In the age of digital, in which screens are the norm and the appeal of physical printed items hasn't gone away. For educational purposes or creative projects, or simply adding an individual touch to the home, printables for free have become an invaluable source. This article will dive to the depths of "Does Massachusetts Allow Bonus Depreciation," exploring what they are, how they can be found, and how they can enhance various aspects of your daily life.

Get Latest Does Massachusetts Allow Bonus Depreciation Below

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/15591797/GettyImages-492972836.0.1447953106.jpg)

Does Massachusetts Allow Bonus Depreciation

Does Massachusetts Allow Bonus Depreciation -

In the context of bonus depreciation a state s conformity status determines whether or not a business can claim bonus depreciation on their state tax returns This can vary

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for

Does Massachusetts Allow Bonus Depreciation cover a large collection of printable items that are available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and many more. The benefit of Does Massachusetts Allow Bonus Depreciation is in their variety and accessibility.

More of Does Massachusetts Allow Bonus Depreciation

What Is Bonus Depreciation And How Does It Work In 2023

What Is Bonus Depreciation And How Does It Work In 2023

Return Filing Requirements For Massachusetts purposes for taxable years ending after September 10 2001 depreciation is to be claimed on all assets

Bonus depreciation is a special first year 100 deduction for eligible property in its first year of use in addition to any section 179 deduction Of the 47 states

Does Massachusetts Allow Bonus Depreciation have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements be it designing invitations making your schedule, or even decorating your home.

-

Educational Impact: These Does Massachusetts Allow Bonus Depreciation are designed to appeal to students of all ages, which makes them a valuable device for teachers and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates reduces time and effort.

Where to Find more Does Massachusetts Allow Bonus Depreciation

Manage Your Tax Bill Focus CPA

Manage Your Tax Bill Focus CPA

Massachusetts adopts the changes to QIP allowing a 15 year depreciable life but it does not allow IRC Sec 168 k bonus depreciation Taxpayers computing

46 Therefore Massachusetts similarly adopts the new federal depreciation deduction starting with the 2018 taxable year The new federal rules do not impact prior taxable

Since we've got your interest in Does Massachusetts Allow Bonus Depreciation We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Does Massachusetts Allow Bonus Depreciation for all reasons.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Does Massachusetts Allow Bonus Depreciation

Here are some ways in order to maximize the use use of Does Massachusetts Allow Bonus Depreciation:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Does Massachusetts Allow Bonus Depreciation are an abundance of fun and practical tools that can meet the needs of a variety of people and hobbies. Their access and versatility makes these printables a useful addition to your professional and personal life. Explore the endless world of Does Massachusetts Allow Bonus Depreciation right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can download and print these documents for free.

-

Can I download free printouts for commercial usage?

- It depends on the specific conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may come with restrictions on usage. Be sure to check the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home with a printer or visit an area print shop for high-quality prints.

-

What program do I require to open printables free of charge?

- The majority of PDF documents are provided in PDF format. These can be opened using free software, such as Adobe Reader.

Mercedes G Wagon Tax Write Off 2022 2023

Tax Planning For Your Business Focus CPA

Check more sample of Does Massachusetts Allow Bonus Depreciation below

PDF Accelerated Depreciation And State Revenues

Manage Your Tax Bill Small Business Tax Planning Focus CPA

Bonus Depreciation Definition Example How Does It Work

Massachusetts Will Allow 100 Capacity At Stadiums In Time For Football

/cdn.vox-cdn.com/uploads/chorus_image/image/69197853/1177744974.jpg.0.jpg)

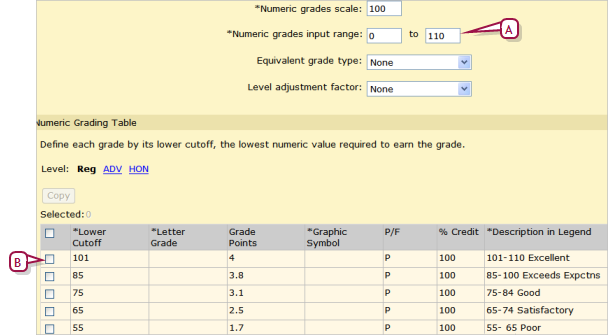

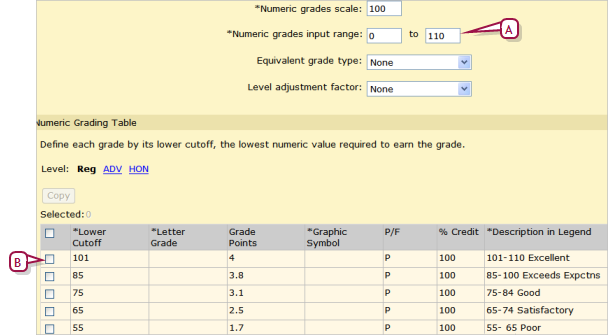

Setting Up A Grading Table To Allow Bonus Points

25 Kent Brooklyn Hirschen Singer Epstein LLP

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/15591797/GettyImages-492972836.0.1447953106.jpg?w=186)

https://www.mass.gov/technical-information-release...

