In this day and age when screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. For educational purposes as well as creative projects or simply adding an element of personalization to your area, Corporate Tax Deduction Malaysia are now an essential source. We'll take a dive deep into the realm of "Corporate Tax Deduction Malaysia," exploring the benefits of them, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Corporate Tax Deduction Malaysia Below

Corporate Tax Deduction Malaysia

Corporate Tax Deduction Malaysia -

Corporate Taxes on corporate income Last reviewed 06 December 2023 For both resident and non resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia Resident companies are also

The prescribed rules specify that the maximum amount of interest deduction allowed is 20 of the Tax EBITDA Earnings Before Income Tax Depreciation and Amortisation from each of the sources of income consisting of a business

Printables for free include a vast assortment of printable material that is available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and many more. The beauty of Corporate Tax Deduction Malaysia is in their variety and accessibility.

More of Corporate Tax Deduction Malaysia

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Company Tax Relief 2023 Malaysia Printable Forms Free Online

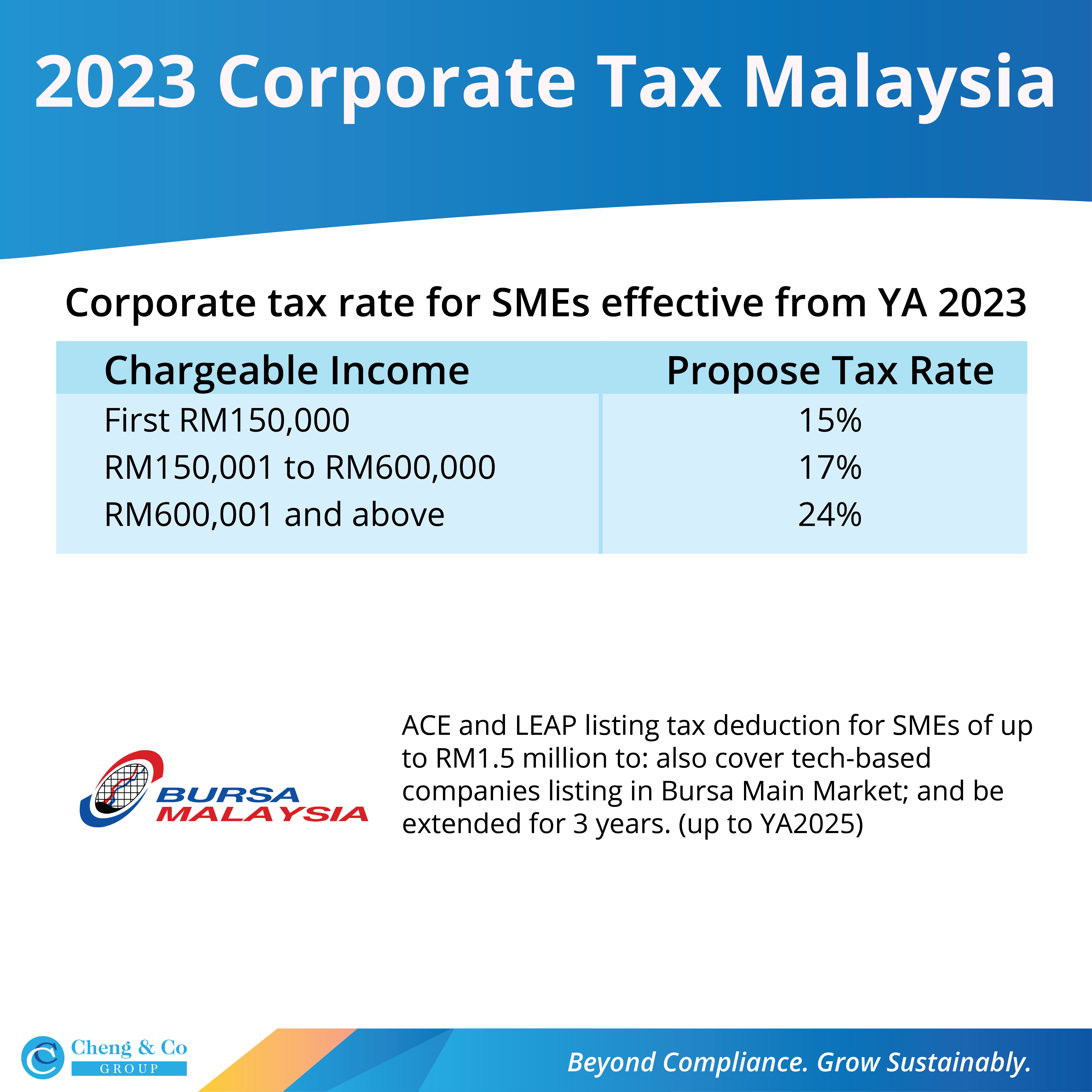

The standard corporate income tax rate in Malaysia is 24 for both resident and non resident companies which gain income within

Corporate tax rates for companies resident in Malaysia is 24 Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid up share capital of MYR 2 5 million and below at the beginning of the basis period for a year of assessment

Corporate Tax Deduction Malaysia have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them an essential tool for parents and teachers.

-

Affordability: You have instant access a plethora of designs and templates will save you time and effort.

Where to Find more Corporate Tax Deduction Malaysia

Donation Tax Deduction Malaysia Employees Are Allowed A Deduction For

Donation Tax Deduction Malaysia Employees Are Allowed A Deduction For

Malaysia Corporate Tax Deductions Within 7 months after the end of a company s assessment year Form C will be filed tax repayable is made in 30 days and advance tax paid in access will be

Corporate income tax in Malaysia is a direct levy by the government applicable to both resident and non resident companies deriving income from the country The corporate income tax rate in Malaysia is contingent upon the specific category of

