In the digital age, where screens rule our lives and the appeal of physical printed items hasn't gone away. If it's to aid in education project ideas, artistic or simply to add some personal flair to your area, Can You Deduct Cis Tax From Corporation Tax are a great source. Here, we'll dive into the world of "Can You Deduct Cis Tax From Corporation Tax," exploring the benefits of them, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Can You Deduct Cis Tax From Corporation Tax Below

Can You Deduct Cis Tax From Corporation Tax

Can You Deduct Cis Tax From Corporation Tax -

If you want the repayment set off against an outstanding Corporation Tax CT liability HMRC need to know your CT Unique Tax Reference UTR and either the end date of

The Construction Industry Scheme CIS deduction rates are 20 for registered subcontractors 30 for unregistered subcontractors 0 if the subcontractor has gross payment status for

Can You Deduct Cis Tax From Corporation Tax offer a wide array of printable materials available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and many more. The beauty of Can You Deduct Cis Tax From Corporation Tax lies in their versatility as well as accessibility.

More of Can You Deduct Cis Tax From Corporation Tax

MY VIP TAX TEAM QUESTION OF THE WEEK CONTRACTORS FAILURE TO DEDUCT CIS

MY VIP TAX TEAM QUESTION OF THE WEEK CONTRACTORS FAILURE TO DEDUCT CIS

CIS subcontractors with gross payment status should declare all the income using the standard method in the Corporation Tax return You should claim back any paid CIS deductions

A further amendment has been added to support HMRC s anti fraud measures in line with which contractors claiming CIS deductions from April 2022 will have to include their Corporation Tax Unique Taxpayer Reference

Can You Deduct Cis Tax From Corporation Tax have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization They can make the design to meet your needs whether it's making invitations planning your schedule or even decorating your home.

-

Educational value: Printables for education that are free can be used by students of all ages, which makes them a valuable resource for educators and parents.

-

The convenience of Access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Can You Deduct Cis Tax From Corporation Tax

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

If you re a self employed individual under the CIS Construction Industry Scheme luckily for you there are a few CIS deductions you can use to maximise your rebate First of

Your business tax account allows you to see all business tax in one place you may need to add the CIS service You can file CIS returns using your business tax account 3

After we've peaked your interest in Can You Deduct Cis Tax From Corporation Tax we'll explore the places the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Can You Deduct Cis Tax From Corporation Tax to suit a variety of uses.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast selection of subjects, everything from DIY projects to planning a party.

Maximizing Can You Deduct Cis Tax From Corporation Tax

Here are some creative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Can You Deduct Cis Tax From Corporation Tax are a treasure trove of useful and creative resources which cater to a wide range of needs and preferences. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the world of Can You Deduct Cis Tax From Corporation Tax and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes, they are! You can print and download these files for free.

-

Can I make use of free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions on their use. Always read these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit a print shop in your area for better quality prints.

-

What program must I use to open Can You Deduct Cis Tax From Corporation Tax?

- Most PDF-based printables are available in the PDF format, and is open with no cost software, such as Adobe Reader.

