In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add an individual touch to the area, Disabled Tax Credit Child are now a vital source. In this article, we'll take a dive deep into the realm of "Disabled Tax Credit Child," exploring what they are, how to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Disabled Tax Credit Child Below

Disabled Tax Credit Child

Disabled Tax Credit Child -

Having a child with a disability can affect your taxes For example the Earned Income Tax Credit EITC is a refundable tax credit meaning you could receive all or part of the

Approved applicants who are 18 years and older on the last day of the year may claim the base disability amount Those who are 17 years and younger on the last day of the year may also claim the supplement for children with

Disabled Tax Credit Child provide a diverse range of downloadable, printable materials online, at no cost. They come in many types, such as worksheets templates, coloring pages, and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Disabled Tax Credit Child

Post Office Card Accounts Will Stop Receiving Tax Credit Child Benefit

Post Office Card Accounts Will Stop Receiving Tax Credit Child Benefit

Find out if your disability benefits and the refund you get for the EITC qualify as earned income for the Earned Income Tax Credit EITC Find out how you can claim a child of any age if the person has a total and permanent disability

The disability tax credit DTC reduces taxes you owe but does not generate a refund You have to apply for the DTC with a medical practitioner s approval The DTC can be claimed for yourself or others who rely on you for daily assistance File your taxes with confidence Get your maximum refund guaranteed Start filing

Disabled Tax Credit Child have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: Your HTML0 customization options allow you to customize the templates to meet your individual needs when it comes to designing invitations making your schedule, or even decorating your house.

-

Education Value The free educational worksheets provide for students of all ages, making them a great instrument for parents and teachers.

-

Accessibility: Fast access a myriad of designs as well as templates can save you time and energy.

Where to Find more Disabled Tax Credit Child

Vehicle Tax Exemption And 50 Reduction Disabled Road Tax

Vehicle Tax Exemption And 50 Reduction Disabled Road Tax

Tax credits for those with disabilities include the child and dependent care credit credit for the elderly and the disabled and earned income tax credit Unlike a tax deduction which only reduces your taxable income a tax credit reduces the amount of tax you have to pay For example a 1 000 credit reduces the tax you owe by 1 000

