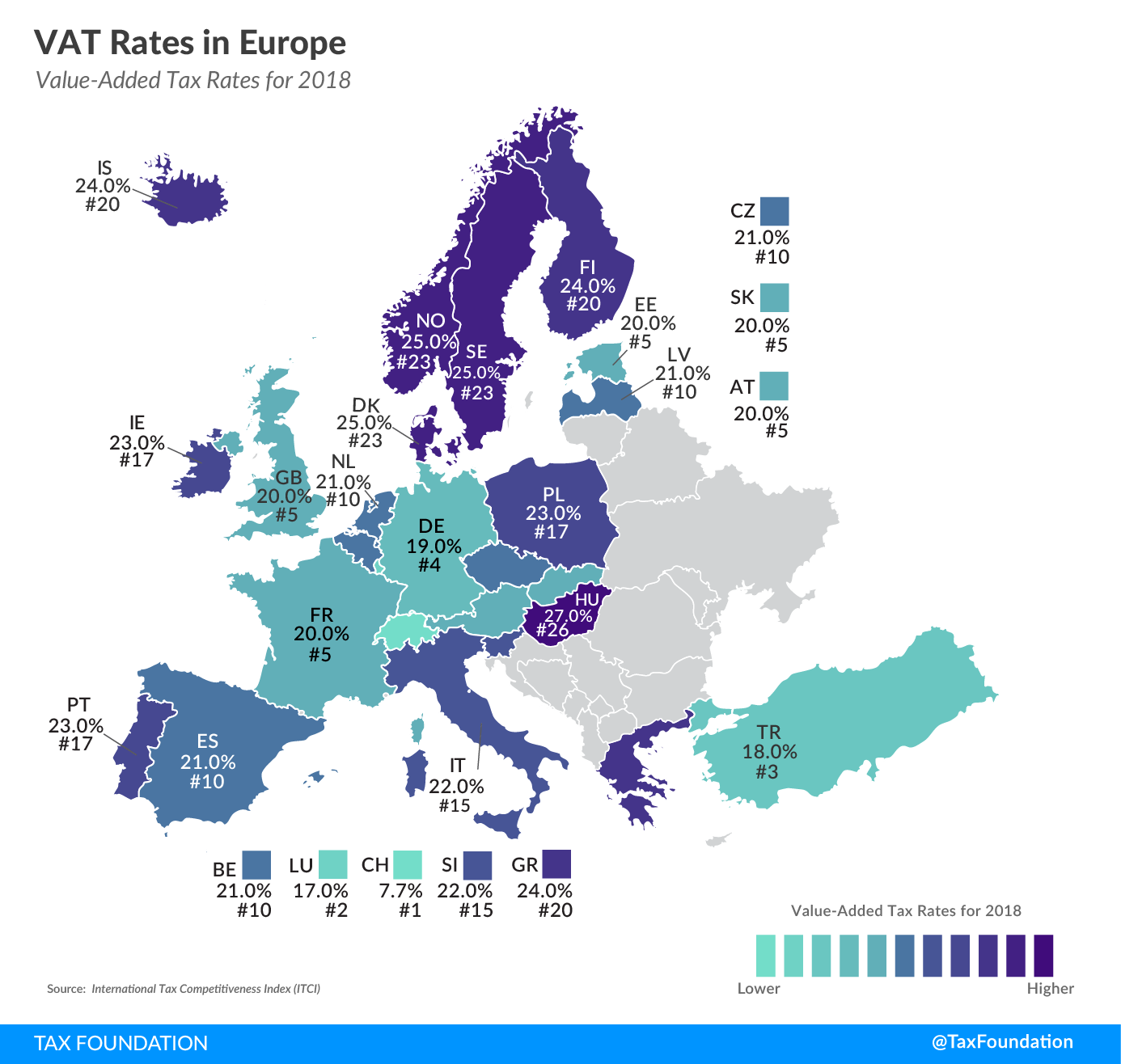

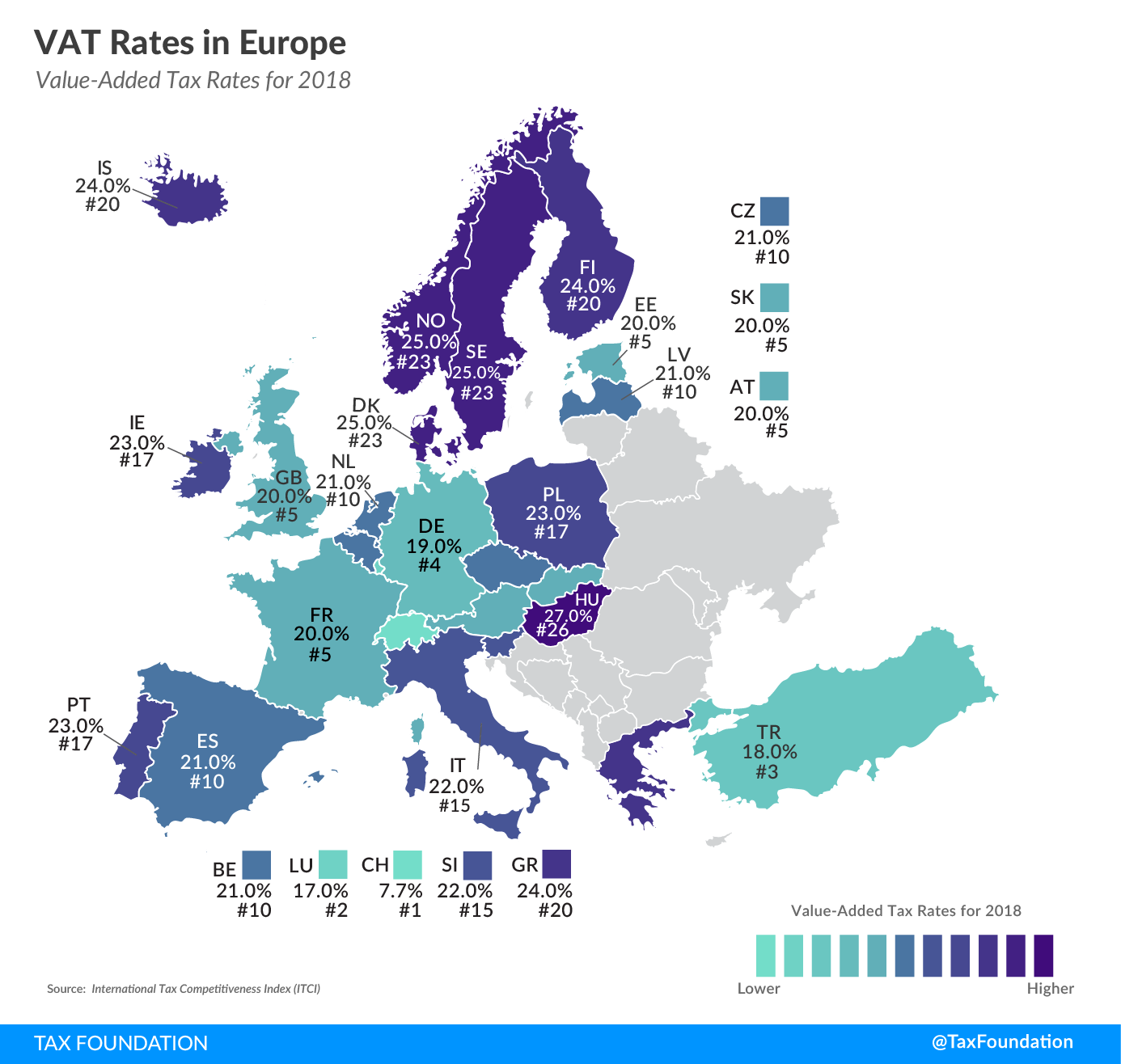

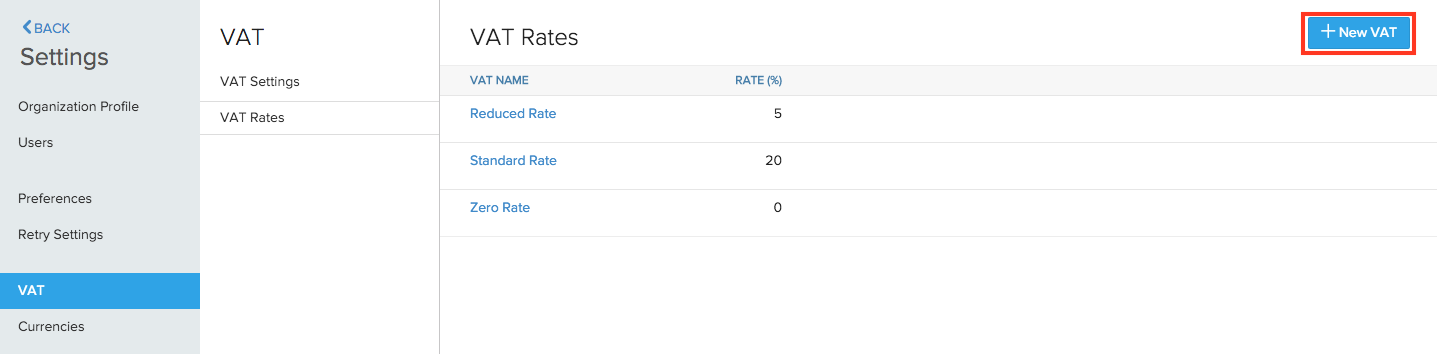

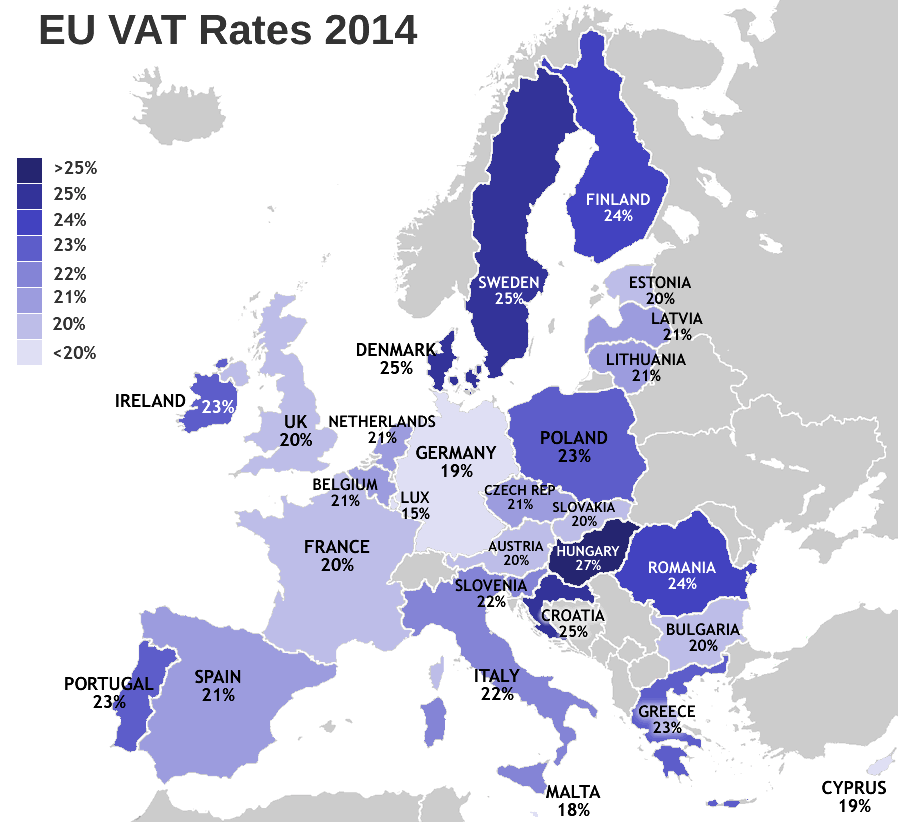

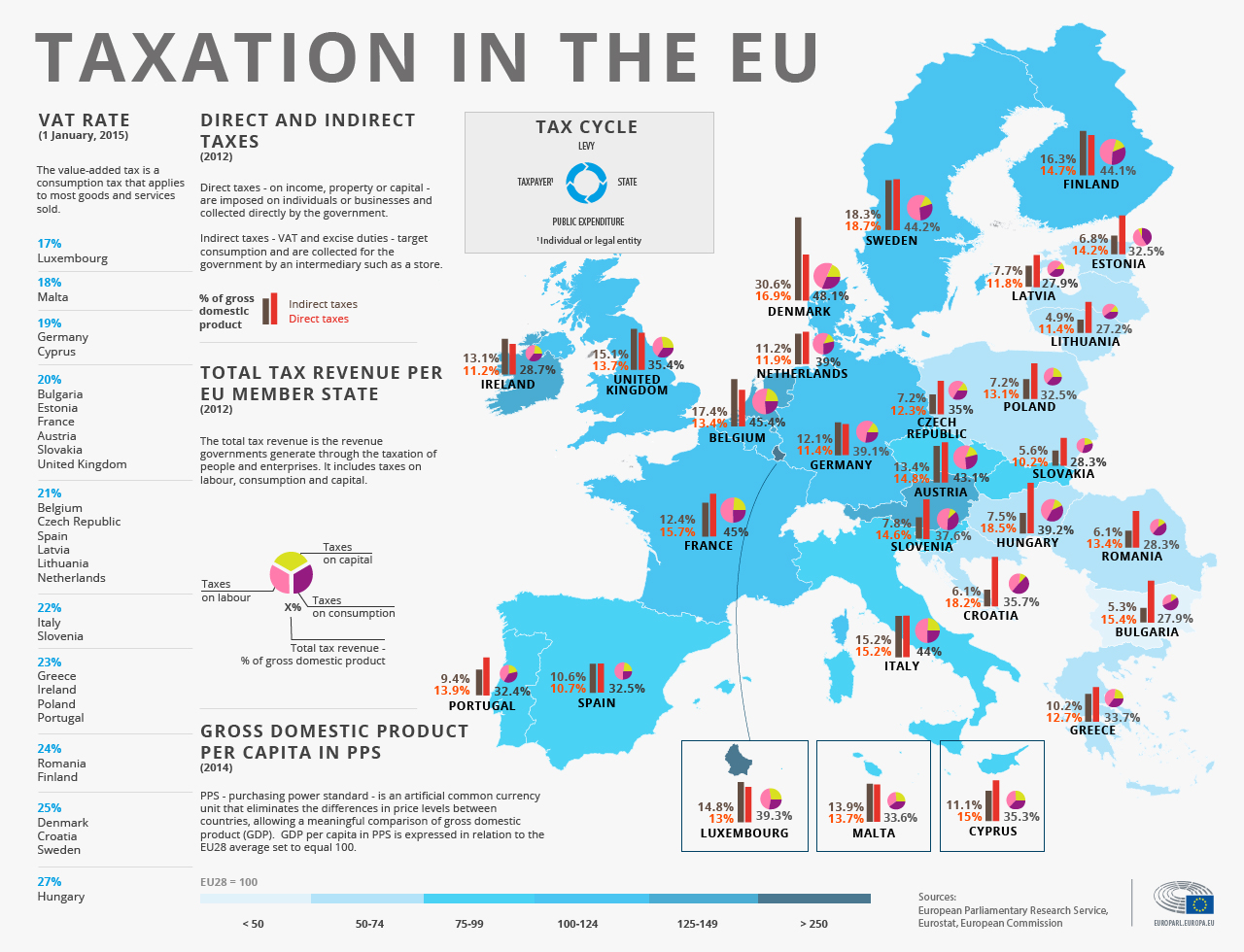

The standard rate of VAT to be applied by all Member States to goods and services is at least 15 Member States may apply one or two reduced rates of at least 5 to specific goods or services listed in Annex III to the directive

From 1 January 2024 the standard VAT rate has been increased from 20 to 22 The two reduced rates of 5 and 9 continue to apply Legal reference K ibemaksuseaduse muutmise seadus amending the Value Added Tax Act RT I 01 07 2023 2 https www riigiteataja ee akt 101072023002

Eu Vat Rates 2024 provide a diverse selection of printable and downloadable materials available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages and more. The great thing about Eu Vat Rates 2024 lies in their versatility as well as accessibility.

