In this age of technology, where screens rule our lives yet the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes project ideas, artistic or just adding a personal touch to your area, Child Tax Credit 2023 Married Filing Jointly are a great resource. Here, we'll dive into the sphere of "Child Tax Credit 2023 Married Filing Jointly," exploring what they are, how they are available, and how they can improve various aspects of your lives.

Get Latest Child Tax Credit 2023 Married Filing Jointly Below

Child Tax Credit 2023 Married Filing Jointly

Child Tax Credit 2023 Married Filing Jointly -

You qualify for married filing jointly status as long as you were married by Dec 31 of the tax year you re filing for Learn more See tax rates and brackets for each filing

The Child Tax Credit is worth up to 2 000 for each qualifying child for 2023 returns filed in 2024 What is the Child Tax Credit Simply stated the Child Tax Credit CTC is a tax credit for those with dependent children

Printables for free cover a broad array of printable resources available online for download at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and much more. The appeal of printables for free is their flexibility and accessibility.

More of Child Tax Credit 2023 Married Filing Jointly

New 2022 IRS Income Tax Brackets And Phaseouts Spinella Consulting

New 2022 IRS Income Tax Brackets And Phaseouts Spinella Consulting

400 000 for married filing jointly 200 000 for single head of household married filing separately and qualified widow er with dependent If your income exceeds the threshold your full

If your total credit cancels out your tax bill completely you could get the remainder up to 1 600 per qualifying child in 2023 as a refund after filing your tax return How much is the Child Tax Credit worth The Child Tax Credit is worth up to 2 000 per qualifying child under age 17 Exactly how much you get depends on your income

Child Tax Credit 2023 Married Filing Jointly have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization We can customize printed materials to meet your requirements whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them a useful source for educators and parents.

-

Easy to use: Instant access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Child Tax Credit 2023 Married Filing Jointly

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Your First Look At 2023 Tax Brackets Deductions And Credits 3

For 2023 the child tax credit was worth 2 000 per qualifying dependent child if your modified adjusted gross income was 400 000 or below married filing jointly or

Last updated 27 March 2024 The child tax credit CTC allows eligible parents and caregivers to reduce their tax liability and might even result in a tax refund However not everyone can

Now that we've ignited your interest in Child Tax Credit 2023 Married Filing Jointly Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing Child Tax Credit 2023 Married Filing Jointly

Here are some fresh ways how you could make the most use of Child Tax Credit 2023 Married Filing Jointly:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Child Tax Credit 2023 Married Filing Jointly are a treasure trove of fun and practical tools which cater to a wide range of needs and interests. Their availability and versatility make these printables a useful addition to each day life. Explore the wide world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial uses?

- It's based on specific rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in their usage. Make sure to read these terms and conditions as set out by the designer.

-

How can I print Child Tax Credit 2023 Married Filing Jointly?

- You can print them at home with your printer or visit an in-store print shop to get premium prints.

-

What software do I need to run printables at no cost?

- Most PDF-based printables are available in the format of PDF, which can be opened with free programs like Adobe Reader.

2022 Georgia State Income Tax Brackets Latest News Update

Federal Income Tax Brackets 2019 Married Filing Jointly Yabtio

Check more sample of Child Tax Credit 2023 Married Filing Jointly below

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets Married Filing Jointly Irs Printable Form

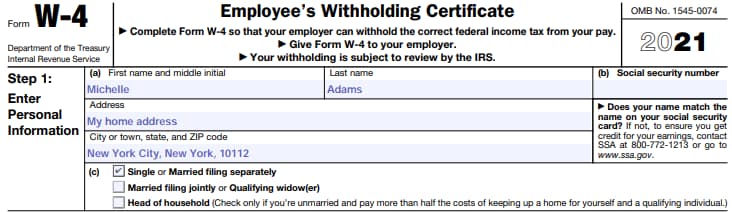

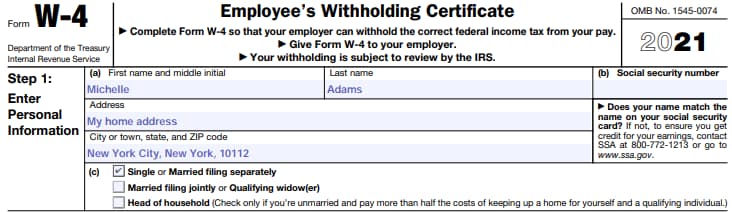

How To Fill Out IRS Form W 4 2020 Married Filing Jointly YouTube

IRS Inflation Adjustments Taxed Right

Tax Filing Chart 2023 Printable Forms Free Online

W4 Form Fillable 2023 W 4 Forms Zrivo Porn Sex Picture

https://www. hrblock.com /tax-center/filing/credits/child-tax-credit

The Child Tax Credit is worth up to 2 000 for each qualifying child for 2023 returns filed in 2024 What is the Child Tax Credit Simply stated the Child Tax Credit CTC is a tax credit for those with dependent children

https:// turbotax.intuit.com /tax-tips/family/child-tax-credit/L9ZIjdlZz

The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses You may have heard about a possible change to the Child Tax Credit but don t worry TurboTax has you covered

The Child Tax Credit is worth up to 2 000 for each qualifying child for 2023 returns filed in 2024 What is the Child Tax Credit Simply stated the Child Tax Credit CTC is a tax credit for those with dependent children

The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses You may have heard about a possible change to the Child Tax Credit but don t worry TurboTax has you covered

IRS Inflation Adjustments Taxed Right

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Tax Filing Chart 2023 Printable Forms Free Online

W4 Form Fillable 2023 W 4 Forms Zrivo Porn Sex Picture

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022 Zailzeorth s Blog

2022 Federal Tax Brackets Married Filing Jointly

2022 Federal Tax Brackets Married Filing Jointly

2022 Irs Income Tax Brackets E Jurnal