Today, where screens have become the dominant feature of our lives however, the attraction of tangible printed materials hasn't faded away. For educational purposes, creative projects, or simply to add personal touches to your home, printables for free are now a vital source. In this article, we'll dive to the depths of "Can Uber Drivers Claim Gas On Taxes," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your daily life.

Get Latest Can Uber Drivers Claim Gas On Taxes Below

Can Uber Drivers Claim Gas On Taxes

Can Uber Drivers Claim Gas On Taxes -

Deducting your mileage for tax purposes To figure out if you can deduct this mileage from your taxes you should Contact an independent tax professional Remember Uber doesn t give tax advice More tax help Check out TurboTax for a comparison between Standard Mileage and Actual Expenses Visit the IRS Sharing Economy Tax Center for more

Follow these tips to report your Uber driver income accurately and minimize your taxes Understanding your Uber 1099s As far as Uber is concerned you re an independent contractor who provides a service not an employee That s why Uber doesn t withhold taxes from your payments

Can Uber Drivers Claim Gas On Taxes encompass a wide assortment of printable, downloadable materials available online at no cost. They are available in numerous types, such as worksheets coloring pages, templates and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Can Uber Drivers Claim Gas On Taxes

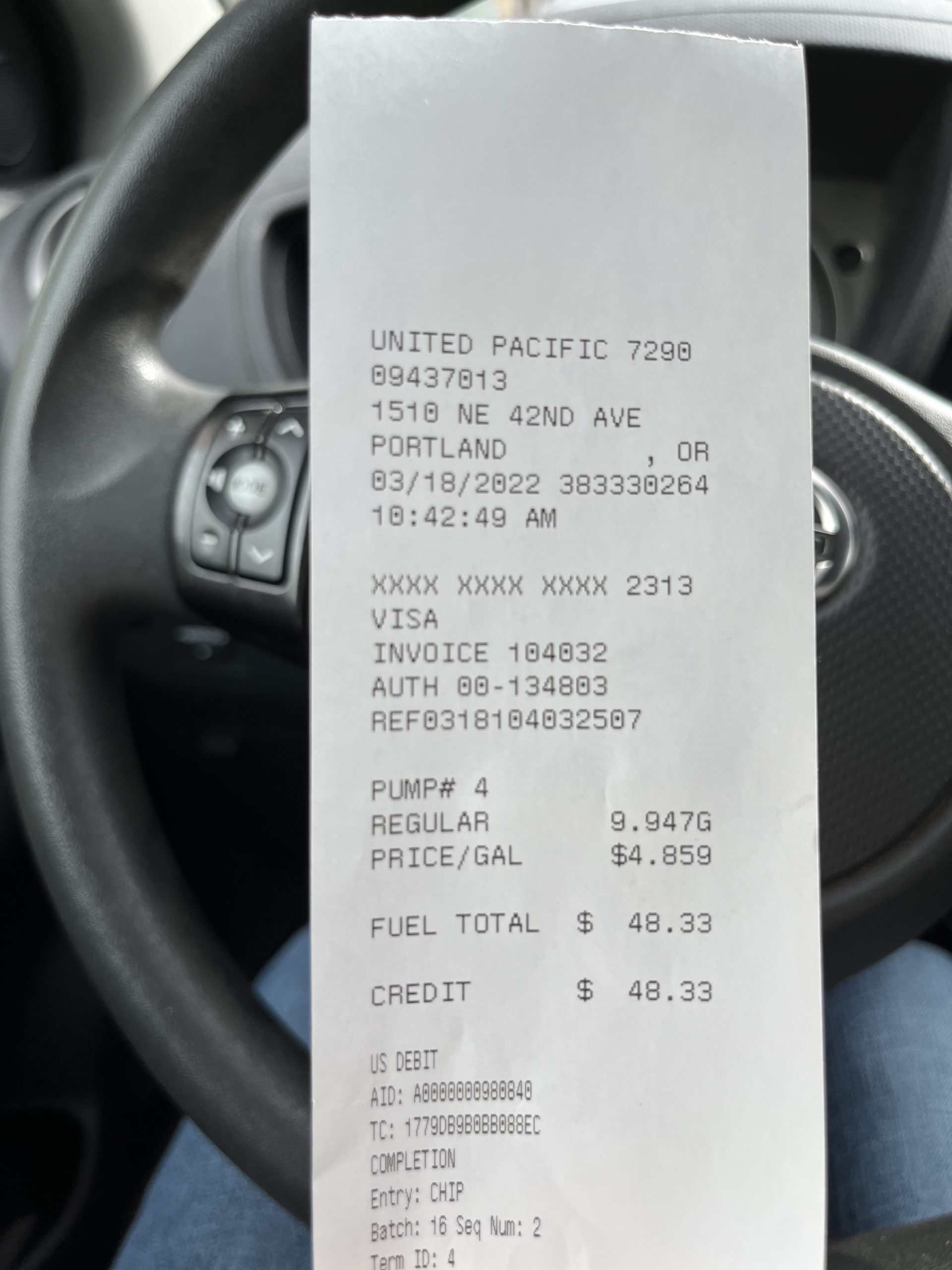

Can You Claim Gas On Your Taxes H R Block Gas Prices Infographic

Can You Claim Gas On Your Taxes H R Block Gas Prices Infographic

You can typically find your tax documents on your rideshare platform whether you drive for Uber or Lyft You can access your 1099 K and 1099 NECs if applicable Any other documents such as deductions for specific expenses should be either handwritten on a spreadsheet or tracked in a mileage tracking app that also

Since you probably spend a significant amount of money running your ride sharing business on things like gas car washes mints and bottled water you ll want to claim those expenses as deductions on your tax return

