In this age of electronic devices, in which screens are the norm however, the attraction of tangible, printed materials hasn't diminished. Whatever the reason, whether for education project ideas, artistic or simply to add an element of personalization to your area, Deduction Of Hra In Income Tax are now a vital resource. Here, we'll dive into the world "Deduction Of Hra In Income Tax," exploring their purpose, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Deduction Of Hra In Income Tax Below

Deduction Of Hra In Income Tax

Deduction Of Hra In Income Tax -

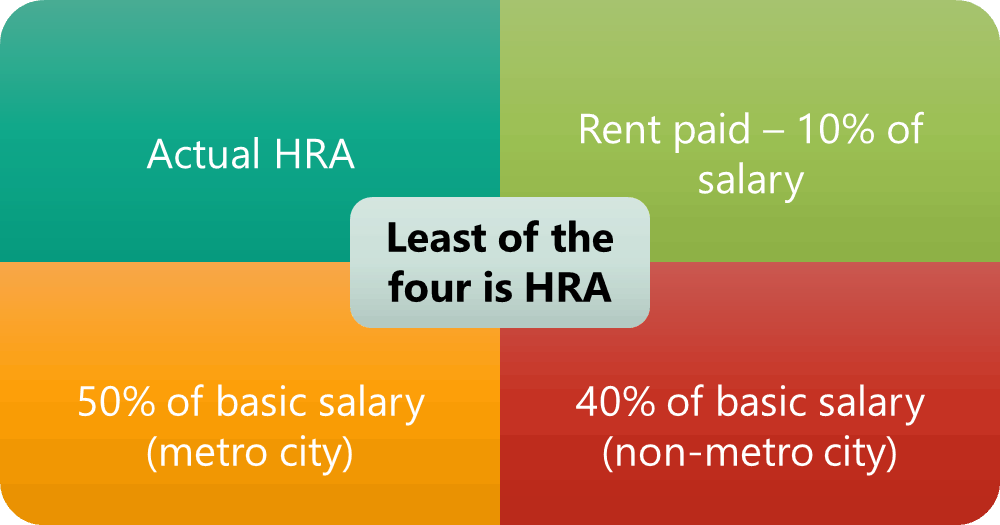

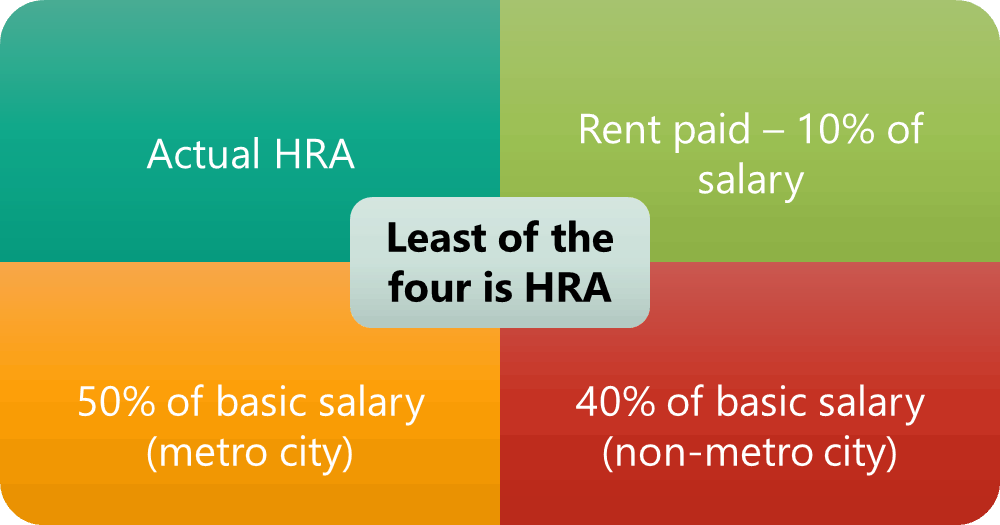

A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance

Printables for free include a vast assortment of printable, downloadable resources available online for download at no cost. They come in many styles, from worksheets to templates, coloring pages, and much more. The benefit of Deduction Of Hra In Income Tax is in their versatility and accessibility.

More of Deduction Of Hra In Income Tax

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10

If one wishes to claim HRA in salary or taxes then one should keep the following documents ready The HRA in salary requires documents like rental agreements and rental receipts Based on these documents the employer will

Deduction Of Hra In Income Tax have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: They can make printed materials to meet your requirements such as designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: Printables for education that are free provide for students from all ages, making them an essential tool for parents and teachers.

-

Easy to use: You have instant access a myriad of designs as well as templates will save you time and effort.

Where to Find more Deduction Of Hra In Income Tax

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income Employment tax is deducted from your salary by your employer and then it is deposited to the state

House Rent Allowance is an employer granted allowance for employee housing rent HRA is usually included in employee CTC Only rent paid amount can be claimed for a

Now that we've piqued your interest in printables for free Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Deduction Of Hra In Income Tax for a variety goals.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Deduction Of Hra In Income Tax

Here are some inventive ways to make the most of Deduction Of Hra In Income Tax:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Deduction Of Hra In Income Tax are an abundance of practical and imaginative resources that meet a variety of needs and preferences. Their accessibility and versatility make them a fantastic addition to both professional and personal lives. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deduction Of Hra In Income Tax really gratis?

- Yes, they are! You can print and download these items for free.

-

Does it allow me to use free printables to make commercial products?

- It's based on the rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright concerns with Deduction Of Hra In Income Tax?

- Some printables may come with restrictions in use. Be sure to read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit an area print shop for more high-quality prints.

-

What program will I need to access printables for free?

- Most printables come in the format of PDF, which can be opened using free software, such as Adobe Reader.

House Rent Allowance HRA Deductions Claim HRA In Income Tax

HRA Calculation Income Tax HRA Deduction In Income Tax How To

Check more sample of Deduction Of Hra In Income Tax below

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Calculator In Excel House Rent Allowance Calculation

How To Show HRA Not Accounted By The Employer In ITR

House Rent Allowance HRA Lenvica HRMS

HRA Calculation Formula On Salary Change How HRA Exemption Is

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://cleartax.in/paytax/hracalculator

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance

https://www.forbesindia.com/article/expl…

According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated by taking the

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance

According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated by taking the

House Rent Allowance HRA Lenvica HRMS

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA Calculation Formula On Salary Change How HRA Exemption Is

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

How To Get Full Rebate On HRA In Income Tax

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

Fresher s How To Calculate Income Tax On Salary How To Calculate HRA