In this day and age with screens dominating our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education project ideas, artistic or simply to add some personal flair to your space, Deductions Other Than 80c are now a vital resource. In this article, we'll take a dive in the world of "Deductions Other Than 80c," exploring their purpose, where to find them and how they can improve various aspects of your daily life.

Get Latest Deductions Other Than 80c Below

Deductions Other Than 80c

Deductions Other Than 80c -

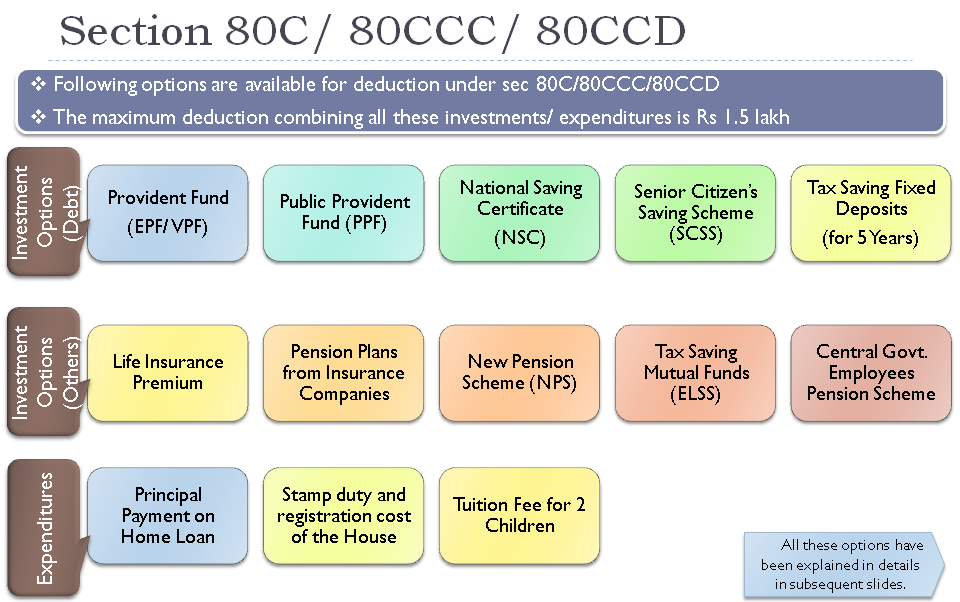

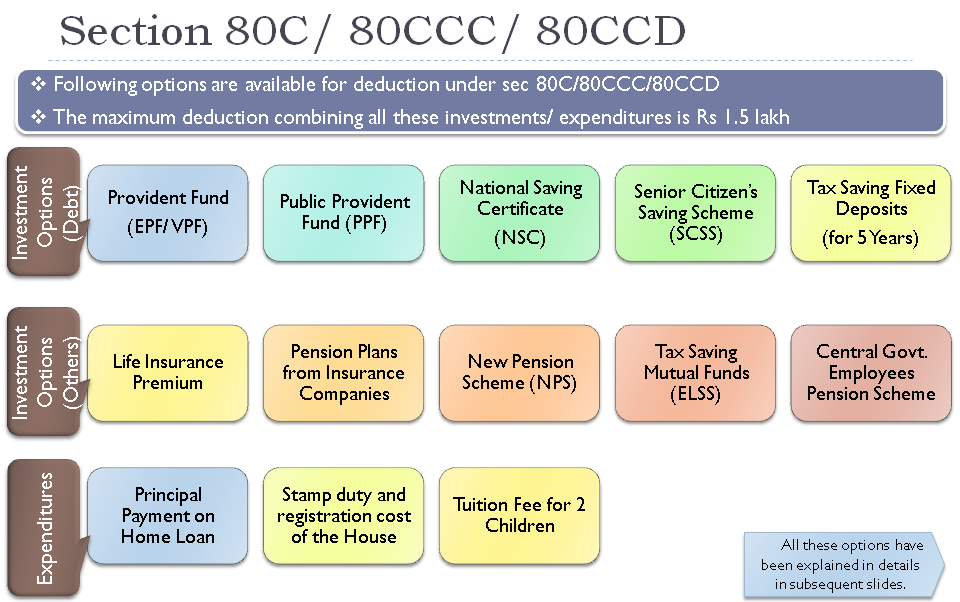

Go beyond Section 80C for more tax deductions Section 80C is the most well known tax deduction that salaried individuals usually use to save income tax The tax deduction limit of Section 80C under the Income tax Act 1961 is

Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions available under Section 80 apart from Section 80C

Deductions Other Than 80c include a broad assortment of printable, downloadable material that is available online at no cost. They come in many designs, including worksheets templates, coloring pages, and much more. The value of Deductions Other Than 80c is in their variety and accessibility.

