In the digital age, in which screens are the norm yet the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply to add an individual touch to the space, Can You Claim Vat On Lease Payments are a great resource. We'll take a dive to the depths of "Can You Claim Vat On Lease Payments," exploring what they are, how you can find them, and how they can improve various aspects of your daily life.

Get Latest Can You Claim Vat On Lease Payments Below

Can You Claim Vat On Lease Payments

Can You Claim Vat On Lease Payments -

The good news is that if you re leasing a car or a van for your VAT registered business you can claim up to 100 of the VAT charged back However the amount you can reclaim

Where you lease or buy a car using a qualifying PCP with the intention that it will be and is used by you or an employee of your business you can reclaim 50 of

Can You Claim Vat On Lease Payments include a broad assortment of printable, downloadable material that is available online at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Can You Claim Vat On Lease Payments

How Far Back Can You Claim Vat In South Africa Greater Good SA

How Far Back Can You Claim Vat In South Africa Greater Good SA

You can reclaim all of the VAT charged on the lease if the car is a qualifying car and you intend to use it primarily for hire with a driver for carrying

One of the most significant tax benefits of car leasing for businesses is the ability to claim VAT back on the monthly payments VAT registered businesses can claim back 50 of the VAT on the

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization We can customize the templates to meet your individual needs whether it's making invitations making your schedule, or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners from all ages, making them an invaluable device for teachers and parents.

-

Easy to use: Access to a plethora of designs and templates helps save time and effort.

