In this digital age, when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. Whatever the reason, whether for education such as creative projects or simply to add an extra personal touch to your space, Dependant Spouse Tax Credit are now an essential resource. We'll dive deep into the realm of "Dependant Spouse Tax Credit," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Dependant Spouse Tax Credit Below

Dependant Spouse Tax Credit

Dependant Spouse Tax Credit -

The definition of dependant for this credit is different than for the Eligible Dependant Amount credit In this case the dependant must be Your child grandchild brother sister niece nephew aunt uncle parent or grandparent Dependent on you or your spouse due to a physical or mental impairment Medical Expenses for Other

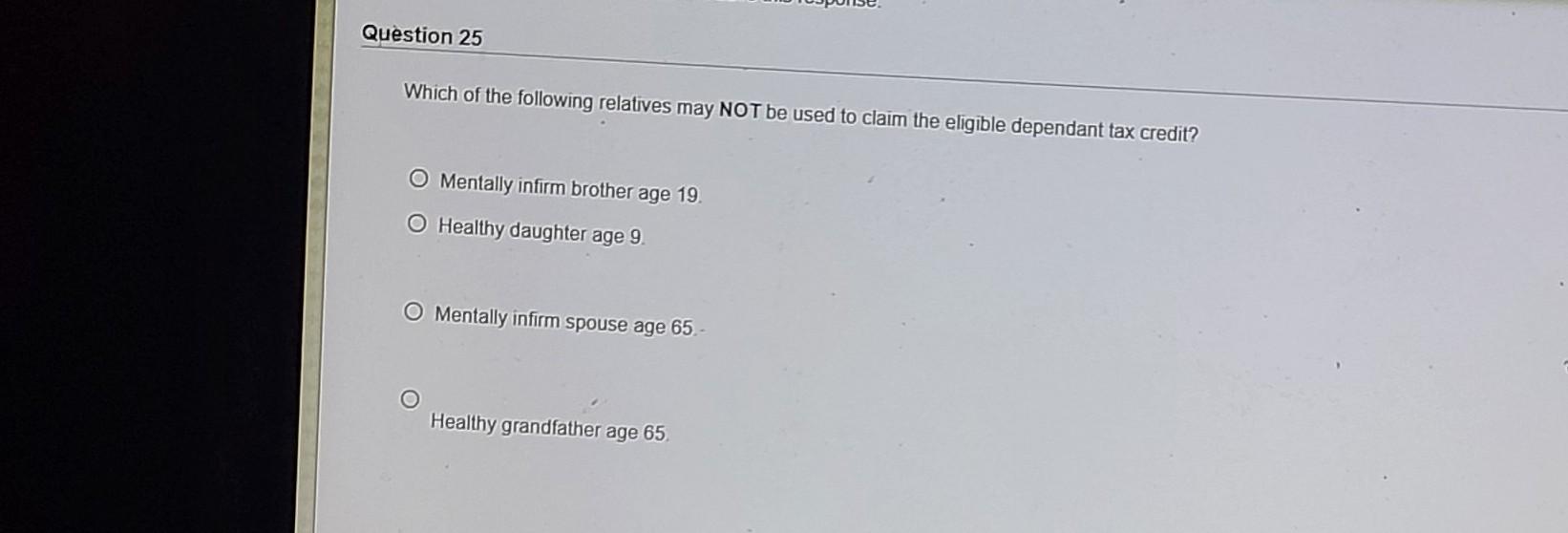

Formerly referred to as the Equivalent to Spouse amount the Amount for an Eligible Dependant Credit is a Non Refundable Tax Credit designed for single adults who are not claiming the spouse common law partner credit and who are responsible for the financial care of a relative

Printables for free include a vast array of printable material that is available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and many more. One of the advantages of Dependant Spouse Tax Credit lies in their versatility and accessibility.

