In this age of technology, with screens dominating our lives yet the appeal of tangible printed items hasn't gone away. If it's to aid in education or creative projects, or just adding the personal touch to your home, printables for free can be an excellent source. Here, we'll take a dive deep into the realm of "Energy Rebates And Tax Deductions For Businesses," exploring their purpose, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Energy Rebates And Tax Deductions For Businesses Below

Energy Rebates And Tax Deductions For Businesses

Energy Rebates And Tax Deductions For Businesses -

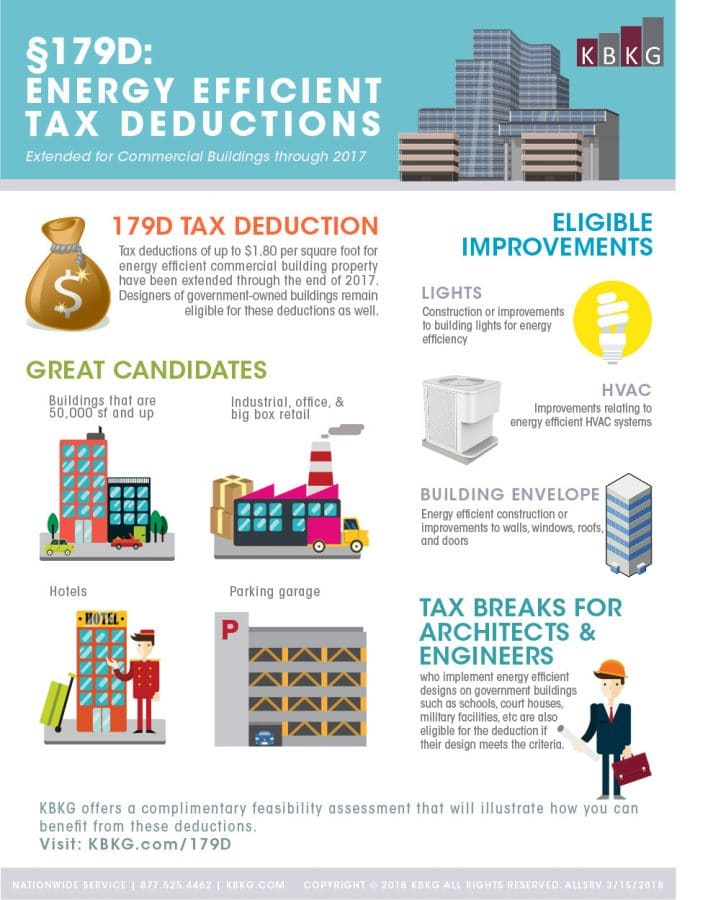

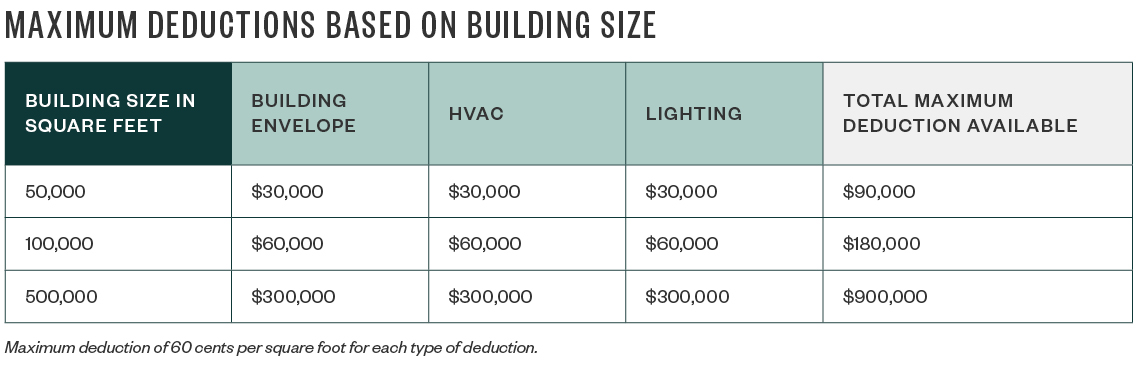

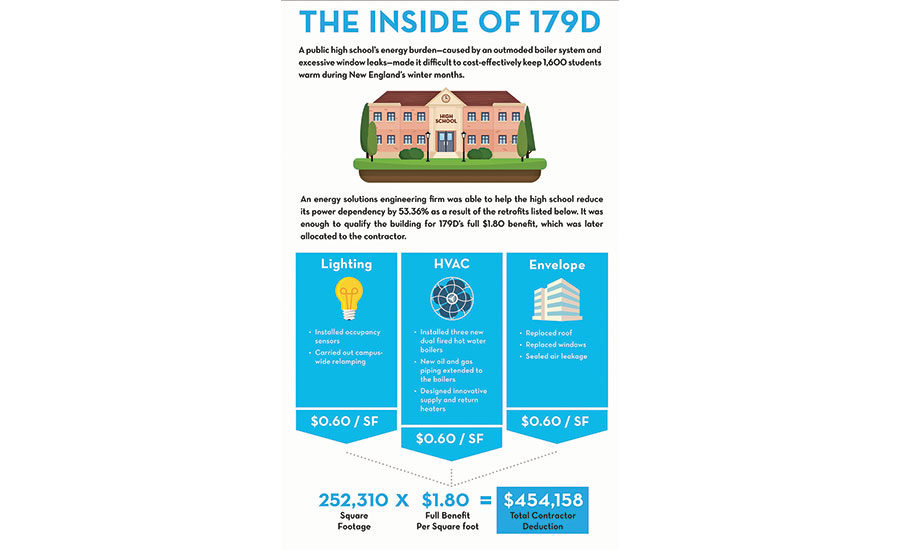

Web 2 juin 2006 nbsp 0183 32 Section 179D of the Internal Revenue Code allows deductions for energy efficient commercial buildings The following information applies to building upgrades

Web 18 d 233 c 2020 nbsp 0183 32 In order to facilitate investment in low carbon energy sources such as renewables and meet such ambitions many governments are incentivising investment

Printables for free cover a broad selection of printable and downloadable material that is available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages and much more. The benefit of Energy Rebates And Tax Deductions For Businesses is in their variety and accessibility.

More of Energy Rebates And Tax Deductions For Businesses

How Energy Efficient Building Deductions Can Save Money For Contractors

How Energy Efficient Building Deductions Can Save Money For Contractors

Web 1 janv 2023 nbsp 0183 32 Individuals Businesses and Self Employed Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify

Web The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for

Energy Rebates And Tax Deductions For Businesses have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: You can tailor print-ready templates to your specific requirements whether it's making invitations making your schedule, or even decorating your home.

-

Educational Value: These Energy Rebates And Tax Deductions For Businesses offer a wide range of educational content for learners from all ages, making them a great instrument for parents and teachers.

-

The convenience of Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Energy Rebates And Tax Deductions For Businesses

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

Web Overview Climate Change Levy Emissions trading Capital allowances on energy efficient items Landfill Tax Aggregates Levy Plastic Packaging Tax Capital allowances on energy

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

After we've peaked your interest in Energy Rebates And Tax Deductions For Businesses and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Energy Rebates And Tax Deductions For Businesses to suit a variety of reasons.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs are a vast variety of topics, including DIY projects to planning a party.

Maximizing Energy Rebates And Tax Deductions For Businesses

Here are some creative ways how you could make the most of Energy Rebates And Tax Deductions For Businesses:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Energy Rebates And Tax Deductions For Businesses are an abundance of creative and practical resources that meet a variety of needs and passions. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the many options of Energy Rebates And Tax Deductions For Businesses now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Rebates And Tax Deductions For Businesses truly are they free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in their usage. Make sure you read the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to any local print store for the highest quality prints.

-

What software must I use to open Energy Rebates And Tax Deductions For Businesses?

- The majority are printed with PDF formats, which is open with no cost software like Adobe Reader.

