In the digital age, where screens dominate our lives The appeal of tangible printed materials hasn't faded away. Be it for educational use as well as creative projects or simply to add a personal touch to your space, Deduction For Hra And Repayment Of Housing Loan have become a valuable resource. Through this post, we'll dive to the depths of "Deduction For Hra And Repayment Of Housing Loan," exploring what they are, how to find them, and how they can be used to enhance different aspects of your life.

Get Latest Deduction For Hra And Repayment Of Housing Loan Below

Deduction For Hra And Repayment Of Housing Loan

Deduction For Hra And Repayment Of Housing Loan -

Income Tax Act allows a deduction for HRA as well as interest paid on the home loan However both deductions can be claimed in the same financial year in certain situations

House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan

Deduction For Hra And Repayment Of Housing Loan offer a wide variety of printable, downloadable materials that are accessible online for free cost. They come in many kinds, including worksheets templates, coloring pages, and many more. The great thing about Deduction For Hra And Repayment Of Housing Loan lies in their versatility as well as accessibility.

More of Deduction For Hra And Repayment Of Housing Loan

Seven Home Loan Repayment Options Borrowers Should Know About

Seven Home Loan Repayment Options Borrowers Should Know About

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh

You should remember that interest and principal repayment deduction is for the home you own whereas the HRA deduction is for the rental expenses you pay You should possess the relevant documents supporting

Deduction For Hra And Repayment Of Housing Loan have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free provide for students from all ages, making them an invaluable tool for parents and educators.

-

Accessibility: Access to an array of designs and templates, which saves time as well as effort.

Where to Find more Deduction For Hra And Repayment Of Housing Loan

How To Claim Both HRA And Home Loan Tax Benefit Together In 2022 Home

How To Claim Both HRA And Home Loan Tax Benefit Together In 2022 Home

A person who pays a Home Loan and receives a House Rent Allowance HRA as part of their salary can claim tax benefits on both Individuals can claim a tax deduction on

A short answer to this is NO One may claim both HRA exemption and interest deduction on a home loan subject to the condition that certain requirements as per the Income Tax Act 1961 are met In this article we aim

After we've peaked your curiosity about Deduction For Hra And Repayment Of Housing Loan Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Deduction For Hra And Repayment Of Housing Loan for a variety reasons.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Deduction For Hra And Repayment Of Housing Loan

Here are some ideas of making the most of Deduction For Hra And Repayment Of Housing Loan:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Deduction For Hra And Repayment Of Housing Loan are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and hobbies. Their availability and versatility make them an essential part of each day life. Explore the endless world of Deduction For Hra And Repayment Of Housing Loan to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deduction For Hra And Repayment Of Housing Loan really available for download?

- Yes you can! You can print and download these tools for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions regarding usage. Always read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an area print shop for premium prints.

-

What program do I need to run printables that are free?

- Most PDF-based printables are available with PDF formats, which can be opened with free software, such as Adobe Reader.

Kisan Own Two Houses Here s How To Claim Tax Deduction On HRA And

TAX Updates4U Claim Tax Benefit On HRA As Well As Tax Deduction On

Check more sample of Deduction For Hra And Repayment Of Housing Loan below

Principal Repayment Needs A Separate IT Section Housing News

Can I Claim Both Home Loan And HRA Tax Benefits

Outbreak Of Pandemic EPF Withdrawal 12 Instances When You Can Apply

Is It Possible To Claim Both Tax Benefit Of HRA And Housing Loan

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Loan Certificate PDF

https://fi.money/guides/personal-loans/how-to...

