In this digital age, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or simply adding personal touches to your area, Child Tuition Fee Tax Exemption Limit have proven to be a valuable source. Through this post, we'll take a dive through the vast world of "Child Tuition Fee Tax Exemption Limit," exploring what they are, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Child Tuition Fee Tax Exemption Limit Below

Child Tuition Fee Tax Exemption Limit

Child Tuition Fee Tax Exemption Limit -

Tuition and Fees Deduction for tax years before 2021 Another option is to claim a deduction of up to 2 000 or up to 4 000

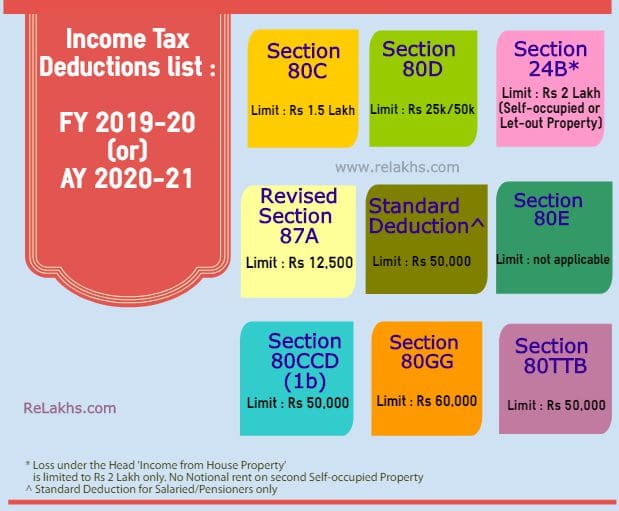

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

Child Tuition Fee Tax Exemption Limit provide a diverse range of printable, free materials that are accessible online for free cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Child Tuition Fee Tax Exemption Limit

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

The official instruction record no VH 3089 00 01 00 2018 is drafted in Finnish and Swedish languages This guidance concerns the taxation of people working

Children Education Allowance Fixed education allowance received from the employer is tax exempt upto Rs 100 per month per child upto a maximum of 2

Child Tuition Fee Tax Exemption Limit have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize printing templates to your own specific requirements for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Worth: Printables for education that are free cater to learners of all ages, making them a great tool for teachers and parents.

-

Convenience: instant access numerous designs and templates is time-saving and saves effort.

Where to Find more Child Tuition Fee Tax Exemption Limit

A K Bhattacharya Time To Revert To Rs 3 5 Lakh As Tax Exemption Limit

A K Bhattacharya Time To Revert To Rs 3 5 Lakh As Tax Exemption Limit

If you are a salaried employee you can also claim exemption of Rs 100 per month per child up to two kids as children s education allowance and Rs 300 a month per child as hostel

Section 10 Tax exemption for tuition fee of up to Rs 1 200 Rs 100 per month per child for a maximum of two children Section 80C In addition you can

In the event that we've stirred your interest in Child Tuition Fee Tax Exemption Limit Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Child Tuition Fee Tax Exemption Limit suitable for many reasons.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing Child Tuition Fee Tax Exemption Limit

Here are some innovative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home and in class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Child Tuition Fee Tax Exemption Limit are an abundance of practical and innovative resources which cater to a wide range of needs and pursuits. Their access and versatility makes them an essential part of your professional and personal life. Explore the plethora of Child Tuition Fee Tax Exemption Limit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can download and print these tools for free.

-

Are there any free printouts for commercial usage?

- It's based on specific conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations in their usage. Be sure to read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit a local print shop for more high-quality prints.

-

What software do I require to view printables at no cost?

- Most PDF-based printables are available as PDF files, which can be opened using free software, such as Adobe Reader.

Hike Tax Exemption Limit For Small Units

Full Tuition Fee Exemption Scholarship 2022

Check more sample of Child Tuition Fee Tax Exemption Limit below

Standard Deduction Relief Income Tax Indian Military Veterans

Assocham For Raising Tax Exemption Limit The Hitavada

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Tuition Fees Exemption In Income Tax 2023 Guide

01 Tax

Income Tax Exemption Limit Likely To Be Enhanced To Rs 5 Lakh Flipboard

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

https://taxguru.in/income-tax/deduction-…

Deduction under this section is available for tuition fees paid on two children s education If Assessee have more then two children

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

Deduction under this section is available for tuition fees paid on two children s education If Assessee have more then two children

Tuition Fees Exemption In Income Tax 2023 Guide

Assocham For Raising Tax Exemption Limit The Hitavada

01 Tax

Income Tax Exemption Limit Likely To Be Enhanced To Rs 5 Lakh Flipboard

Budget 2016 MPs Want Income Tax Exemption Limit For Individuals To Be

Tax Exemption Limit Raised To Rs 2 5 Lakh Rediff Business

Tax Exemption Limit Raised To Rs 2 5 Lakh Rediff Business

ITR AY 22 23 Income Below Exemption Limit Filing Income Tax Return Is