In the digital age, where screens have become the dominant feature of our lives, the charm of tangible printed objects hasn't waned. Whatever the reason, whether for education and creative work, or just adding an individual touch to the home, printables for free have proven to be a valuable source. We'll take a dive into the world of "Dependent Care Tax Credit 2023 Irs," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Dependent Care Tax Credit 2023 Irs Below

Dependent Care Tax Credit 2023 Irs

Dependent Care Tax Credit 2023 Irs -

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

Printables for free cover a broad range of downloadable, printable resources available online for download at no cost. They come in many forms, including worksheets, coloring pages, templates and many more. One of the advantages of Dependent Care Tax Credit 2023 Irs lies in their versatility as well as accessibility.

More of Dependent Care Tax Credit 2023 Irs

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

The Dependent Care Tax Credit 2023 Irs have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printables to your specific needs whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Value These Dependent Care Tax Credit 2023 Irs offer a wide range of educational content for learners from all ages, making them a great instrument for parents and teachers.

-

Accessibility: You have instant access many designs and templates can save you time and energy.

Where to Find more Dependent Care Tax Credit 2023 Irs

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

What is the child and dependent care credit This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed by taxpayers who in order to work or look for work pay someone to take care of their qualifying person A qualifying person is a Qualifying child under age 13

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to report the claim on your tax return LAST UPDATED January 10 2024 SHARE THIS PAGE Have a

We hope we've stimulated your interest in printables for free and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Dependent Care Tax Credit 2023 Irs for various needs.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Dependent Care Tax Credit 2023 Irs

Here are some ideas that you can make use use of Dependent Care Tax Credit 2023 Irs:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Dependent Care Tax Credit 2023 Irs are an abundance of practical and innovative resources designed to meet a range of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Dependent Care Tax Credit 2023 Irs really gratis?

- Yes they are! You can download and print these documents for free.

-

Do I have the right to use free printables in commercial projects?

- It depends on the specific conditions of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright issues with Dependent Care Tax Credit 2023 Irs?

- Certain printables may be subject to restrictions in use. Be sure to review the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with any printer or head to the local print shop for the highest quality prints.

-

What program do I require to open printables at no cost?

- Most printables come as PDF files, which can be opened with free software such as Adobe Reader.