House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan

https://economictimes.indiatimes.com…

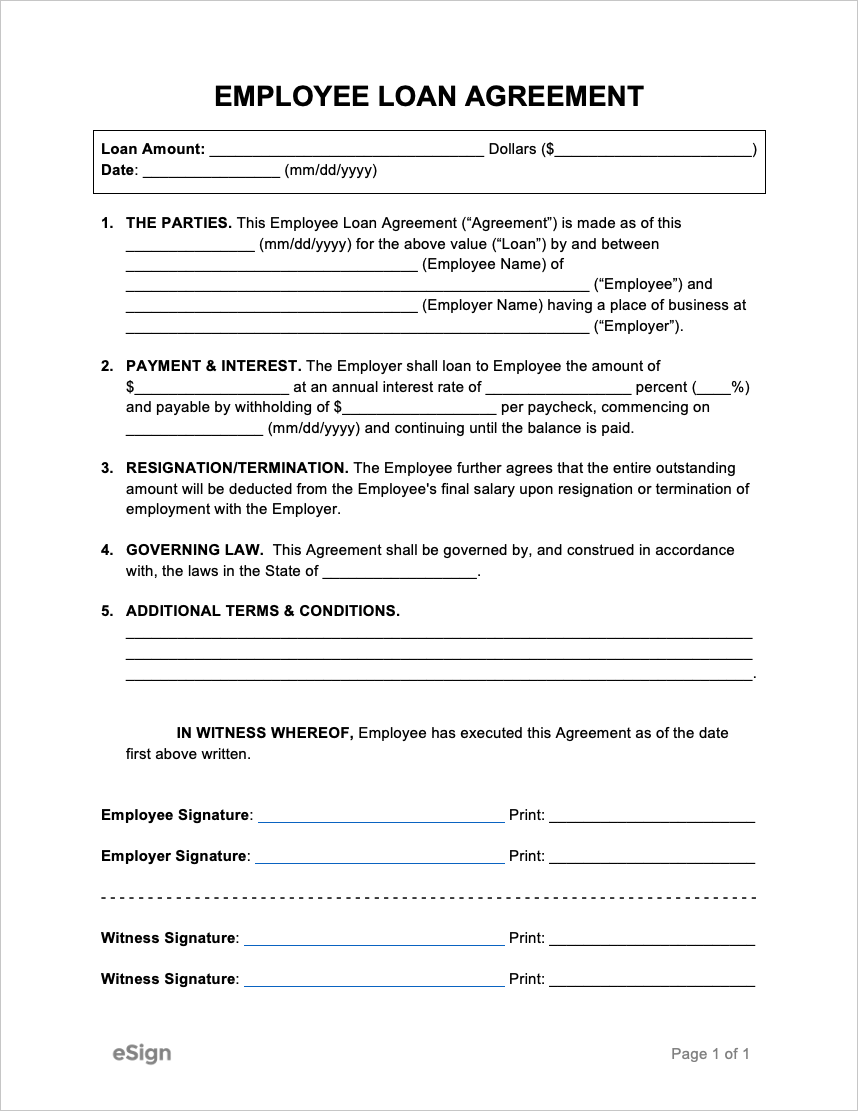

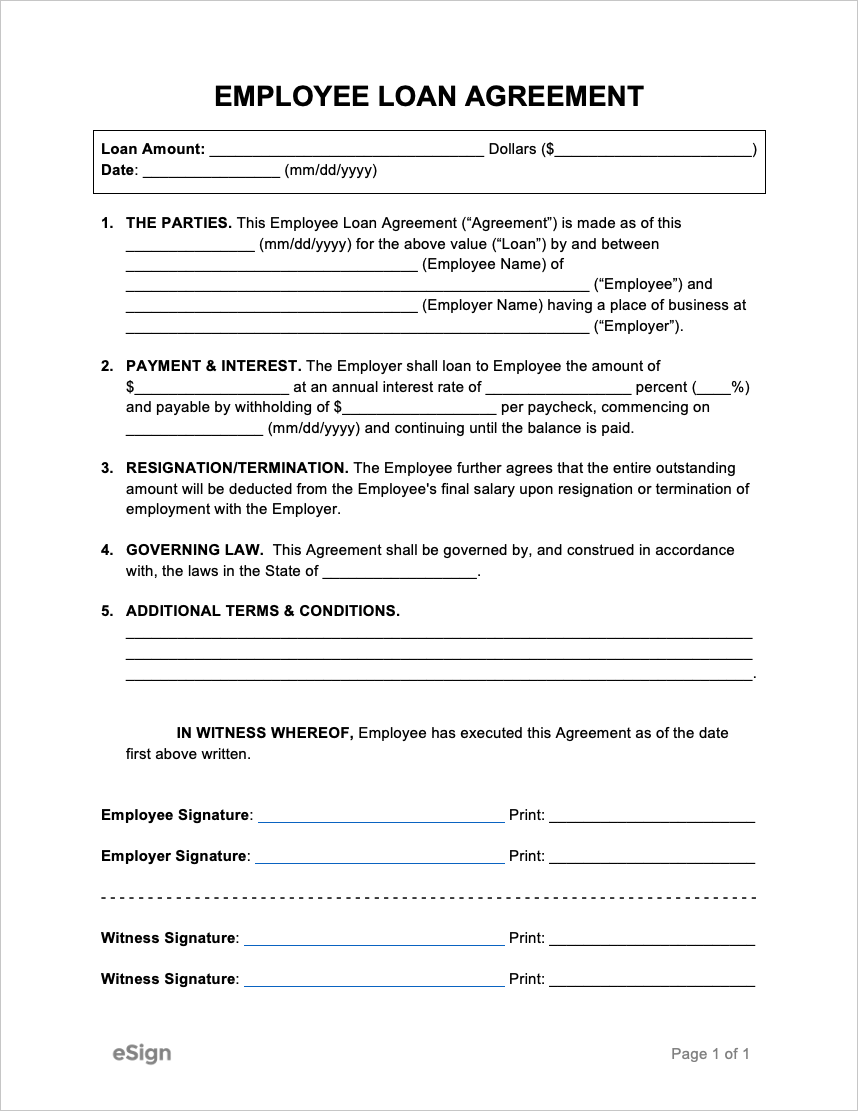

As per Section 23 2 of the Income tax Act read with Section 24 b interest on housing loan may be claimed as deduction for self occupied house property up to Rs 2 lakh per financial year

House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan

As per Section 23 2 of the Income tax Act read with Section 24 b interest on housing loan may be claimed as deduction for self occupied house property up to Rs 2 lakh per financial year

Is It Possible To Claim Both Tax Benefit Of HRA And Housing Loan

Can I Claim Both Home Loan And HRA Tax Benefits

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Loan Certificate PDF

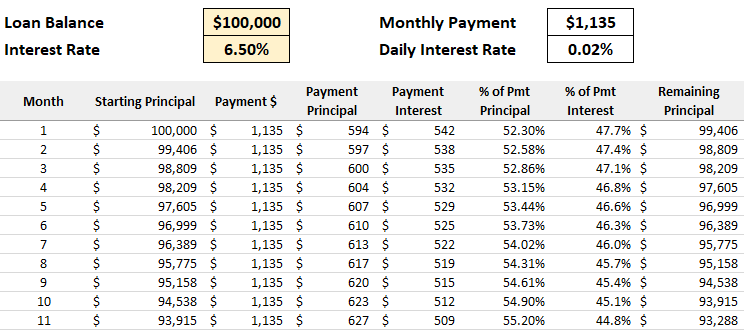

Housing Loan Repayment Calculator Lupon gov ph

Employee Repayment Agreement Template

Employee Repayment Agreement Template

Excel Student Loan Repayment Calculator Lockqlol