In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education or creative projects, or simply to add personal touches to your space, Can I Claim Child Care Credit If Married Filing Separately are now a vital source. With this guide, you'll take a dive into the world of "Can I Claim Child Care Credit If Married Filing Separately," exploring what they are, where to find them and what they can do to improve different aspects of your lives.

Get Latest Can I Claim Child Care Credit If Married Filing Separately Below

Can I Claim Child Care Credit If Married Filing Separately

Can I Claim Child Care Credit If Married Filing Separately -

For the 2022 tax year you can claim this credit when you pay for childcare or dependent care so you can either work or look for work That s pretty straightforward But it gets more complicated of course so hang with us

Amy s filing status is married filing separately and Sam qualifies as a qualifying person for the child and dependent care credit Because of the following facts Amy is able to claim the credit for child and dependent care expenses even though Amy uses the married filing separately filing status

Can I Claim Child Care Credit If Married Filing Separately offer a wide array of printable material that is available online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and more. The beauty of Can I Claim Child Care Credit If Married Filing Separately is in their versatility and accessibility.

More of Can I Claim Child Care Credit If Married Filing Separately

Can I Claim Child Care Expenses On My Tax Return

Can I Claim Child Care Expenses On My Tax Return

Generally to claim the credit as a married couple you must file married filing jointly However the primary custodial parent may claim the credit if the couple is legally

If your client received any dependent care benefits Lacerte will complete Part III of Form 2441 to determine how much of the care expenses were already covered by deductible or excluded benefits and can t be used to calculate the credit Why aren t dependent care benefits from my client s partnership or sole proprietorship flowing to the

Can I Claim Child Care Credit If Married Filing Separately have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization We can customize printing templates to your own specific requirements such as designing invitations and schedules, or even decorating your house.

-

Educational Benefits: These Can I Claim Child Care Credit If Married Filing Separately are designed to appeal to students from all ages, making these printables a powerful tool for teachers and parents.

-

Easy to use: The instant accessibility to a variety of designs and templates will save you time and effort.

Where to Find more Can I Claim Child Care Credit If Married Filing Separately

CYC Ministries Frequently Asked Questions

CYC Ministries Frequently Asked Questions

In many cases you will not be able to take the child and dependent care credit If you live in a community property state you will be required to provide additional information regarding your spouse s income If you are using online TurboTax to prepare your returns you will need to prepare two separate returns and pay twice

If you re married but not filing jointly with your spouse you can claim the credit if You paid more than half the cost of maintaining a household for the year Both you and the qualifying person must have used the home as your main residence for more than half the tax year

Now that we've piqued your interest in printables for free Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Can I Claim Child Care Credit If Married Filing Separately for different needs.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing including flashcards, learning materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing Can I Claim Child Care Credit If Married Filing Separately

Here are some new ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Can I Claim Child Care Credit If Married Filing Separately are an abundance of practical and innovative resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast collection that is Can I Claim Child Care Credit If Married Filing Separately today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I utilize free printables to make commercial products?

- It's determined by the specific usage guidelines. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and regulations provided by the creator.

-

How can I print Can I Claim Child Care Credit If Married Filing Separately?

- You can print them at home with your printer or visit a local print shop to purchase higher quality prints.

-

What program do I need to open printables at no cost?

- Most printables come in the format PDF. This can be opened using free software like Adobe Reader.

Can I Refile If Married Filing Separately JacAnswers

Should I Pay My Old Daycare Provider Or Let Her Take Me To Court

Check more sample of Can I Claim Child Care Credit If Married Filing Separately below