Where to Find more Can You Claim Vat On Lease Payments

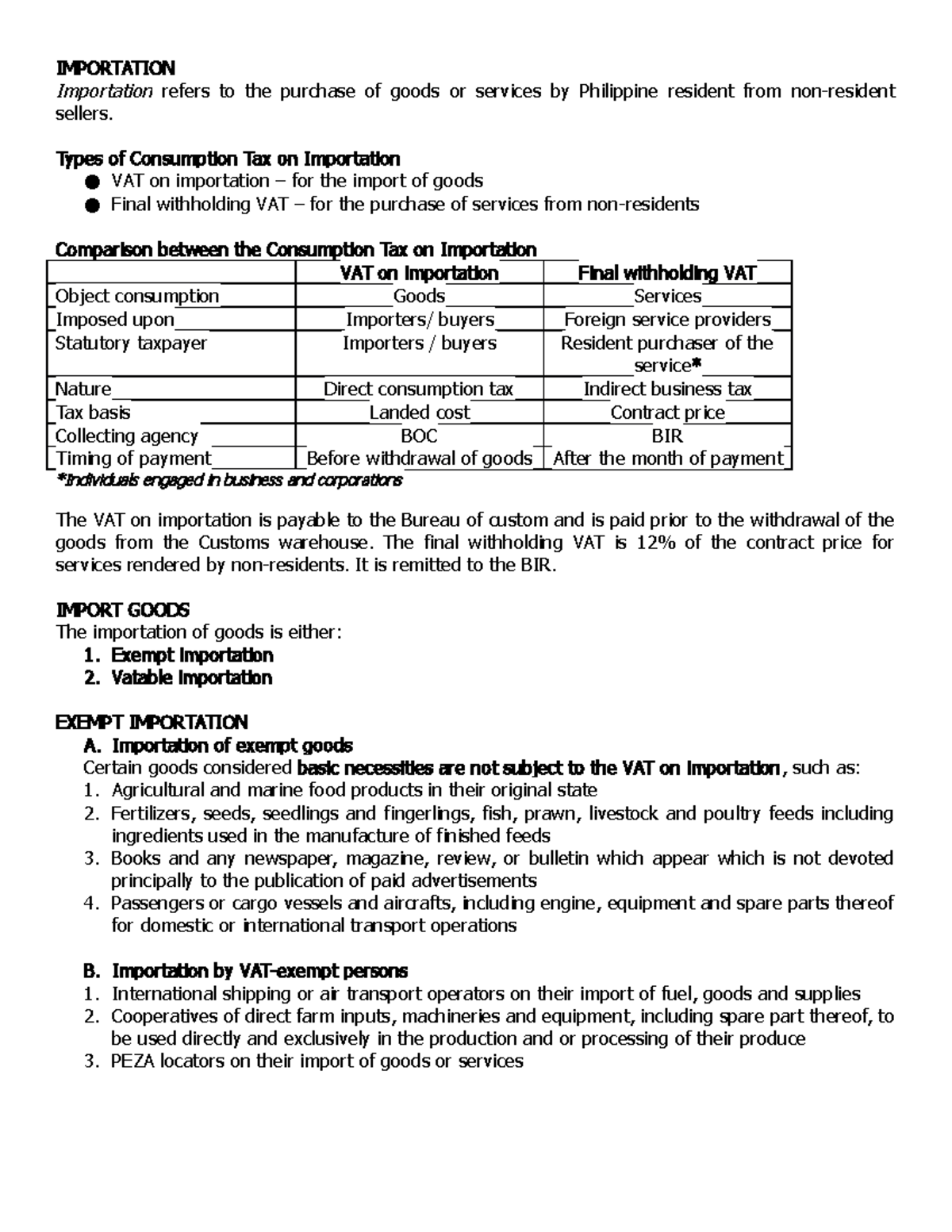

TAX 02 VAT ON Importation IMPORTATION Importation Refers To The

TAX 02 VAT ON Importation IMPORTATION Importation Refers To The

You can reclaim 100 of VAT paid on separately charges servicing and maintenance amounts You can also reclaim 100 of the VAT you pay where the business arranges for the servicing and

If you re VAT registered you can reclaim up to 100 of the VAT you pay on your lease payments Sole traders can claim the total cost of their lease payments as a business expense and due to that

In the event that we've stirred your curiosity about Can You Claim Vat On Lease Payments Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Can You Claim Vat On Lease Payments for all motives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Can You Claim Vat On Lease Payments

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can You Claim Vat On Lease Payments are an abundance of fun and practical tools which cater to a wide range of needs and needs and. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the plethora of Can You Claim Vat On Lease Payments today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can print and download these files for free.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted on usage. Check the terms and conditions provided by the creator.

-

How do I print Can You Claim Vat On Lease Payments?

- Print them at home with printing equipment or visit a local print shop to purchase high-quality prints.

-

What program will I need to access printables that are free?

- Many printables are offered in the PDF format, and can be opened using free programs like Adobe Reader.