Can You Deduct Your S Corporation Losses

List Of Tax Deductions Here s What You Can Deduct

Check more sample of Can You Deduct Cis Tax From Corporation Tax below

Can You Deduct Your Tuition On Your Taxes YouTube

Employees Can Deduct Workplace Expenses From Their Taxes ExpensePoint

Tax Deductions You Can Deduct What Napkin Finance

Is Dubai Tax Free PRO Partner Group

Jaime Bolton AATQB On LinkedIn If You Run Payroll Or Pay Any CIS

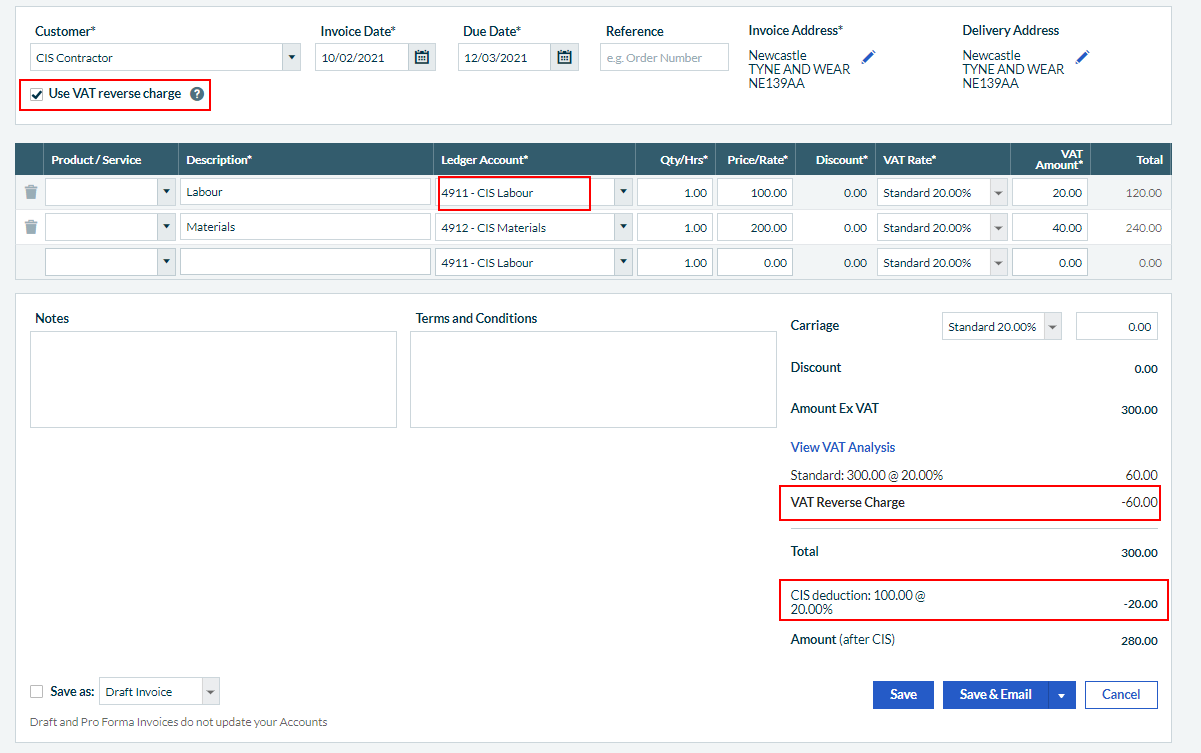

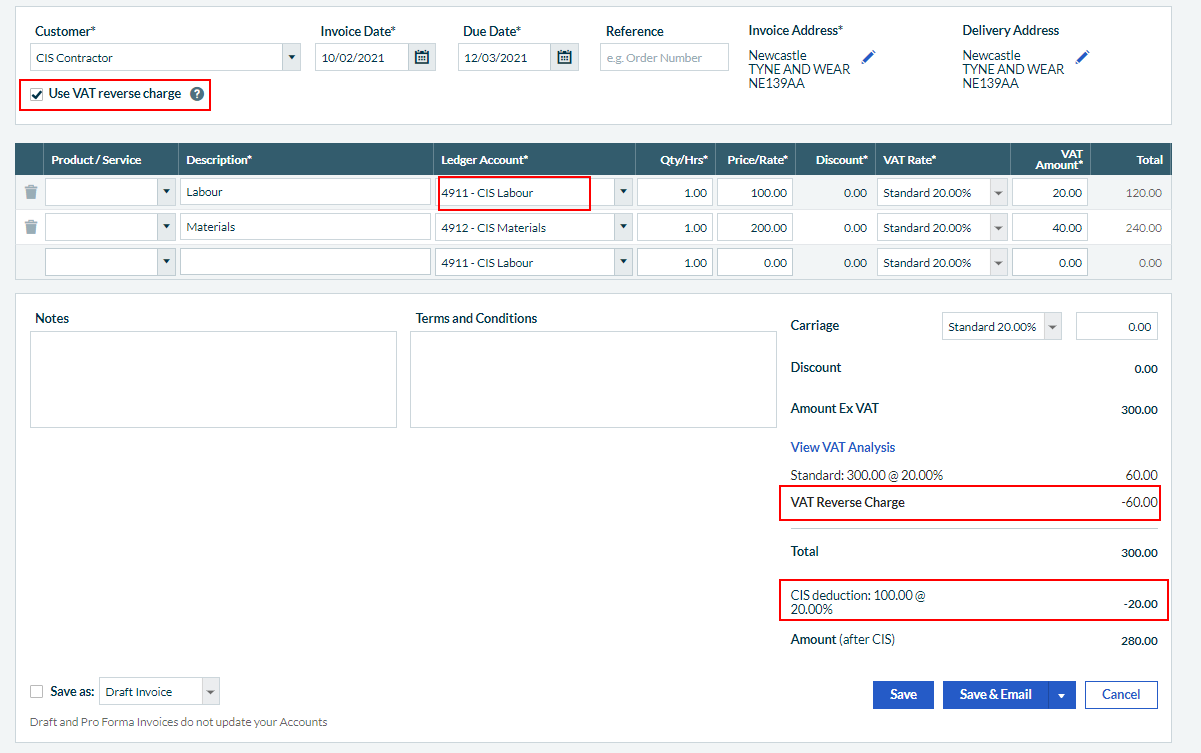

Create And Send A CIS Sales Invoice To A Contractor

https://www.gov.uk › what-you-must-do-as-a-cis...

The Construction Industry Scheme CIS deduction rates are 20 for registered subcontractors 30 for unregistered subcontractors 0 if the subcontractor has gross payment status for

https://www.gov.uk › what-you-must-do-as-a-cis...

If you pay CIS deductions you must claim these back through your company s monthly payroll scheme Do not try to claim back through your Corporation Tax return you may get a penalty

The Construction Industry Scheme CIS deduction rates are 20 for registered subcontractors 30 for unregistered subcontractors 0 if the subcontractor has gross payment status for

If you pay CIS deductions you must claim these back through your company s monthly payroll scheme Do not try to claim back through your Corporation Tax return you may get a penalty

