In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education and creative work, or simply adding a personal touch to your space, Cares Act Recovery Rebate Accounting Today are now a useful resource. This article will dive in the world of "Cares Act Recovery Rebate Accounting Today," exploring what they are, where they are available, and how they can improve various aspects of your daily life.

Get Latest Cares Act Recovery Rebate Accounting Today Below

Cares Act Recovery Rebate Accounting Today

Cares Act Recovery Rebate Accounting Today -

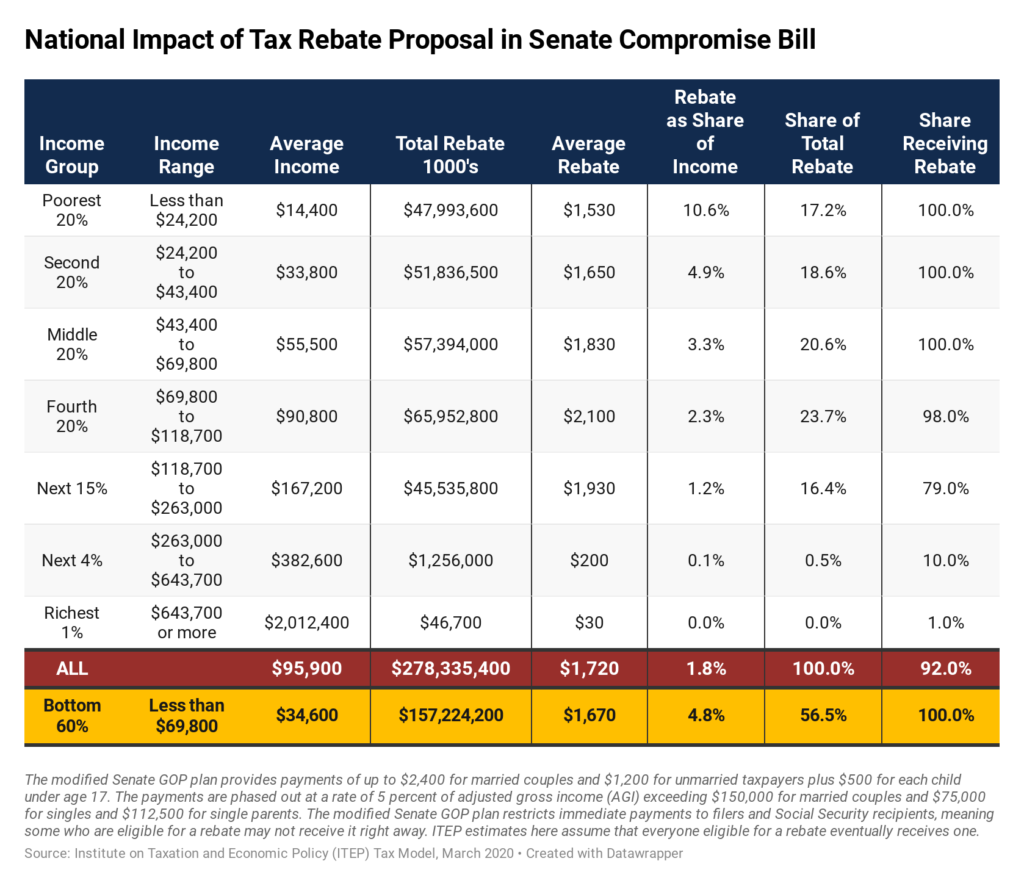

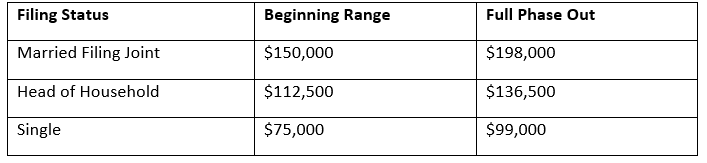

Web 10 mars 2021 nbsp 0183 32 The act creates a new Sec 6428B that provides individuals with a 1 400 recovery rebate credit 2 800 for married taxpayers filing jointly plus 1 400 for each

Web 23 mai 2022 nbsp 0183 32 The Recovery Rebate Credit was part of the federal government s efforts to provide a stimulus to the economy during the early days of the COVID 19 pandemic The

Cares Act Recovery Rebate Accounting Today provide a diverse range of printable, free material that is available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and much more. The appealingness of Cares Act Recovery Rebate Accounting Today is their flexibility and accessibility.

