In this age of technology, in which screens are the norm, the charm of tangible printed products hasn't decreased. Be it for educational use, creative projects, or simply adding an element of personalization to your home, printables for free are now a useful resource. Through this post, we'll take a dive into the world of "Can You Claim Hydro On Income Tax Ontario," exploring what they are, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Can You Claim Hydro On Income Tax Ontario Below

Can You Claim Hydro On Income Tax Ontario

Can You Claim Hydro On Income Tax Ontario -

A wide range of expenses can be claimed including Maintenance costs such as heating hydro electricity and water Home insurance Cleaning materials Rent Property taxes Mortgage interest Routine maintenance and incidental repairs Calculating Your Business Use of Home Expenses How much of the above expenses you can claim

Ontario Energy and Property Tax Credit Questions and Answers The questions and answers below refer to claims for the 2024 OEPTC which you apply for on your 2023 income tax and benefit return However the eligibility rules for previous years are similar to the rules for the 2024 OEPTC If you need these rules when reading the questions and

The Can You Claim Hydro On Income Tax Ontario are a huge range of printable, free items that are available online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages and many more. One of the advantages of Can You Claim Hydro On Income Tax Ontario lies in their versatility as well as accessibility.

More of Can You Claim Hydro On Income Tax Ontario

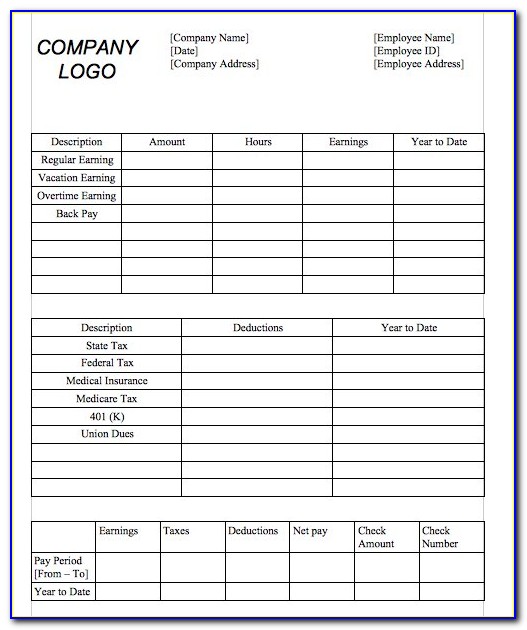

Paycheck Calculator Ontario Excel Templates

Paycheck Calculator Ontario Excel Templates

Line 9220 Utilities You can deduct expenses for utilities such as gas oil electricity water and cable if your rental arrangement specifies that you pay for the utilities of your rental space or units

If you paid rent in Ontario and had a lower income you may be able to claim a tax credit Learn more in this article and get your maximum tax refund

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization There is the possibility of tailoring the design to meet your needs be it designing invitations and schedules, or even decorating your home.

-

Educational Benefits: These Can You Claim Hydro On Income Tax Ontario provide for students of all ages. This makes them a vital device for teachers and parents.

-

It's easy: You have instant access a plethora of designs and templates saves time and effort.

Where to Find more Can You Claim Hydro On Income Tax Ontario

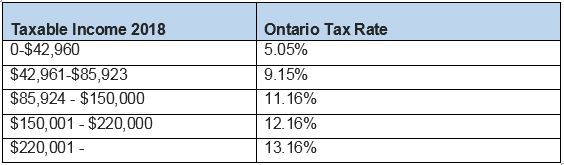

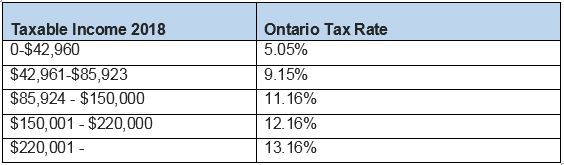

Personal Income Tax Brackets Ontario 2022 MD Tax

Personal Income Tax Brackets Ontario 2022 MD Tax

Are you referring to Ontario Energy and Property Tax Credit OEPTC under Trillium benefit If so this is not directly based on energy bills but on rent costs or property taxes October 30 2019 3 55 AM

Get up to 1 065 for the 2021 benefit year in tax credits if you or your family have low to moderate income and up to 1 247 if you re an eligible senior To apply for the Ontario Energy and Property Tax Credit download and fill out the ON BEN application form PDF file your income tax to see if you are eligible to receive the credit

We hope we've stimulated your interest in Can You Claim Hydro On Income Tax Ontario Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Can You Claim Hydro On Income Tax Ontario for a variety applications.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad variety of topics, starting from DIY projects to party planning.

Maximizing Can You Claim Hydro On Income Tax Ontario

Here are some new ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Can You Claim Hydro On Income Tax Ontario are a treasure trove of practical and imaginative resources designed to meet a range of needs and passions. Their availability and versatility make these printables a useful addition to both personal and professional life. Explore the many options of Can You Claim Hydro On Income Tax Ontario and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can print and download these files for free.

-

Are there any free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright problems with Can You Claim Hydro On Income Tax Ontario?

- Some printables may have restrictions on use. Be sure to check the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home with your printer or visit an area print shop for better quality prints.

-

What program do I need to open printables that are free?

- Many printables are offered with PDF formats, which is open with no cost software, such as Adobe Reader.

3 Helpful Tips For Filing Ontario Tax MB Accounting

Starface SESAME STREET X STARFACE IS HERE Milled

Check more sample of Can You Claim Hydro On Income Tax Ontario below

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

Can I Claim Adult Children On My Income Tax JacAnswers

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

Customizing The Hydro Task List On A Claim Web Encircle

Tullah HEC Worker Wins Supreme Court Broken Leg Appeal The Examiner

https://www.canada.ca/en/revenue-agency/services/...

Ontario Energy and Property Tax Credit Questions and Answers The questions and answers below refer to claims for the 2024 OEPTC which you apply for on your 2023 income tax and benefit return However the eligibility rules for previous years are similar to the rules for the 2024 OEPTC If you need these rules when reading the questions and

https://turbotax.intuit.ca/tips/can-you-claim-rent-in-ontario-5715

You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle income and you live in Ontario This tax credit helps with rent and property taxes paid to your municipal government and is part of the Ontario Trillium Benefit

Ontario Energy and Property Tax Credit Questions and Answers The questions and answers below refer to claims for the 2024 OEPTC which you apply for on your 2023 income tax and benefit return However the eligibility rules for previous years are similar to the rules for the 2024 OEPTC If you need these rules when reading the questions and

You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle income and you live in Ontario This tax credit helps with rent and property taxes paid to your municipal government and is part of the Ontario Trillium Benefit

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

Can I Claim Adult Children On My Income Tax JacAnswers

Customizing The Hydro Task List On A Claim Web Encircle

Tullah HEC Worker Wins Supreme Court Broken Leg Appeal The Examiner

Janice Plut Minor Ontario Tax Calculator Cobor i In Fiecare Zi Te

Taxes In Toronto WorkingHolidayinCanada

Taxes In Toronto WorkingHolidayinCanada

2023 Tax Tables Australia IMAGESEE