More of Deductions Other Than 80c

Tax Saving Options Other Than 80C Exhausted Rs 1 5 Lakh Limit Here

Tax Saving Options Other Than 80C Exhausted Rs 1 5 Lakh Limit Here

Apart from 80C various other provisions allow deductions to taxpayer as follows 80D for medical insurance premium for self spouse dependent parents Section 80EE Deduction for interest payment of home loan for first home owners Section 24 Interest deduction for housing loan upto Rs 2 lakh

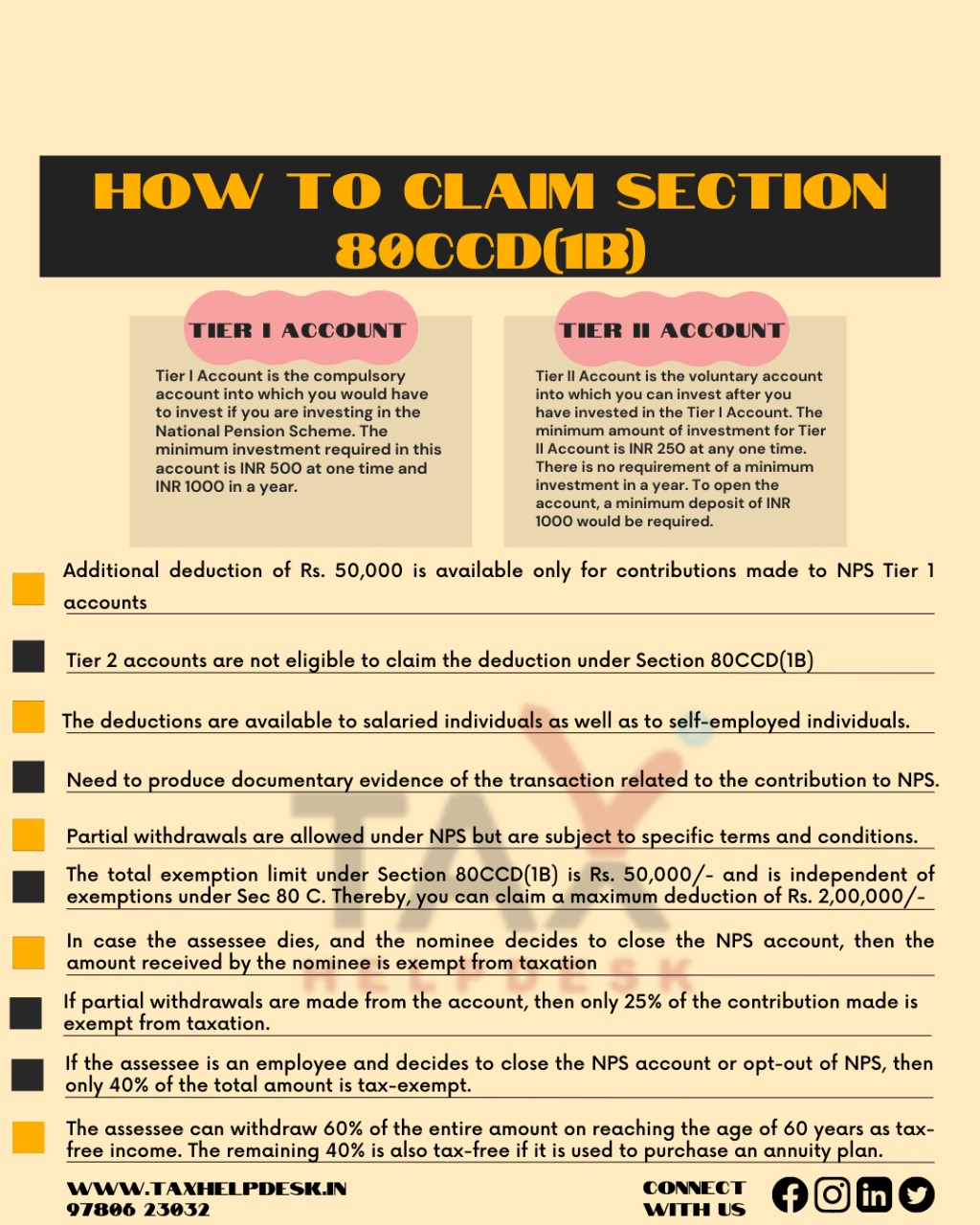