In the event that we've stirred your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of goals.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad selection of subjects, everything from DIY projects to planning a party.

Maximizing Corporate Tax Deduction Malaysia

Here are some innovative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Corporate Tax Deduction Malaysia are a treasure trove with useful and creative ideas catering to different needs and needs and. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the vast world that is Corporate Tax Deduction Malaysia today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can download and print these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in Corporate Tax Deduction Malaysia?

- Some printables could have limitations regarding their use. Make sure to read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with printing equipment or visit an in-store print shop to get high-quality prints.

-

What software do I need in order to open Corporate Tax Deduction Malaysia?

- A majority of printed materials are in PDF format. They can be opened with free software such as Adobe Reader.

I Believe In You Quotes For Daughter

Monthly Tax Deduction Malaysia Pippa Johnston

Check more sample of Corporate Tax Deduction Malaysia below

Latest Budget 2023 Malaysia Summary Cheng Co Group

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Cukai Makmur Is One off Corporate Tax

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Corporate Tax Reforms New Interest Deduction Rules In Belgium Nexia

What You Should Understand About Monthly Tax Deduction In Malaysia

https://www.pwc.com/my/en/publications/mtb/corporate-income-tax.html

The prescribed rules specify that the maximum amount of interest deduction allowed is 20 of the Tax EBITDA Earnings Before Income Tax Depreciation and Amortisation from each of the sources of income consisting of a business

https://www.hasil.gov.my/en/company/tax-rate-of-company

Tax Rate of Company Year Assessment 2023 Percentage Company with paid up capital not more than RM2 5 million and gross business income of not more than RM50 million On first RM150 000 15 RM150 001 to RM600 000 17 RM600 001 and Subsequent

The prescribed rules specify that the maximum amount of interest deduction allowed is 20 of the Tax EBITDA Earnings Before Income Tax Depreciation and Amortisation from each of the sources of income consisting of a business

Tax Rate of Company Year Assessment 2023 Percentage Company with paid up capital not more than RM2 5 million and gross business income of not more than RM50 million On first RM150 000 15 RM150 001 to RM600 000 17 RM600 001 and Subsequent

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Corporate Tax Reforms New Interest Deduction Rules In Belgium Nexia