Tax Incentives For Energy Efficient Buildings

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

Check more sample of Energy Rebates And Tax Deductions For Businesses below

5 Tips On Energy efficiency Tax Deductions For Businesses St Louis

Tax Planning Strategies Tips Steps Resources For Planning

The Ultimate List Of Tax Deductions For Shop Owners In 2019

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Energy Efficient Rebates Tax Incentives For MA Homeowners

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://cms.law/.../tax-incentives-and-measures

Web 18 d 233 c 2020 nbsp 0183 32 In order to facilitate investment in low carbon energy sources such as renewables and meet such ambitions many governments are incentivising investment

https://www.irs.gov/credits-and-deductions-under-the-inflation...

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

Web 18 d 233 c 2020 nbsp 0183 32 In order to facilitate investment in low carbon energy sources such as renewables and meet such ambitions many governments are incentivising investment

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Tax Planning Strategies Tips Steps Resources For Planning

Energy Efficient Rebates Tax Incentives For MA Homeowners

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

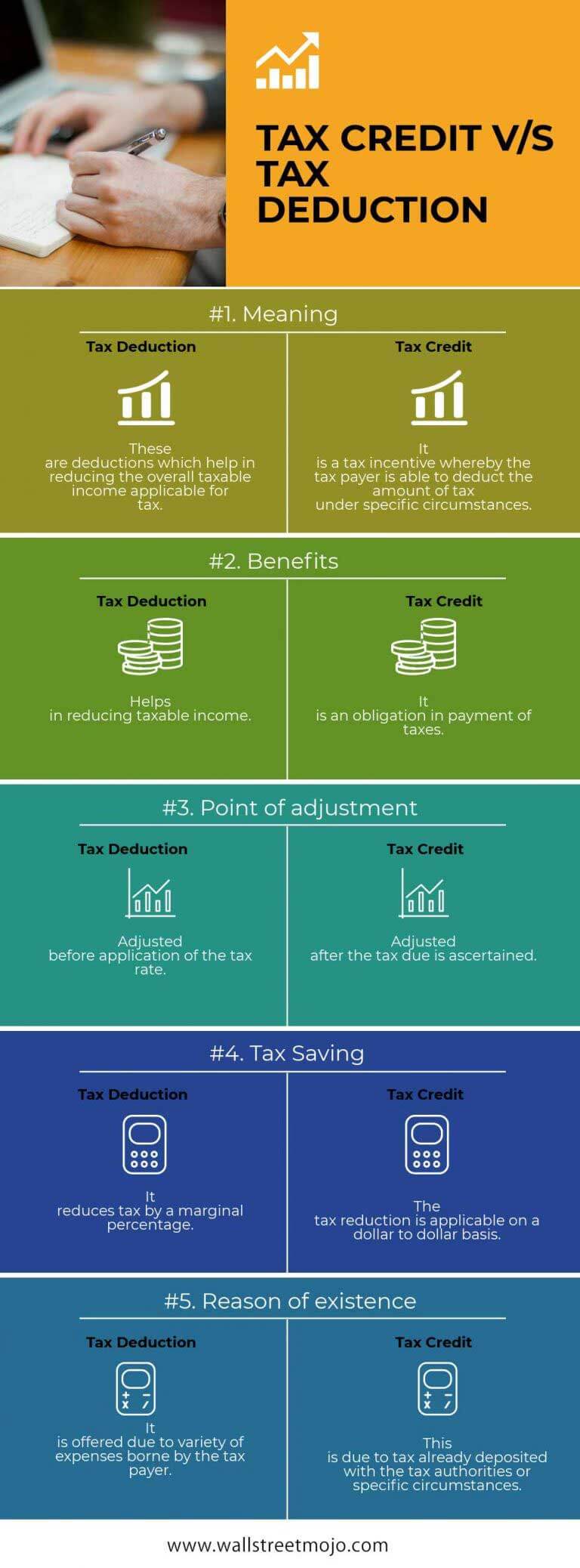

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

Business Tax Credit Vs Tax Deduction What s The Difference

Business Tax Credit Vs Tax Deduction What s The Difference

Tax Deduction Definition TaxEDU Tax Foundation