In this age of electronic devices, where screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses for creative projects, simply to add an extra personal touch to your home, printables for free can be an excellent resource. The following article is a take a dive deep into the realm of "Cell Phone Tax Deduction Business Expense Canada," exploring what they are, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Cell Phone Tax Deduction Business Expense Canada Below

Cell Phone Tax Deduction Business Expense Canada

Cell Phone Tax Deduction Business Expense Canada -

As long as you can prove that the use of the phone is strictly for business you can deduct 100 of the bill Keep in mind that if you bought the phone outright and the cost is high enough you may need

December 2 2016 1 min read The Canada Revenue Agency CRA lets small business owners self employed individuals and freelancers deduct business related mobile

Cell Phone Tax Deduction Business Expense Canada include a broad range of downloadable, printable materials online, at no cost. These printables come in different styles, from worksheets to coloring pages, templates and more. The appeal of printables for free is in their variety and accessibility.

More of Cell Phone Tax Deduction Business Expense Canada

SC Cell Phone Tax Hike Moving Forward FITSNews

SC Cell Phone Tax Hike Moving Forward FITSNews

Is my cell phone bill a small business expense The short answer to this question is yes it can be But that depends on a variety of factors from the circumstances of your employment to the amount and

Key Takeaways If you use a computer cellphone iPad or other gadgets to run your business you may be able to deduct their expenses if they are both

Cell Phone Tax Deduction Business Expense Canada have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor the design to meet your needs for invitations, whether that's creating them, organizing your schedule, or even decorating your home.

-

Educational value: The free educational worksheets are designed to appeal to students of all ages, making them an invaluable aid for parents as well as educators.

-

Easy to use: Fast access a plethora of designs and templates reduces time and effort.

Where to Find more Cell Phone Tax Deduction Business Expense Canada

Is Your Cell Phone Tax Deductible Cell Phone Deduction Taxfluence

Is Your Cell Phone Tax Deductible Cell Phone Deduction Taxfluence

An example of this would be cell phone usage costs Capital items that are also use partly for personal use would be capitalized at 100 of the cost and depreciation would be

You can claim a deduction on any technological device or service that you use for your company including Televisions Computers Tablets Smartphones

If we've already piqued your interest in printables for free Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of objectives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing Cell Phone Tax Deduction Business Expense Canada

Here are some inventive ways of making the most use of Cell Phone Tax Deduction Business Expense Canada:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Cell Phone Tax Deduction Business Expense Canada are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and preferences. Their availability and versatility make them an essential part of any professional or personal life. Explore the many options of Cell Phone Tax Deduction Business Expense Canada to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can download and print the resources for free.

-

Can I use free printables in commercial projects?

- It's determined by the specific conditions of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright violations with Cell Phone Tax Deduction Business Expense Canada?

- Certain printables could be restricted on usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print Cell Phone Tax Deduction Business Expense Canada?

- Print them at home with either a printer at home or in an area print shop for premium prints.

-

What program do I need in order to open printables at no cost?

- The majority of PDF documents are provided as PDF files, which is open with no cost programs like Adobe Reader.

Taxpayer Association Fights 7 Cell phone Tax The Oregon Catalyst

Cell Phone Tax Deduction Mobile Phone AI Tax FlyFin

Check more sample of Cell Phone Tax Deduction Business Expense Canada below

How To Deduct Cell Phone Bill On Taxes

How To Calculate Cell Phone Tax Deduction

Business Expense Canada Business Tax Deduction Rules

/businessmanreceiptsgetty-57a624813df78cf45908cf6b.jpg)

