In this digital age, where screens dominate our lives and the appeal of physical printed products hasn't decreased. For educational purposes in creative or artistic projects, or simply to add an extra personal touch to your area, Business Uniform Tax Deduction have become a valuable source. Through this post, we'll take a dive into the world of "Business Uniform Tax Deduction," exploring their purpose, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Business Uniform Tax Deduction Below

Business Uniform Tax Deduction

Business Uniform Tax Deduction -

Businesses A business could potentially qualify for a tax deduction related to business attire in various scenarios including Furnishing clothing to their employees Providing a clothing allowance for specific clothing items Reimbursing their employees for work clothing purchases

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense

Business Uniform Tax Deduction provide a diverse range of downloadable, printable material that is available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and much more. The benefit of Business Uniform Tax Deduction is their versatility and accessibility.

More of Business Uniform Tax Deduction

Uniform Tax Rebate Healthcare Workers Uniform Tax Refund

Uniform Tax Rebate Healthcare Workers Uniform Tax Refund

Who can write off clothes on their taxes If you re a sole proprietor or small business owner you might be able to write off your work clothes not to mention other clothing related expenses That s right the IRS allows for certain items of clothing to be written off as business expenses depending on how they re used

ANSWER Under general tax principles the value of employer provided clothing is a taxable benefit unless the clothing qualifies for an exclusion

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: You can tailor print-ready templates to your specific requirements such as designing invitations and schedules, or even decorating your house.

-

Educational Worth: Free educational printables cater to learners from all ages, making them an essential resource for educators and parents.

-

An easy way to access HTML0: Quick access to the vast array of design and templates reduces time and effort.

Where to Find more Business Uniform Tax Deduction

Can You Deduct Dry Cleaning Expenses On Your Taxes Uniforms Clothing

Can You Deduct Dry Cleaning Expenses On Your Taxes Uniforms Clothing

What does HMRC consider to be a uniform Clothing expenses The three golden rules Part of a uniform has your branding on it A costume Personal protective clothing and equipment Comprehensive tax return services What clothes can t you claim for as a business expense How do I claim a uniform against tax How will the rebate be

The IRS guidance on work clothes and uniforms is much the same If uniforms are required for work and not suitable for everyday use they re likely tax deductible Suitable for everyday use is not exactly a common sense term when it comes to sartorial choices but here are some tips for knowing when a uniform is tax deductible

We've now piqued your interest in printables for free We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Business Uniform Tax Deduction designed for a variety needs.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad range of interests, including DIY projects to party planning.

Maximizing Business Uniform Tax Deduction

Here are some inventive ways how you could make the most of Business Uniform Tax Deduction:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Business Uniform Tax Deduction are an abundance of practical and imaginative resources designed to meet a range of needs and needs and. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the world of Business Uniform Tax Deduction now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes they are! You can print and download these files for free.

-

Do I have the right to use free templates for commercial use?

- It's based on specific conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted regarding their use. Be sure to check the terms of service and conditions provided by the designer.

-

How do I print Business Uniform Tax Deduction?

- You can print them at home with the printer, or go to any local print store for better quality prints.

-

What program do I require to open printables for free?

- Many printables are offered with PDF formats, which is open with no cost software like Adobe Reader.