More of Cares Act Recovery Rebate Accounting Today

Recovery Rebate Income Limits Recovery Rebate

Recovery Rebate Income Limits Recovery Rebate

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 24 mai 2021 nbsp 0183 32 CARES Act signed into law on March payments to the 27 2020 is a refundable Recovery Rebate Credit for individuals The Act authorizes the IRS to make

Cares Act Recovery Rebate Accounting Today have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements in designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them a vital instrument for parents and teachers.

-

It's easy: Quick access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Cares Act Recovery Rebate Accounting Today

Check Status Of Recovery Rebate Recovery Rebate

Check Status Of Recovery Rebate Recovery Rebate

Web Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible

Web 1 avr 2020 nbsp 0183 32 Every United States resident or citizen who filed a tax return in 2018 or 2019 may be eligible to receive a recovery rebate under the CARES Act Filers are eligible

If we've already piqued your interest in Cares Act Recovery Rebate Accounting Today Let's find out where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Cares Act Recovery Rebate Accounting Today for a variety needs.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Cares Act Recovery Rebate Accounting Today

Here are some innovative ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Cares Act Recovery Rebate Accounting Today are an abundance filled with creative and practical information which cater to a wide range of needs and interests. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the wide world that is Cares Act Recovery Rebate Accounting Today today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print the resources for free.

-

Can I utilize free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Cares Act Recovery Rebate Accounting Today?

- Some printables may come with restrictions concerning their use. Always read these terms and conditions as set out by the designer.

-

How do I print Cares Act Recovery Rebate Accounting Today?

- You can print them at home using either a printer at home or in a print shop in your area for better quality prints.

-

What software do I require to open printables free of charge?

- Most printables come as PDF files, which can be opened with free software like Adobe Reader.

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

How Did The CARES Act Recovery Rebate Work

Check more sample of Cares Act Recovery Rebate Accounting Today below

Taxes On New Car Rebates Tennessee 2023 Carrebate

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

Recovery Rebates For Individuals Under The CARES Act Bruning

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

Summary Of Individual Provisions Of CARES Act

CARES Act 2020 Recovery Rebates

https://www.accountingtoday.com/news/irs-sent-millions-in-potentially...

Web 23 mai 2022 nbsp 0183 32 The Recovery Rebate Credit was part of the federal government s efforts to provide a stimulus to the economy during the early days of the COVID 19 pandemic The

https://www.accountingtoday.com/news/irs-reducing-correcting-recovery...

Web 5 avr 2021 nbsp 0183 32 The Recovery Rebate Credit is supposed to allow taxpayers to get either the first or second rounds of stimulus payments they didn t receive last year or earlier this

Web 23 mai 2022 nbsp 0183 32 The Recovery Rebate Credit was part of the federal government s efforts to provide a stimulus to the economy during the early days of the COVID 19 pandemic The

Web 5 avr 2021 nbsp 0183 32 The Recovery Rebate Credit is supposed to allow taxpayers to get either the first or second rounds of stimulus payments they didn t receive last year or earlier this

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

Summary Of Individual Provisions Of CARES Act

CARES Act 2020 Recovery Rebates

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

CARES Act For Individuals Rebates Retirement Account Changes And More

CARES Act For Individuals Rebates Retirement Account Changes And More

Calam o Best Done For You CARES Act Rebate Application 2022 Top ERTC