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for

https://www.mass.gov/regulations/830-CMR-6331n1...

On its 2009 Massachusetts tax return X must calculate the federal depreciation deduction for the property as if it did not elect to utilize the federal bonus

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for

On its 2009 Massachusetts tax return X must calculate the federal depreciation deduction for the property as if it did not elect to utilize the federal bonus

/cdn.vox-cdn.com/uploads/chorus_image/image/69197853/1177744974.jpg.0.jpg)

Massachusetts Will Allow 100 Capacity At Stadiums In Time For Football

Manage Your Tax Bill Small Business Tax Planning Focus CPA

Setting Up A Grading Table To Allow Bonus Points

25 Kent Brooklyn Hirschen Singer Epstein LLP

The White House Budget Highlights The Need To Extend Pro Growth TCJA

Solved Instructions Based On The Following Information Prepare The

Solved Instructions Based On The Following Information Prepare The

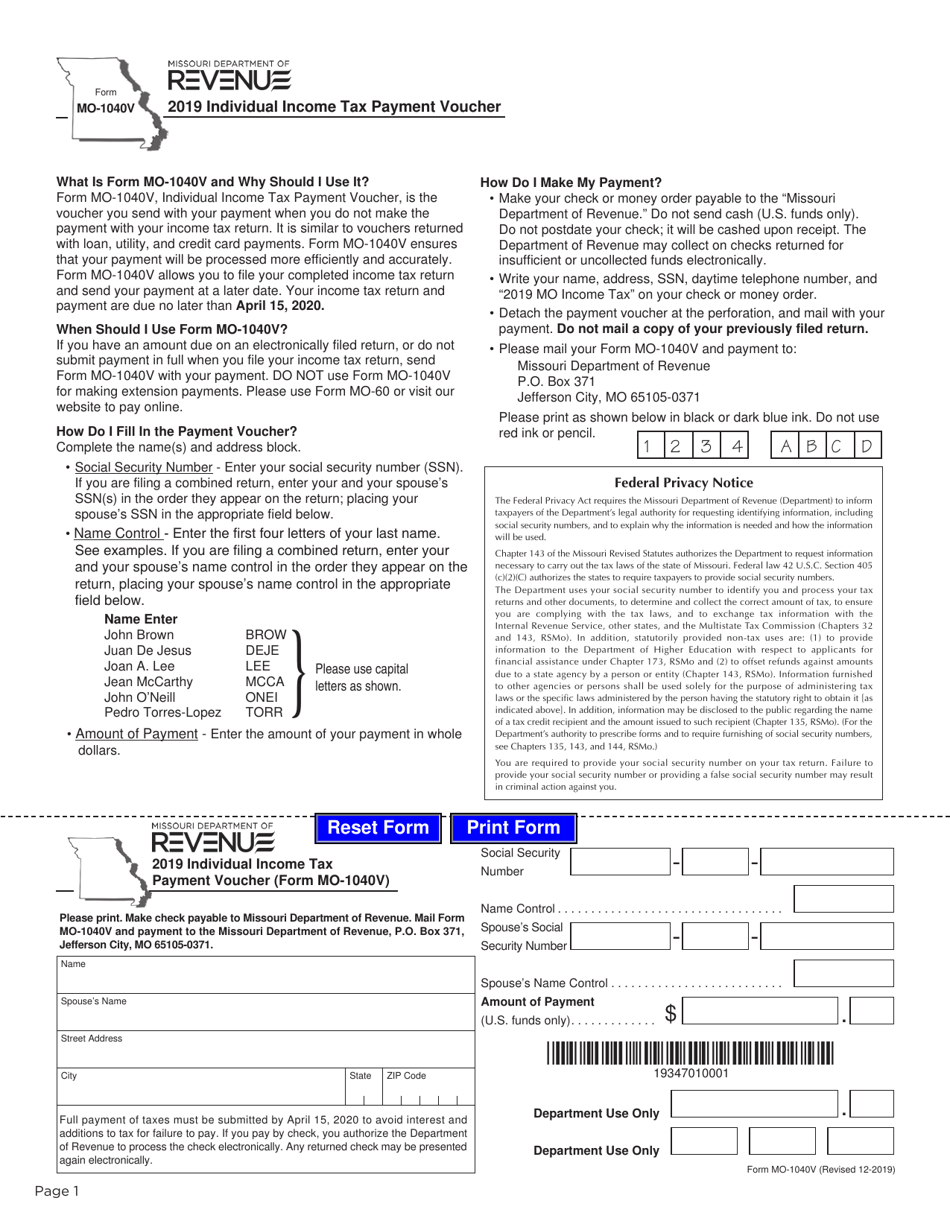

Missouri Form 4682 Fillable Printable Forms Free Online