In this age of technology, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or just adding an extra personal touch to your space, Deduction Under Section 10 Of Income Tax Act have become an invaluable source. We'll take a dive deeper into "Deduction Under Section 10 Of Income Tax Act," exploring the different types of printables, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Deduction Under Section 10 Of Income Tax Act Below

Deduction Under Section 10 Of Income Tax Act

Deduction Under Section 10 Of Income Tax Act -

Section 10 of the Income Tax Act provides tax exemptions to salaried professionals by focusing on income sources that are not part of total income Features of Section 10 of Income Tax Act The following are the significant features of

B Deduction of Tax 35 Deduction of tax from certain income 36 Deduction of tax from annuities etc paid under a will etc 37 Deductions of tax from emoluments 37A Penalty for failure to make deductions under section 35 36 or 37 38 Application to Government C Set off of Tax 39 Set off of tax 39A Repealed D Double Taxation

Deduction Under Section 10 Of Income Tax Act encompass a wide variety of printable, downloadable materials that are accessible online for free cost. These resources come in many forms, including worksheets, coloring pages, templates and many more. The attraction of printables that are free is in their variety and accessibility.

More of Deduction Under Section 10 Of Income Tax Act

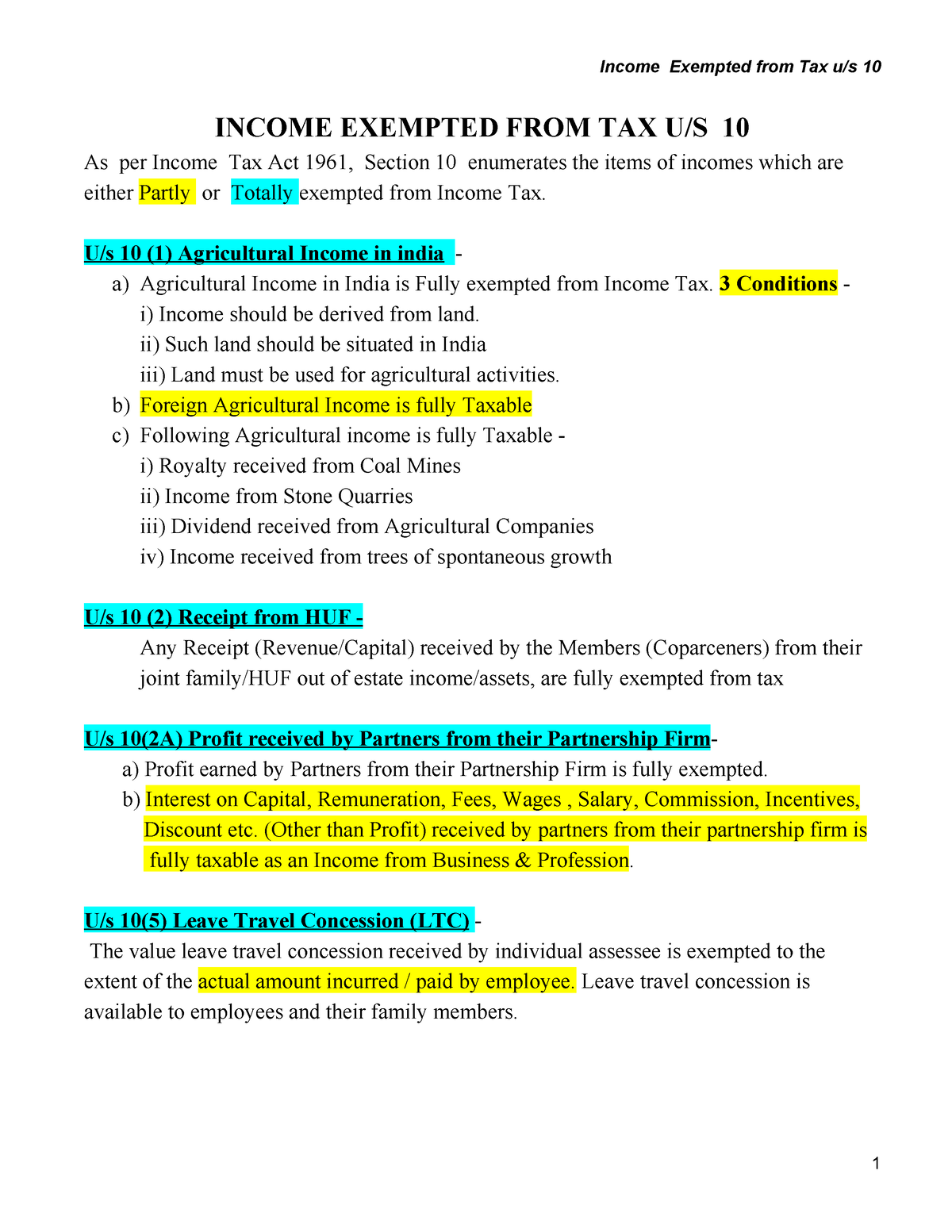

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Section 10 of Income Tax Act 1961 includes such income that does not form part of the total income while calculating the total tax liability of any person These incomes are also known as exempted income In this article we have covered each exempted income in detail along with the special provisions of exemption for salaried

