Today, with screens dominating our lives and the appeal of physical printed materials isn't diminishing. Be it for educational use project ideas, artistic or just adding a personal touch to your space, Deduction On Car Loan have proven to be a valuable source. We'll take a dive into the sphere of "Deduction On Car Loan," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Deduction On Car Loan Below

Deduction On Car Loan

Deduction On Car Loan -

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct

If 60 of your driving time is used for pie delivery and 40 is for personal tasks you can deduct 60 of your auto loan interest The costs you can deduct with

Deduction On Car Loan include a broad variety of printable, downloadable materials online, at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and more. The value of Deduction On Car Loan is their flexibility and accessibility.

More of Deduction On Car Loan

Section 80EE Of Income Tax Act Deduction On Home Loan

Section 80EE Of Income Tax Act Deduction On Home Loan

If the taxable profit of your business in the current year is Rs 50 lakh Rs 2 4 lakh 12 of Rs 20 lakh can be deducted from this amount So your total taxable

Topic no 505 Interest expense Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To

Deduction On Car Loan have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: We can customize designs to suit your personal needs when it comes to designing invitations and schedules, or even decorating your house.

-

Educational Use: Free educational printables are designed to appeal to students of all ages. This makes these printables a powerful device for teachers and parents.

-

It's easy: Quick access to many designs and templates will save you time and effort.

Where to Find more Deduction On Car Loan

Interest On Car Loan Calculator CALCULATORUK DFE

Interest On Car Loan Calculator CALCULATORUK DFE

Updated December 08 2023 Reviewed by Thomas Brock Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal expenses the

Car loan interest is deductible in certain situations where you use your vehicle for business purposes When you can deduct car loan interest from your taxes

If we've already piqued your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Deduction On Car Loan for different goals.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs are a vast range of topics, that includes DIY projects to planning a party.

Maximizing Deduction On Car Loan

Here are some innovative ways how you could make the most use of Deduction On Car Loan:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Deduction On Car Loan are an abundance of practical and imaginative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the vast collection of Deduction On Car Loan now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deduction On Car Loan truly completely free?

- Yes they are! You can download and print these materials for free.

-

Can I use free printing templates for commercial purposes?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions regarding usage. You should read the terms of service and conditions provided by the designer.

-

How can I print Deduction On Car Loan?

- You can print them at home using the printer, or go to any local print store for more high-quality prints.

-

What software do I require to view printables for free?

- A majority of printed materials are in the PDF format, and can be opened with free software such as Adobe Reader.

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

4 Quick Tips To Get A Lower Interest Rate On Car Loan

Check more sample of Deduction On Car Loan below

Deduction On Electrical Vehicle For Interest Paid On Loan

Deduction Helps Reaching Goals Pictured As A Race Car With A Phrase

How To Make Your Car A Tax Deduction YouTube

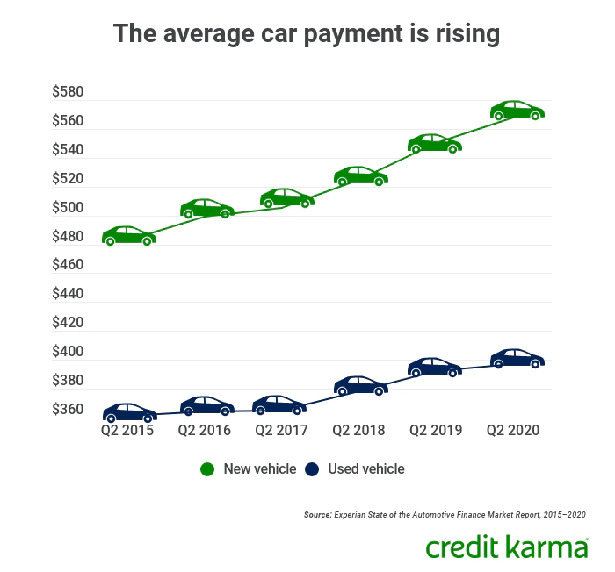

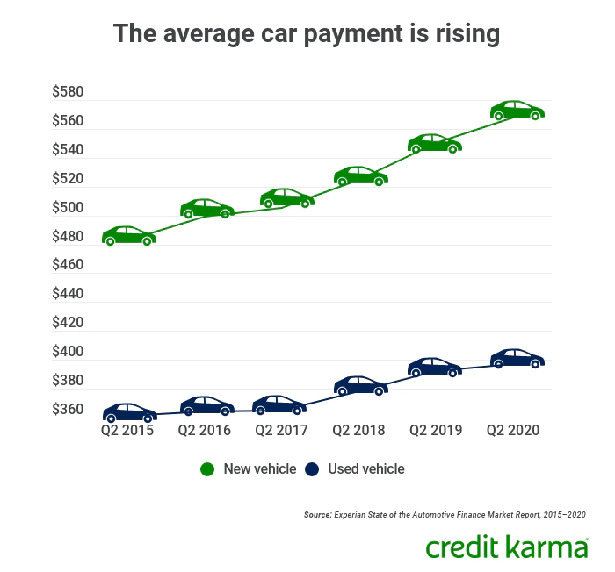

Calculating Payments On A Car Loan 100 Quality Save 70 Jlcatj gob mx

Salary Deduction Letter To Employee For Loan Download FREE

Instead They Can Claim Both The Student Loan Interest Deduction And

https://www.keepertax.com/posts/can-i-write-off-my-car-payment

If 60 of your driving time is used for pie delivery and 40 is for personal tasks you can deduct 60 of your auto loan interest The costs you can deduct with

https://www.charteredclub.com/tax-deduction-car-loan

This depreciation is allowed to be claimed irrespective of whether the car is purchased through loan or without a loan The depreciation on Car is allowed to be claimed

If 60 of your driving time is used for pie delivery and 40 is for personal tasks you can deduct 60 of your auto loan interest The costs you can deduct with

This depreciation is allowed to be claimed irrespective of whether the car is purchased through loan or without a loan The depreciation on Car is allowed to be claimed

Calculating Payments On A Car Loan 100 Quality Save 70 Jlcatj gob mx

Deduction Helps Reaching Goals Pictured As A Race Car With A Phrase

Salary Deduction Letter To Employee For Loan Download FREE

Instead They Can Claim Both The Student Loan Interest Deduction And

All About Section 80EEA For Deduction On Home Loan Interest

How Do I Take Over Payments On Car Loan Contract 2022

How Do I Take Over Payments On Car Loan Contract 2022

Calculate Apr On Car Loan Offers Discount Save 68 Jlcatj gob mx