2021 Child And Dependent Care Tax Credit How To Get Up To An 8 000

Learn About The Child And Dependent Care Tax Credit Credit Karma

Check more sample of Dependent Care Tax Credit 2023 Irs below

Child And Dependent Care Tax Credit How To Qualify And How Much It Is

Dependent Care Flexible Spending Account Vs Child And Dependent Care

Build Your Own Child Tax Credit 2 0 Committee For A Responsible

Dependent Care Fsa Income Limit Tricheenlight

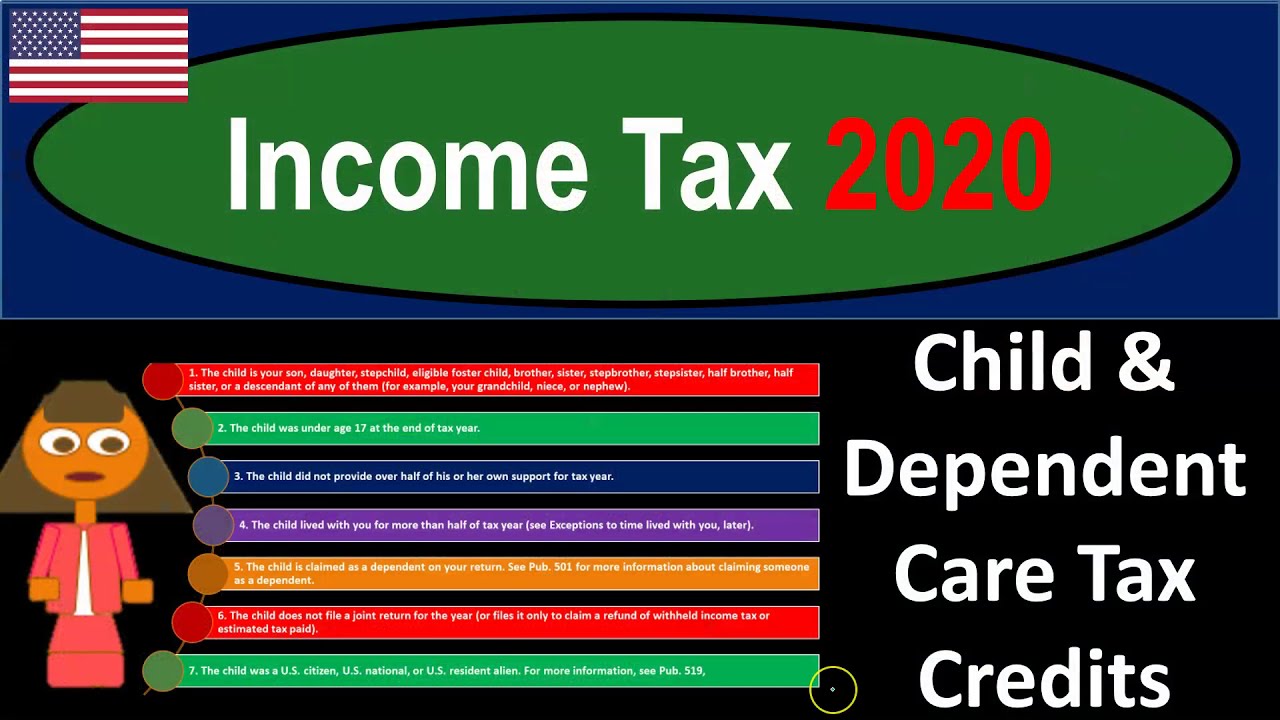

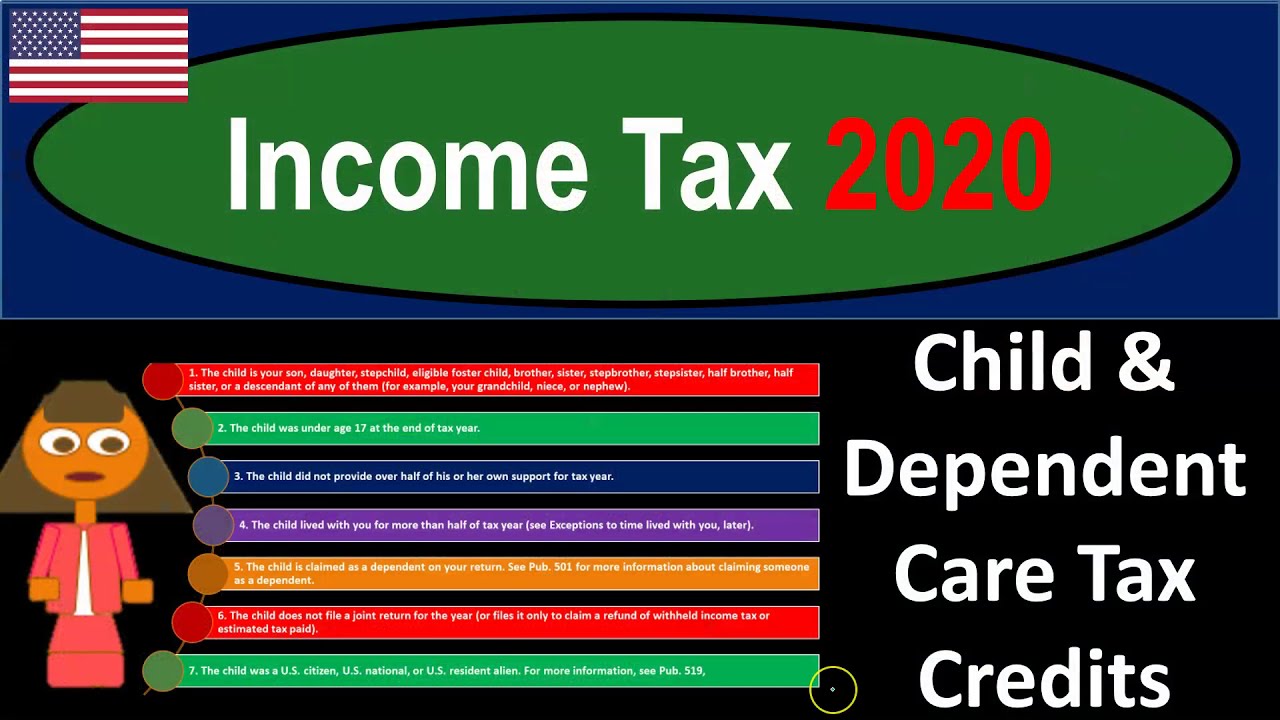

Child Dependent Care Tax Credits 905 Income Tax 2020 YouTube

Dependent Care Tax Benefits Tax Credits Employer Plans

https://www. irs.gov /newsroom/child-and-dependent-care-credit-faqs

FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

https://www. irs.gov /taxtopics/tc602

Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a

FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a

Dependent Care Fsa Income Limit Tricheenlight

Dependent Care Flexible Spending Account Vs Child And Dependent Care

Child Dependent Care Tax Credits 905 Income Tax 2020 YouTube

Dependent Care Tax Benefits Tax Credits Employer Plans

Child Tax Credit Vs Dependent Care Fsa Kitchen Cabinet

What Is The Child And Dependent Care Tax Credit 2020 2021 YouTube

What Is The Child And Dependent Care Tax Credit 2020 2021 YouTube

How To Get Your Child Care Dependent Care Tax Credit Approved YouTube