Today, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply to add an extra personal touch to your home, printables for free have proven to be a valuable resource. Here, we'll take a dive deeper into "Doing Your Own Tax Return Sole Trader," exploring the benefits of them, where to find them and how they can improve various aspects of your daily life.

Get Latest Doing Your Own Tax Return Sole Trader Below

Doing Your Own Tax Return Sole Trader

Doing Your Own Tax Return Sole Trader -

You ll get your refund faster generally within 2 weeks 14 days You can upload records you keep in the myDeductions tool to pre fill your tax return It is available for all individuals and sole traders who want to lodge their own tax return You will receive a lodgment receipt by email to confirm that we have your lodgment

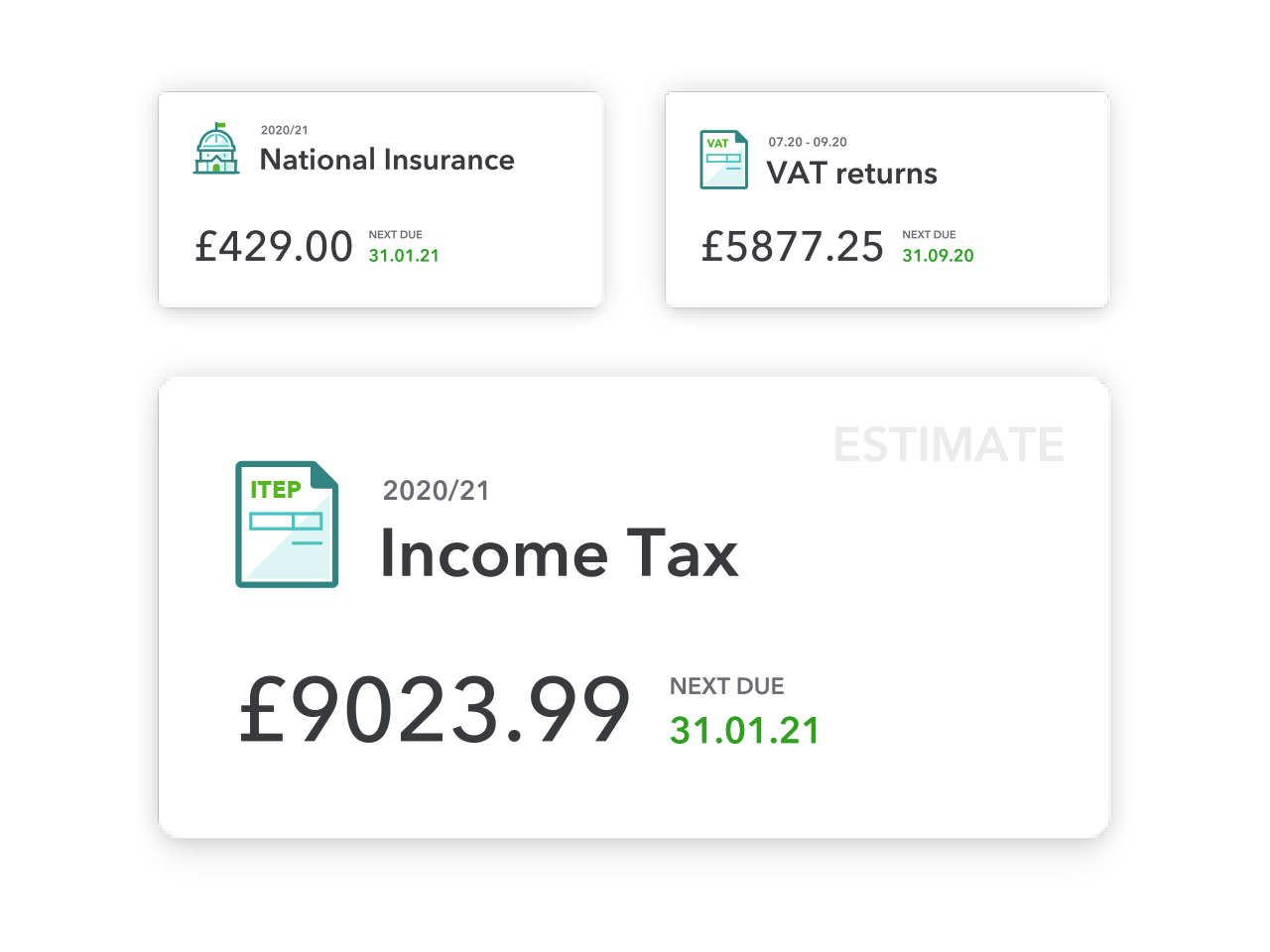

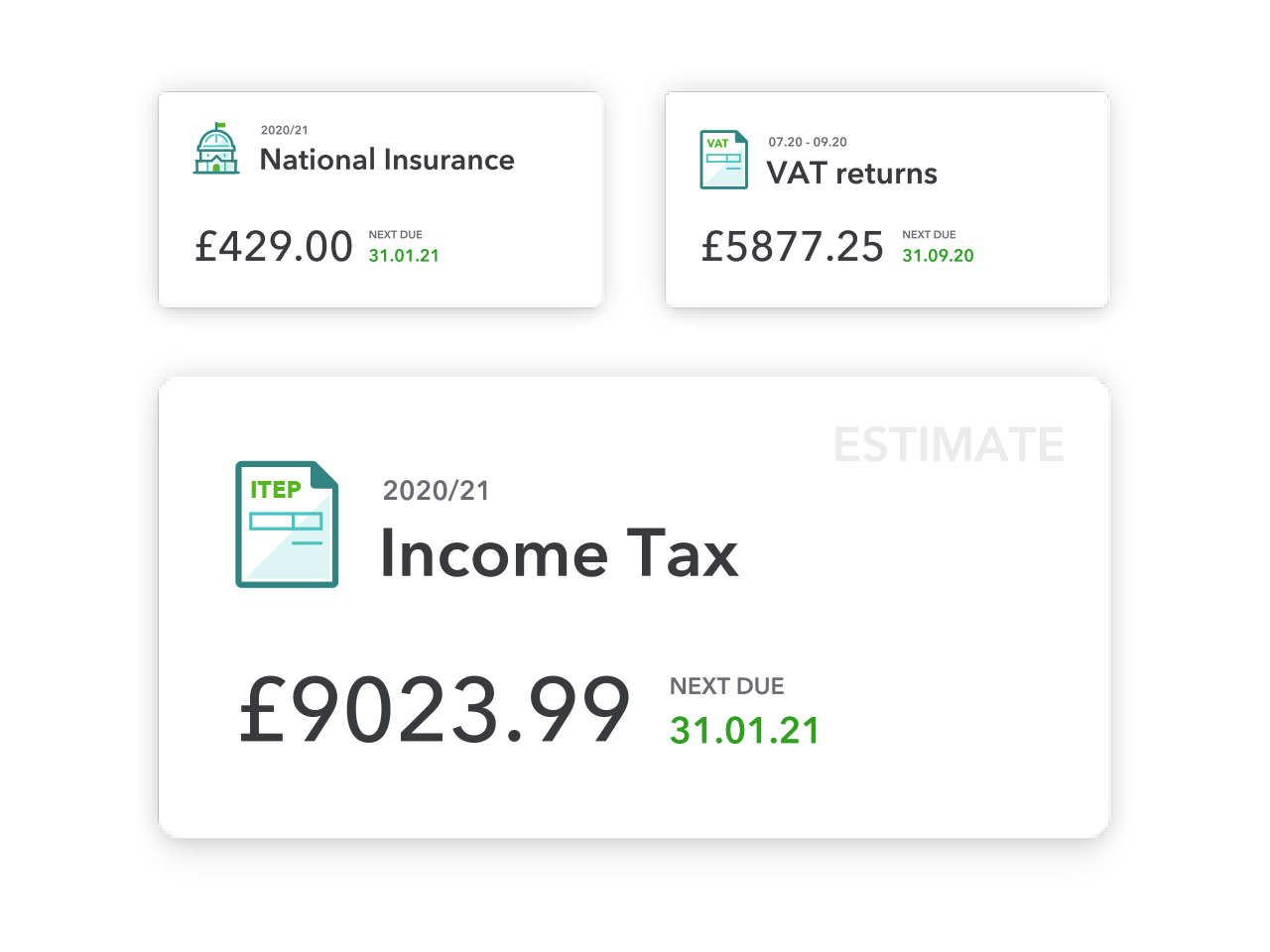

Last Updated 5th May 2022 Self Assessment Sole Traders Tax Return If you re self employed individual who owns your own business you ll need to submit what s known as a Self Assessment tax return This is so you can then pay the right amount of Income Tax and National Insurance Filing your taxes for the first time may seem like a

The Doing Your Own Tax Return Sole Trader are a huge assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in various styles, from worksheets to templates, coloring pages, and more. The great thing about Doing Your Own Tax Return Sole Trader is in their versatility and accessibility.

