In the digital age, in which screens are the norm and the appeal of physical printed objects isn't diminished. Whether it's for educational purposes as well as creative projects or simply to add the personal touch to your home, printables for free have become an invaluable source. Through this post, we'll dive deep into the realm of "Child And Dependent Care Tax Credit Income Limit," exploring the different types of printables, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Child And Dependent Care Tax Credit Income Limit Below

Child And Dependent Care Tax Credit Income Limit

Child And Dependent Care Tax Credit Income Limit -

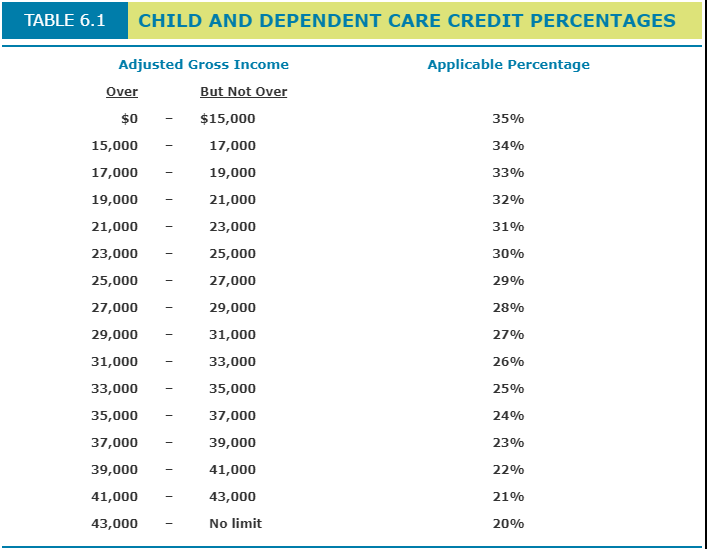

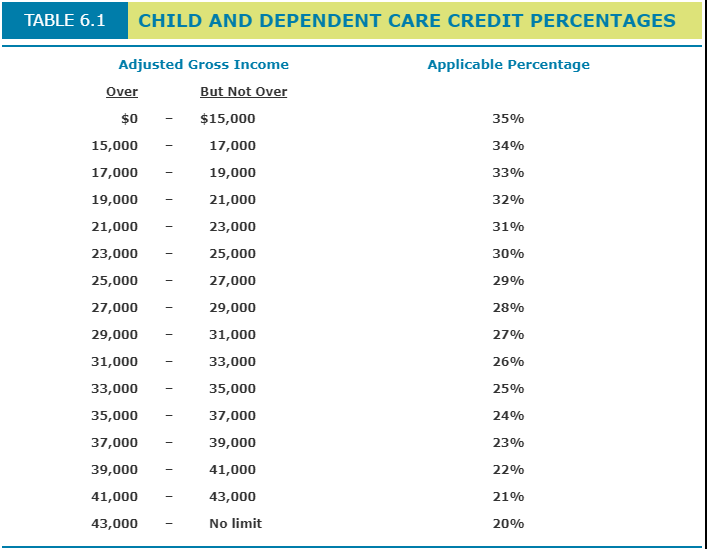

The percentage of eligible expenses that qualify for the tax credit varies depending on the taxpayer s income level and there is a limit on the total dollar amount of expenses that qualify

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Printables for free include a vast selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in many kinds, including worksheets coloring pages, templates and more. The great thing about Child And Dependent Care Tax Credit Income Limit lies in their versatility as well as accessibility.

More of Child And Dependent Care Tax Credit Income Limit

2021 Child And Dependent Care Tax Credit How To Get Up To An 8 000

2021 Child And Dependent Care Tax Credit How To Get Up To An 8 000

In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear except for 2021 In 2021 the credit is unavailable for any taxpayer with adjusted gross income over 438 000

For tax year 2021 only the exclusion for employer provided dependent care assistance has increased from 5 000 to 10 500 Note If the qualifying child turned 13 during the tax year the qualifying expenses include amounts incurred for the child while under age 13 when the care was provided

The Child And Dependent Care Tax Credit Income Limit have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: This allows you to modify the templates to meet your individual needs, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Benefits: Free educational printables offer a wide range of educational content for learners from all ages, making them a great instrument for parents and teachers.

-

An easy way to access HTML0: You have instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Child And Dependent Care Tax Credit Income Limit

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Specifically the CDCTC credit rate for 2021 is For workers with income under 125 000 50 For workers with income between 125 000 and 183 000 The credit rate gradually declines by one percentage point for each 2 000 or fraction thereof above 125 000 of AGI until it reaches 20 at 183 000 of AGI

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or

If we've already piqued your curiosity about Child And Dependent Care Tax Credit Income Limit, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Child And Dependent Care Tax Credit Income Limit for all applications.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs are a vast array of topics, ranging from DIY projects to planning a party.

Maximizing Child And Dependent Care Tax Credit Income Limit

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Child And Dependent Care Tax Credit Income Limit are a treasure trove of useful and creative resources which cater to a wide range of needs and needs and. Their accessibility and versatility make these printables a useful addition to both personal and professional life. Explore the vast array of Child And Dependent Care Tax Credit Income Limit and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's contingent upon the specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright violations with Child And Dependent Care Tax Credit Income Limit?

- Certain printables could be restricted regarding usage. Make sure you read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a print shop in your area for better quality prints.

-

What program will I need to access printables free of charge?

- The majority of PDF documents are provided in PDF format. These is open with no cost programs like Adobe Reader.

Dependent Care Fsa Income Limit Tricheenlight

Dependent Care Flexible Spending Account Vs Child And Dependent Care

Check more sample of Child And Dependent Care Tax Credit Income Limit below

What Is The Child And Dependent Care Tax Credit 2020 2021 YouTube

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Credit Limit Worksheet Child And Dependent Care Worksheet Resume Examples

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

Earned Income Credit 2022 Calculator INCOMEBAU

Tax Guy The Child And Dependent Care Tax Credit Is More Lucrative Than

https://www.irs.gov/newsroom/understanding-the...

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

https://www.irs.gov/taxtopics/tc602

In general you can exclude up to 5 000 for dependent care benefits received from your employer Additionally in general the expenses claimed may not exceed the smaller of your earned income or your spouse s earned income

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

In general you can exclude up to 5 000 for dependent care benefits received from your employer Additionally in general the expenses claimed may not exceed the smaller of your earned income or your spouse s earned income

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Earned Income Credit 2022 Calculator INCOMEBAU

Tax Guy The Child And Dependent Care Tax Credit Is More Lucrative Than

Child Care Tax Credit Income Limit Paradox

Calculate The Amount Of The Child And Dependent Care Chegg

Calculate The Amount Of The Child And Dependent Care Chegg

Credit Limit Worksheet 8839 Free Download Goodimg co