Is Dubai Tax Free PRO Partner Group

Employees Can Deduct Workplace Expenses From Their Taxes ExpensePoint

Jaime Bolton AATQB On LinkedIn If You Run Payroll Or Pay Any CIS

Create And Send A CIS Sales Invoice To A Contractor

Tax2u Claiming Back Your CIS Tax

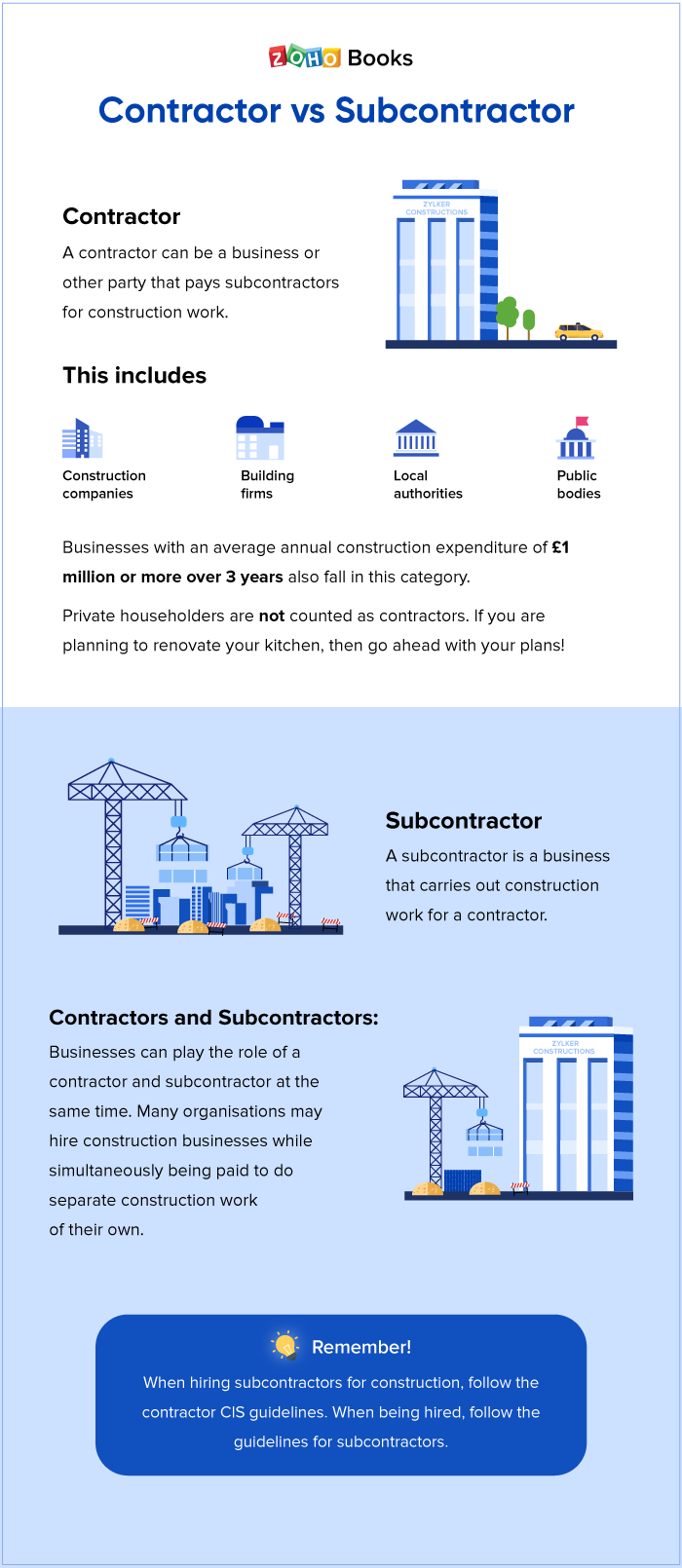