May 22 2022 7778 0 This article is written by Satyaki Deb a final year B A LL B Hons student from the Department of Law Calcutta University This article provides an exhaustive overview of the exemptions available under Section 10 of the Income Tax Act 1961 with relevant case laws and illustrations from an analytical viewpoint

The Deduction Under Section 10 Of Income Tax Act have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: They can make the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value The free educational worksheets can be used by students from all ages, making the perfect device for teachers and parents.

-

Affordability: immediate access various designs and templates is time-saving and saves effort.

Where to Find more Deduction Under Section 10 Of Income Tax Act

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

7 min read Gratuity is a benefit given by the employer to employees A recently approved amendment by the Centre has increased the maximum limit of gratuity Now it is tax exempt up to Rs 20 lakh from the previous ceiling of Rs 10 lakh which comes under Section 10 10 of the Income Tax Act

In the new tax regime you can claim deductions of up to 1 5 Lakh upon maturity of an insurance policy excluding ULIP where the total premium paid is up to or less than 5 Lakh Learn everything about Section 10 of Income Tax Act Get insights on tax rules and deductions exemptions and more

If we've already piqued your curiosity about Deduction Under Section 10 Of Income Tax Act Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Deduction Under Section 10 Of Income Tax Act for all motives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Deduction Under Section 10 Of Income Tax Act

Here are some fresh ways to make the most use of Deduction Under Section 10 Of Income Tax Act:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Deduction Under Section 10 Of Income Tax Act are a treasure trove filled with creative and practical information that cater to various needs and preferences. Their availability and versatility make these printables a useful addition to your professional and personal life. Explore the endless world of Deduction Under Section 10 Of Income Tax Act today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deduction Under Section 10 Of Income Tax Act truly cost-free?

- Yes they are! You can download and print these documents for free.

-

Do I have the right to use free templates for commercial use?

- It's based on specific terms of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may come with restrictions on usage. Always read the terms and condition of use as provided by the designer.

-

How do I print Deduction Under Section 10 Of Income Tax Act?

- Print them at home using a printer or visit the local print shops for better quality prints.

-

What software will I need to access Deduction Under Section 10 Of Income Tax Act?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software like Adobe Reader.

Section 80G Of IT Act Tax Deduction On Donations To Charity

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Check more sample of Deduction Under Section 10 Of Income Tax Act below

Section 10 Of Income Tax Act Exempt Income Of Non Residents

Income Exempted Taxact Accounting Education Tax Money

Section 10 Of Income Tax Act Exempted Income Under Section 10

Special Allowance Under Section 10 For Salaried Employees

Section 10 10D Of Income Tax Act Exemptions Payouts

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

https://kra.go.ke/images/publications/IncomeTaxAct2of1975.pdf

B Deduction of Tax 35 Deduction of tax from certain income 36 Deduction of tax from annuities etc paid under a will etc 37 Deductions of tax from emoluments 37A Penalty for failure to make deductions under section 35 36 or 37 38 Application to Government C Set off of Tax 39 Set off of tax 39A Repealed D Double Taxation

https://tax2win.in/guide/section-10-of-income-tax-act

Contents What is Section 10 of the Income Tax Act What are the available Exemptions under Section 10 Frequently Asked Questions What is Section 10 of the Income Tax Act Section 10 under the IT Act is a provision that lists various types of incomes that are exempt from income tax in India

B Deduction of Tax 35 Deduction of tax from certain income 36 Deduction of tax from annuities etc paid under a will etc 37 Deductions of tax from emoluments 37A Penalty for failure to make deductions under section 35 36 or 37 38 Application to Government C Set off of Tax 39 Set off of tax 39A Repealed D Double Taxation

Contents What is Section 10 of the Income Tax Act What are the available Exemptions under Section 10 Frequently Asked Questions What is Section 10 of the Income Tax Act Section 10 under the IT Act is a provision that lists various types of incomes that are exempt from income tax in India

Special Allowance Under Section 10 For Salaried Employees

Income Exempted Taxact Accounting Education Tax Money

Section 10 10D Of Income Tax Act Exemptions Payouts

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Tax Deduction Under Section 80U Of Income Tax Act Disability YouTube

What Is Section 10AA Of Income Tax Act Ebizfiling

What Is Section 10AA Of Income Tax Act Ebizfiling

Deduction Under Section 80TTB FinancePost