How To Claim Back VAT VAT Guide Xero UK

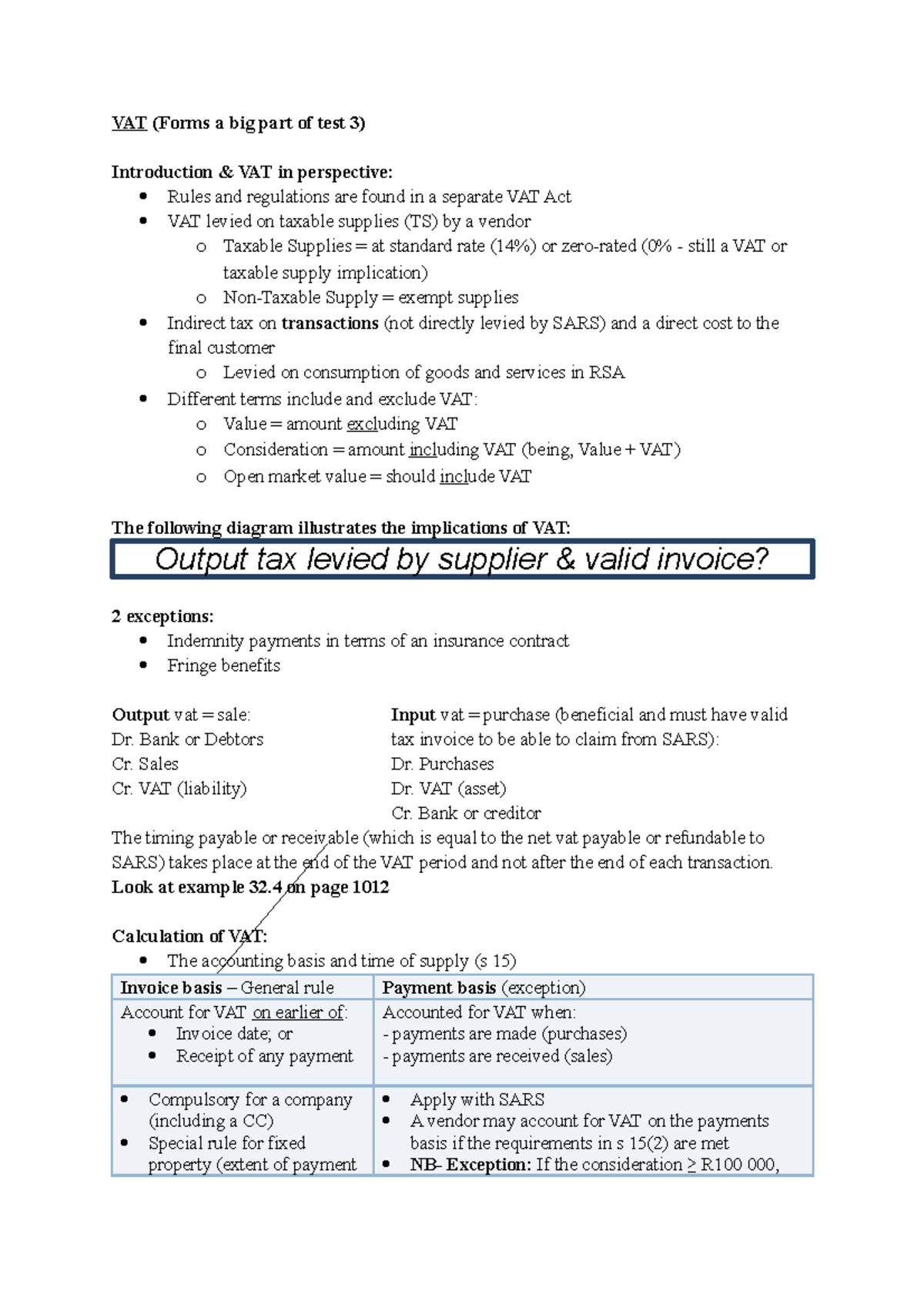

Chapter 32 VAT VAT Forms A Big Part Of Test 3 Introduction VAT

Check more sample of Can You Claim Vat On Lease Payments below

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

VAT On Leased Cars Can You Claim Back VAT On Car Leasing

Can You Claim VAT On Entertaining Clients Employees YouTube

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

Can You Claim VAT On Commission Paid

Can You Claim Back VAT On Lease Cars ACL Automotive

.jpg)

https://chw-accounting.co.uk › news-and-blog › leasing...

Where you lease or buy a car using a qualifying PCP with the intention that it will be and is used by you or an employee of your business you can reclaim 50 of

https://www.iasplus.com › ... › march › vat-lease-payment

Almost all respondents said lessees generally do not include non refundable VAT as part of lease payments in practice They considered that VAT

Where you lease or buy a car using a qualifying PCP with the intention that it will be and is used by you or an employee of your business you can reclaim 50 of

Almost all respondents said lessees generally do not include non refundable VAT as part of lease payments in practice They considered that VAT

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

VAT On Leased Cars Can You Claim Back VAT On Car Leasing

Can You Claim VAT On Commission Paid

.jpg)

Can You Claim Back VAT On Lease Cars ACL Automotive

How To Claim A VAT Refund Everything You Need To Know

How Far Back Can You Claim VAT On Expenses Goselfemployed co

How Far Back Can You Claim VAT On Expenses Goselfemployed co

Can You Claim VAT On Foreign Invoices