What You Should Understand About Monthly Tax Deduction In Malaysia

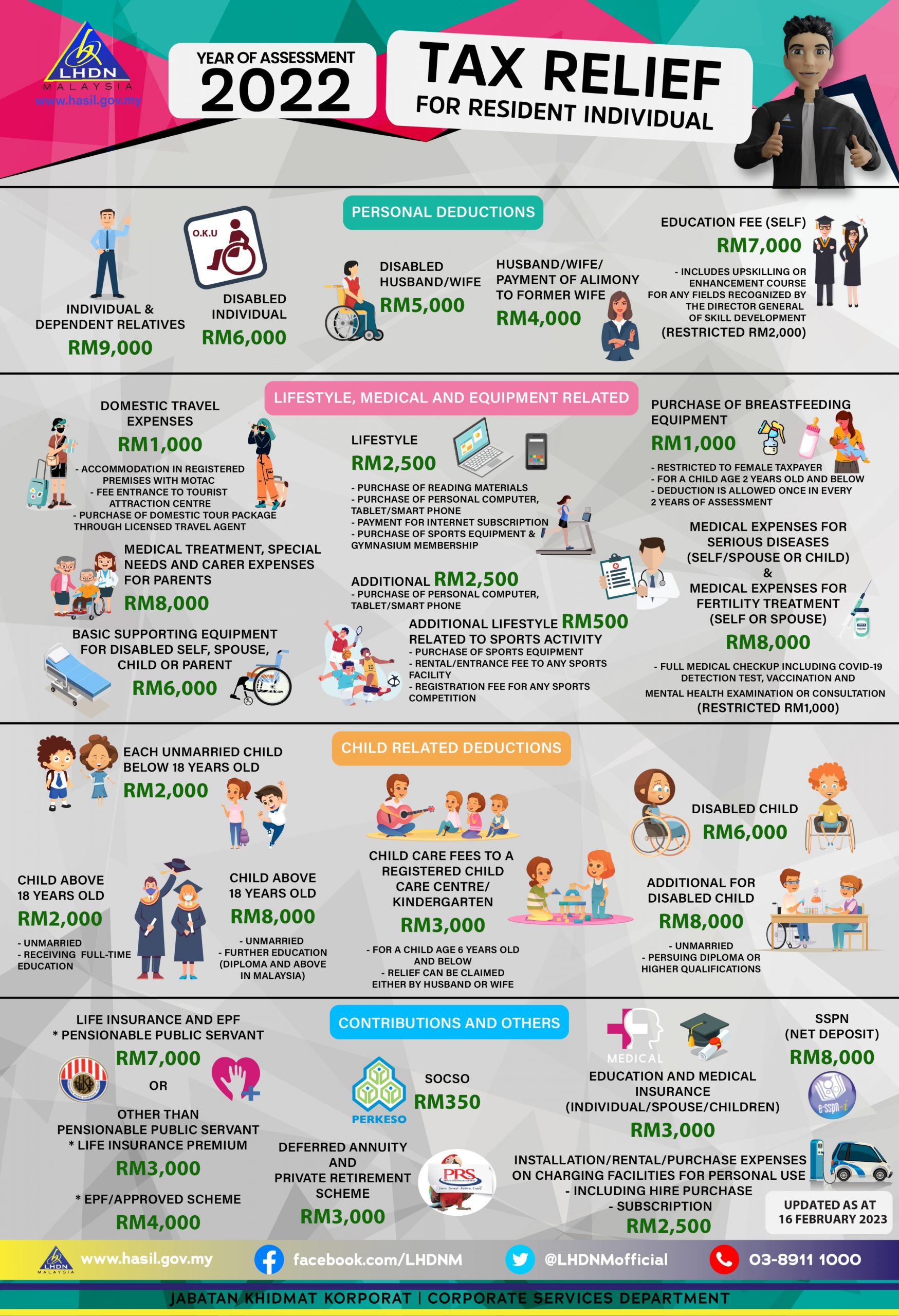

Tax 2022 Malaysia Calculator IMAGESEE

Donation Tax Deduction Malaysia Phillip Weiss

Donation Tax Deduction Malaysia Phillip Weiss

NickolasropMays