In this day and age when screens dominate our lives The appeal of tangible printed material hasn't diminished. Be it for educational use as well as creative projects or simply adding some personal flair to your space, Do Rebates Need To Be Reported On Tax Returns have become an invaluable resource. This article will take a dive into the sphere of "Do Rebates Need To Be Reported On Tax Returns," exploring their purpose, where they can be found, and how they can improve various aspects of your life.

Get Latest Do Rebates Need To Be Reported On Tax Returns Below

Do Rebates Need To Be Reported On Tax Returns

Do Rebates Need To Be Reported On Tax Returns -

Web 13 janv 2022 nbsp 0183 32 DO NOT report any information regarding your first or second Economic Impact Payment or 2020 Recovery Rebate Credit on your 2021 tax return Q H1 I m

Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Do Rebates Need To Be Reported On Tax Returns cover a large assortment of printable, downloadable resources available online for download at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The benefit of Do Rebates Need To Be Reported On Tax Returns lies in their versatility and accessibility.

More of Do Rebates Need To Be Reported On Tax Returns

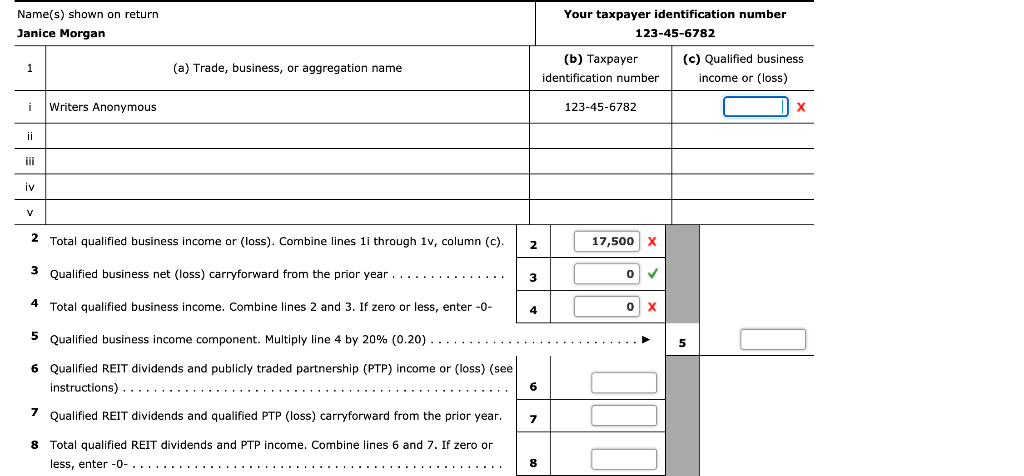

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be

Web 20 d 233 c 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax

Do Rebates Need To Be Reported On Tax Returns have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor designs to suit your personal needs in designing invitations planning your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a great resource for educators and parents.

-

Affordability: Instant access to various designs and templates is time-saving and saves effort.

Where to Find more Do Rebates Need To Be Reported On Tax Returns

How To Report A 1099 R Rollover To Your Self Directed 401k YouTube

How To Report A 1099 R Rollover To Your Self Directed 401k YouTube

Web 11 sept 2017 nbsp 0183 32 Cash rebates from a dealer or manufacturer for an item you for items you buy are tax free They are viewed in the tax law as merely reducing the purchase price

Web 9 f 233 vr 2023 nbsp 0183 32 The payments do not need to be claimed as income on California state income tax returns according to a spokesman for California s Franchise Tax Board

After we've peaked your interest in Do Rebates Need To Be Reported On Tax Returns, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Do Rebates Need To Be Reported On Tax Returns to suit a variety of uses.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide range of topics, including DIY projects to planning a party.

Maximizing Do Rebates Need To Be Reported On Tax Returns

Here are some unique ways for you to get the best use of Do Rebates Need To Be Reported On Tax Returns:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Do Rebates Need To Be Reported On Tax Returns are an abundance filled with creative and practical information for a variety of needs and passions. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the wide world of Do Rebates Need To Be Reported On Tax Returns and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free templates for commercial use?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with Do Rebates Need To Be Reported On Tax Returns?

- Certain printables might have limitations in their usage. Be sure to check the terms and condition of use as provided by the creator.

-

How do I print Do Rebates Need To Be Reported On Tax Returns?

- Print them at home using either a printer at home or in a local print shop for premium prints.

-

What software do I require to view printables for free?

- The majority of printables are in PDF format. These is open with no cost programs like Adobe Reader.

Rick Telberg On Twitter IRS Says Special State Payments And Tax

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Check more sample of Do Rebates Need To Be Reported On Tax Returns below

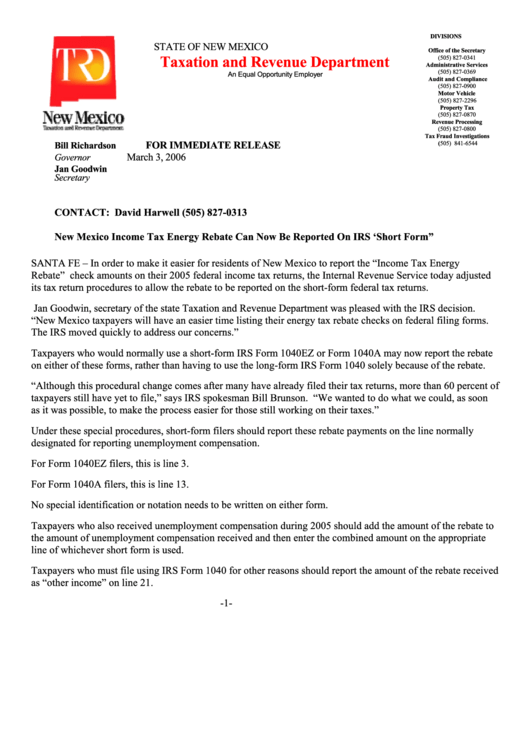

Form 1040 New Mexico Income Tax Energy Rebate Can Now Be Reported On

PragmaticObotsUnite On Twitter RT PIX11News The IRS Says People Who

WarDamnEagle On Twitter RT Tropicow Tens Of Thousands Of

Form 1040X Lets You Fix A Wrong Tax Return Don t Mess With Taxes

How To Report Your 2020 RMD Rollover On Your Tax Return Merriman

Kathleen Malone Works On Tax Returns At The Cincinnati Internal News

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Form 1040X Lets You Fix A Wrong Tax Return Don t Mess With Taxes

PragmaticObotsUnite On Twitter RT PIX11News The IRS Says People Who

How To Report Your 2020 RMD Rollover On Your Tax Return Merriman

Kathleen Malone Works On Tax Returns At The Cincinnati Internal News

:max_bytes(150000):strip_icc()/Life-insurance-cash-in_final-f8e68bd9f44049eab8722b08240470a4.png)

Cashing In Your Life Insurance Policy

How Do I Get My Rebate From Verizon A Step by Step Guide Verizon Rebates

How Do I Get My Rebate From Verizon A Step by Step Guide Verizon Rebates

Recovery Rebate Credit What You Need To Know Before Filing Your 2020