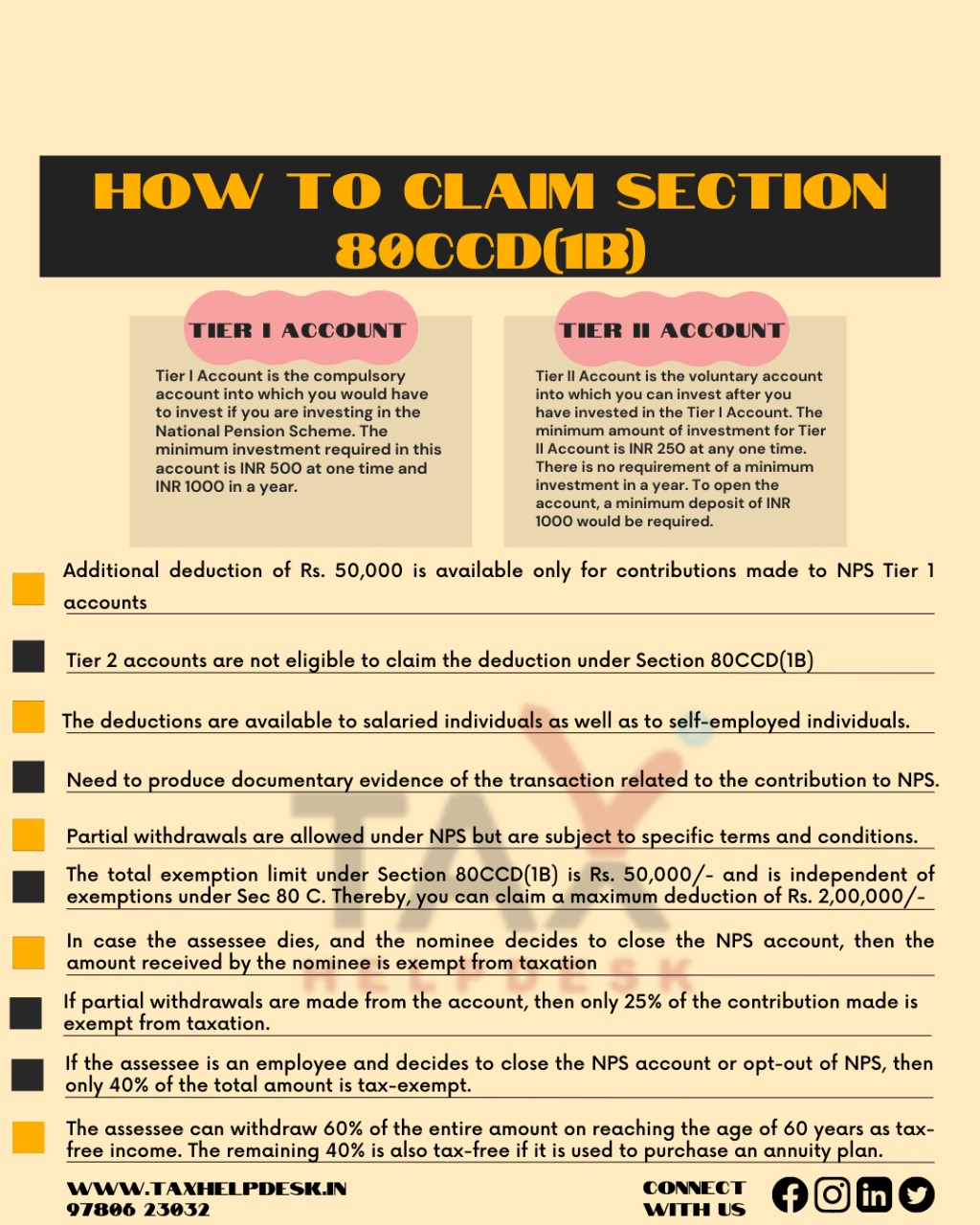

Beyond the contribution of Rs 1 5 lakh under Section 80C you can invest an additional Rs 50 000 in NPS which can be claimed as tax deduction under Section 80CCD This gives you the option of

Deductions Other Than 80c have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Printables for education that are free are designed to appeal to students of all ages, which makes these printables a powerful tool for parents and educators.

