Today, where screens rule our lives it's no wonder that the appeal of tangible printed objects hasn't waned. If it's to aid in education, creative projects, or simply to add personal touches to your space, Difference Between Tax Relief And Tax Rebate Singapore have become a valuable source. The following article is a dive to the depths of "Difference Between Tax Relief And Tax Rebate Singapore," exploring the benefits of them, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Difference Between Tax Relief And Tax Rebate Singapore Below

Difference Between Tax Relief And Tax Rebate Singapore

Difference Between Tax Relief And Tax Rebate Singapore -

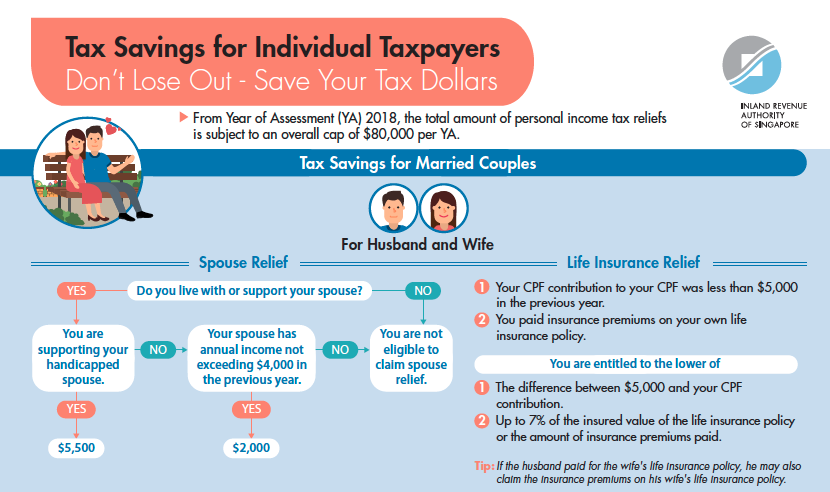

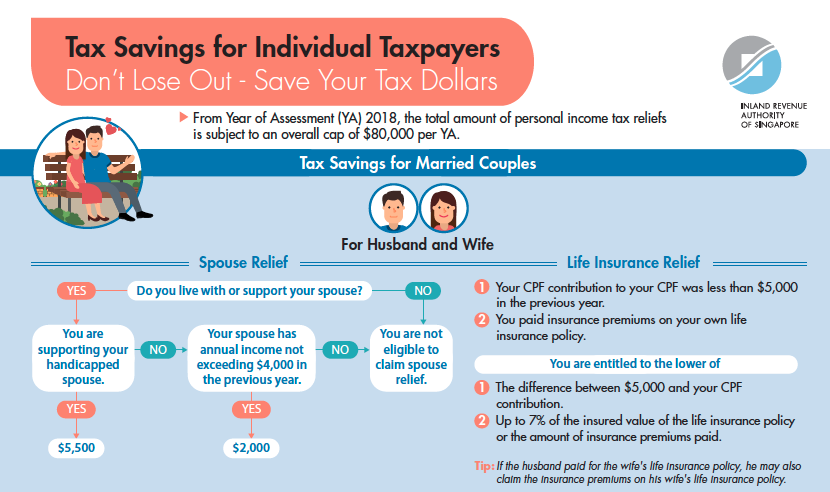

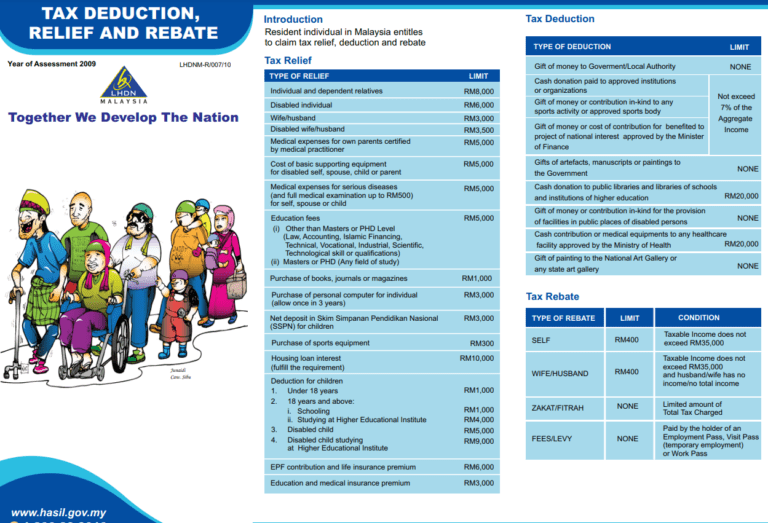

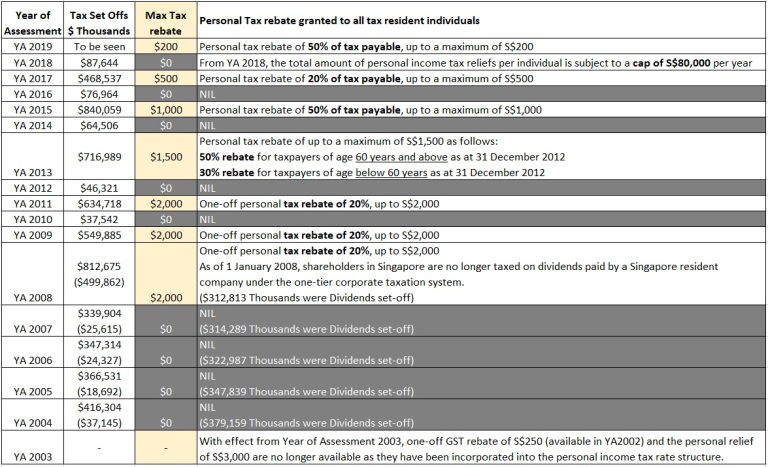

Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Resident individuals are entitled to certain personal reliefs and deductions and are subject to graduated tax rates ranging from 0 to 22 24 from

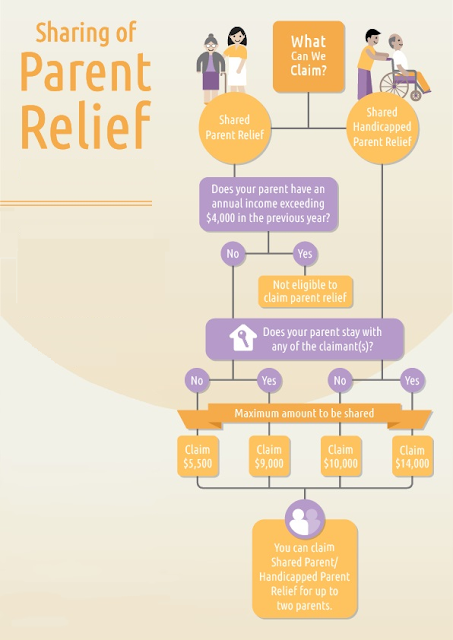

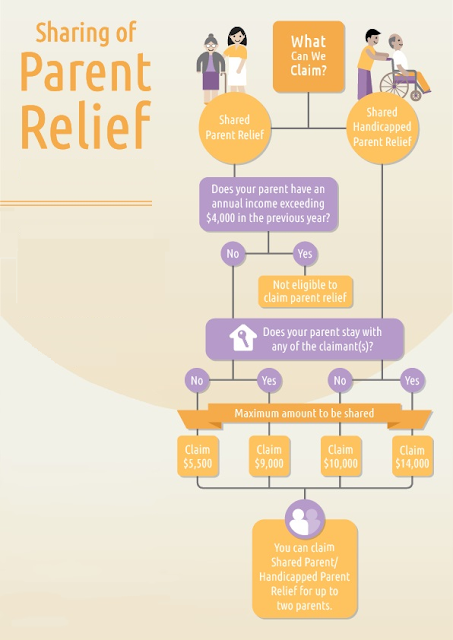

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

Difference Between Tax Relief And Tax Rebate Singapore encompass a wide assortment of printable materials online, at no cost. They come in many kinds, including worksheets templates, coloring pages, and more. The value of Difference Between Tax Relief And Tax Rebate Singapore is their versatility and accessibility.

More of Difference Between Tax Relief And Tax Rebate Singapore

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Web 1 Regional Headquarters Award 2 International Headquarters Award PWCS Tier 1 co funding ratios Mergers and Acquisitions Allowance Capital allowances Deduction on

Web Tax reliefs and rebates in Singapore are used to encourage filial piety family formation and even the advancement of certain skills through these reliefs given in support of the

Difference Between Tax Relief And Tax Rebate Singapore have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Individualization This allows you to modify printing templates to your own specific requirements, whether it's designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Impact: Printables for education that are free offer a wide range of educational content for learners of all ages, making them a vital tool for parents and teachers.

