In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education, creative projects, or simply to add an extra personal touch to your space, Business Tax Credits For Energy Efficiency are now an essential source. In this article, we'll dive into the world of "Business Tax Credits For Energy Efficiency," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Business Tax Credits For Energy Efficiency Below

Business Tax Credits For Energy Efficiency

Business Tax Credits For Energy Efficiency -

Unleash the benefits of clean energy tax credits for your company Businesses can explore ways to optimize their tax strategies in light of these credits some of which

The energy credit provides a tax credit for investment in renewable energy fuel cell solar geothermal small wind energy storage biogas microgrid controllers

Business Tax Credits For Energy Efficiency provide a diverse variety of printable, downloadable materials available online at no cost. These resources come in various types, like worksheets, templates, coloring pages, and much more. The attraction of printables that are free is their versatility and accessibility.

More of Business Tax Credits For Energy Efficiency

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Clean vehicle

The Business Energy Investment Tax Credit ITC is a U S federal corporate tax credit that is applicable to commercial industrial utility and agricultural sectors

Business Tax Credits For Energy Efficiency have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization It is possible to tailor print-ready templates to your specific requirements whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: Free educational printables can be used by students of all ages, making them an essential tool for parents and educators.

-

Convenience: Access to the vast array of design and templates can save you time and energy.

Where to Find more Business Tax Credits For Energy Efficiency

Small Business Tax Credits For Hiring Disabled Workers Small Business

Small Business Tax Credits For Hiring Disabled Workers Small Business

Small business building owners can receive a tax credit up to 5 per square foot to support energy efficiency improvements that deliver lower utility bills

The energy efficient commercial buildings deduction under Sec 179D provides taxpayers with an incentive to make certain commercial building property more energy efficient

Now that we've piqued your curiosity about Business Tax Credits For Energy Efficiency Let's find out where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of reasons.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to party planning.

Maximizing Business Tax Credits For Energy Efficiency

Here are some creative ways of making the most use of Business Tax Credits For Energy Efficiency:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home as well as in the class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Business Tax Credits For Energy Efficiency are a treasure trove of fun and practical tools catering to different needs and pursuits. Their accessibility and versatility make them a valuable addition to each day life. Explore the vast world of Business Tax Credits For Energy Efficiency to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Business Tax Credits For Energy Efficiency really available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It's based on specific rules of usage. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Business Tax Credits For Energy Efficiency?

- Some printables may come with restrictions concerning their use. You should read the terms and condition of use as provided by the creator.

-

How can I print Business Tax Credits For Energy Efficiency?

- You can print them at home using printing equipment or visit a local print shop to purchase more high-quality prints.

-

What program must I use to open printables at no cost?

- The majority of printables are with PDF formats, which can be opened using free software like Adobe Reader.

Expired Energy Efficiency Tax Credits Renewed Under Inflation Reduction

The Inflation Reduction Act You Sapling

Check more sample of Business Tax Credits For Energy Efficiency below

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel

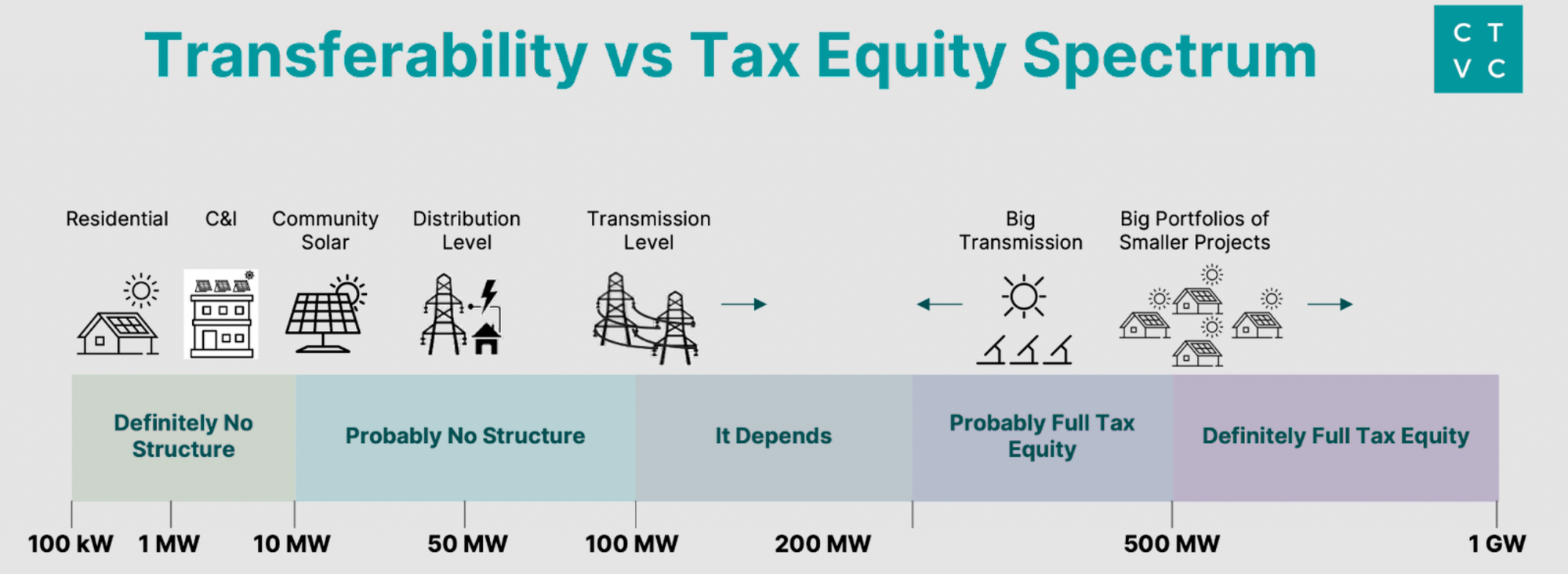

Tax Equity In A Direct pay World EY US

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Take Advantage Of Tax Credits For Energy Efficiency Improvements

Tax Credits For Energy Industry Are Under Scrutiny The New York Times

Tax Credits For Energy Efficient Home Improvements Kiplinger

https:// pro.bloombergtax.com /brief/business-energy-tax-credits

The energy credit provides a tax credit for investment in renewable energy fuel cell solar geothermal small wind energy storage biogas microgrid controllers

https://www. irs.gov /pub/irs-pdf/p5886.pdf

The Inlation Reduction Act of 2022 IRA makes several clean energy tax credits available to businesses

The energy credit provides a tax credit for investment in renewable energy fuel cell solar geothermal small wind energy storage biogas microgrid controllers

The Inlation Reduction Act of 2022 IRA makes several clean energy tax credits available to businesses

Take Advantage Of Tax Credits For Energy Efficiency Improvements

Tax Equity In A Direct pay World EY US

Tax Credits For Energy Industry Are Under Scrutiny The New York Times

Tax Credits For Energy Efficient Home Improvements Kiplinger

Federal Tax Credits For Energy Efficiency Waverly Utilities

New Tax Credits For Energy Efficiency Home Improvements In Georgia

New Tax Credits For Energy Efficiency Home Improvements In Georgia

Breaking Down IRA s Tax credit Breaks