More of Eu Vat Rates 2024

Europe Search Marketing Country Information

Europe Search Marketing Country Information

The VAT Directive sets the framework for the VAT rates in the EU but it gives national governments freedom to set the number and level of rates they choose subject only to 2 basic rules Rule 1 The standard rate for all goods and services Rule 2 An EU country can opt to apply one or two reduced rates but only to goods or services listed in

What VAT rates EU countries apply in 2024 What are the lowest standard VAT rates possible according to the EU VAT rules What hides under the term super reduced VAT rates To which groups of products super reduced vat rates can apply The European Union VAT rates for 2024

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization: It is possible to tailor the design to meet your needs when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Value: Educational printables that can be downloaded for free cater to learners of all ages. This makes them a vital tool for teachers and parents.

-

Accessibility: Instant access to the vast array of design and templates will save you time and effort.

Where to Find more Eu Vat Rates 2024

Complete Guide To EU VAT Invoice Requirements

/VAT_exemption_threshholds.png)

Complete Guide To EU VAT Invoice Requirements

Modernised VAT rate regime in the European Union In An Economy that Works for People Status Adopted Completed Type Legislative Package VAT Regime Action Plan Procedure 2018 0005 CNS CWP 2017 CWP indicative date Q3 2017 NL 20 03 2024 PDF version

The Council today reached agreement on a proposal to update EU rules on rates of value added tax VAT The new rules reflect member states current needs and the EU s present policy objectives which have changed considerably since the old rules were put in place

If we've already piqued your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Eu Vat Rates 2024 for various needs.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing Eu Vat Rates 2024

Here are some creative ways create the maximum value of Eu Vat Rates 2024:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Eu Vat Rates 2024 are an abundance of useful and creative resources catering to different needs and hobbies. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast array of Eu Vat Rates 2024 today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these tools for free.

-

Does it allow me to use free printables to make commercial products?

- It is contingent on the specific conditions of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues with Eu Vat Rates 2024?

- Some printables may come with restrictions in use. Check the conditions and terms of use provided by the creator.

-

How can I print Eu Vat Rates 2024?

- Print them at home with an printer, or go to a print shop in your area for more high-quality prints.

-

What software do I need to run printables free of charge?

- Most PDF-based printables are available in PDF format. They can be opened with free software, such as Adobe Reader.

VAT Rates Applied In The Member States Of The European Union

UK VAT Rate Accounting Finance Blog

Check more sample of Eu Vat Rates 2024 below

French VAT Rates Accounting Finance Blog

2020 Value Added Tax Rates In Europe European Union Value Added Tax

2023 Global VAT Rate Changes Vatcalc

Guide On Understanding VAT Registration Amazon Global Selling

Eu Vat Rates Forex Ea Crack

Eu Vat Rates The Forex Trading Academy

https://trade.ec.europa.eu/access-to-markets/en/...

From 1 January 2024 the standard VAT rate has been increased from 20 to 22 The two reduced rates of 5 and 9 continue to apply Legal reference K ibemaksuseaduse muutmise seadus amending the Value Added Tax Act RT I 01 07 2023 2 https www riigiteataja ee akt 101072023002

https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates

Although VAT is charged throughout the EU each EU country is responsible for setting its own rates You can consult the rates that currently apply in the table below You should check the latest rates with the VAT authority of your country

From 1 January 2024 the standard VAT rate has been increased from 20 to 22 The two reduced rates of 5 and 9 continue to apply Legal reference K ibemaksuseaduse muutmise seadus amending the Value Added Tax Act RT I 01 07 2023 2 https www riigiteataja ee akt 101072023002

Although VAT is charged throughout the EU each EU country is responsible for setting its own rates You can consult the rates that currently apply in the table below You should check the latest rates with the VAT authority of your country

Guide On Understanding VAT Registration Amazon Global Selling

2020 Value Added Tax Rates In Europe European Union Value Added Tax

Eu Vat Rates Forex Ea Crack

Eu Vat Rates The Forex Trading Academy

Polska W UE A 25 Rocznica Podatku VAT Conectum Finanse

Chart Mind The Gap Uncollected VAT Cost The EU 140 Billion In 2018

Chart Mind The Gap Uncollected VAT Cost The EU 140 Billion In 2018

VAT Validation Understanding How VIES Help Your Company