More of Dependant Spouse Tax Credit

Benefits And Demarits Of Coming On Dependant Spouse Visa In UK Jobs

Benefits And Demarits Of Coming On Dependant Spouse Visa In UK Jobs

If there is no spouse or common law partner an eligible dependant equivalent to spouse tax credit line 30400 may be claimed for a dependant relative calculated in the same way as the spousal amount but using the net income of the dependant relative instead of the net income of the spouse

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: You can tailor printables to your specific needs in designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them a valuable device for teachers and parents.

-

The convenience of You have instant access many designs and templates is time-saving and saves effort.

Where to Find more Dependant Spouse Tax Credit

What Is A Dependant Spouse Visa

What Is A Dependant Spouse Visa

The Canada caregiver credit CCC is a non refundable tax credit that you can claim if you support a spouse common law partner or dependant with a physical or mental impairment The CCC combines and replaces three previous credits The caregiver credit The infirm dependant credit The family caregiver benefit

Page Last Reviewed or Updated 30 Jan 2024 Tax Tip 2023 22 February 21 2023 Taxpayers with dependents who don t qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents They can claim this credit in addition to the Child and Dependent Care Credit and the Earned Income Credit

After we've peaked your interest in printables for free We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Dependant Spouse Tax Credit for all applications.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast variety of topics, everything from DIY projects to party planning.

Maximizing Dependant Spouse Tax Credit

Here are some inventive ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Dependant Spouse Tax Credit are a treasure trove with useful and creative ideas which cater to a wide range of needs and hobbies. Their availability and versatility make them an essential part of each day life. Explore the vast array of Dependant Spouse Tax Credit to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I download free printables to make commercial products?

- It's determined by the specific conditions of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Dependant Spouse Tax Credit?

- Some printables may have restrictions in use. Be sure to check the terms of service and conditions provided by the author.

-

How do I print Dependant Spouse Tax Credit?

- Print them at home using either a printer at home or in the local print shops for higher quality prints.

-

What program do I require to view printables for free?

- The majority of PDF documents are provided in PDF format, which can be opened using free programs like Adobe Reader.

Can A Spouse Sign A Tax Return For The Other Spouse Mind The Tax

What Is An Injured Spouse Injured Spouse Tax Eligibility HowStuffWorks

Check more sample of Dependant Spouse Tax Credit below

Tax Both Dependant Parent Head Of Household

Who Qualifies As A Dependant Health Plus

Eligible Dependant Tax Credit Tax Online

78 Child Tax Credit Form Page 3 Free To Edit Download Print CocoDoc

Taxability Of Insurance BlueZone Financial

Spouse Tax Adjustment Worksheet

https://turbotax.intuit.ca/tips/claiming-the...

Formerly referred to as the Equivalent to Spouse amount the Amount for an Eligible Dependant Credit is a Non Refundable Tax Credit designed for single adults who are not claiming the spouse common law partner credit and who are responsible for the financial care of a relative

https://www.taxtips.ca/filing/eligible-dependant...

An individual may claim under certain circumstances the amount for an eligible dependant equivalent to spouse tax credit for a dependent child or other dependent relatives on line 30400 of the tax return The amount of this federal non refundable tax credit is 15 000 for 2023 see revision below 15 705 for 2024 the same as the

Formerly referred to as the Equivalent to Spouse amount the Amount for an Eligible Dependant Credit is a Non Refundable Tax Credit designed for single adults who are not claiming the spouse common law partner credit and who are responsible for the financial care of a relative

An individual may claim under certain circumstances the amount for an eligible dependant equivalent to spouse tax credit for a dependent child or other dependent relatives on line 30400 of the tax return The amount of this federal non refundable tax credit is 15 000 for 2023 see revision below 15 705 for 2024 the same as the

78 Child Tax Credit Form Page 3 Free To Edit Download Print CocoDoc

Who Qualifies As A Dependant Health Plus

Taxability Of Insurance BlueZone Financial

Spouse Tax Adjustment Worksheet

Solved Sponse Question 22 Bunly Im Is A Self employed Chegg

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

BK Partners Your Chartered Accountant Dependant Tax Offset Changed