In this age of electronic devices, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects isn't diminished. If it's to aid in education or creative projects, or simply adding an individual touch to your space, Education Loan Tax Benefit India are a great resource. The following article is a dive into the world of "Education Loan Tax Benefit India," exploring their purpose, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Education Loan Tax Benefit India Below

Education Loan Tax Benefit India

Education Loan Tax Benefit India -

An individual who has availed a loan for higher education can enjoy various tax benefits as per the provisions of the Income Tax Act Suppose a taxpayer has already claimed the maximum amount of deductions Rs 1 50 000 available under Section 80C

Education loan deduction under Section 80E allows individuals to claim tax benefits on interest paid for higher studies It is applicable for those who have taken loans from recognized institutions The deduction can only be claimed on the interest part of the EMI and not on the principal part

Education Loan Tax Benefit India include a broad range of printable, free content that can be downloaded from the internet at no cost. These resources come in many styles, from worksheets to coloring pages, templates and more. The great thing about Education Loan Tax Benefit India is their versatility and accessibility.

More of Education Loan Tax Benefit India

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

Understanding Education Loan Tax Benefits The tax benefit on education loans is given under Section 80E of the Income Tax Act It allows taxpayers to claim deductions on the interest paid towards education loans for themselves their spouse their children or a person for whom the taxpayer is a legal guardian

Education Loan Tax Benefit India have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations or arranging your schedule or decorating your home.

-

Educational Use: These Education Loan Tax Benefit India are designed to appeal to students of all ages, making the perfect tool for parents and teachers.

-

An easy way to access HTML0: immediate access a variety of designs and templates can save you time and energy.

Where to Find more Education Loan Tax Benefit India

Home Loan Tax Benefit Under Section 80EE

Home Loan Tax Benefit Under Section 80EE

The tax benefit of taking education loan is that the interest paid on education loan can be claimed as deduction while calculating your taxable income without any fixed upper limit as per the income tax law Section 80E of the Income Tax Act of India 1961

The Government of India wished to provide a tax deduction on the interest component of an education loan availed for higher studies For this purpose Section 80E allows taxpayers to claim a deduction to the extent of actual repayments made on educational loans

We hope we've stimulated your interest in printables for free We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Education Loan Tax Benefit India for different purposes.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing Education Loan Tax Benefit India

Here are some ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Education Loan Tax Benefit India are an abundance filled with creative and practical information that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them a great addition to each day life. Explore the plethora of Education Loan Tax Benefit India today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial use?

- It's based on the terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Check the terms and condition of use as provided by the designer.

-

How can I print Education Loan Tax Benefit India?

- Print them at home using either a printer or go to the local print shops for superior prints.

-

What software do I need to open printables free of charge?

- The majority of PDF documents are provided in PDF format, which can be opened with free software, such as Adobe Reader.

Education Loan Tax Benefit Section 80E Explained YouTube

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Check more sample of Education Loan Tax Benefit India below

