In the digital age, in which screens are the norm it's no wonder that the appeal of tangible printed material hasn't diminished. If it's to aid in education or creative projects, or simply to add an individual touch to the space, Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs can be an excellent source. The following article is a dive in the world of "Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs," exploring their purpose, where to find them and ways they can help you improve many aspects of your life.

Get Latest Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs Below

Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs

Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs -

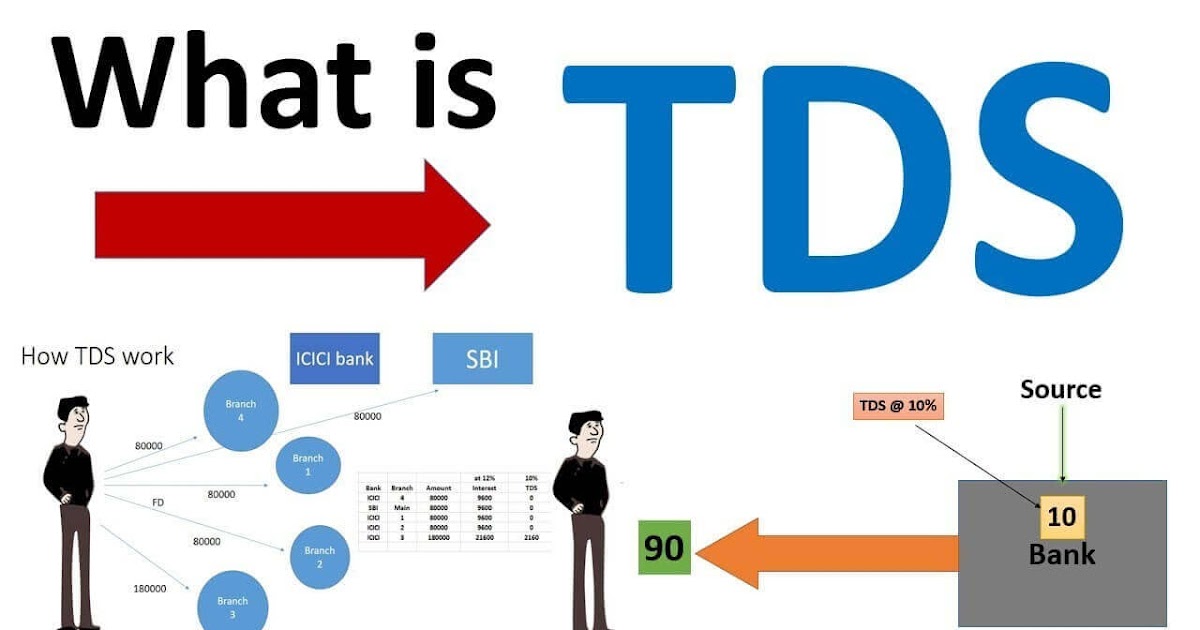

Tax deduction at source TDS is an Indian withholding tax that is a means of collecting tax on income dividends or asset sales by requiring the payer or legal intermediary to

Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8

Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs provide a diverse array of printable resources available online for download at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and much more. The beauty of Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs is in their variety and accessibility.

More of Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs

Declaration Under Section 194C PDF Government Public Finance

Declaration Under Section 194C PDF Government Public Finance

TDS is basically a part of income tax It has to be deducted by a person for certain payments made by them In this article we will discuss in detail the TDS

Under the new tax regime the rebate is available if the taxable income is less than 7 lakhs Therefore tax exemption and tax deductions help in saving money by

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: They can make printing templates to your own specific requirements in designing invitations planning your schedule or even decorating your house.

-

Educational Impact: Education-related printables at no charge provide for students of all ages, making them a useful tool for parents and teachers.

-

An easy way to access HTML0: You have instant access various designs and templates cuts down on time and efforts.

Where to Find more Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs

Payment Made By Mahindra To Dealers Towards Free Car Services On Its

Payment Made By Mahindra To Dealers Towards Free Car Services On Its

Form 16 TDS Due Date TDS Return Last updated on February 16th 2023 Tax Deducted at Source is an indirect method of collecting Income Tax TDS is based

Tax Deducted at Source is a type of advance tax that the Government of India levies on a periodic basis The overall deducted TDS is claimed as a tax refund after a taxpayer

Since we've got your curiosity about Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs we'll explore the places the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs for all reasons.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, from DIY projects to party planning.

Maximizing Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs

Here are some ideas for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs are an abundance with useful and creative ideas that meet a variety of needs and hobbies. Their availability and versatility make them a valuable addition to your professional and personal life. Explore the many options of Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It depends on the specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs?

- Some printables could have limitations on their use. You should read the terms and condition of use as provided by the creator.

-

How can I print Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs?

- You can print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software do I need to open printables at no cost?

- Most printables come in PDF format, which is open with no cost programs like Adobe Reader.

PRESENTATION ON TAX DEDUCTION AT SOURCE ICAI

Section 194Q Deduction Of Tax At Source On Payment Of Doc Template

Check more sample of Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs below

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Rebates And Reliefs Of Income Tax Law

Meaning Of TDS Tax Deducted At Source What Is TDS Teachoo

Section 194Q TDS Applicability On Goods Purchased

Vehicle Declaration Form SexiezPicz Web Porn

TDS Declaration Under Section 194C PDF

https://taxguru.in/income-tax/rebates-reliefs-income-tax-law.html

Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8

https://www.caclubindia.com/articles/rebate-and...

Step 1 Calculate your gross total income for the financial year Step 2 After that decrease your tax deduction for investment or tax savings etc Step 3 Get your

Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8

Step 1 Calculate your gross total income for the financial year Step 2 After that decrease your tax deduction for investment or tax savings etc Step 3 Get your

Section 194Q TDS Applicability On Goods Purchased

Rebates And Reliefs Of Income Tax Law

Vehicle Declaration Form SexiezPicz Web Porn

TDS Declaration Under Section 194C PDF

Income Tax Deduction From Salaries During The Financial Year 2022 23

Overview Of Rates For Deduction Of Tax At Source TDS Under The Income

Overview Of Rates For Deduction Of Tax At Source TDS Under The Income

TDS What Is Tax Deduction At Source Details In Tamil