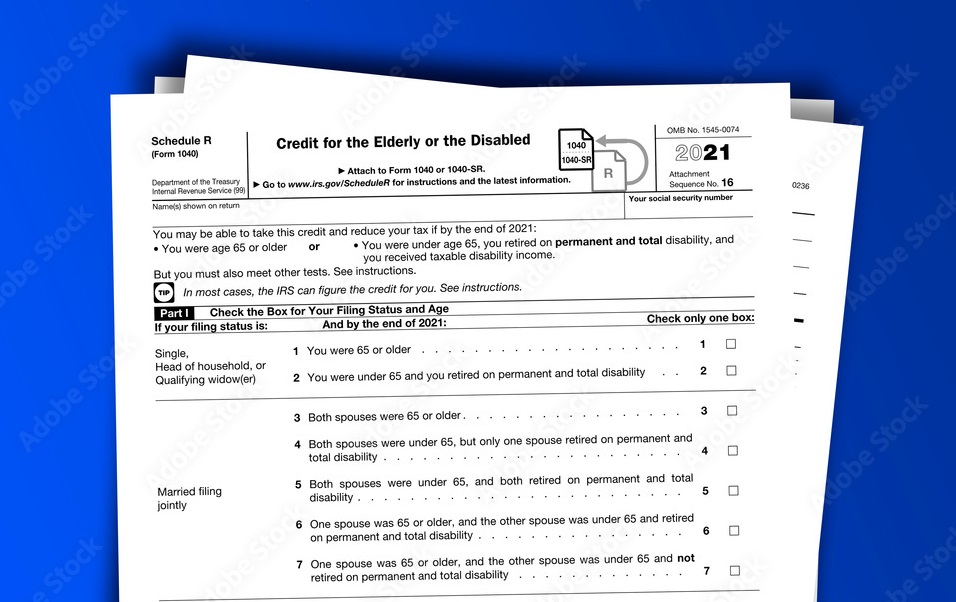

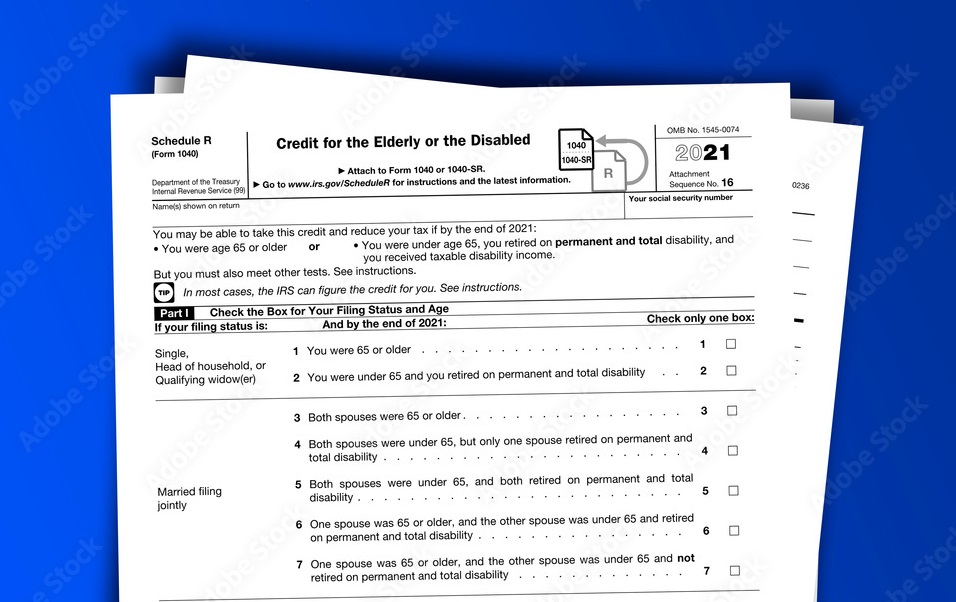

The elderly and disabled can receive a tax credit that could reduce and even potentially eliminate the tax they owe for the entire year Here s how to figure out if you qualify

We've now piqued your interest in printables for free, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Disabled Tax Credit Child designed for a variety reasons.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a broad range of topics, everything from DIY projects to party planning.

Maximizing Disabled Tax Credit Child

Here are some creative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to aid in learning at your home and in class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Disabled Tax Credit Child are a treasure trove of fun and practical tools that can meet the needs of a variety of people and passions. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the vast world of Disabled Tax Credit Child today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Disabled Tax Credit Child?

- Some printables may contain restrictions on their use. Always read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit the local print shop for premium prints.

-

What program is required to open printables for free?

- Most PDF-based printables are available in the format PDF. This can be opened using free software such as Adobe Reader.

Rescue Plan s Expansions Of Earned Income Tax Credit Child Tax Credit

The ABLE Account For Disabled Tax Advantaged Account For Individuals

Check more sample of Disabled Tax Credit Child below

Tax Credits For Hiring The Disabled What To Know Parachor Consulting

Tax Tips For The Disabled taxes disabled Https www gobankingrates

How To Change Your Car Tax Class As A Disabled Driver Adrian Flux

10 Major Tax Credits And Deductions For Disabled Tax Filers

Become Accessible To Get The Disabled Access Tax Credit SeaMonster

Credit For The Elderly Or Disabled Qualifications How To Claim

https://www.canada.ca/.../disability-tax-credit/claiming-dtc.html

Approved applicants who are 18 years and older on the last day of the year may claim the base disability amount Those who are 17 years and younger on the last day of the year may also claim the supplement for children with

https://www.canada.ca/en/revenue-agency/services/tax/individuals...

The disability tax credit DTC is a non refundable tax credit that helps people with disabilities or their supporting family member reduce the amount of income tax they may have to pay If you have a severe and prolonged impairment you may apply for the credit

Approved applicants who are 18 years and older on the last day of the year may claim the base disability amount Those who are 17 years and younger on the last day of the year may also claim the supplement for children with

The disability tax credit DTC is a non refundable tax credit that helps people with disabilities or their supporting family member reduce the amount of income tax they may have to pay If you have a severe and prolonged impairment you may apply for the credit

10 Major Tax Credits And Deductions For Disabled Tax Filers

Tax Tips For The Disabled taxes disabled Https www gobankingrates

Become Accessible To Get The Disabled Access Tax Credit SeaMonster

Credit For The Elderly Or Disabled Qualifications How To Claim

Many People Being Left Behind Panel Report Says Disabled Tax Credit

10 Major Tax Credits And Deductions For Disabled Tax Filers

10 Major Tax Credits And Deductions For Disabled Tax Filers

New Bill Would Make Aging In Place Easier Rethinking65