In this age of technology, where screens dominate our lives and the appeal of physical printed objects hasn't waned. No matter whether it's for educational uses or creative projects, or simply adding an individual touch to your home, printables for free can be an excellent resource. The following article is a dive through the vast world of "Disability Tax Credit Amount Per Year," exploring their purpose, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Disability Tax Credit Amount Per Year Below

Disability Tax Credit Amount Per Year

Disability Tax Credit Amount Per Year -

For 2005 and later years eligibility for the disability amount tax credit includes persons with a severe and prolonged mental or physical impairment which significantly restricts the ability to perform more than one basic activity of daily living including vision speaking hearing walking elimination bowel or bladder functions feeding

2024 01 23 The disability tax credit DTC is a non refundable tax credit that helps people with impairments or a supporting family member reduce the amount of income tax they may have to pay

Disability Tax Credit Amount Per Year include a broad assortment of printable materials online, at no cost. They are available in a variety of designs, including worksheets templates, coloring pages, and more. The appealingness of Disability Tax Credit Amount Per Year is in their variety and accessibility.

More of Disability Tax Credit Amount Per Year

Applying For The Disability Tax Credit What You Should Know Raven Law

Applying For The Disability Tax Credit What You Should Know Raven Law

Disability Tax Credit Statistics 2012 to 2021 Calendar Years This publication provides statistics based on information that the Canada Revenue Agency CRA processed from applications for the Disability Tax Credit DTC or from individuals who claimed the DTC on their individual T1 Income Tax and Benefit Return

Read more about the Benefits of Getting Approved for the Disability Tax Credit Updated 2024 Disability Tax Credit DTC and Canada Caregiver Credit CCC amounts for the years 2012 to 2023 2023 Federal amount is 8 986

Disability Tax Credit Amount Per Year have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring printables to your specific needs for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Value Education-related printables at no charge can be used by students of all ages. This makes them a valuable source for educators and parents.

-

Easy to use: Access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Disability Tax Credit Amount Per Year

How Do You Apply For The Disability Tax Credit T2201 CCCA

How Do You Apply For The Disability Tax Credit T2201 CCCA

Key Takeaways The disability tax credit DTC reduces taxes you owe but does not generate a refund You have to apply for the DTC with a medical practitioner s approval The DTC can be claimed for yourself or others who rely on you for daily assistance File your taxes with confidence Get your maximum refund guaranteed

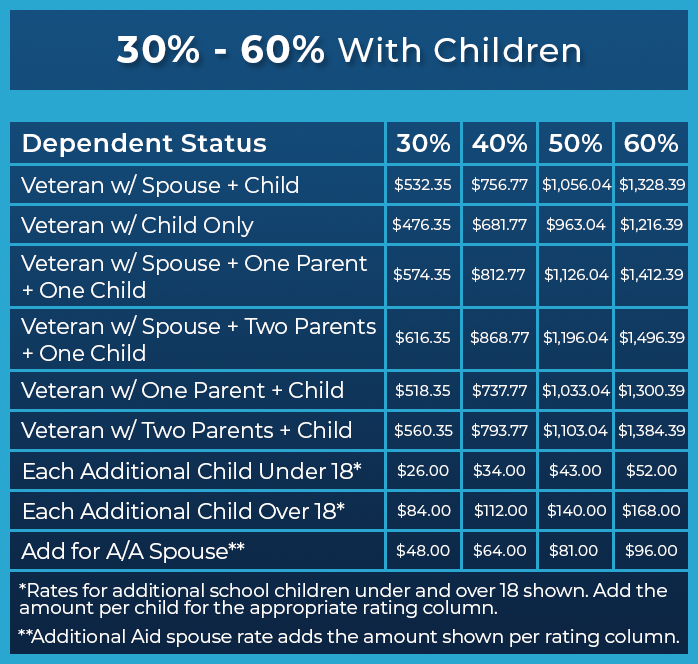

And How much is the disability tax credit amount This isn t a simple answer as the value is based on many factors regarding disability tax credit eligibility The Disability Tax Credit is broken down by Federal and Provincial amounts

After we've peaked your interest in Disability Tax Credit Amount Per Year Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Disability Tax Credit Amount Per Year for various needs.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to party planning.

Maximizing Disability Tax Credit Amount Per Year

Here are some creative ways for you to get the best of Disability Tax Credit Amount Per Year:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Disability Tax Credit Amount Per Year are an abundance of useful and creative resources that cater to various needs and desires. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the plethora that is Disability Tax Credit Amount Per Year today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can download and print these files for free.

-

Are there any free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in their usage. Make sure to read the terms and conditions set forth by the author.

-

How do I print Disability Tax Credit Amount Per Year?

- Print them at home with either a printer at home or in any local print store for higher quality prints.

-

What program do I need in order to open Disability Tax Credit Amount Per Year?

- The majority of printables are in PDF format, which is open with no cost programs like Adobe Reader.

Do I Qualify For The CRA Disability Tax Credit Blueprint Accounting

Disability Tax Credit 2020 Maxpro Financials

Check more sample of Disability Tax Credit Amount Per Year below

Canadian Disability Benefits Disability Tax Credit YouTube

Disability Tax Credit Certificate World OSCAR

CAOT BC A Guide To The Disability Tax Credit For Occupational Therapists

Child Tax Credit 2022 Age Limit Latest News Update

Utilizing Your Disability Tax Credit To Avoid Debt Consolidated

Social Security Maximum Taxable Earnings DisabilityTalk

https://www.canada.ca/en/revenue-agency/services...

2024 01 23 The disability tax credit DTC is a non refundable tax credit that helps people with impairments or a supporting family member reduce the amount of income tax they may have to pay

https://disabilitycreditcanada.com/disability-tax...

The federal DTC portion is 15 of the disability amount for that tax year The Base Amount maximum for 2023 is 9 428 according to the Canada Revenue Agency s CRA s Indexation Chart The Supplemental Amount for children with disabilities is a maximum of 5 500 2023 according to the CRA s Indexation Chart

2024 01 23 The disability tax credit DTC is a non refundable tax credit that helps people with impairments or a supporting family member reduce the amount of income tax they may have to pay

The federal DTC portion is 15 of the disability amount for that tax year The Base Amount maximum for 2023 is 9 428 according to the Canada Revenue Agency s CRA s Indexation Chart The Supplemental Amount for children with disabilities is a maximum of 5 500 2023 according to the CRA s Indexation Chart

Child Tax Credit 2022 Age Limit Latest News Update

Disability Tax Credit Certificate World OSCAR

Utilizing Your Disability Tax Credit To Avoid Debt Consolidated

Social Security Maximum Taxable Earnings DisabilityTalk

Your Disability Tax Credit Claim An Update

Disability Tax Credit Tax Reviews

Disability Tax Credit Tax Reviews

VA Disability Rating Calculator 2021 VA Disability Rates 2021