In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects isn't diminished. If it's to aid in education or creative projects, or simply to add an extra personal touch to your home, printables for free are a great source. In this article, we'll dive in the world of "Can You Claim Donations On Taxes," exploring what they are, how you can find them, and how they can add value to various aspects of your daily life.

Get Latest Can You Claim Donations On Taxes Below

Can You Claim Donations On Taxes

Can You Claim Donations On Taxes -

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be

Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions for

Printables for free cover a broad assortment of printable, downloadable resources available online for download at no cost. These printables come in different styles, from worksheets to coloring pages, templates and more. The beauty of Can You Claim Donations On Taxes is their versatility and accessibility.

More of Can You Claim Donations On Taxes

Can You Claim Gambling Losses On Your Taxes

Can You Claim Gambling Losses On Your Taxes

The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t itemize Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people file

A promise to pay Promised donations do not equate to tax deductible donations That pledge you made doesn t become deductible until you actually give the money When you agree to contribute 10 per month during a fund raising drive only the monthly payments you make during the tax year can be deducted on that year s return

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: You can tailor designs to suit your personal needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Worth: The free educational worksheets offer a wide range of educational content for learners of all ages. This makes the perfect tool for teachers and parents.

-

An easy way to access HTML0: Instant access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Can You Claim Donations On Taxes

How Many Kids Can You Claim On Taxes Hanfincal

How Many Kids Can You Claim On Taxes Hanfincal

A Guide to Tax Deductions for Charitable Contributions Here s how your philanthropic giving can lower your tax bill By Beth Braverman Dec 15 2022 at 1 29 p m Getty Images Most

You can deduct donations you make to qualified charities This can reduce your taxable income but to claim the donations you have to itemize your deductions Claim your charitable donations on Form 1040 Schedule A Your donations must go to an organization that s one of these Nonprofit religious group Nonprofit educational group

After we've peaked your interest in Can You Claim Donations On Taxes we'll explore the places the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Can You Claim Donations On Taxes designed for a variety needs.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing Can You Claim Donations On Taxes

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Can You Claim Donations On Taxes are a treasure trove of practical and imaginative resources that meet a variety of needs and hobbies. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the vast world of Can You Claim Donations On Taxes today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can You Claim Donations On Taxes truly for free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues with Can You Claim Donations On Taxes?

- Some printables may have restrictions on their use. Make sure you read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit an area print shop for top quality prints.

-

What software do I require to view printables that are free?

- Many printables are offered in PDF format. These is open with no cost software such as Adobe Reader.

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Tax Deductions Welsh Tax

Check more sample of Can You Claim Donations On Taxes below

Can You Claim Doctor Copayments On Your Taxes AnchorAndHopeSF

How Much Do You Need To Donate For Tax Deduction

Can You Claim Gofundme Donations On Taxes Romainedesign

A New Rule Makes It Easier To Claim Donations On Your Taxes This Year

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Claiming Donations On Taxes In Australia Odin Tax

https://www.investopedia.com/articles/personal...

Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions for

https://www.ramseysolutions.com/taxes/charitable-donations-tax-deduction

Key Takeaways Yup charitable donations made to qualified charitable organizations and nonprofits are tax deductible You can deduct up to 60 of your adjusted gross income AGI for cash contributions made to nonprofits You need to itemize your deduction if you want to claim charitable donations on your tax return

Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions for

Key Takeaways Yup charitable donations made to qualified charitable organizations and nonprofits are tax deductible You can deduct up to 60 of your adjusted gross income AGI for cash contributions made to nonprofits You need to itemize your deduction if you want to claim charitable donations on your tax return

A New Rule Makes It Easier To Claim Donations On Your Taxes This Year

How Much Do You Need To Donate For Tax Deduction

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Claiming Donations On Taxes In Australia Odin Tax

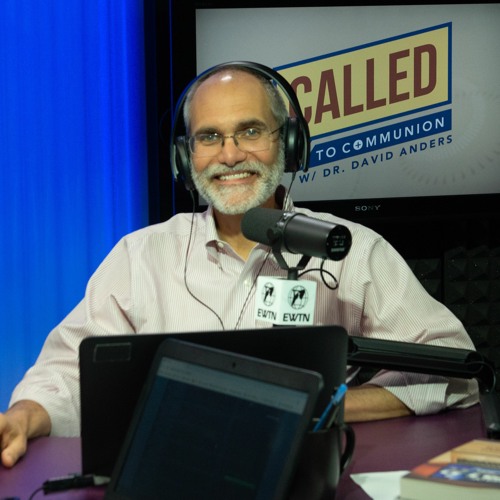

Stream Called To Communion About Claiming Charitable Donations On

5 Charitable Donations You Can Make On A Budget

5 Charitable Donations You Can Make On A Budget

Donating Fine Art And Collectibles Schwab Charitable Donor Advised