In the digital age, when screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or just adding an element of personalization to your home, printables for free have become an invaluable source. For this piece, we'll take a dive through the vast world of "Child Tuition Fee Tax Deduction," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Child Tuition Fee Tax Deduction Below

Child Tuition Fee Tax Deduction

Child Tuition Fee Tax Deduction -

Tuition and Fees Deduction for tax years before 2021 Another option is to claim a deduction of up to 2 000 or up to 4 000 of qualified tuition and mandatory enrollment fees depending on your income You do not have to itemize your deductions to claim the tuition and fees deduction

You paid 7 000 tuition and fees in August 2023 and your child began college in September 2023 You filed your 2023 tax return on February 17 2024 and claimed an American opportunity credit of 2 500 After you filed your return you received a

Child Tuition Fee Tax Deduction offer a wide collection of printable items that are available online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and many more. The benefit of Child Tuition Fee Tax Deduction is their flexibility and accessibility.

More of Child Tuition Fee Tax Deduction

Tax Benefits On Tuition Fees School Fees Education Allowances

Tax Benefits On Tuition Fees School Fees Education Allowances

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero

Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year

The Child Tuition Fee Tax Deduction have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization You can tailor the templates to meet your individual needs such as designing invitations and schedules, or even decorating your house.

-

Education Value These Child Tuition Fee Tax Deduction provide for students of all ages. This makes them an essential instrument for parents and teachers.

-

An easy way to access HTML0: You have instant access numerous designs and templates reduces time and effort.

Where to Find more Child Tuition Fee Tax Deduction

Letter To Bank For TDS Certificate Letter To Bank Manager YouTube

Letter To Bank For TDS Certificate Letter To Bank Manager YouTube

Have you been asking yourself is private school tuition tax deductible The good news is that it may be possible to lower education costs by using tuition tax breaks Even if the money comes out of your pocket at first you might be able to recoup some of those dollars come tax time

Section 80C of the Income Tax Act has provisions for tax deductions on tuition fees paid by a parent towards educating their children Check out this blog to know more

Since we've got your interest in printables for free and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Child Tuition Fee Tax Deduction for all purposes.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast selection of subjects, that range from DIY projects to party planning.

Maximizing Child Tuition Fee Tax Deduction

Here are some creative ways how you could make the most use of Child Tuition Fee Tax Deduction:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Tuition Fee Tax Deduction are an abundance of practical and imaginative resources that cater to various needs and pursuits. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the vast world of Child Tuition Fee Tax Deduction today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Child Tuition Fee Tax Deduction really absolutely free?

- Yes you can! You can download and print these tools for free.

-

Can I use the free printables for commercial uses?

- It's dependent on the particular usage guidelines. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in Child Tuition Fee Tax Deduction?

- Certain printables could be restricted concerning their use. Always read the terms and conditions set forth by the creator.

-

How do I print Child Tuition Fee Tax Deduction?

- You can print them at home using any printer or head to a local print shop to purchase higher quality prints.

-

What software will I need to access printables that are free?

- The majority of printables are as PDF files, which is open with no cost software like Adobe Reader.

Tax Deduction On Tax And Secretarial Fee 2022 Jan 25 2022 Johor

Children Tuition Fee School Fees College Fees Income Tax Deduction Us

Check more sample of Child Tuition Fee Tax Deduction below

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Child Tuition Stock Illustrations 562 Child Tuition Stock

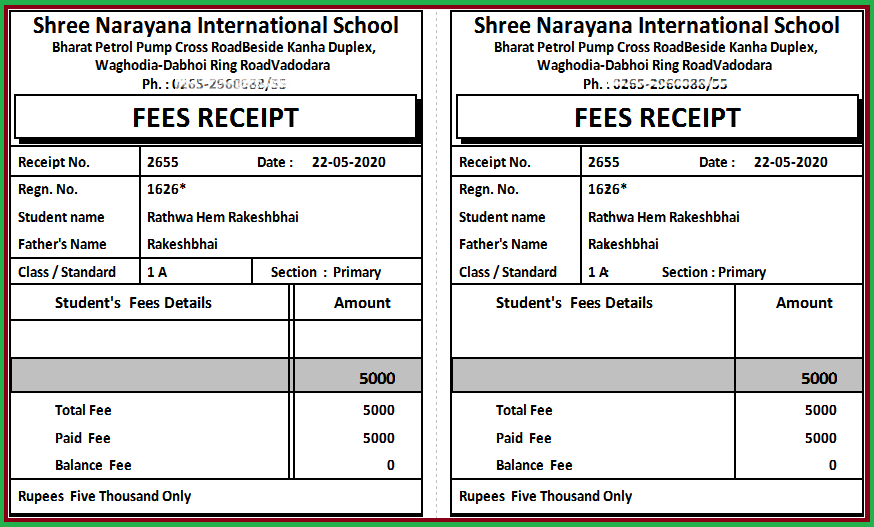

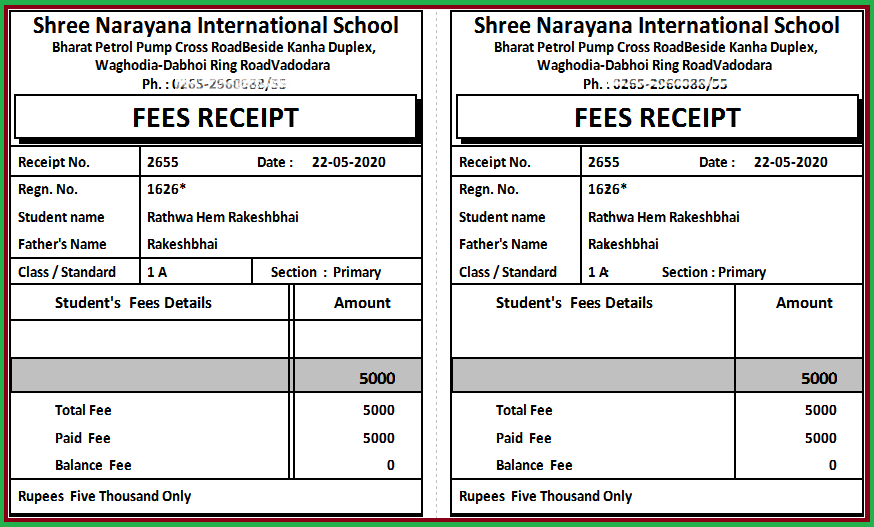

Fee Slip Format For School Toparhitecti ro

Tax Deduction For Secretarial And Tax Filing Fee

How To Claim Tax Deduction On Tuition Fees

https://www.irs.gov/publications/p970

You paid 7 000 tuition and fees in August 2023 and your child began college in September 2023 You filed your 2023 tax return on February 17 2024 and claimed an American opportunity credit of 2 500 After you filed your return you received a

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax savings while investing in your child s future

You paid 7 000 tuition and fees in August 2023 and your child began college in September 2023 You filed your 2023 tax return on February 17 2024 and claimed an American opportunity credit of 2 500 After you filed your return you received a

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax savings while investing in your child s future

Fee Slip Format For School Toparhitecti ro

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Tax Deduction For Secretarial And Tax Filing Fee

How To Claim Tax Deduction On Tuition Fees

Contribute To 529 Education Saving Plan To Get Tax Deduction When You

Group And Classroom based Tuition Is The Smarter Choice For Parents And

Group And Classroom based Tuition Is The Smarter Choice For Parents And

Calculate Your Chargeable Or Taxable Income For Income Tax