More of Doing Your Own Tax Return Sole Trader

Hire A Bookkeeper Brisbane Brisbane Bookkeeping BAS Agent Brisbane

Hire A Bookkeeper Brisbane Brisbane Bookkeeping BAS Agent Brisbane

Key tax obligations As a sole trader you use your individual tax file number TFN when lodging your tax return report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders

Self employed people carry out business activity on their own Self employment includes contracting working as a sole trader and small business owners Usually a self employed person can start in business without following any formal or legal set up tasks Tax summary If you re self employed you use your individual IRD number to pay tax

Doing Your Own Tax Return Sole Trader have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printables to fit your particular needs when it comes to designing invitations planning your schedule or decorating your home.

-

Education Value The free educational worksheets offer a wide range of educational content for learners of all ages, making them a valuable aid for parents as well as educators.

-

Accessibility: Fast access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Doing Your Own Tax Return Sole Trader

When To Lodge Your Tax Return

When To Lodge Your Tax Return

6 April 2024 Guidance Self Assessment tax return Report your income and claim tax reliefs and any repayment due to you using the SA100 return How to complete your tax return for

If you operate as a sole trader or plan to structure your business as one your main obligations include Use your own TFN Tax File Number You have the right to obtain an Australian Business Number ABN and should use it for all your business related activities Report all business income and expenses in your individual tax return

Since we've got your interest in Doing Your Own Tax Return Sole Trader Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Doing Your Own Tax Return Sole Trader for various motives.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a broad selection of subjects, ranging from DIY projects to party planning.

Maximizing Doing Your Own Tax Return Sole Trader

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Doing Your Own Tax Return Sole Trader are an abundance of practical and imaginative resources that cater to various needs and interest. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the endless world that is Doing Your Own Tax Return Sole Trader today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Doing Your Own Tax Return Sole Trader really available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with Doing Your Own Tax Return Sole Trader?

- Some printables may have restrictions concerning their use. You should read the terms and conditions set forth by the author.

-

How do I print Doing Your Own Tax Return Sole Trader?

- Print them at home using either a printer at home or in any local print store for more high-quality prints.

-

What software do I require to open Doing Your Own Tax Return Sole Trader?

- Most printables come in PDF format, which is open with no cost programs like Adobe Reader.

Sole Trader Tax Returns BT Tax

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

Check more sample of Doing Your Own Tax Return Sole Trader below

Webinar File Your Own Tax Return Online YouTube

Differences Between Sole Trader And A Company Tax Return

Paid Program The Many Benefits Of Doing Your Own Taxes

Tax Tips For Your Tax Return As A Sole Trader In Australia

Doing Your Own Tax Return Sole Trader Create Your Own Business T Does

TaxTips ca Methods Of Filing Your Tax Return

https://www. gosimpletax.com /blog/sole-traders...

Last Updated 5th May 2022 Self Assessment Sole Traders Tax Return If you re self employed individual who owns your own business you ll need to submit what s known as a Self Assessment tax return This is so you can then pay the right amount of Income Tax and National Insurance Filing your taxes for the first time may seem like a

https://www. gov.uk /self-employed-records

You must keep records of your business income and expenses for your tax return if you re self employed as a sole trader partner in a business partnership You ll also need to keep records

Last Updated 5th May 2022 Self Assessment Sole Traders Tax Return If you re self employed individual who owns your own business you ll need to submit what s known as a Self Assessment tax return This is so you can then pay the right amount of Income Tax and National Insurance Filing your taxes for the first time may seem like a

You must keep records of your business income and expenses for your tax return if you re self employed as a sole trader partner in a business partnership You ll also need to keep records

Tax Tips For Your Tax Return As A Sole Trader In Australia

Differences Between Sole Trader And A Company Tax Return

Doing Your Own Tax Return Sole Trader Create Your Own Business T Does

TaxTips ca Methods Of Filing Your Tax Return

Insights Blue Dragon Business Tax Services

Things You Should Know About Sole Trader Tax Return

Things You Should Know About Sole Trader Tax Return

9 Reasons To Stop Doing Your Own Taxes L F Cochrane Associates