In this day and age when screens dominate our lives but the value of tangible, printed materials hasn't diminished. In the case of educational materials or creative projects, or simply adding an individual touch to the area, Electrical Panel Solar Tax Credit have proven to be a valuable resource. This article will dive in the world of "Electrical Panel Solar Tax Credit," exploring their purpose, where to find them, and how they can enhance various aspects of your daily life.

Get Latest Electrical Panel Solar Tax Credit Below

Electrical Panel Solar Tax Credit

Electrical Panel Solar Tax Credit -

Provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed Am I eligible to claim the federal solar tax credit

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Electrical Panel Solar Tax Credit offer a wide range of printable, free content that can be downloaded from the internet at no cost. These resources come in many types, such as worksheets templates, coloring pages and many more. The appealingness of Electrical Panel Solar Tax Credit lies in their versatility as well as accessibility.

More of Electrical Panel Solar Tax Credit

Solar Panel Tax Credit Orangemarigolds

Solar Panel Tax Credit Orangemarigolds

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Electrical Panel Solar Tax Credit have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: This allows you to modify printables to fit your particular needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages, making them a valuable resource for educators and parents.

-

The convenience of immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Electrical Panel Solar Tax Credit

All Solar Panel Incentives Tax Credits In 2023 By State

All Solar Panel Incentives Tax Credits In 2023 By State

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

Now that we've piqued your interest in Electrical Panel Solar Tax Credit We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Electrical Panel Solar Tax Credit to suit a variety of objectives.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Electrical Panel Solar Tax Credit

Here are some creative ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Electrical Panel Solar Tax Credit are an abundance of creative and practical resources which cater to a wide range of needs and hobbies. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the vast world of Electrical Panel Solar Tax Credit right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial use?

- It's determined by the specific rules of usage. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Electrical Panel Solar Tax Credit?

- Some printables may contain restrictions on use. Be sure to read the terms and regulations provided by the creator.

-

How do I print Electrical Panel Solar Tax Credit?

- Print them at home using any printer or head to an area print shop for higher quality prints.

-

What software do I require to open Electrical Panel Solar Tax Credit?

- Many printables are offered with PDF formats, which is open with no cost software like Adobe Reader.

Solar Panel Tax Credits Get Them Before They Disappear

When Does Solar Tax Credit End SolarProGuide 2022

Check more sample of Electrical Panel Solar Tax Credit below

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Solar Panel Tax Credit 2023 Q2023F

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

The Federal Solar Tax Credit Extension Can We Win If We Lose

Colorado Government Solar Tax Credit Big History Blogger Photography

Solar Tax Credit Solar Residential Solar Solar Panel Installation

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.energystar.gov/.../electric-panel-upgrade

Electric Panel Upgrade Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Electric Panel Upgrade Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

The Federal Solar Tax Credit Extension Can We Win If We Lose

Solar Panel Tax Credit 2023 Q2023F

Colorado Government Solar Tax Credit Big History Blogger Photography

Solar Tax Credit Solar Residential Solar Solar Panel Installation

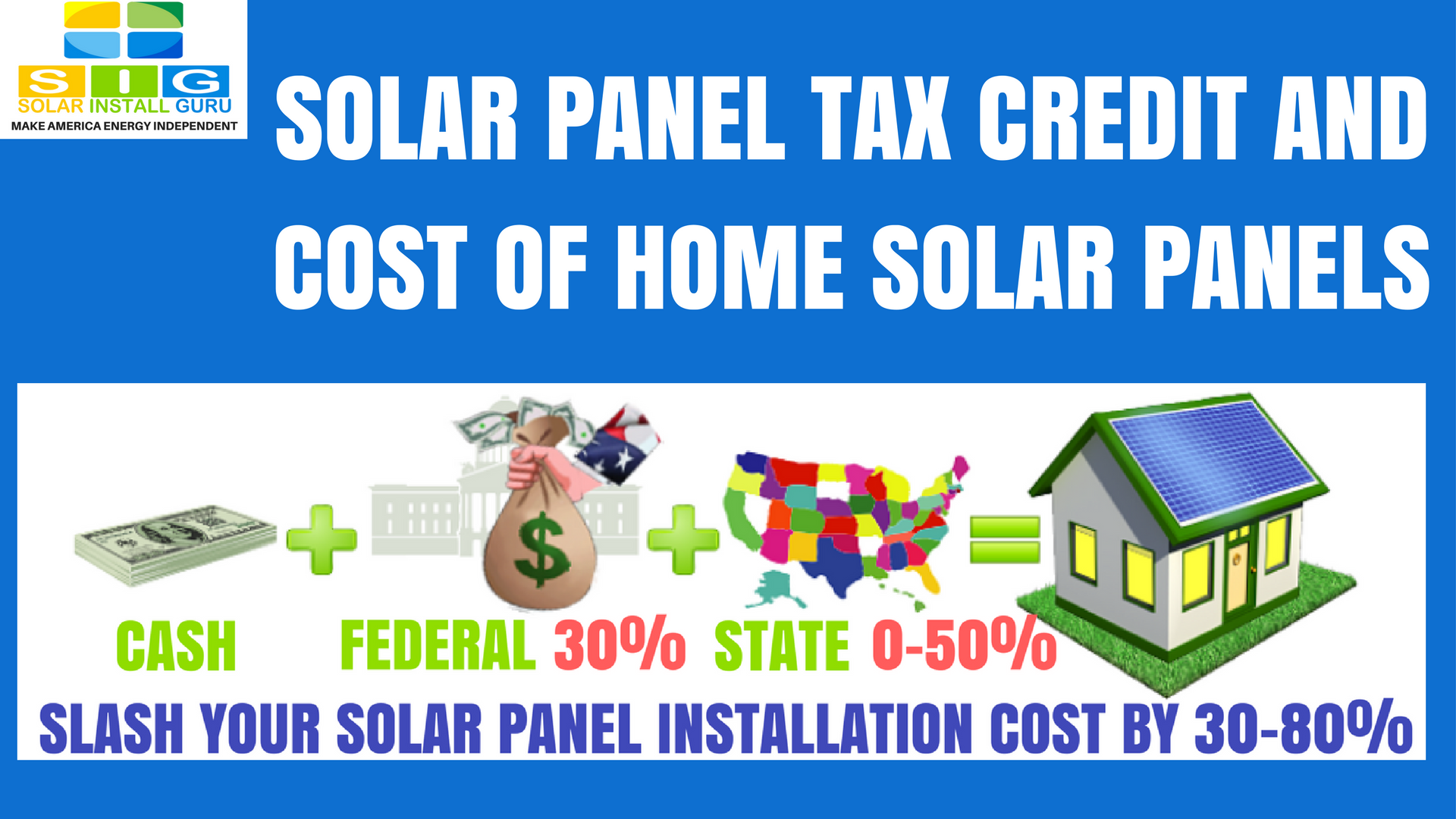

Solar Panel Tax Credit And Home Solar Panels SOLAR Install GURU Blog

Solar Tax Credit Solarponics

Solar Tax Credit Solarponics

Solar Tax Credit Calculator NikiZsombor