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Education-related printables at no charge can be used by students of all ages. This makes them a valuable device for teachers and parents.

-

The convenience of Access to a myriad of designs as well as templates can save you time and energy.

Where to Find more Can Uber Drivers Claim Gas On Taxes

Can You Claim Gas On Your Taxes The Oasis Firm Credit Repair

Can You Claim Gas On Your Taxes The Oasis Firm Credit Repair

Taking all the Uber driver tax deductions you re entitled to can reduce the amount of taxable income you have for the year Your most significant deduction as an Uber driver will likely be your car expenses You can deduct these expenses one of two ways the standard mileage rate or the actual expense method

In most cases Uber drivers decide to claim a mileage deduction for the use of your personal vehicle for business purposes Can Uber drivers claim mileage on taxes Absolutely

If we've already piqued your interest in Can Uber Drivers Claim Gas On Taxes and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of goals.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Can Uber Drivers Claim Gas On Taxes

Here are some ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home and in class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Can Uber Drivers Claim Gas On Taxes are an abundance of practical and innovative resources catering to different needs and passions. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the plethora of Can Uber Drivers Claim Gas On Taxes now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printables to make commercial products?

- It's determined by the specific conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations regarding usage. Be sure to read the terms and condition of use as provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer at home or in an in-store print shop to get higher quality prints.

-

What software will I need to access printables at no cost?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software, such as Adobe Reader.

