In the digital age, where screens rule our lives yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply adding a personal touch to your home, printables for free are a great source. For this piece, we'll take a dive in the world of "Entertainment Tax Deduction," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Entertainment Tax Deduction Below

Entertainment Tax Deduction

Entertainment Tax Deduction -

The law known as the Tax Cuts and Jobs Act TCJA P L 115 97 significantly changed Sec 274 a by eliminating any deduction of expenses considered entertainment amusement or recreation The TCJA also extended the 50 deduction limitation for expenses related to food and beverages to those

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

Printables for free include a vast variety of printable, downloadable materials online, at no cost. These resources come in many designs, including worksheets templates, coloring pages and much more. The benefit of Entertainment Tax Deduction is in their versatility and accessibility.

More of Entertainment Tax Deduction

Do You Know What

Do You Know What

50 deductible 100 for tax years 2021 and 2022 Food for charitable causes 100 deductible Meals for in office meetings 50 deductible Snacks for employees 50 deductible Renting out an entertainment facility 0 deductible

The cost of entertainment tickets is generally deductible However you can only deduct the face value of the ticket even if you paid a higher price for example if you pay more than face value for a ticket from a

Entertainment Tax Deduction have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor printing templates to your own specific requirements, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Impact: Free educational printables cater to learners of all ages, which makes them an essential resource for educators and parents.

-

Accessibility: The instant accessibility to many designs and templates is time-saving and saves effort.

Where to Find more Entertainment Tax Deduction

Is Entertainment Tax Deductible YYC Business School YYC

Is Entertainment Tax Deductible YYC Business School YYC

The entertainment and meals tax deduction has been a great way for successful business owners or self employed people to maximize their tax deductions yearly Unfortunately the Trump tax plan cut

The IRS issued final regulations T D 9925 clarifying amendments to the deductibility of certain business meals and entertainment expenses under the law known as the Tax Cuts and Jobs Act TCJA P L 115 97 enacted in December 2017 These final regulations apply to tax years beginning on or after

Since we've got your interest in printables for free Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Entertainment Tax Deduction designed for a variety goals.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast range of topics, including DIY projects to planning a party.

Maximizing Entertainment Tax Deduction

Here are some fresh ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Entertainment Tax Deduction are an abundance of fun and practical tools catering to different needs and interests. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the vast array of Entertainment Tax Deduction and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes, they are! You can download and print these items for free.

-

Do I have the right to use free printables to make commercial products?

- It depends on the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on use. Check the terms and regulations provided by the creator.

-

How do I print Entertainment Tax Deduction?

- You can print them at home using your printer or visit an in-store print shop to get the highest quality prints.

-

What program do I need to run printables that are free?

- Most PDF-based printables are available as PDF files, which can be opened with free software such as Adobe Reader.

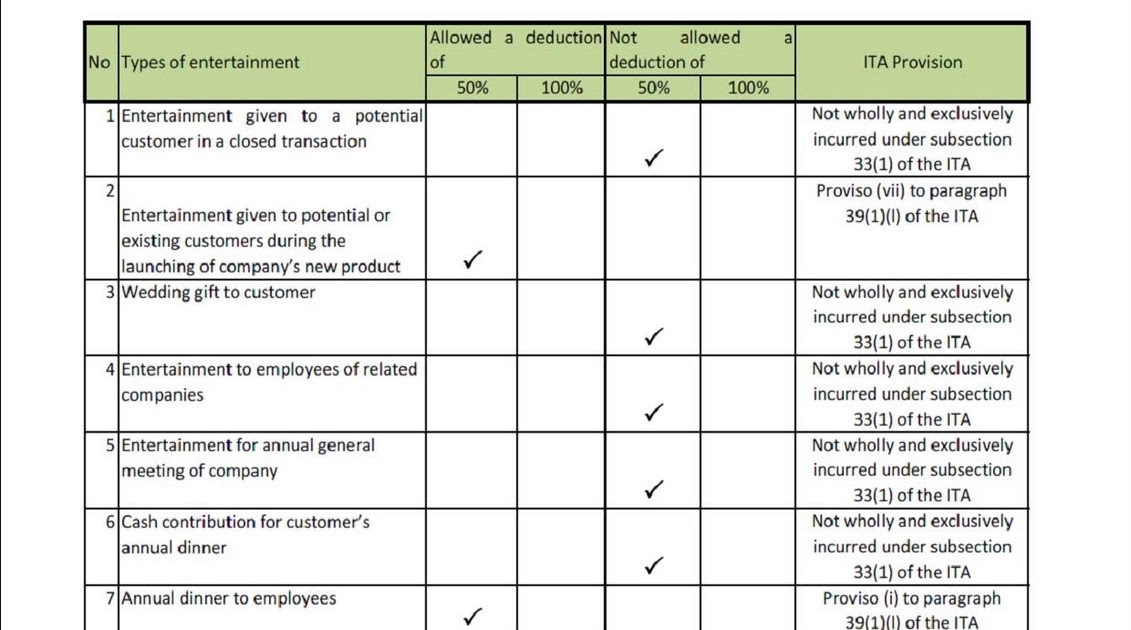

Here Is A Summary Table Of The Most Popular Deductions And How They

Entertainment And Meal Deductibility Chart

Check more sample of Entertainment Tax Deduction below

GOP Tax Overhaul Eliminates Business Entertainment Tax Deduction

Entertainment Tax Deduction Ppt Powerpoint Presentation Visual Aids

Non Allowable Expenses In Taxation Malaysia Prisingly Not Many

Do You Know What

The Meals And Entertainment Deduction Andrews Tax Accounting

Meals And Entertainment Deduction 2022 Taxed Right

https://www.bench.co/blog/tax-tips/deduct-meals-entertainment

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

https://www.vero.fi/en/individuals/tax-cards-and...

Individuals Tax card and tax return Deductions You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

Individuals Tax card and tax return Deductions You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

Do You Know What

Entertainment Tax Deduction Ppt Powerpoint Presentation Visual Aids

The Meals And Entertainment Deduction Andrews Tax Accounting

Meals And Entertainment Deduction 2022 Taxed Right

Sanjiv Gupta CPA Firm Business Taxes Personal Taxes Tax

Tax Deduction Tax Brackets Standard Deduction WEBSTORIES

Tax Deduction Tax Brackets Standard Deduction WEBSTORIES

Tax Reform Business Meals Entertainment Tax Deduction Law Changes