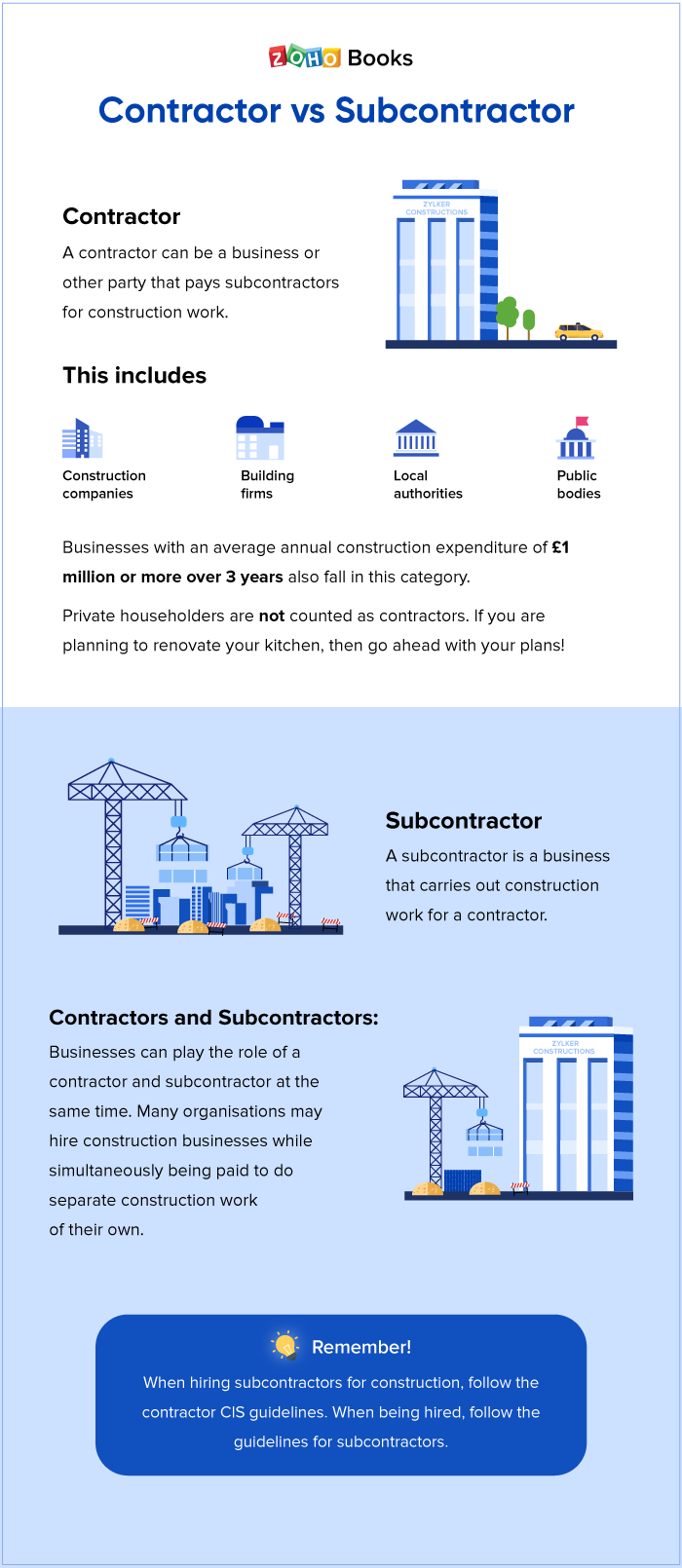

What Is Construction Industry Scheme CIS How To Register For CIS

What Is Construction Industry Scheme CIS How To Register For CIS

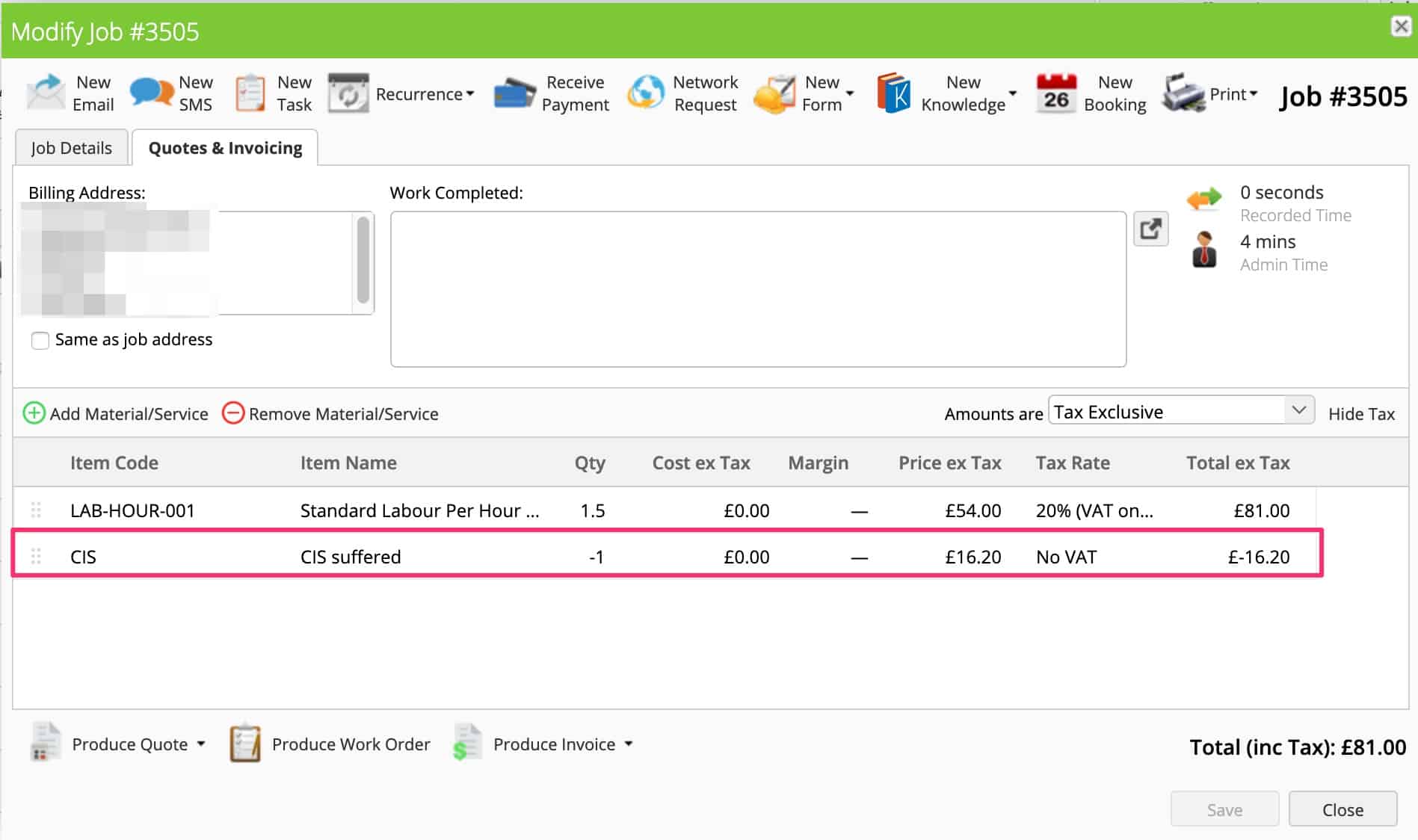

Q A How Do I Deduct CIS From A ServiceM8 Invoice Hazel Whicher