In a world where screens dominate our lives however, the attraction of tangible printed objects hasn't waned. In the case of educational materials as well as creative projects or simply to add an individual touch to your home, printables for free are now an essential source. With this guide, you'll dive deep into the realm of "Corporate Tax Relief Malaysia," exploring their purpose, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Corporate Tax Relief Malaysia Below

Corporate Tax Relief Malaysia

Corporate Tax Relief Malaysia -

Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three consecutive YAs for a new SME or LLP which fulfils the requirements specified in Section 6D and or any other conditions which may be imposed by the Minister via a statutory order

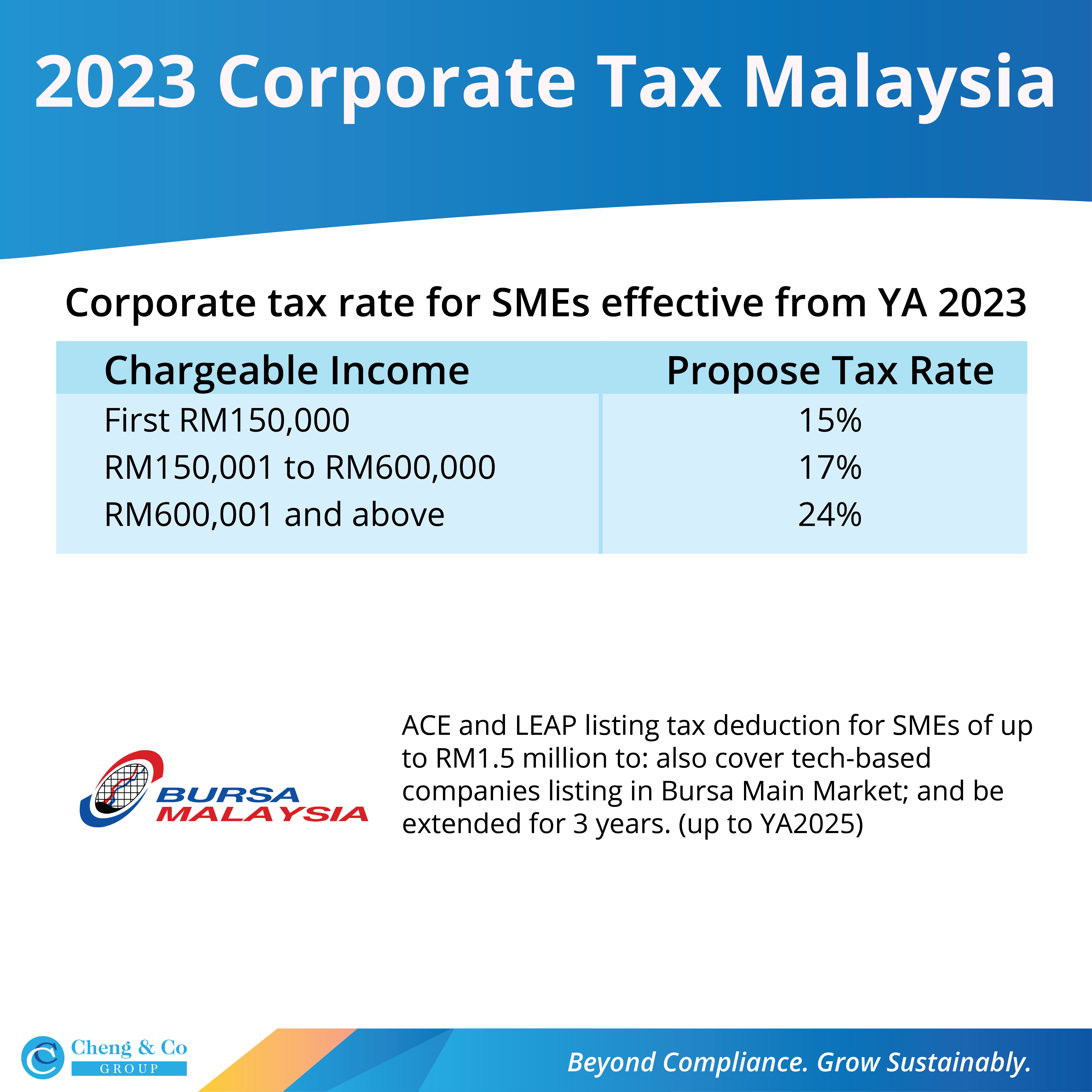

Generally the rate as as follows Companies with paid up capital not exceeding RM2 5 million 17 on the first RM600 000 of chargeable income and 24 on the subsequent balance Companies with paid up capital exceeding RM2 5 million 24 on the entire chargeable income