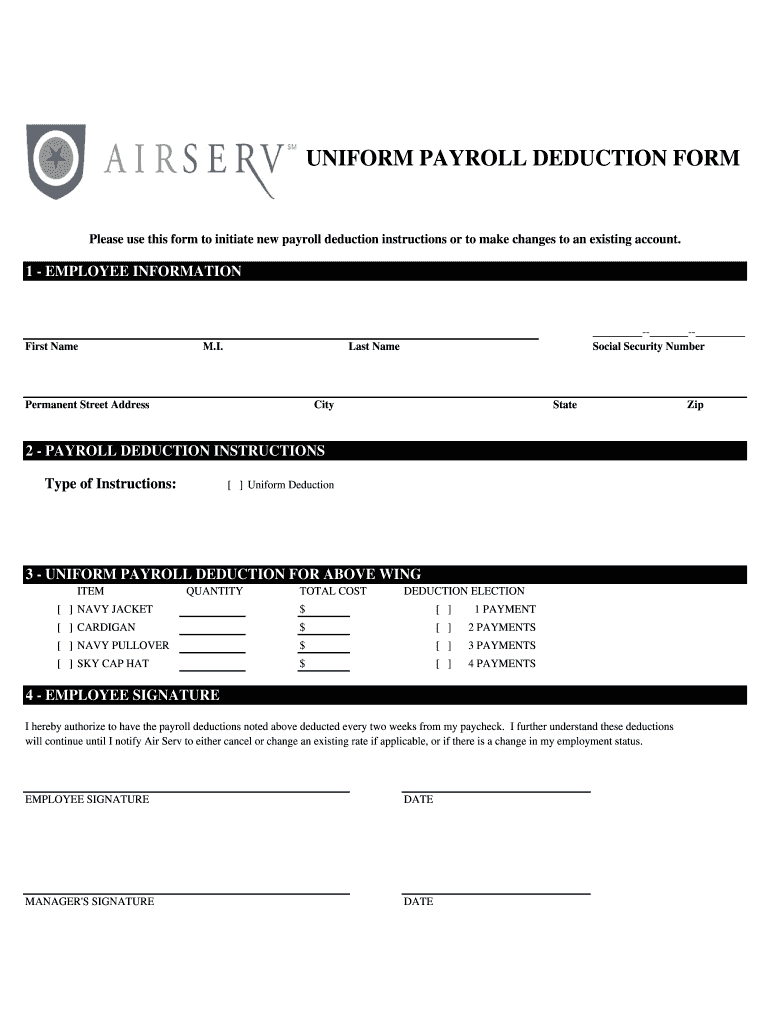

Payroll Deduction Form

Uniform Tax Rebate G Sec Ltd

Check more sample of Business Uniform Tax Deduction below

Uniform Payroll Deduction Form Fill Out And Sign Printable PDF

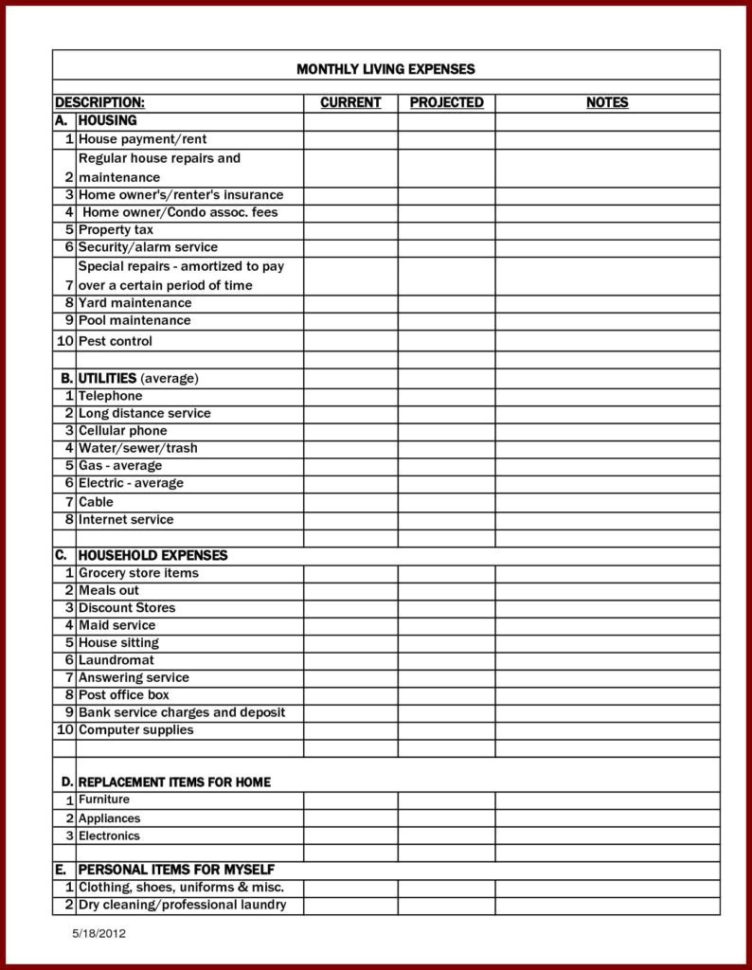

Self Employed Tax Deductions Worksheet Db excel

Hints Tips To Get Started In Ordering Company Uniform

Employee Uniforms Tax Deductions Plymate

How To Claim Uniform Tax Rebate Money Back Helpdesk

How To Claim A Tax Deduction For Work Uniform Expenses Keats Accounting

https://www.bench.co/blog/tax-tips/clothing-tax-deduction

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense

https://www.hrblock.com/tax-center/filing...

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform The clothes are not suitable for everyday wear

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform The clothes are not suitable for everyday wear

Employee Uniforms Tax Deductions Plymate

Self Employed Tax Deductions Worksheet Db excel

How To Claim Uniform Tax Rebate Money Back Helpdesk

How To Claim A Tax Deduction For Work Uniform Expenses Keats Accounting

Uniform Tax Rebate What It Covers And How Much You Can Claim

Tax Deduction For Work Clothing Uniform

Tax Deduction For Work Clothing Uniform

Uniform Tax On Small Big Cars Is Bad News For Auto Sector Maruti