How To Claim Child Benefit In 2022

Wow Married Filing Separately May Be The Tax Year 2020 Strategy

What Is Child Care Expenses March 2023 Smartstartga

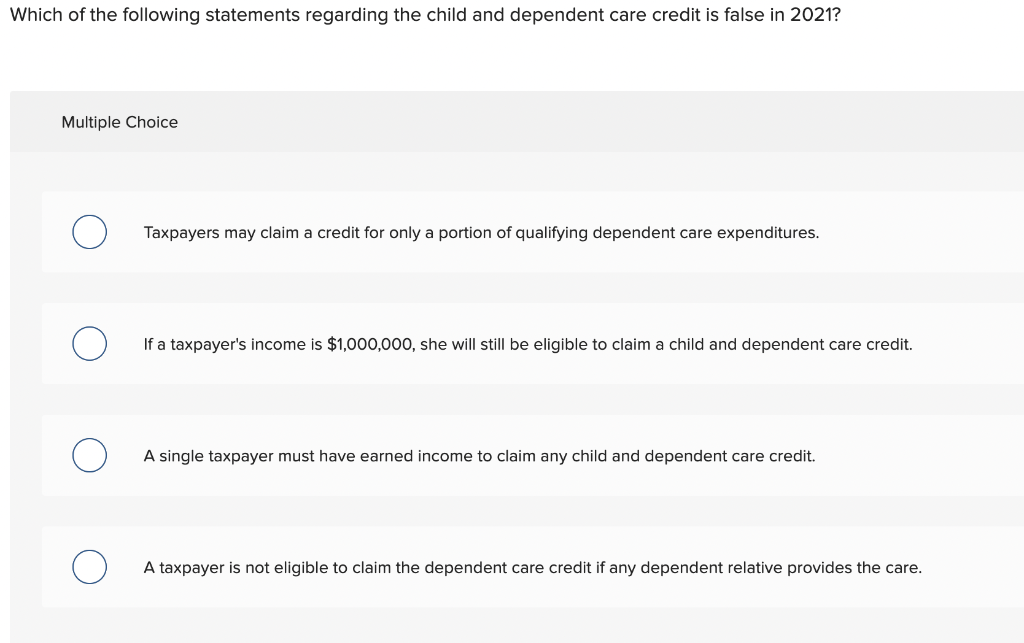

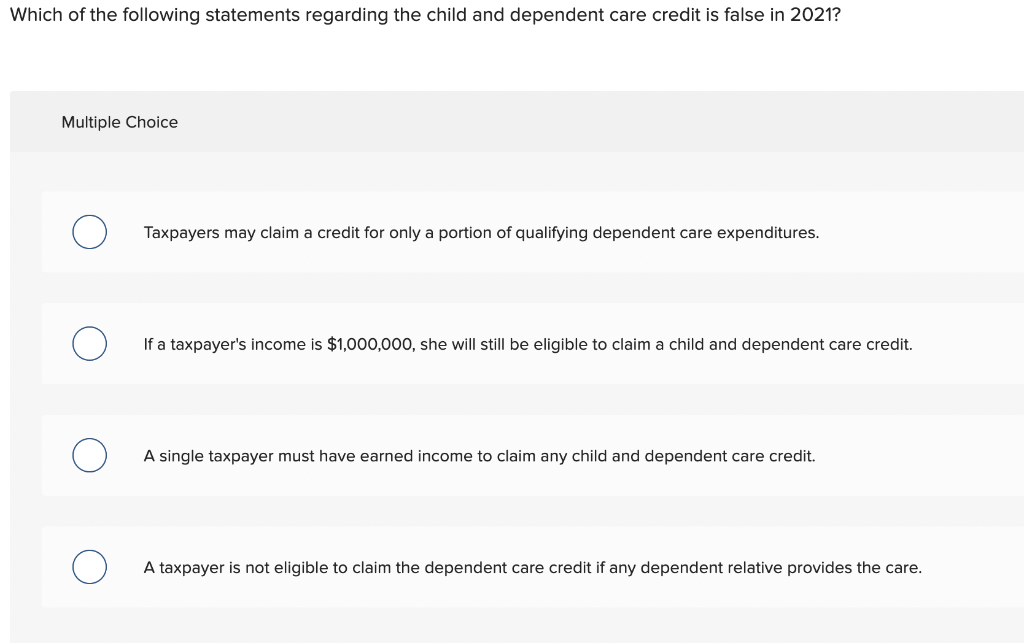

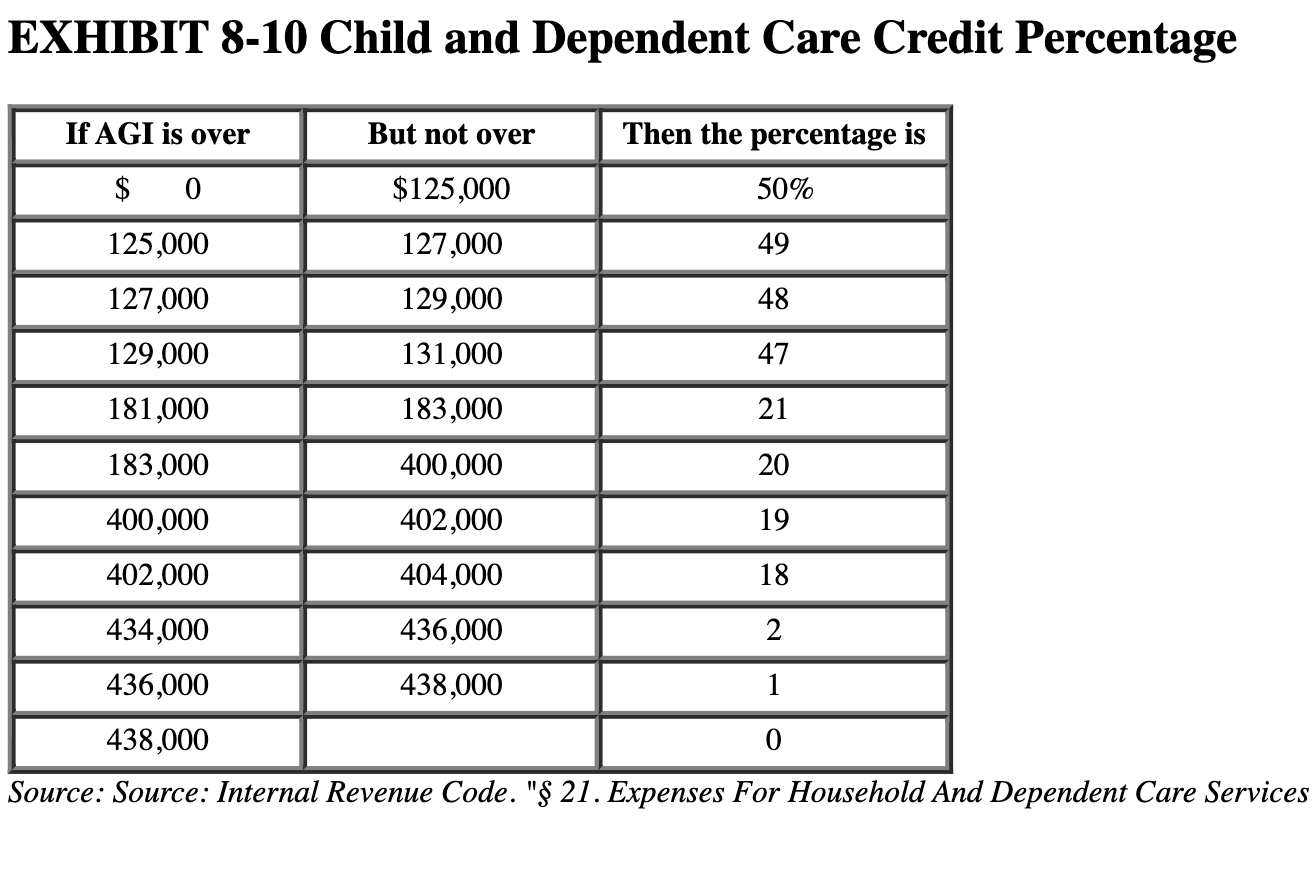

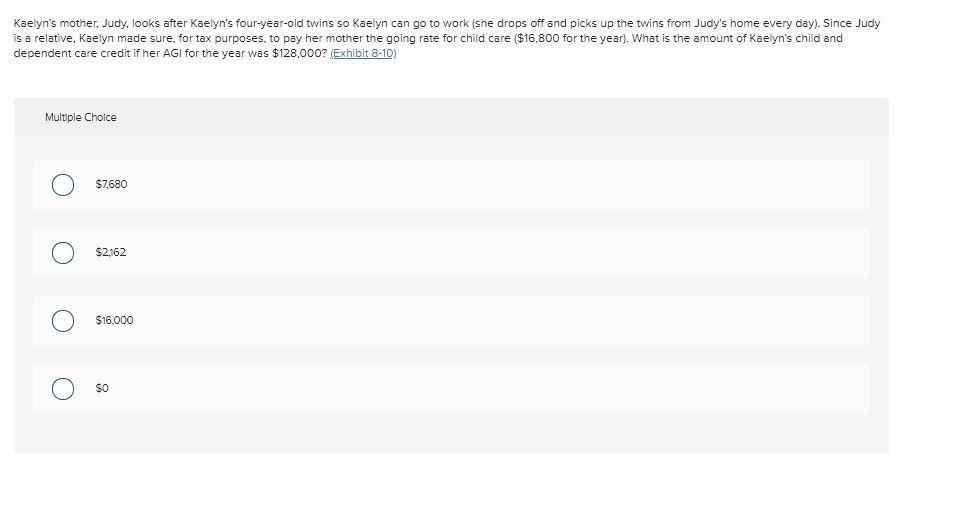

Solved EXHIBIT 8 10 Child And Dependent Care Credit Chegg

Can I Claim Child Tax Credit If Married Filing Separately YouTube

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

https://www.irs.gov/publications/p503

Amy s filing status is married filing separately and Sam qualifies as a qualifying person for the child and dependent care