Can You Deduct Gas On Taxes

Uber Drivers And Canadian Income Tax

Check more sample of Can Uber Drivers Claim Gas On Taxes below

Watch Biden Claim Gas Was 5 A Gallon When He Took Office Not The Bee

How Can Uber Driver Save Tax 2021 In Canada Uber Tax Deductions And

Do I Need Fuel Receipts For Taxes Leia Aqui Can I Claim Gas On My

Can Uber Drivers Also Work For Uber Eats CheddarDen

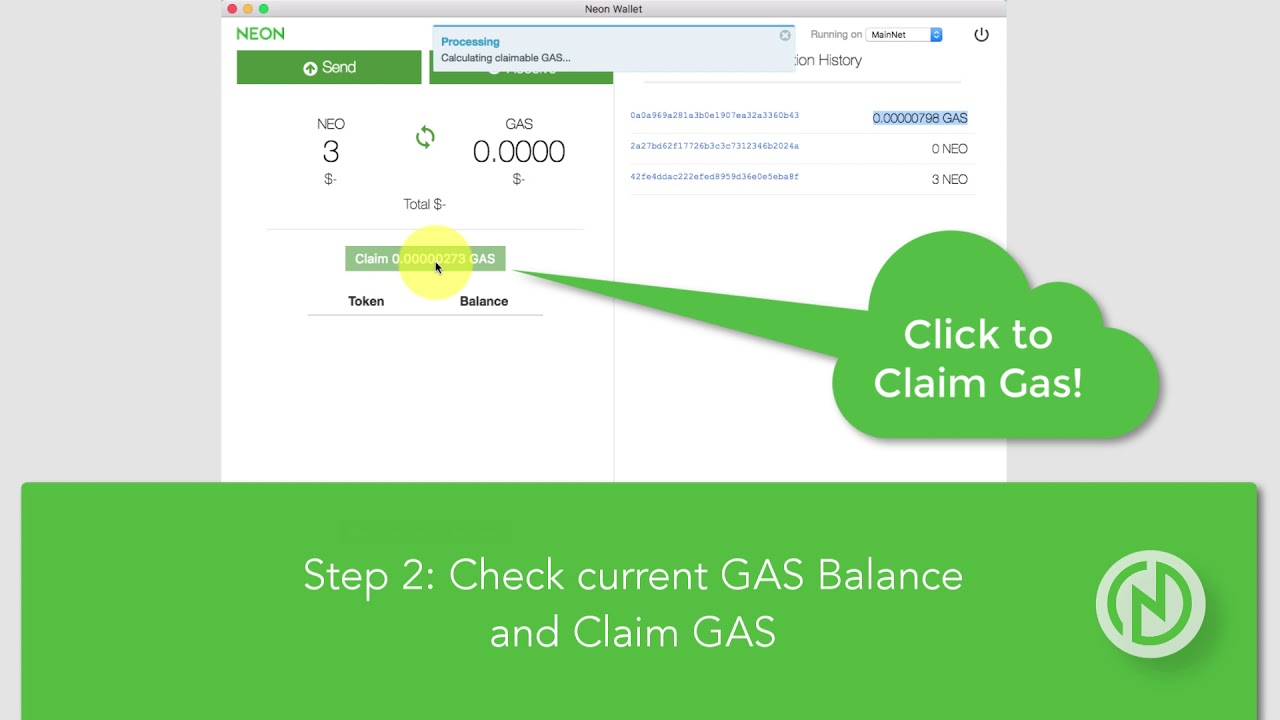

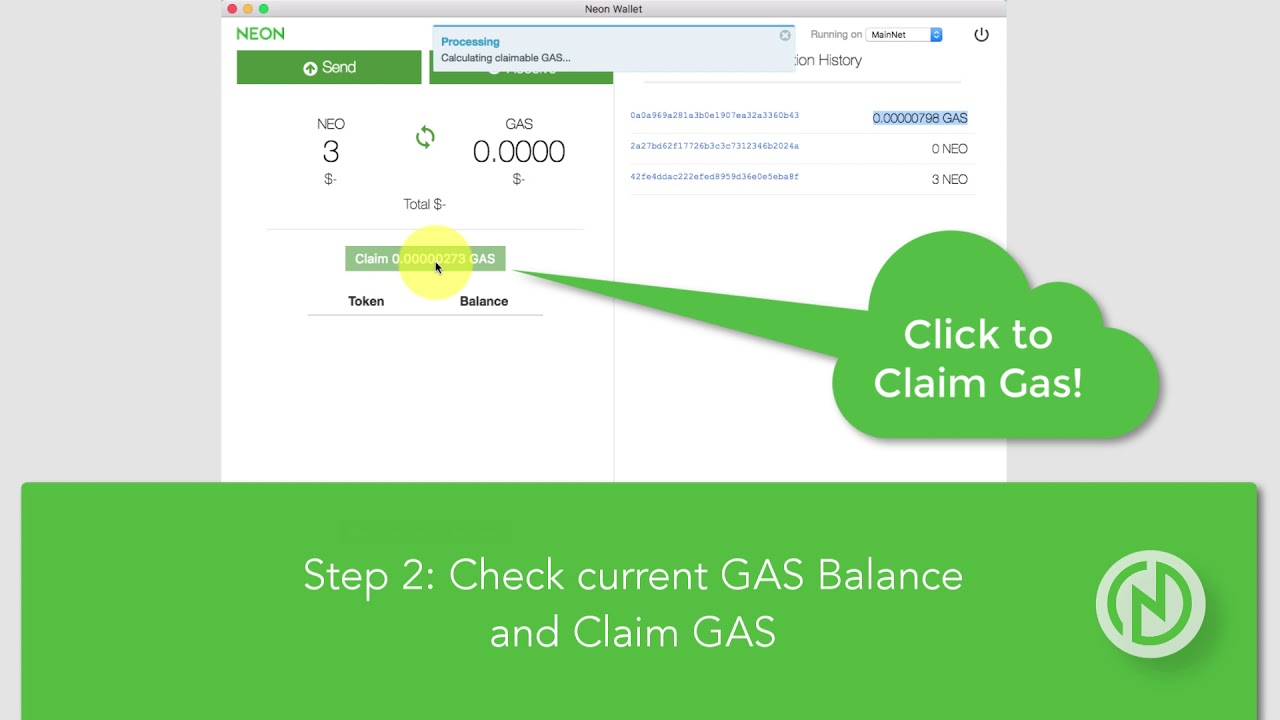

How To Claim GAS aka NeoGAS With NEON Wallet YouTube

Can I Claim Gas On My Taxes For Driving To Work Rules Explained

https://turbotax.intuit.com/tax-tips/self...

Follow these tips to report your Uber driver income accurately and minimize your taxes Understanding your Uber 1099s As far as Uber is concerned you re an independent contractor who provides a service not an employee That s why Uber doesn t withhold taxes from your payments

https://therideshareguy.com/rideshare-deductions...

You can t claim depreciation oil changes or fuel but there are some individual expenses that you can claim on top of the standard mileage deduction Vehicle registration fees Parking fees Tolls Car washes How Actual Expenses Work With the actual expenses deduction drivers can claim all the individual costs they spend on their

Follow these tips to report your Uber driver income accurately and minimize your taxes Understanding your Uber 1099s As far as Uber is concerned you re an independent contractor who provides a service not an employee That s why Uber doesn t withhold taxes from your payments

You can t claim depreciation oil changes or fuel but there are some individual expenses that you can claim on top of the standard mileage deduction Vehicle registration fees Parking fees Tolls Car washes How Actual Expenses Work With the actual expenses deduction drivers can claim all the individual costs they spend on their

Can Uber Drivers Also Work For Uber Eats CheddarDen

How Can Uber Driver Save Tax 2021 In Canada Uber Tax Deductions And

How To Claim GAS aka NeoGAS With NEON Wallet YouTube

Can I Claim Gas On My Taxes For Driving To Work Rules Explained

Can I Claim Gas Mileage To School On My Taxes School Walls

GAS COIN TO THE MOON GAS CRYPTO PRICE PREDICTION 25 IS REAL BUY

GAS COIN TO THE MOON GAS CRYPTO PRICE PREDICTION 25 IS REAL BUY

Rideshare Tax Guide What You Need To Know For 2023 TripLog