-

An easy way to access HTML0: immediate access many designs and templates helps save time and effort.

Where to Find more Deductions Other Than 80c

These 3 Post Office Schemes Give Higher Returns Than Bank FDs With 80C

These 3 Post Office Schemes Give Higher Returns Than Bank FDs With 80C

How to Save Tax Other Than 80c Section 80C of the Income Tax Act allows you to claim a deduction of up to Rs 1 5 lac from your total taxable income This is an excellent way to minimize your tax liability However there s a lot more to tax planning than Section 80C

Income tax saving instruments other than 80C can be listed under the following acts 1 Interest Income Generated from Savings Account Deposits Section 80TTA Limit 10 000 Total interest income generated from savings account deposits can be claimed under Section 80TTA

In the event that we've stirred your interest in Deductions Other Than 80c Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Deductions Other Than 80c for different motives.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs are a vast range of interests, including DIY projects to party planning.

Maximizing Deductions Other Than 80c

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Deductions Other Than 80c are an abundance of practical and innovative resources designed to meet a range of needs and hobbies. Their availability and versatility make them an essential part of both professional and personal life. Explore the wide world of Deductions Other Than 80c to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deductions Other Than 80c truly available for download?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free printables in commercial projects?

- It's dependent on the particular rules of usage. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Deductions Other Than 80c?

- Some printables may contain restrictions concerning their use. Always read these terms and conditions as set out by the creator.

-

How do I print Deductions Other Than 80c?

- You can print them at home with either a printer or go to the local print shop for the highest quality prints.

-

What software is required to open printables free of charge?

- A majority of printed materials are in the format PDF. This can be opened using free software, such as Adobe Reader.

Breaking News 10 New Deductions Under Income Tax Allowed Old Tax

What Are The Tax Saving Investments Other Than Section 80C For Senior

Check more sample of Deductions Other Than 80c below

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

Lambert Lab Research

How To Claim Section 80CCD 1B TaxHelpdesk

Old Vs New Tax Regime Make Sure Which One To Opt For With These 4 Tips

Income Tax Saving 2019 Three Lesser known Tax Saver Options Other

https://life.futuregenerali.in/life-insurance-made...

Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions available under Section 80 apart from Section 80C

https://cleartax.in/s/how-to-save-tax-other-than-80c

Options other than 80C for tax savings include Section 80D for health insurance 80E for educational loans 80G for donations and more Taxpayers can benefit from various deductions available in the Income Tax Act to reduce their tax burdens and improve financial planning

Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions available under Section 80 apart from Section 80C

Options other than 80C for tax savings include Section 80D for health insurance 80E for educational loans 80G for donations and more Taxpayers can benefit from various deductions available in the Income Tax Act to reduce their tax burdens and improve financial planning

How To Claim Section 80CCD 1B TaxHelpdesk

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

Old Vs New Tax Regime Make Sure Which One To Opt For With These 4 Tips

Income Tax Saving 2019 Three Lesser known Tax Saver Options Other

Exhausted Section 80C Limit Here Are 10 Other Tax Saving Investment

Budget 2014 Impact On Money Taxes And Savings

Budget 2014 Impact On Money Taxes And Savings

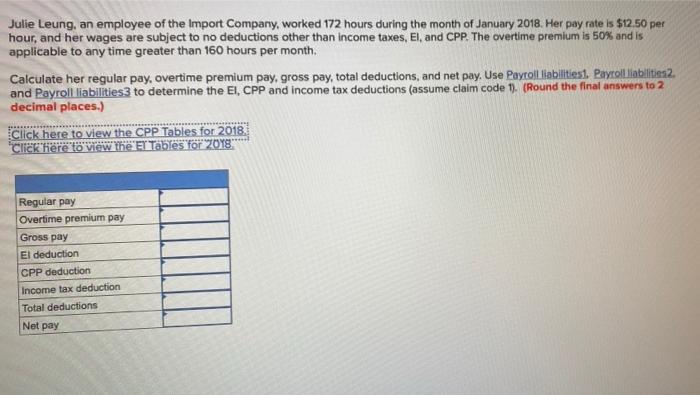

Solved Julie Leung An Employee Of The Import Company Chegg