Home Loan Tax Benefit 2021 22 YouTube

Home Loan Tax Benefit

Home Construction Loan How To Claim Tax Benefits Loan Trivia

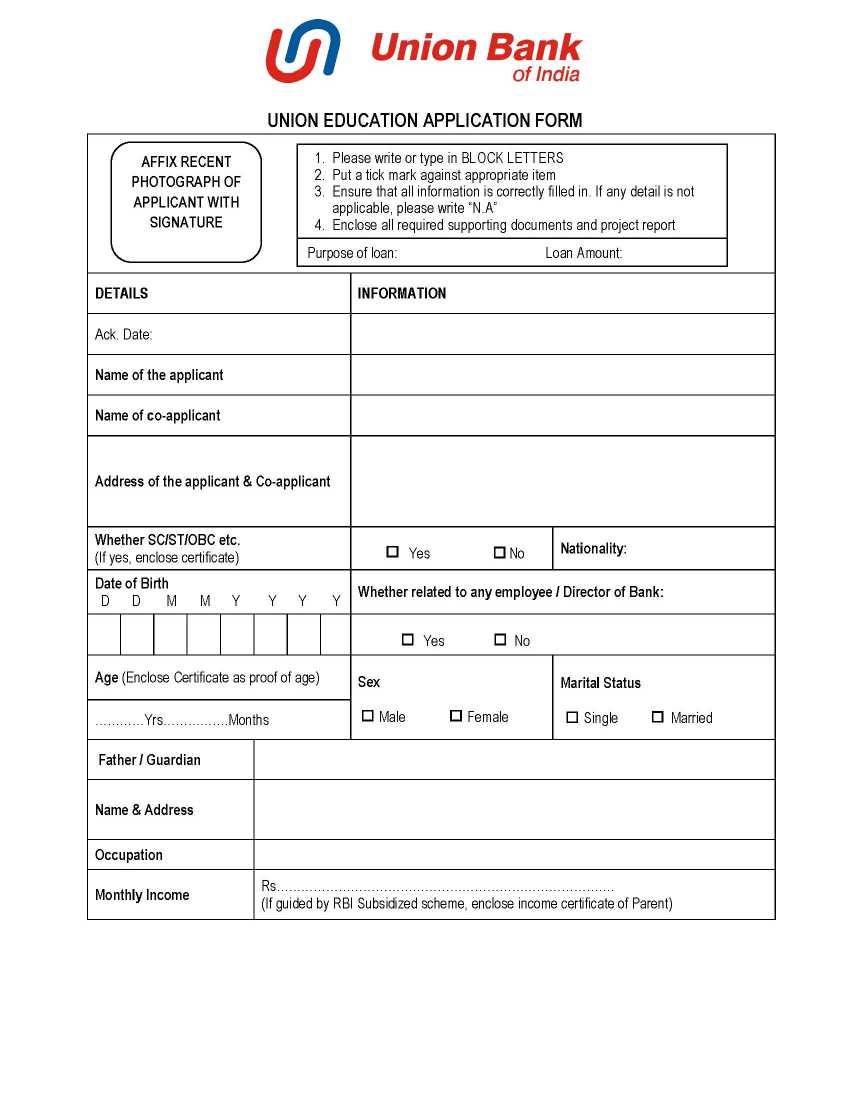

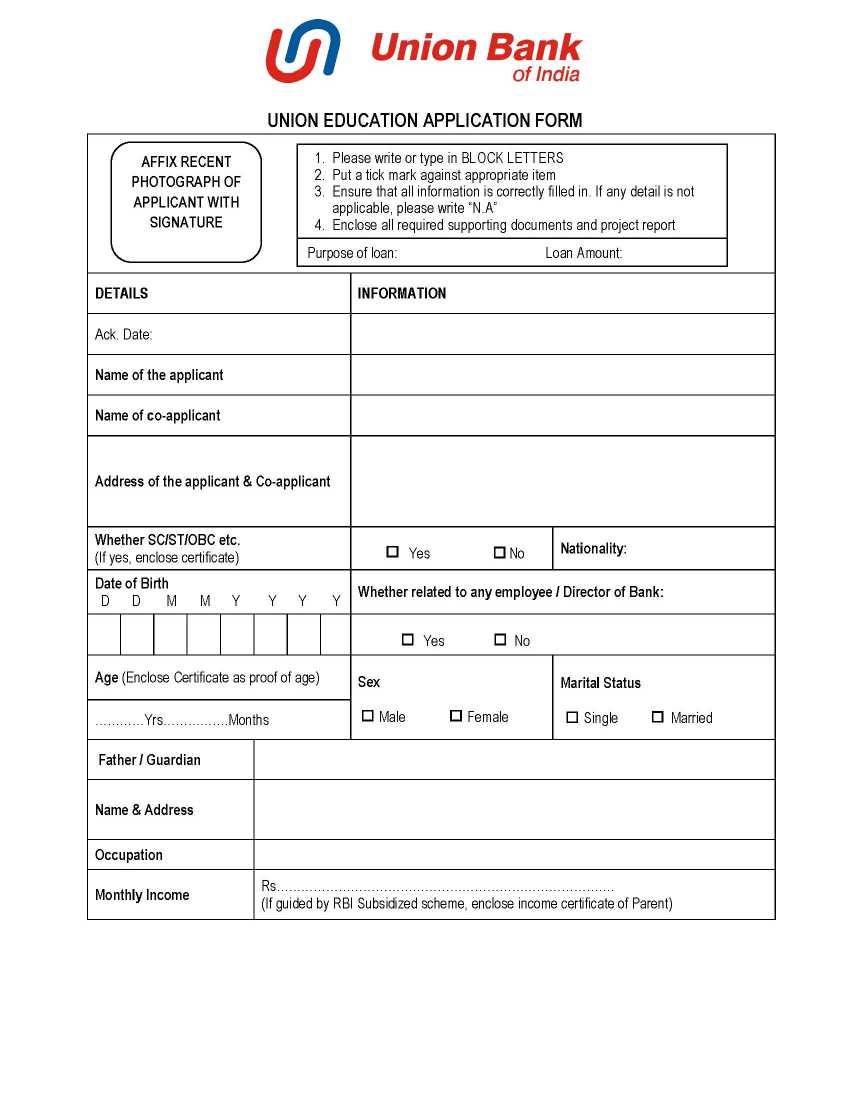

Union Bank Of India Education Loan Online Application Form 2023 2024

Income Tax Benefits On Housing Loan In India

ABCs Of Education Loan Tax Benefit From India Smart Debt Smarter Taxes

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Education loan deduction under Section 80E allows individuals to claim tax benefits on interest paid for higher studies It is applicable for those who have taken loans from recognized institutions The deduction can only be claimed on the interest part of the EMI and not on the principal part

https://www.etmoney.com/learn/income-tax/education...

To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961

Education loan deduction under Section 80E allows individuals to claim tax benefits on interest paid for higher studies It is applicable for those who have taken loans from recognized institutions The deduction can only be claimed on the interest part of the EMI and not on the principal part

To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961

Union Bank Of India Education Loan Online Application Form 2023 2024

Home Loan Tax Benefit

Income Tax Benefits On Housing Loan In India

ABCs Of Education Loan Tax Benefit From India Smart Debt Smarter Taxes

Avail Joint Home Loan To Get These Amazing Benefits Homes Loans Blog

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Overseas Education Loan Tax Benefits