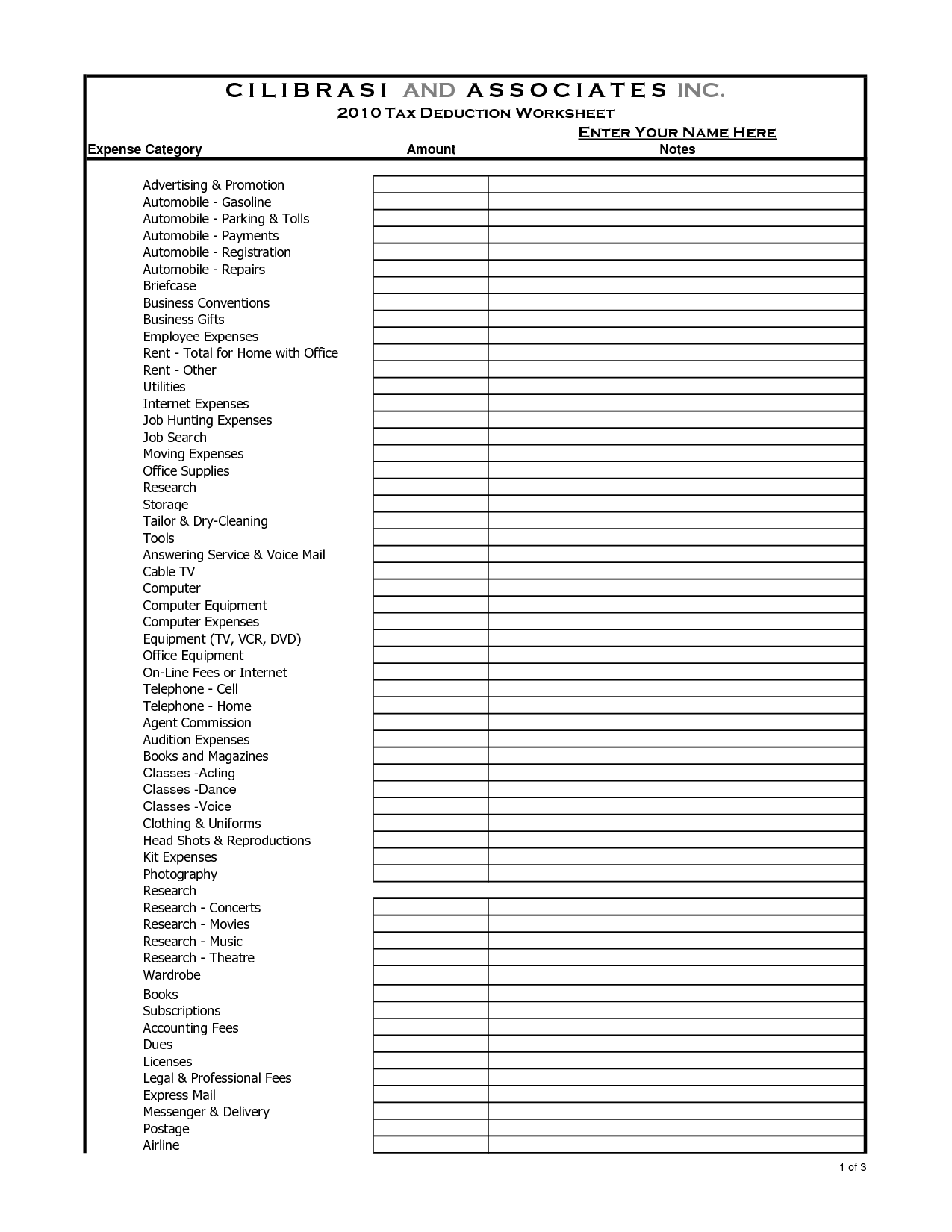

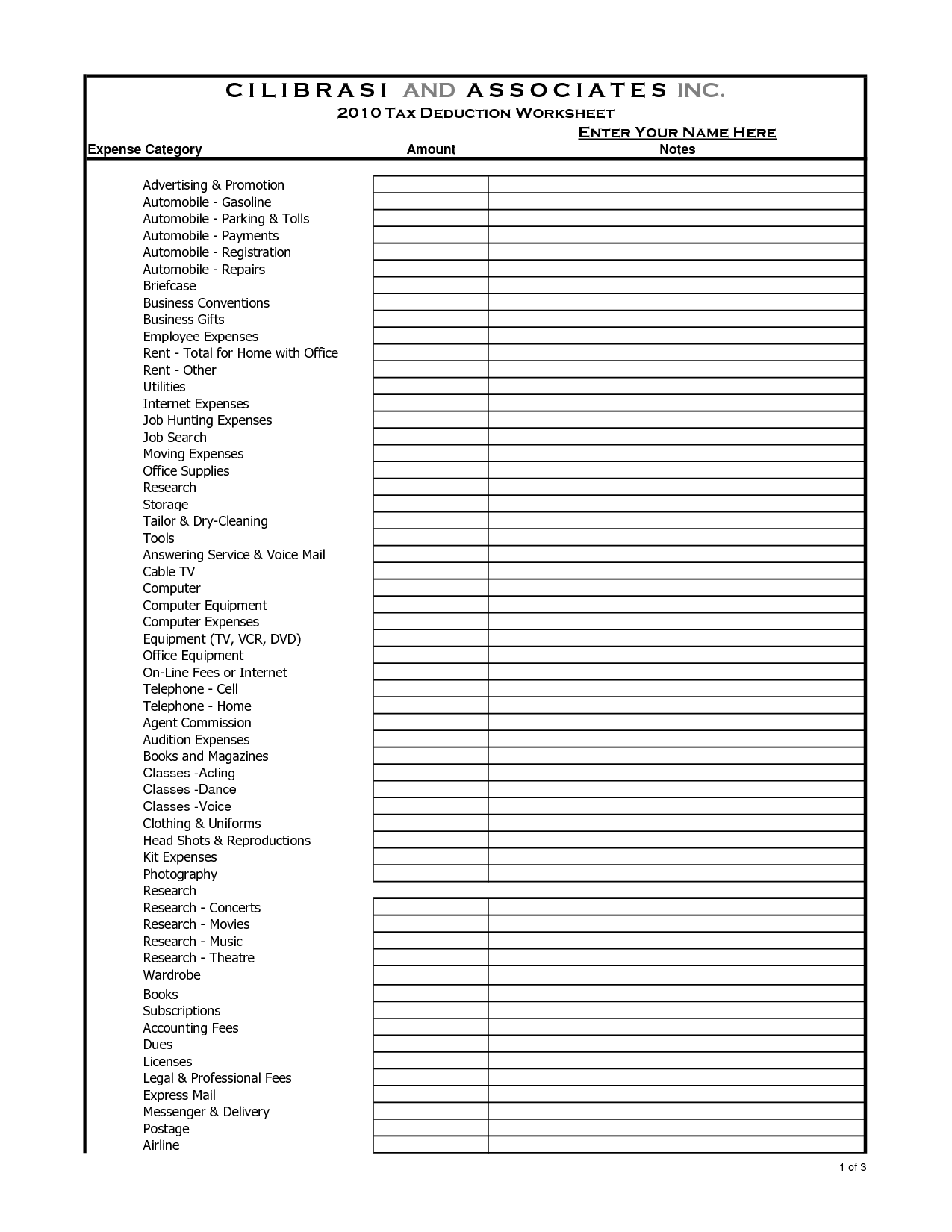

16 Tax Organizer Worksheet Worksheeto

Washington State Cell Phone Taxes Spokane Economic And Demographic Data

Tax Deduction For A Donated Cell Phone Sapling

https://quickbooks.intuit.com/ca/resources/taxes/...

December 2 2016 1 min read The Canada Revenue Agency CRA lets small business owners self employed individuals and freelancers deduct business related mobile

https://www.canada.ca/en/revenue-agency/services/...

Under the CRA s administrative policy if you provide your employee with a cell phone or other handheld communication device that you own and you require your employee to

December 2 2016 1 min read The Canada Revenue Agency CRA lets small business owners self employed individuals and freelancers deduct business related mobile

Under the CRA s administrative policy if you provide your employee with a cell phone or other handheld communication device that you own and you require your employee to

16 Tax Organizer Worksheet Worksheeto

How To Calculate Cell Phone Tax Deduction

Washington State Cell Phone Taxes Spokane Economic And Demographic Data

Tax Deduction For A Donated Cell Phone Sapling

Brilliant Tax Write Off Template Stores Inventory Excel Format

Monthly Expense In Canada International Student Kitchener

Monthly Expense In Canada International Student Kitchener

How To Claim A Cell Phone Tax Deduction And Save Money