Printables for free cover a broad collection of printable content that can be downloaded from the internet at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and many more. The beauty of Corporate Tax Relief Malaysia is their versatility and accessibility.

More of Corporate Tax Relief Malaysia

Malaysians Must Know The TRUTH MPs Putrajaya Free To Plagiarise

Malaysians Must Know The TRUTH MPs Putrajaya Free To Plagiarise

The current CIT rates are provided in the following table Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields

For small and medium enterprise SME the first RM150 000 Chargeable Income will be tax at 15 RM150 001 to RM600 000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600 000 will be tax at 24 The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more

Corporate Tax Relief Malaysia have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: They can make printables to your specific needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages. This makes them a valuable resource for educators and parents.

-

Affordability: Fast access a plethora of designs and templates reduces time and effort.

Where to Find more Corporate Tax Relief Malaysia

Simple Resume Format Malaysia Coverletterpedia

Simple Resume Format Malaysia Coverletterpedia

The standard corporate income tax rate in Malaysia is 24 for both resident and non resident companies which gain income within Malaysia However there are exceptions for certain sectors Approved companies may apply and enjoy incentives that are available for their business sector

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope Income that is attributable to a place of business as defined in Malaysia is also deemed derived from Malaysia

If we've already piqued your curiosity about Corporate Tax Relief Malaysia we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Corporate Tax Relief Malaysia for a variety reasons.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a wide range of topics, from DIY projects to planning a party.

Maximizing Corporate Tax Relief Malaysia

Here are some innovative ways how you could make the most of Corporate Tax Relief Malaysia:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Corporate Tax Relief Malaysia are an abundance of useful and creative resources catering to different needs and hobbies. Their accessibility and flexibility make them a valuable addition to any professional or personal life. Explore the world of Corporate Tax Relief Malaysia and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free printouts for commercial usage?

- It's based on the terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Corporate Tax Relief Malaysia?

- Some printables could have limitations regarding usage. Be sure to review the terms and conditions offered by the author.

-

How can I print Corporate Tax Relief Malaysia?

- You can print them at home using printing equipment or visit a local print shop for premium prints.

-

What program do I need to open printables at no cost?

- A majority of printed materials are as PDF files, which can be opened with free software such as Adobe Reader.

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Ap Style Quotes And Punctuation