credit Because of the following facts Amy is able to claim the credit for child and dependent care expenses even though Amy uses the married filing separately filing status

https://ttlc.intuit.com/community/taxes/discussion/...

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work You may not take this credit if your filing status is married filing separately

Amy s filing status is married filing separately and Sam qualifies as a qualifying person for the child and dependent care credit Because of the following facts Amy is able to claim the credit for child and dependent care expenses even though Amy uses the married filing separately filing status

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work You may not take this credit if your filing status is married filing separately

Solved EXHIBIT 8 10 Child And Dependent Care Credit Chegg

Wow Married Filing Separately May Be The Tax Year 2020 Strategy

Can I Claim Child Tax Credit If Married Filing Separately YouTube

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Solved Kaelyn s Mother Judy Looks After Kaelyn s Chegg

State Withholding Tax Form 2023 Printable Forms Free Online

State Withholding Tax Form 2023 Printable Forms Free Online

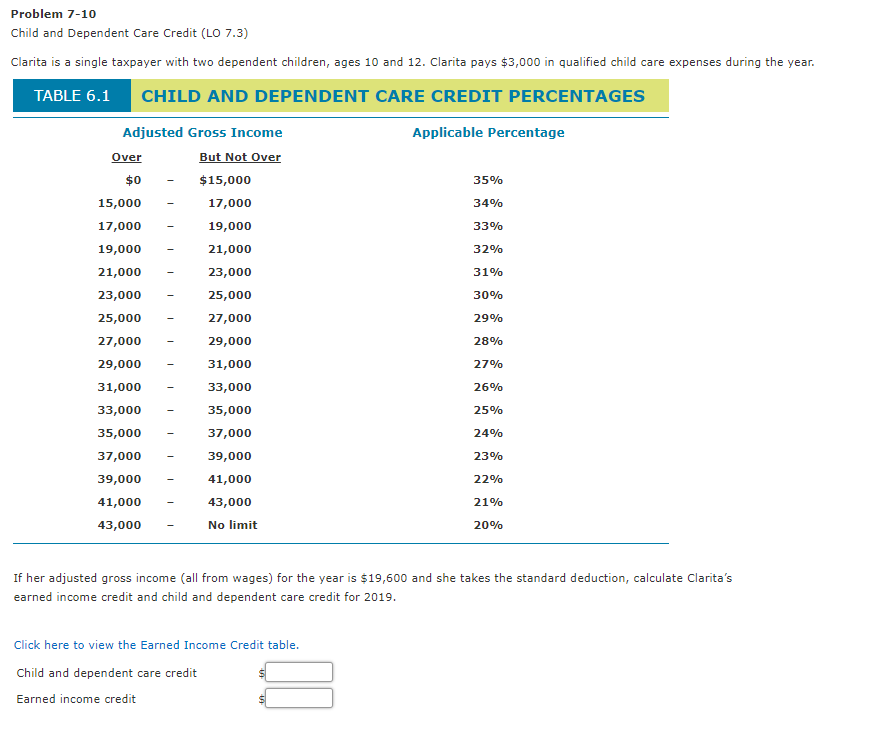

Solved Problem 7 10 Child And Dependent Care Credit LO 7 3 Chegg