-

The convenience of Access to many designs and templates is time-saving and saves effort.

Where to Find more Difference Between Tax Relief And Tax Rebate Singapore

A Guide To Taxes And Tax Relief R singaporefi

A Guide To Taxes And Tax Relief R singaporefi

Web 24 janv 2020 nbsp 0183 32 For the second child 20 of earned income is eligible for tax relief For the third and subsequent children 25 of earned income is eligible for tax relief The percentage of tax rebate can also be added

Web Articles CPF amp SRS Understanding the latest Singapore income tax reliefs 2022 Updated 3 Nov 2022 published 4 Dec 2020 While Singapore has one of the lowest

Since we've got your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Difference Between Tax Relief And Tax Rebate Singapore suitable for many objectives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad array of topics, ranging that includes DIY projects to party planning.

Maximizing Difference Between Tax Relief And Tax Rebate Singapore

Here are some creative ways that you can make use of Difference Between Tax Relief And Tax Rebate Singapore:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Difference Between Tax Relief And Tax Rebate Singapore are an abundance with useful and creative ideas that cater to various needs and pursuits. Their access and versatility makes them a wonderful addition to every aspect of your life, both professional and personal. Explore the vast world that is Difference Between Tax Relief And Tax Rebate Singapore today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes they are! You can download and print these files for free.

-

Does it allow me to use free templates for commercial use?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Difference Between Tax Relief And Tax Rebate Singapore?

- Some printables may contain restrictions concerning their use. Be sure to review these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in a local print shop for the highest quality prints.

-

What program do I need to open Difference Between Tax Relief And Tax Rebate Singapore?

- The majority are printed as PDF files, which can be opened using free software like Adobe Reader.

Freelancer Guide All You Need To Know About Your Income Taxes

Index Of wp content uploads 2022 03

Check more sample of Difference Between Tax Relief And Tax Rebate Singapore below

All Income Earned In Singapore Is Subject To Tax However Singapore

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

How To Reduce Your Income Tax In Singapore make Use Of These Tax

How To Reduce Your Income Tax In Singapore make Use Of These Tax

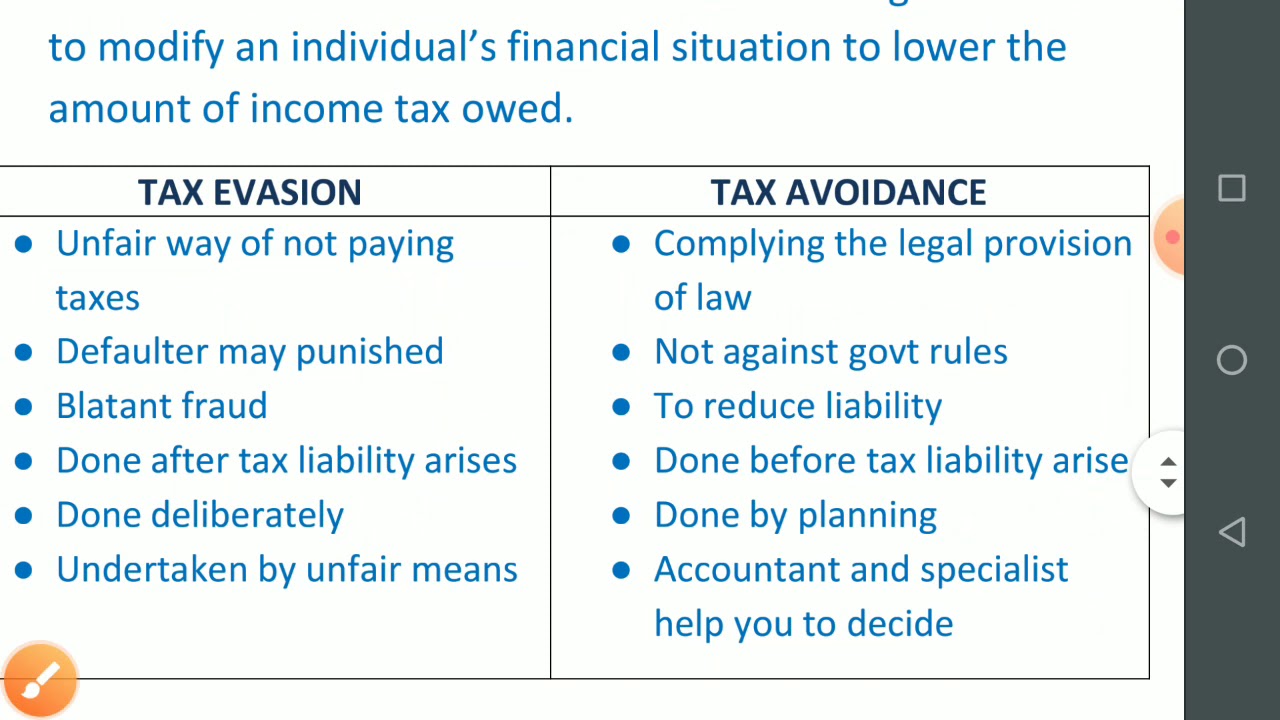

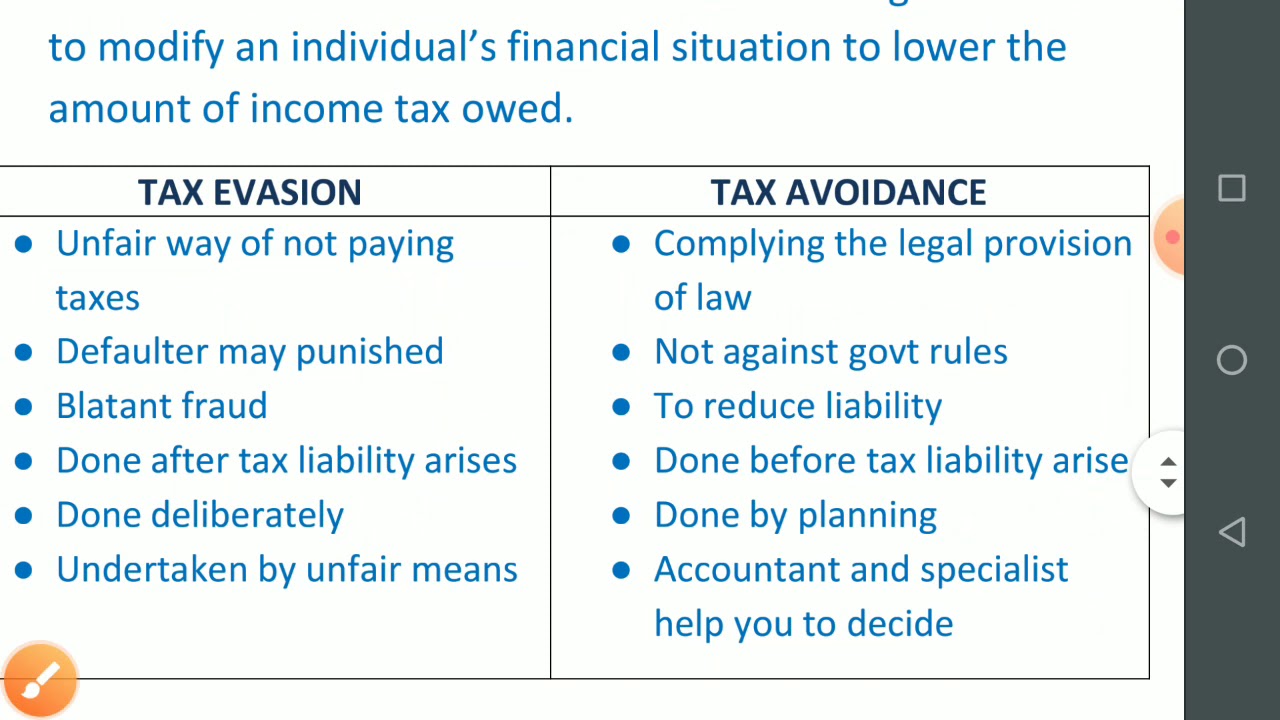

Tax Evasion And Tax Avoidance YouTube

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Tax Evasion And Tax Avoidance YouTube

Difference Between Rebate And Relief Act Printable Rebate Form

Why I Stress That Working Singaporeans Should Maximise Their Tax

Why I Stress That Working Singaporeans Should Maximise Their Tax

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022