Check more sample of Corporate Tax Relief Malaysia below

Corporate Tax Relief An Elixir For The Indian Economy Diplomatist

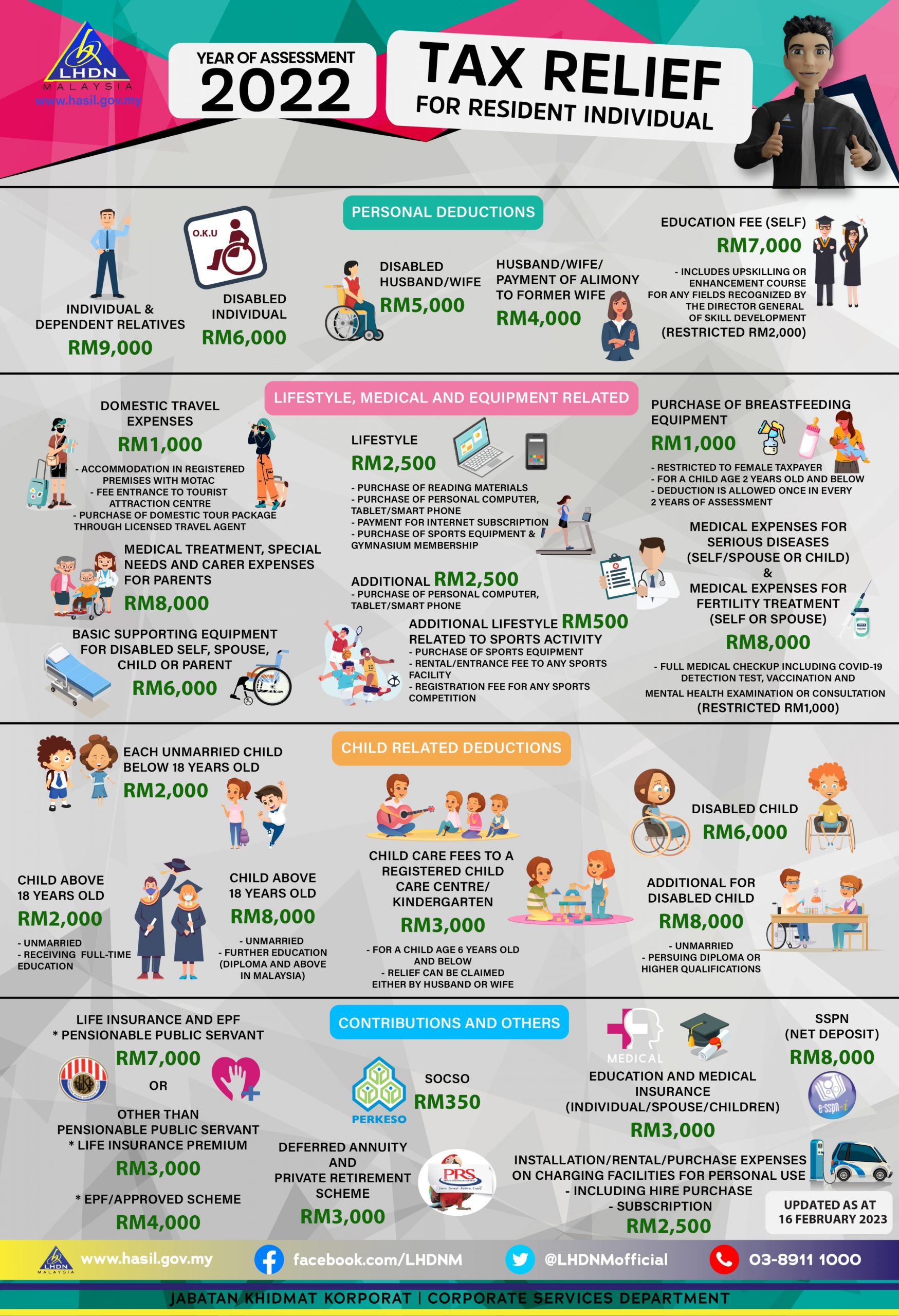

Malaysia Personal Income Tax Relief 2022

Latest Budget 2023 Malaysia Summary Cheng Co Group

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

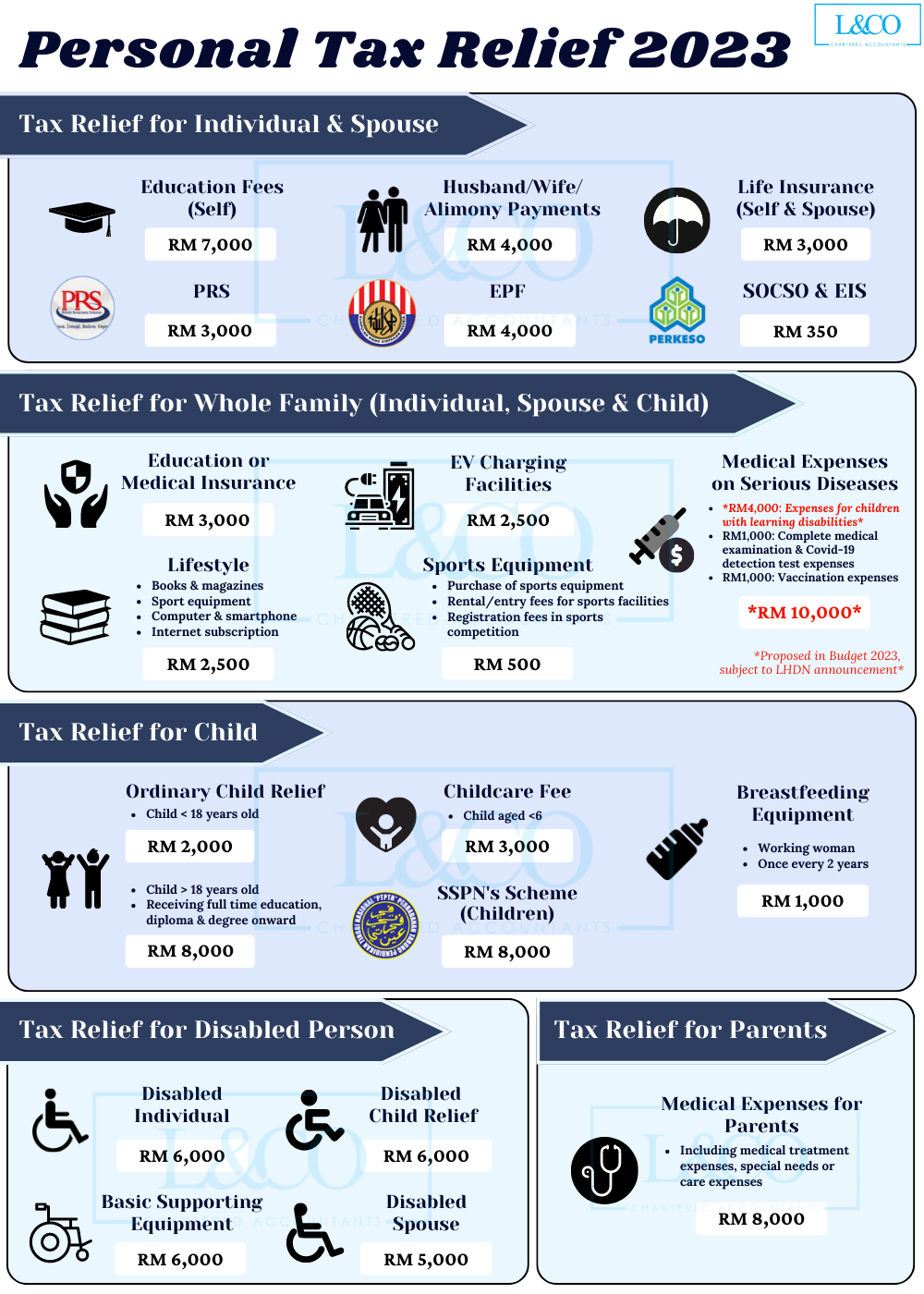

List Of Personal Tax Relief And Incentives In Malaysia 2023

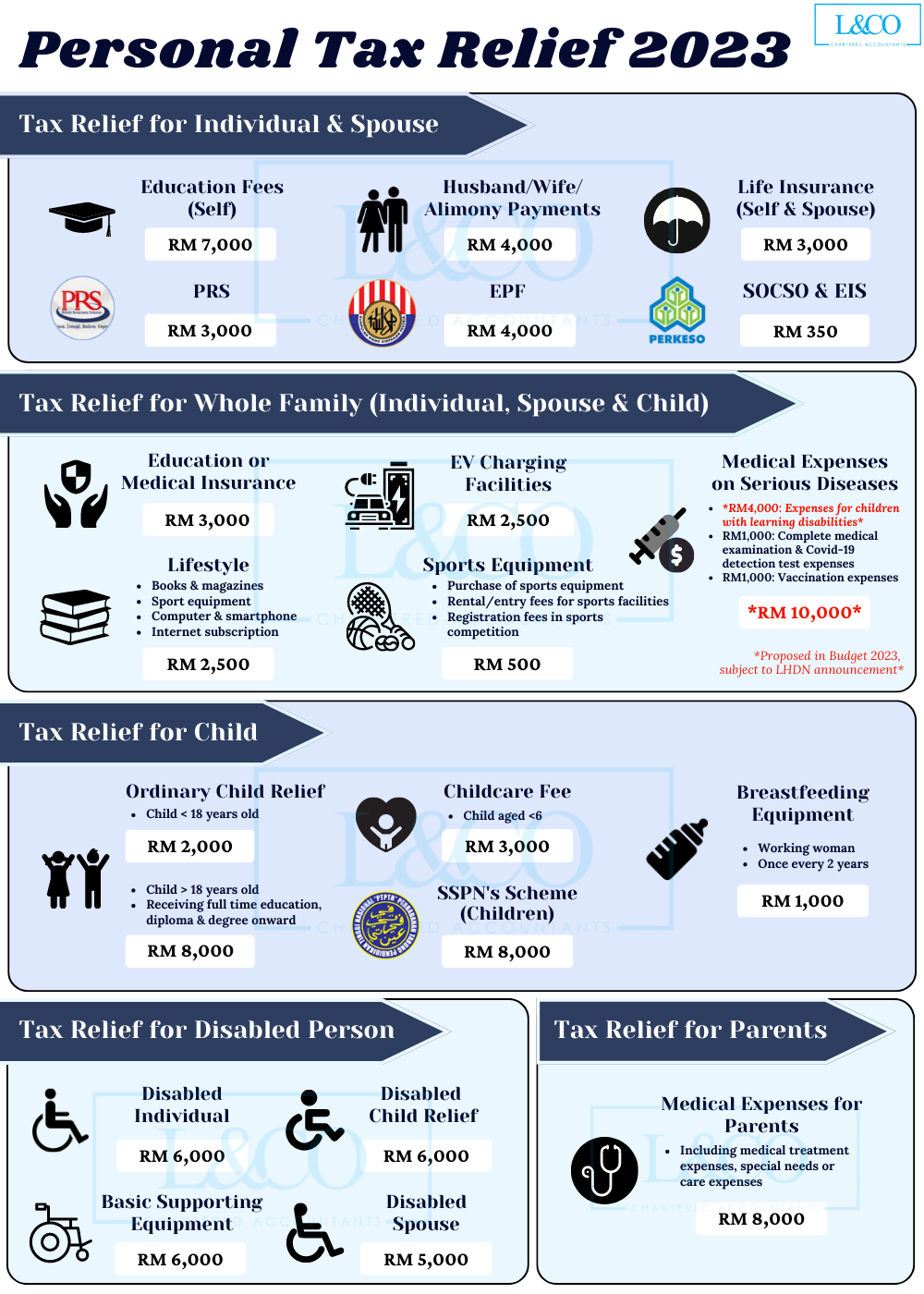

Personal Tax Relief Y A 2023 L Co Accountants

https://wecorporate.com.my/guides/how-to-reduce-company-tax-malaysia

Generally the rate as as follows Companies with paid up capital not exceeding RM2 5 million 17 on the first RM600 000 of chargeable income and 24 on the subsequent balance Companies with paid up capital exceeding RM2 5 million 24 on the entire chargeable income

https://www.pwc.com/my/en/publications/mtb/corporate-income-tax.html

A newly established company with paid up capital of RM2 5 million and less is exempted from this requirement for 2 to 3 YAs beginning from the YA in which the company commences operation subject to certain conditions

Generally the rate as as follows Companies with paid up capital not exceeding RM2 5 million 17 on the first RM600 000 of chargeable income and 24 on the subsequent balance Companies with paid up capital exceeding RM2 5 million 24 on the entire chargeable income

A newly established company with paid up capital of RM2 5 million and less is exempted from this requirement for 2 to 3 YAs beginning from the YA in which the company commences operation subject to certain conditions

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

Malaysia Personal Income Tax Relief 2022

List Of Personal Tax Relief And Incentives In Malaysia 2023

Personal Tax Relief Y A 2023 L Co Accountants

Party Ends For Easy Corporate Tax Relief SWI Swissinfo ch

Labour Sector What s Needed For Malaysians First New Straits

Labour Sector What s Needed For Malaysians First New Straits

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical